This version of the form is not currently in use and is provided for reference only. Download this version of

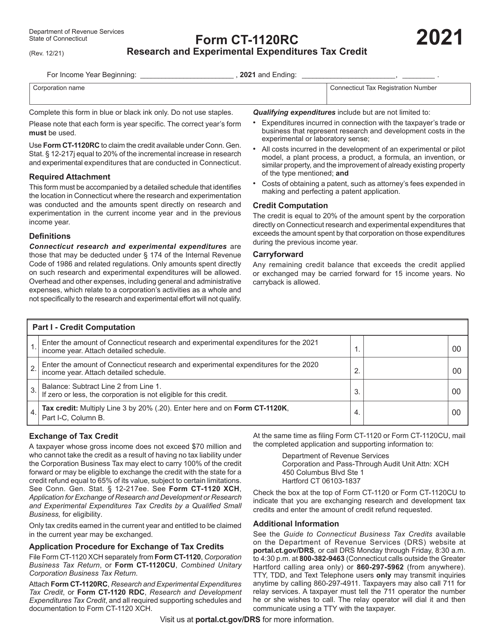

Form CT-1120RC

for the current year.

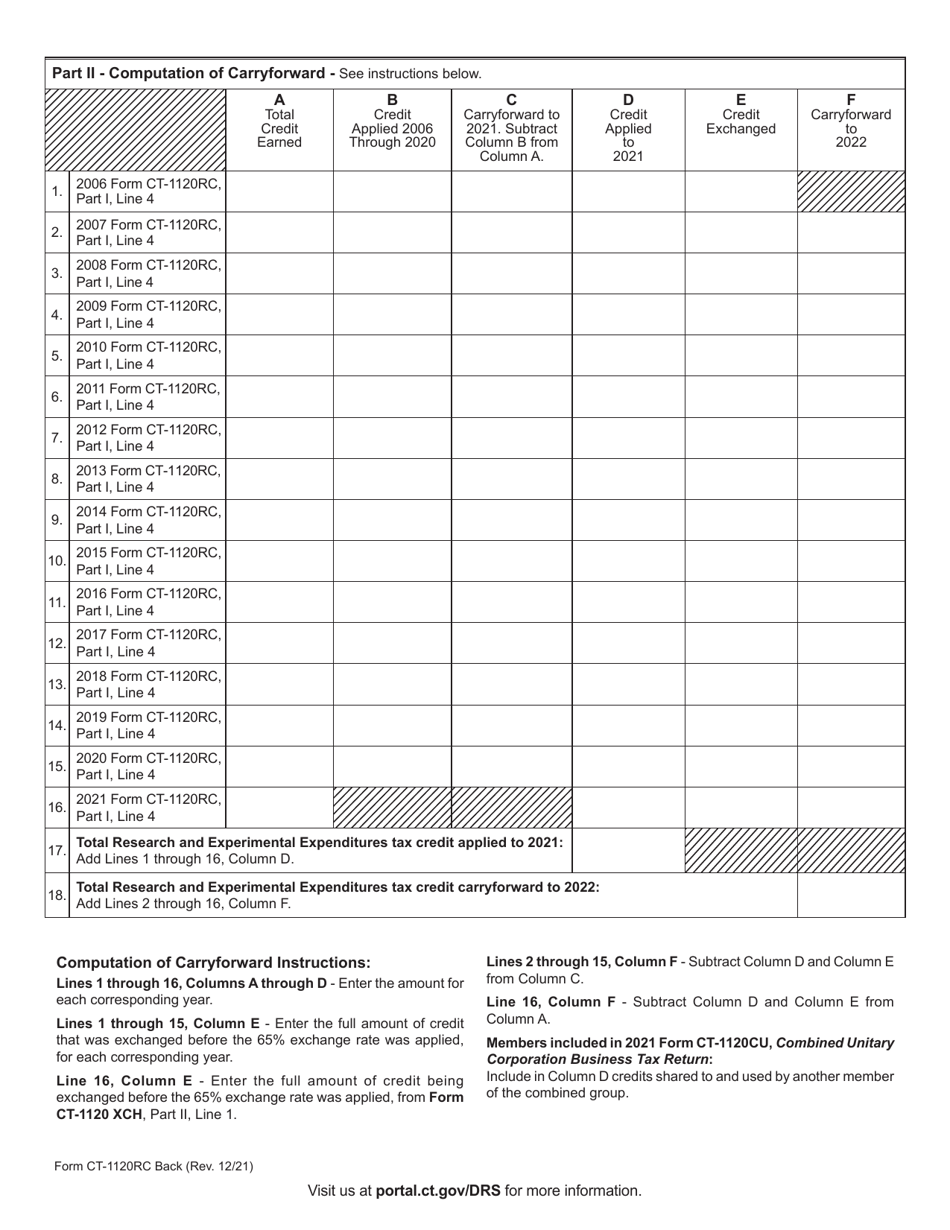

Form CT-1120RC Research and Experimental Expenditures Tax Credit - Connecticut

What Is Form CT-1120RC?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1120RC?

