This version of the form is not currently in use and is provided for reference only. Download this version of

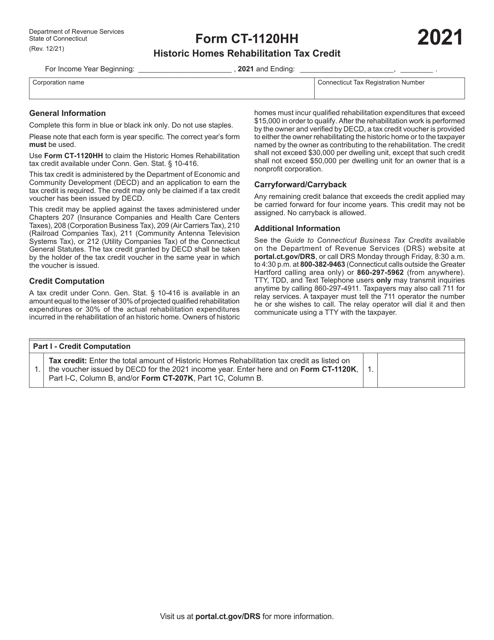

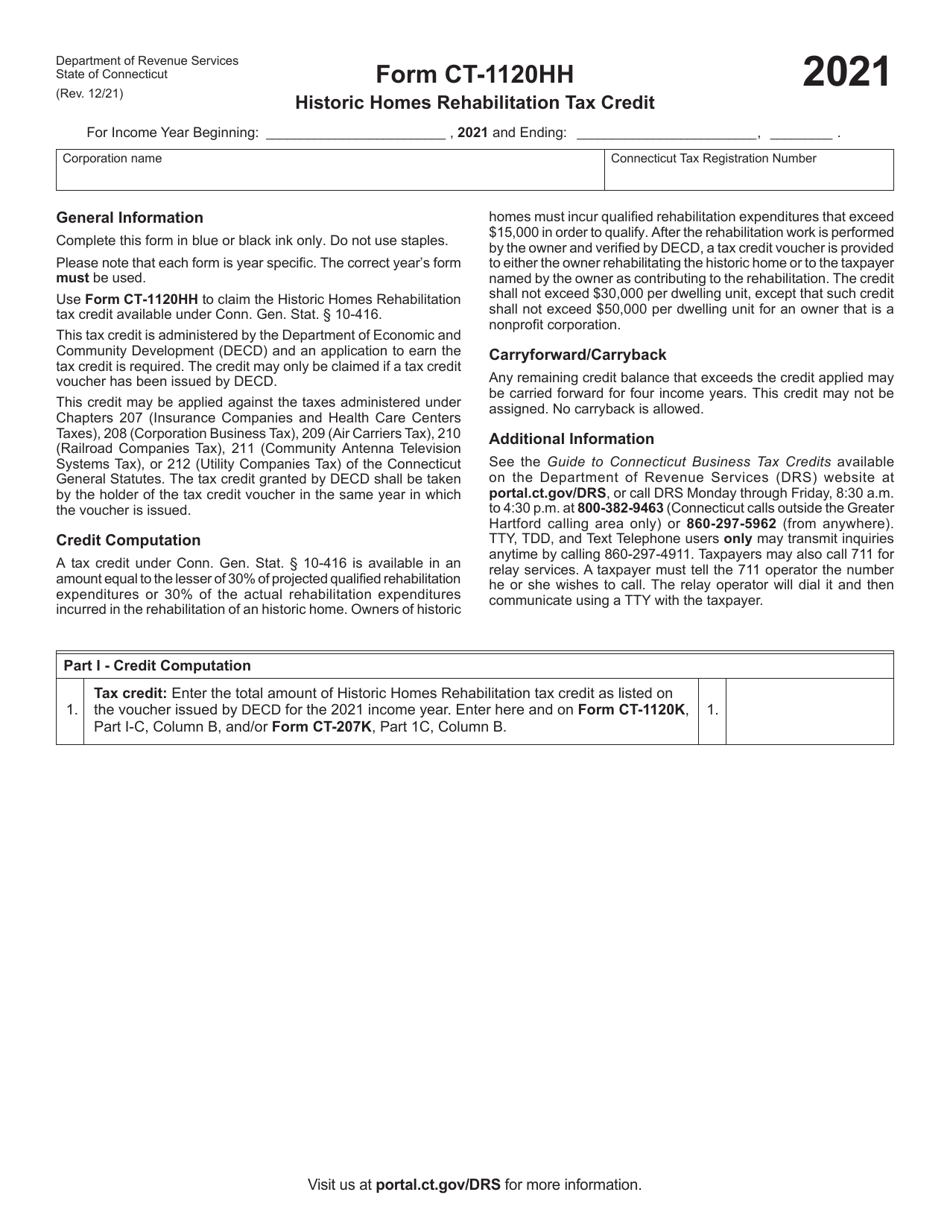

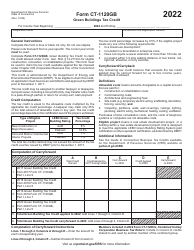

Form CT-1120HH

for the current year.

Form CT-1120HH Historic Homes Rehabilitation Tax Credit - Connecticut

What Is Form CT-1120HH?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1120HH?

A: Form CT-1120HH is a tax form used in Connecticut to claim the Historic Homes Rehabilitation Tax Credit.

Q: What is the Historic Homes Rehabilitation Tax Credit?

