This version of the form is not currently in use and is provided for reference only. Download this version of

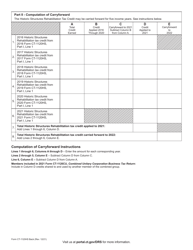

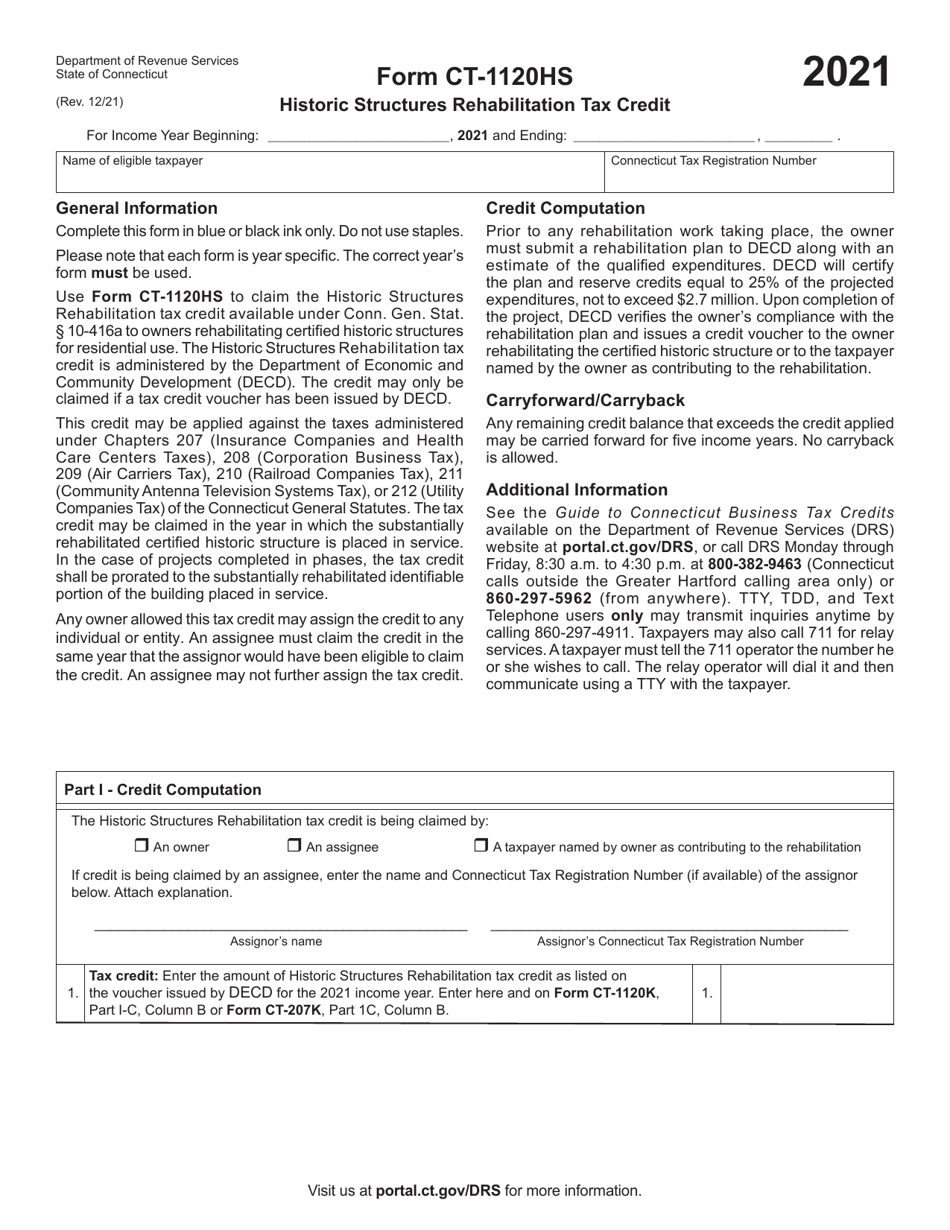

Form CT-1120HS

for the current year.

Form CT-1120HS Historic Structures Rehabilitation Tax Credit - Connecticut

What Is Form CT-1120HS?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1120HS?

A: Form CT-1120HS is the form used to claim the Historic Structures Rehabilitation Tax Credit in Connecticut.

Q: What is the Historic Structures Rehabilitation Tax Credit?

A: The Historic Structures Rehabilitation Tax Credit is a tax credit offered by the state of Connecticut to encourage the rehabilitation and preservation of qualifying historic structures.

Q: Who is eligible to claim the Historic Structures Rehabilitation Tax Credit?

A: Owners of qualified historic structures in Connecticut who undertake substantial rehabilitation work may be eligible to claim this tax credit.

Q: What is considered a qualified historic structure?

A: A qualified historic structure is a building that is listed on the State or National Register of Historic Places or is deemed eligible for such listing.

Q: What kind of rehabilitation work qualifies for the tax credit?

A: Substantial rehabilitation work that meets the Connecticut Historic Rehabilitation Tax Credit Program's requirements may qualify for the tax credit.

Q: How much is the tax credit?

A: The tax credit is equal to 30% of the qualified rehabilitation expenses.

Q: Are there any limitations to the tax credit?

A: Yes, the tax credit is subject to certain limitations, including a maximum credit amount and a credit recapture period.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120HS by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.