This version of the form is not currently in use and is provided for reference only. Download this version of

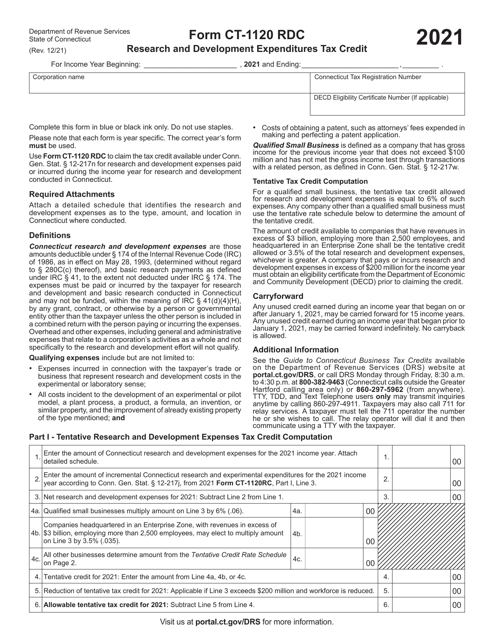

Form CT-1120 RDC

for the current year.

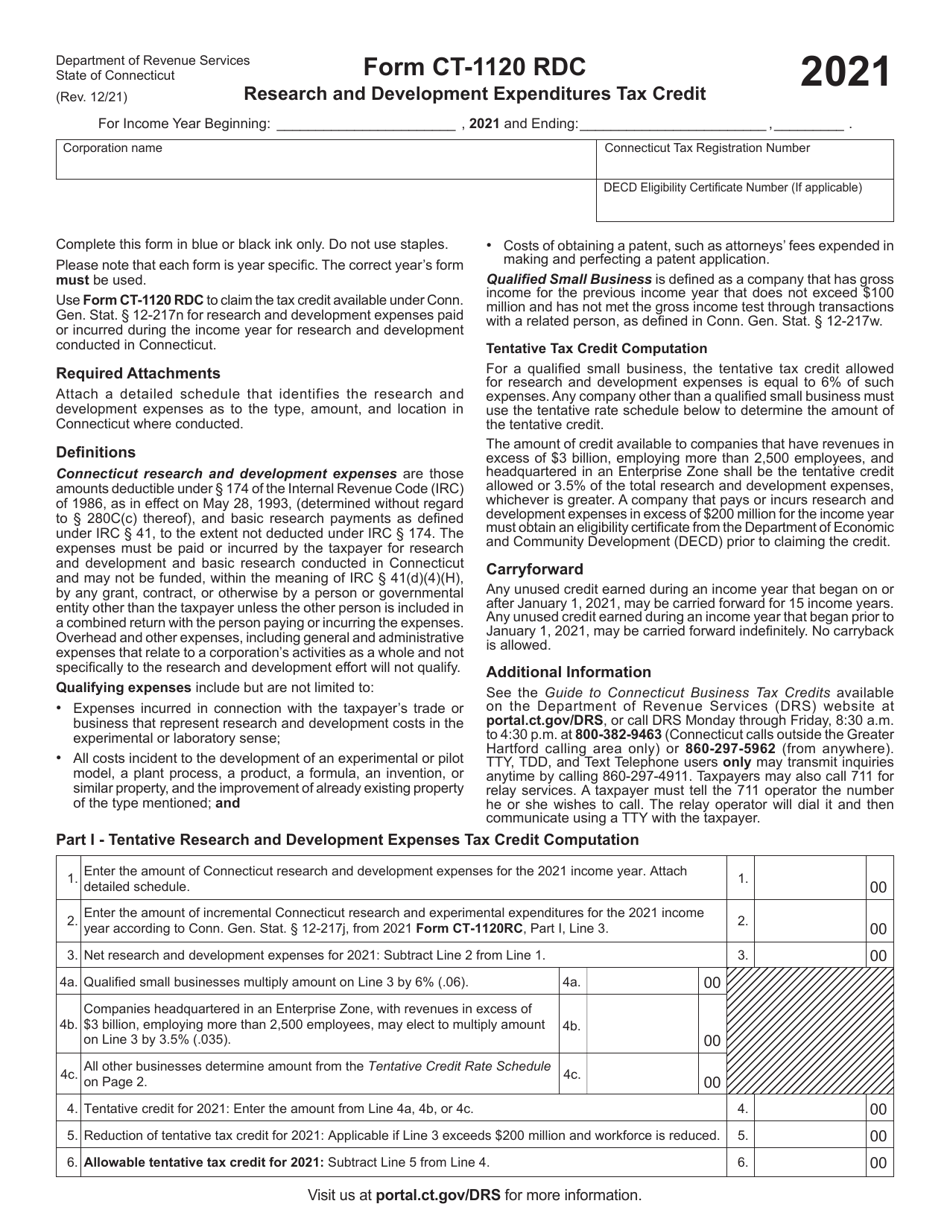

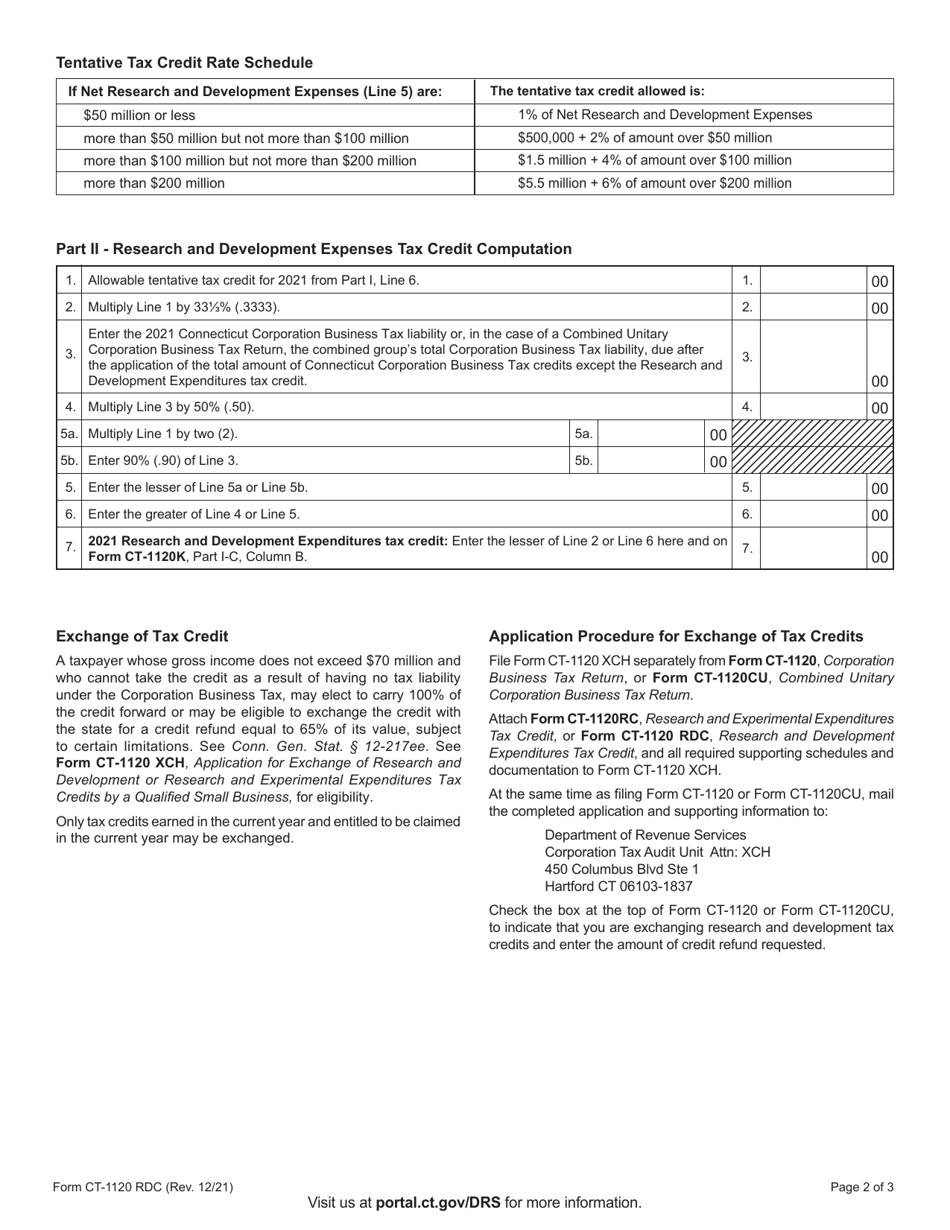

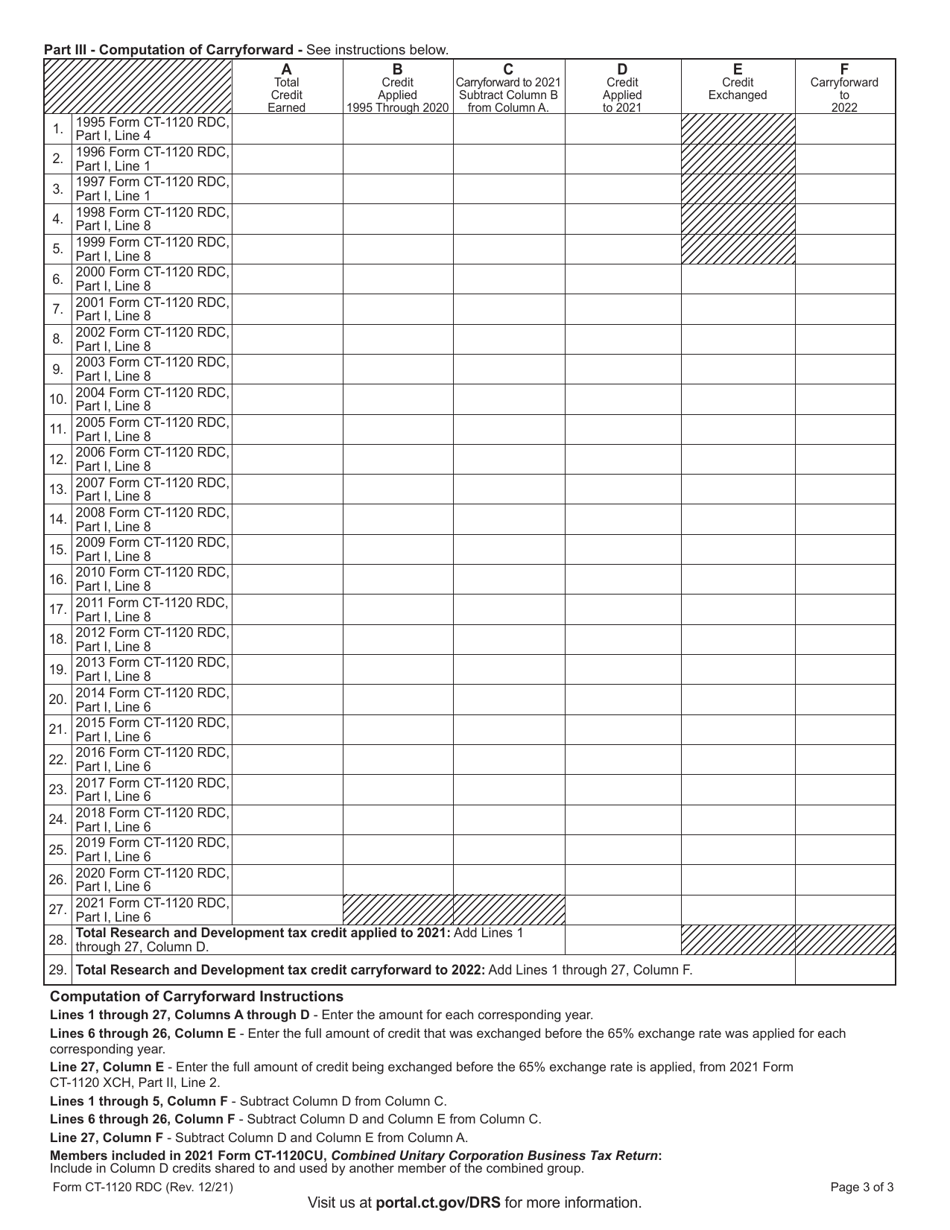

Form CT-1120 RDC Research and Development Expenditures Tax Credit - Connecticut

What Is Form CT-1120 RDC?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1120 RDC?

A: Form CT-1120 RDC is a Connecticut tax form for claiming the Research and Development Expenditures Tax Credit.

Q: What is the Research and Development Expenditures Tax Credit?

A: The Research and Development Expenditures Tax Credit is a tax credit available in Connecticut for companies that incur eligible research and development expenses.