A: The Historic Homes Rehabilitation Tax Credit is a tax credit offered in Connecticut for the rehabilitation of certified historic homes.

Q: Who is eligible to claim the Historic Homes Rehabilitation Tax Credit?

A: Owners of certified historic homes in Connecticut who have completed qualifying rehabilitation projects are eligible to claim the tax credit.

Q: What is the purpose of Form CT-1120HH?

A: Form CT-1120HH is used to calculate and claim the Historic Homes Rehabilitation Tax Credit in Connecticut.

Q: What information is required to complete Form CT-1120HH?

A: To complete Form CT-1120HH, you will need information about the certified historic home, details about the rehabilitation project, and documentation to support the claimed expenses.

Q: Is there a deadline for filing Form CT-1120HH?

A: Yes, Form CT-1120HH must generally be filed by the due date of the Connecticut corporation business tax return for the year in which the rehabilitation project is completed.

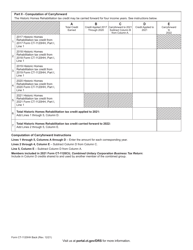

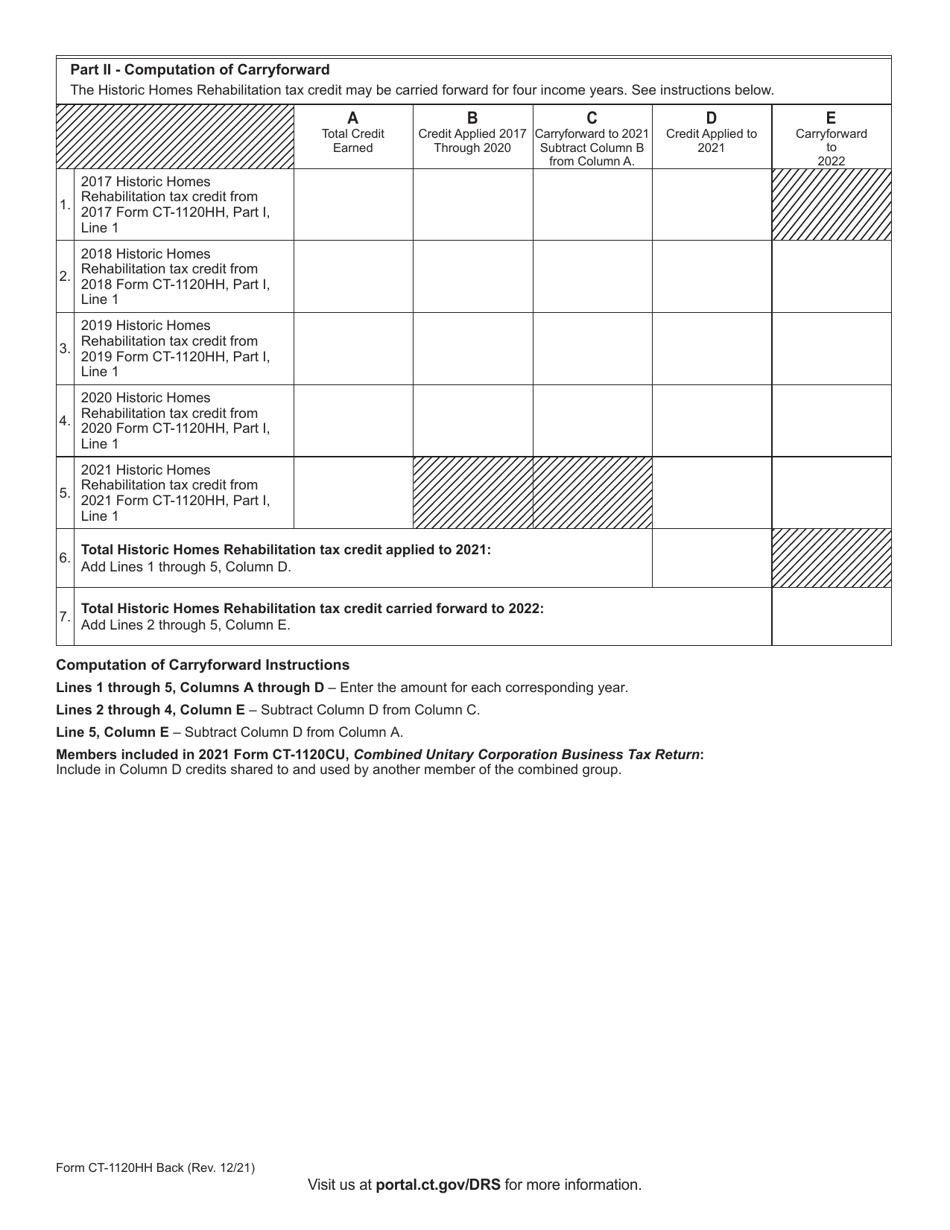

Q: Can the Historic Homes Rehabilitation Tax Credit be carried forward or back?

A: No, the Historic Homes Rehabilitation Tax Credit cannot be carried forward or back. It can only be used to offset Connecticut corporation business tax liability in the year it is claimed.

Q: Are there any limitations or restrictions on claiming the Historic Homes Rehabilitation Tax Credit?

A: Yes, there are limitations and restrictions on claiming the Historic Homes Rehabilitation Tax Credit, including a maximum credit amount and requirements for certification and approval of the rehabilitation project.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120HH by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.