This version of the form is not currently in use and is provided for reference only. Download this version of

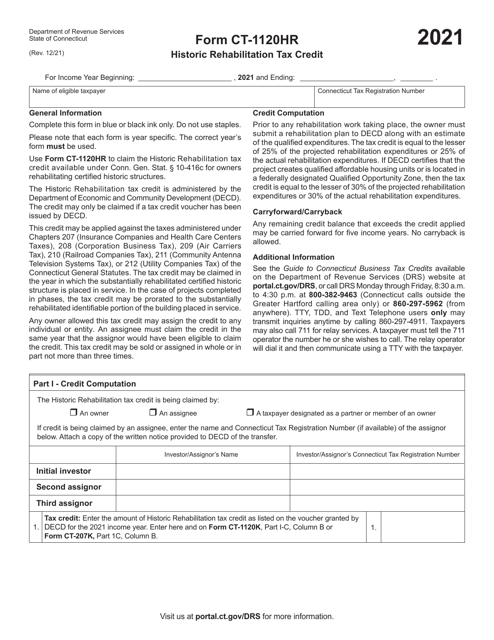

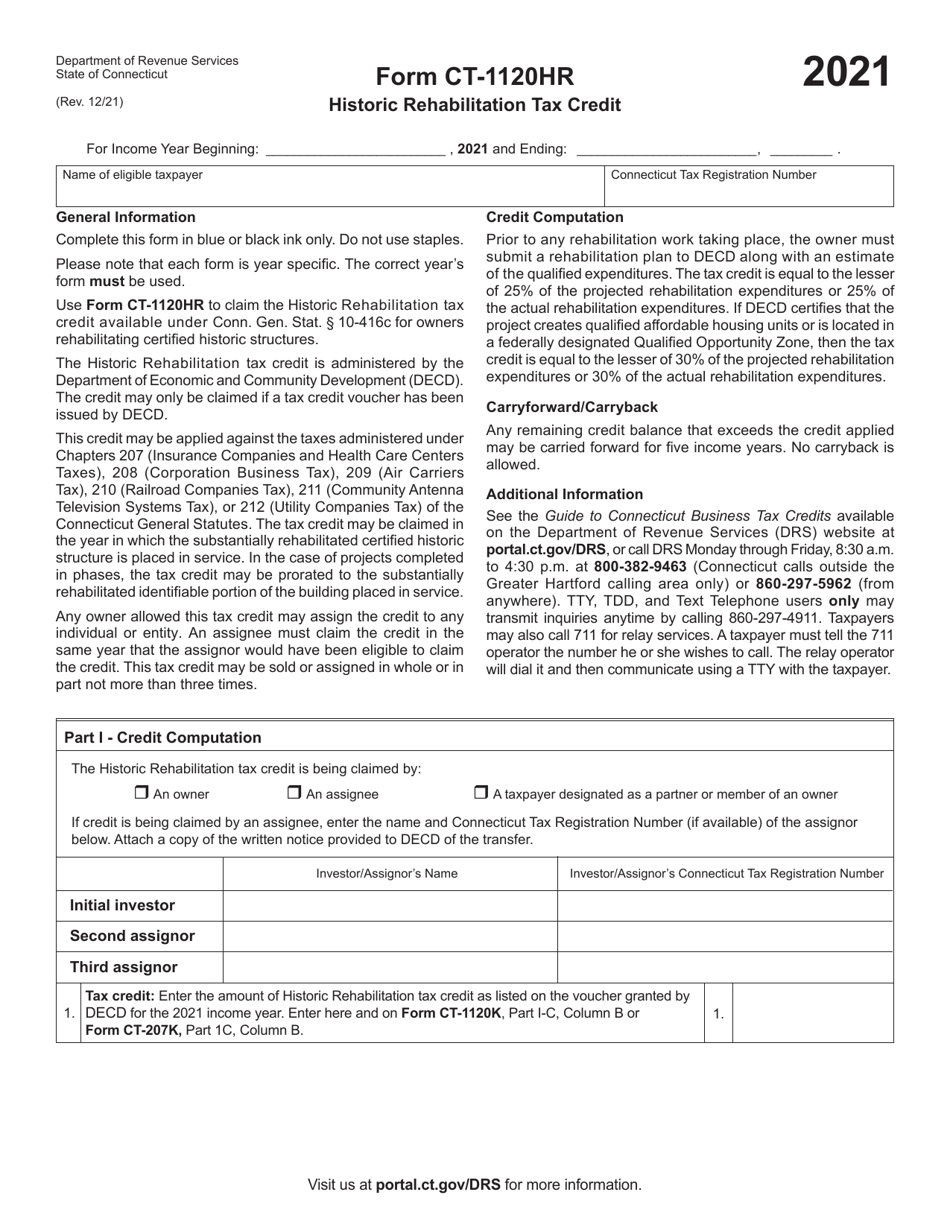

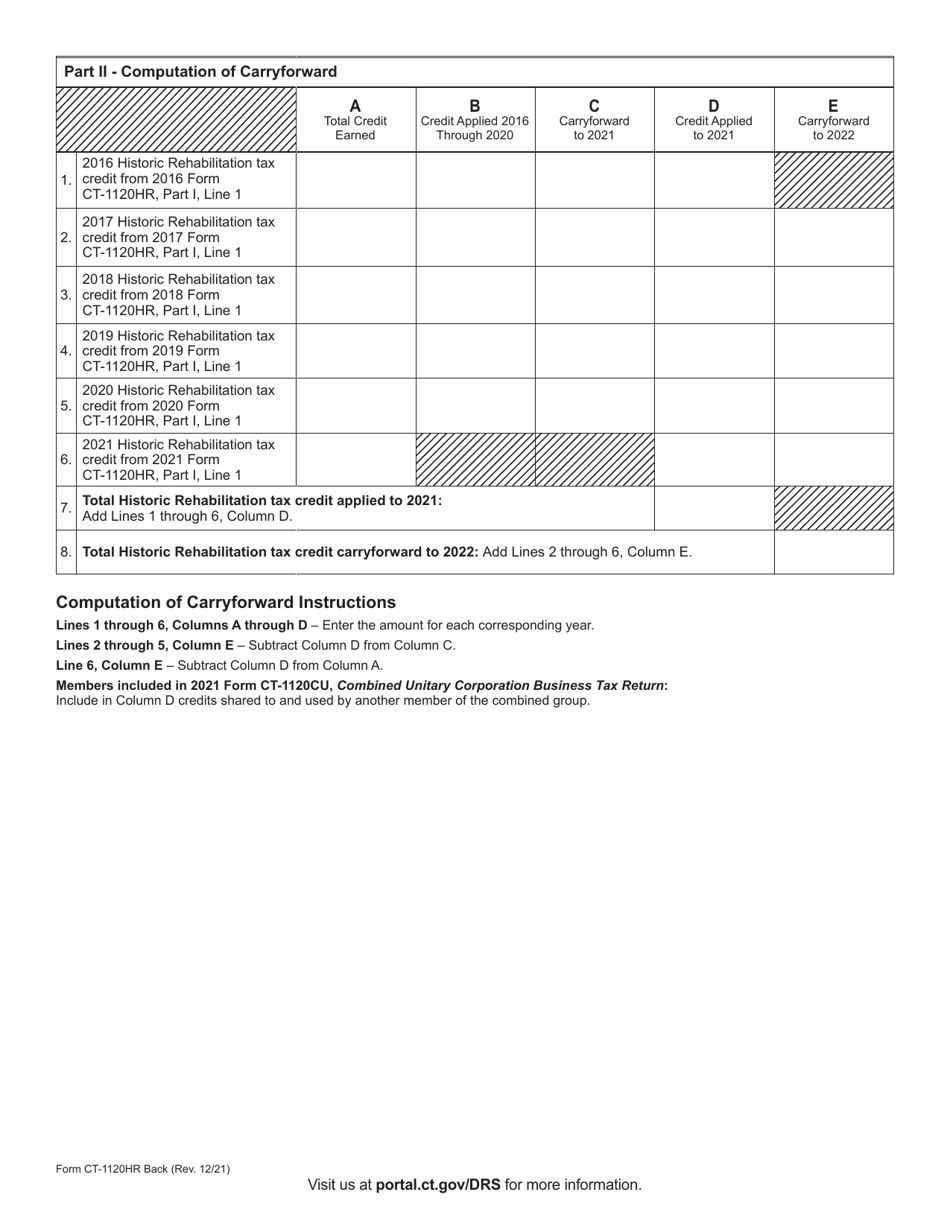

Form CT-1120HR

for the current year.

Form CT-1120HR Historic Rehabilitation Tax Credit - Connecticut

What Is Form CT-1120HR?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1120HR?

A: Form CT-1120HR is a tax form used for claiming the Historic Rehabilitation Tax Credit in Connecticut.

Q: What is the Historic Rehabilitation Tax Credit?

A: The Historic Rehabilitation Tax Credit is a tax incentive program that encourages the rehabilitation of historic properties in Connecticut.

Q: Who is eligible to claim the Historic Rehabilitation Tax Credit?

A: Property owners or lessees who have rehabilitated a certified historic structure in Connecticut may be eligible to claim the credit.

Q: What is the purpose of the Historic Rehabilitation Tax Credit?

A: The purpose of the credit is to stimulate the rehabilitation and preservation of historic structures in Connecticut.

Q: How much is the Historic Rehabilitation Tax Credit?

A: The credit is equal to a percentage of the qualified rehabilitation expenses incurred during the rehabilitation process.

Q: How do I claim the Historic Rehabilitation Tax Credit?

A: To claim the credit, you must complete Form CT-1120HR and include it with your Connecticut business tax return.

Q: Are there any limitations or restrictions on the Historic Rehabilitation Tax Credit?

A: Yes, there are certain limitations and restrictions on the credit, such as the maximum credit amount and the phased credit rate.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120HR by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.