Q: Who is eligible to claim the Research and Development Expenditures Tax Credit?

A: Companies that incur qualifying research and development expenses in Connecticut are eligible to claim the tax credit.

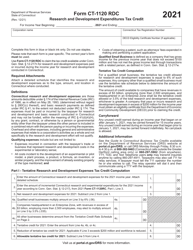

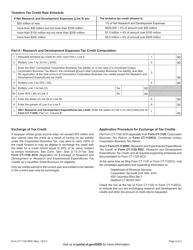

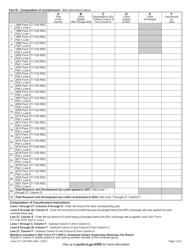

Q: What expenses qualify for the Research and Development Expenditures Tax Credit?

A: Qualifying research and development expenses include expenses for wages, supplies, and contract research incurred for qualified research activities.

Q: How do I claim the Research and Development Expenditures Tax Credit?

A: To claim the tax credit, you need to complete and file Form CT-1120 RDC along with your Connecticut corporate income tax return.

Q: Is there a deadline for claiming the Research and Development Expenditures Tax Credit?

A: Yes, the tax credit must be claimed within three years from the due date of the tax return for the year in which the expenses were incurred.

Q: What other requirements or restrictions apply to the Research and Development Expenditures Tax Credit?

A: There are various requirements and restrictions that apply, such as limitations on the amount of credit that can be claimed and eligibility criteria for the research activities.

Q: Can the Research and Development Expenditures Tax Credit be carried forward or backward?

A: Yes, any unused tax credit can be carried forward for up to five years or carried back for up to three years, subject to certain limitations.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120 RDC by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.