A: Form CT-1120RC is the form used to claim the Research and Experimental Expenditures Tax Credit in Connecticut.

Q: What is the Research and Experimental Expenditures Tax Credit?

A: The Research and Experimental Expenditures Tax Credit is a credit that businesses in Connecticut can claim for qualifying research expenses.

Q: Who is eligible to claim the Research and Experimental Expenditures Tax Credit?

A: Businesses that have incurred qualifying research expenses in Connecticut may be eligible to claim the credit.

Q: What are qualifying research expenses?

A: Qualifying research expenses include expenses related to the development or improvement of products, processes, or software through technological research or experimentation.

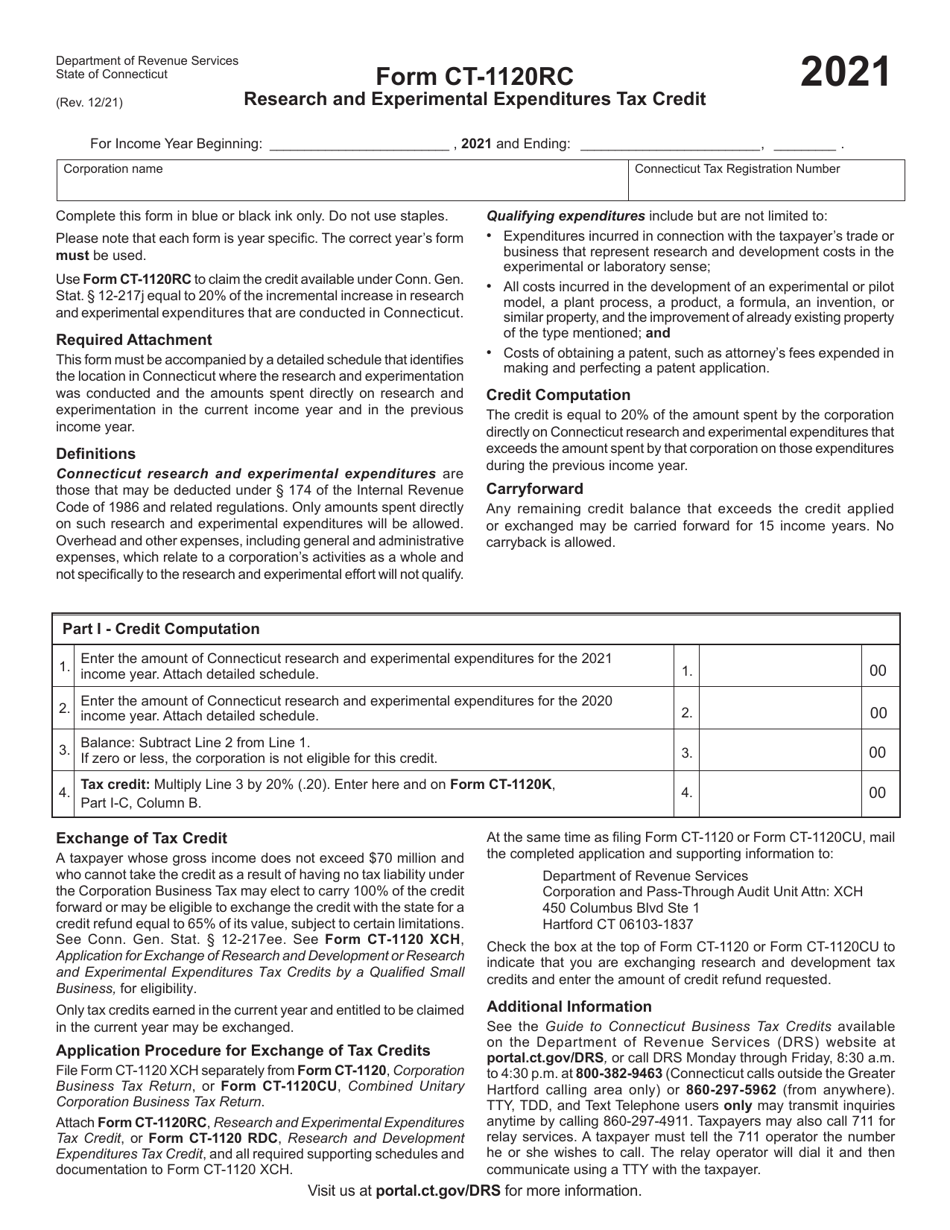

Q: How do I file Form CT-1120RC?

A: Form CT-1120RC is filed along with the Connecticut corporation business tax return (Form CT-1120) or the combined unitary corporation business tax return (Form CT-1120CU).

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120RC by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.