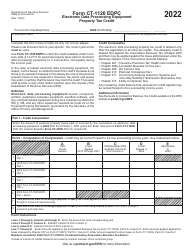

This version of the form is not currently in use and is provided for reference only. Download this version of

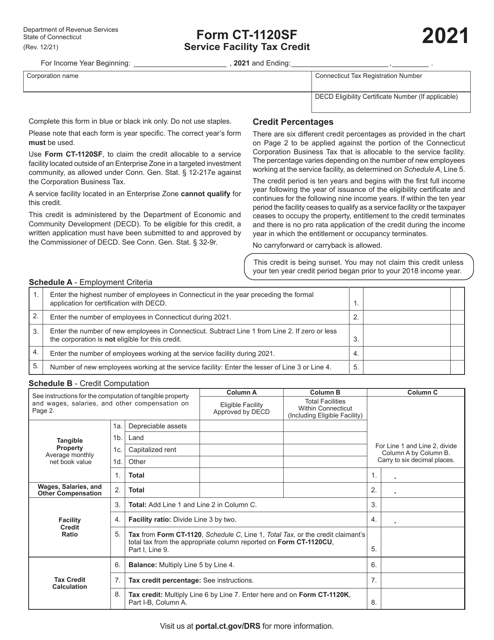

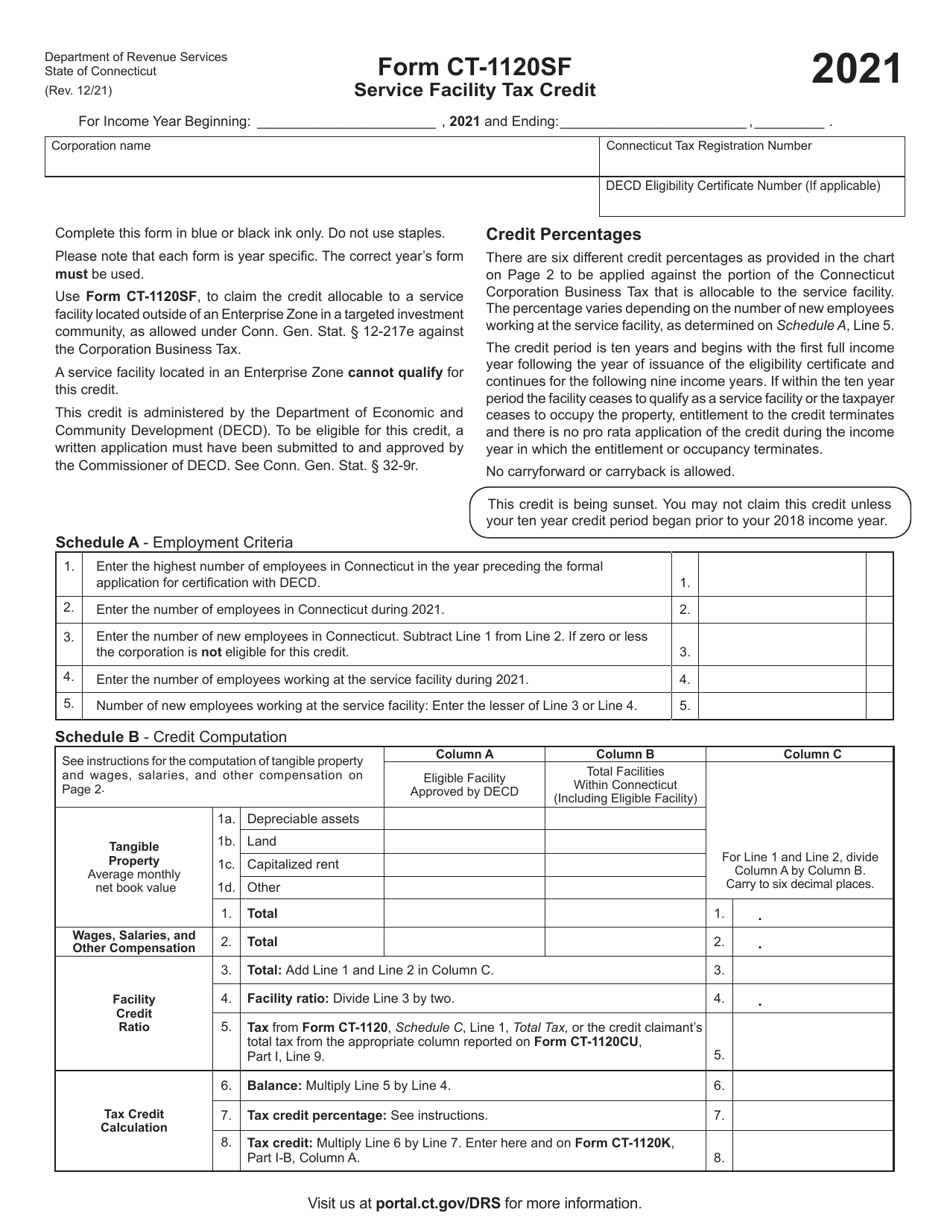

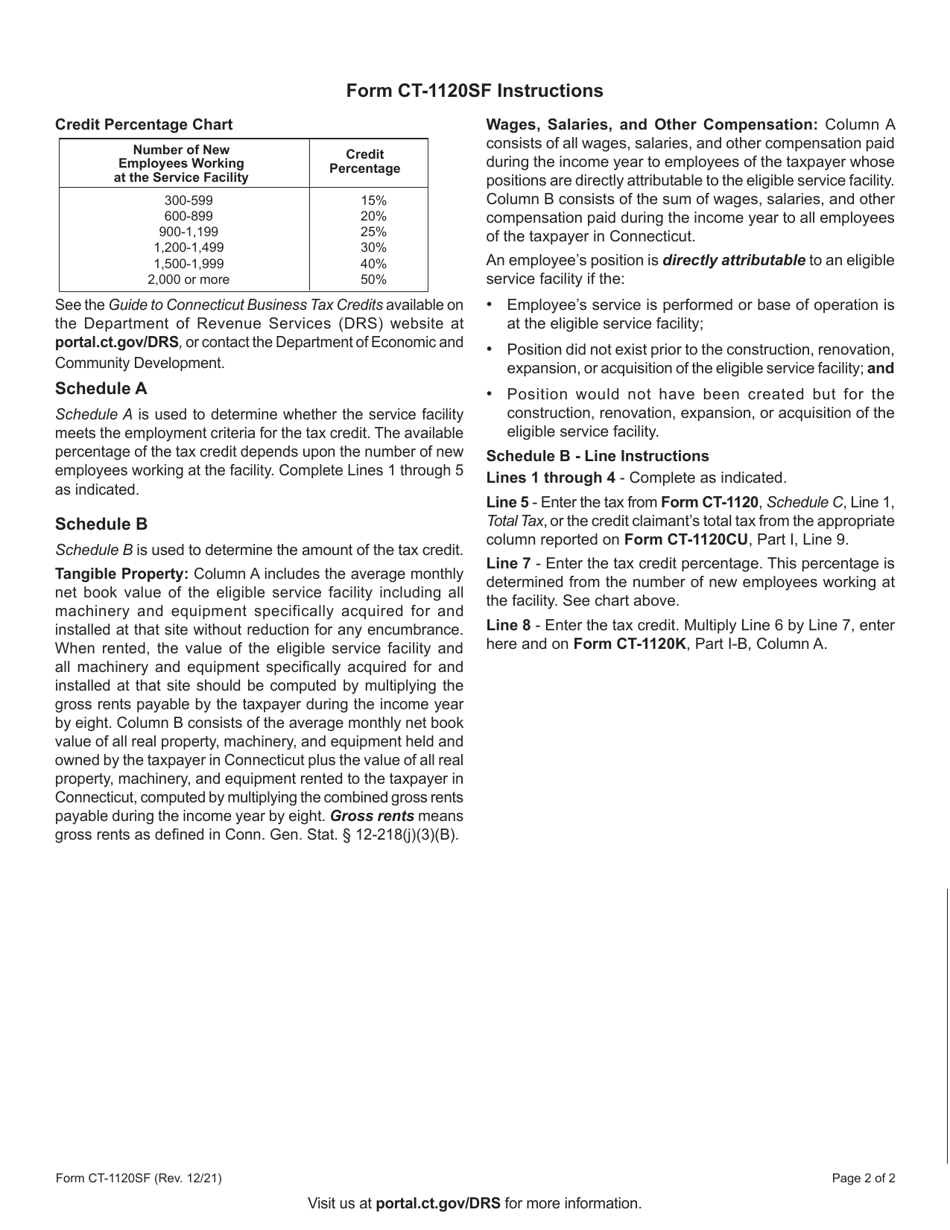

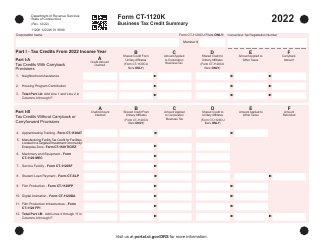

Form CT-1120SF

for the current year.

Form CT-1120SF Service Facility Tax Credit - Connecticut

What Is Form CT-1120SF?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

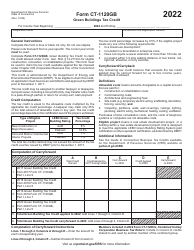

Q: What is Form CT-1120SF?

A: Form CT-1120SF is a tax form used in Connecticut to claim the Service Facility Tax Credit.

Q: What is the Service Facility Tax Credit?

A: The Service Facility Tax Credit is a credit available to businesses in Connecticut that operate a qualifying service facility.

Q: Who is eligible to claim the Service Facility Tax Credit?

A: Businesses in Connecticut that operate a qualifying service facility are eligible to claim the Service Facility Tax Credit.

Q: What is a qualifying service facility?

A: A qualifying service facility is a facility that meets certain criteria specified by the Connecticut Department of Economic and Community Development.

Q: How do I claim the Service Facility Tax Credit?

A: To claim the Service Facility Tax Credit, you must complete and file Form CT-1120SF with your Connecticut tax return.

Q: Are there any deadlines for filing Form CT-1120SF?

A: Yes, the deadline for filing Form CT-1120SF is the same as the deadline for filing your Connecticut tax return.

Q: Can I claim the Service Facility Tax Credit if I have multiple service facilities?

A: Yes, you can claim the Service Facility Tax Credit for each qualifying service facility you operate in Connecticut.

Q: Is the Service Facility Tax Credit refundable?

A: No, the Service Facility Tax Credit is not refundable, but it can be carried forward for up to five years.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120SF by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.