This version of the form is not currently in use and is provided for reference only. Download this version of

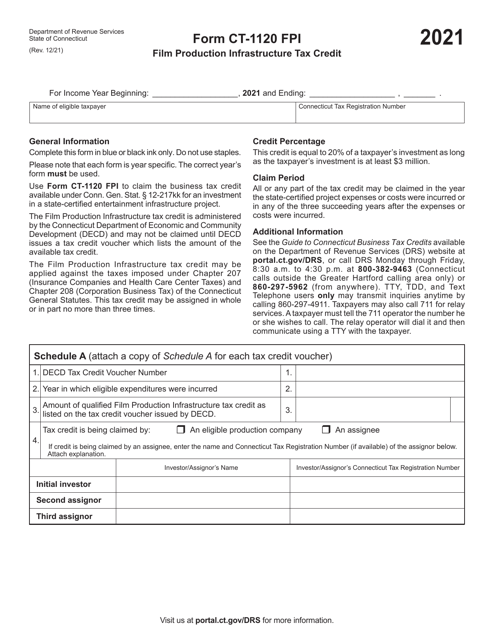

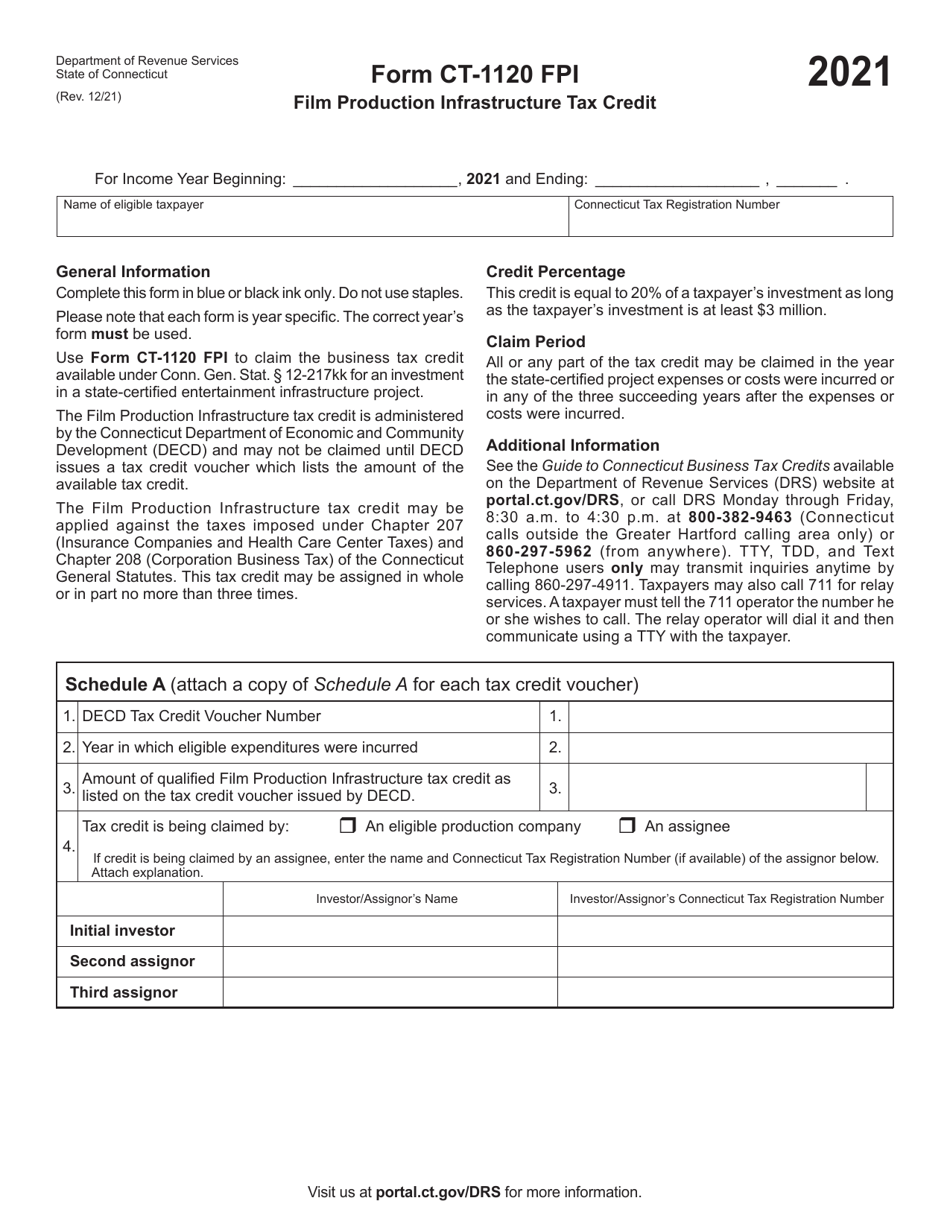

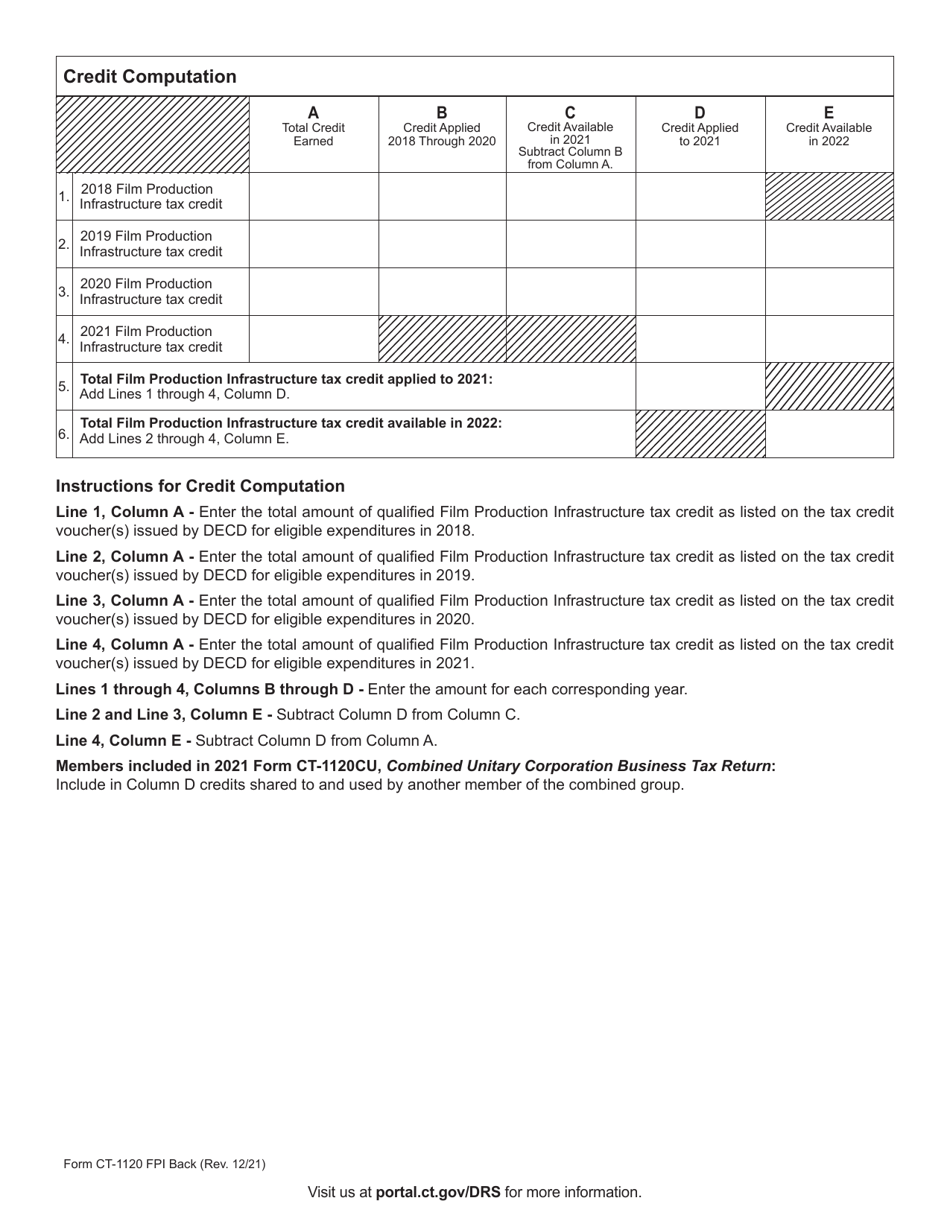

Form CT-1120 FPI

for the current year.

Form CT-1120 FPI Film Production Infrastructure Tax Credit - Connecticut

What Is Form CT-1120 FPI?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1120 FPI?

A: Form CT-1120 FPI is the tax form used by film production companies to claim the Film Production Infrastructure Tax Credit in Connecticut.

Q: What is the Film Production Infrastructure Tax Credit?

A: The Film Production Infrastructure Tax Credit is a tax credit available to film production companies for investing in infrastructure in Connecticut.

Q: Who is eligible to claim the Film Production Infrastructure Tax Credit?

A: Film production companies that have invested in infrastructure in Connecticut are eligible to claim the tax credit.

Q: How do I fill out Form CT-1120 FPI?

A: You can fill out Form CT-1120 FPI by providing information about your film production company and the infrastructure investments made in Connecticut.

Q: What supporting documents do I need to attach with Form CT-1120 FPI?

A: You may need to attach documentation such as invoices, receipts, and other proof of infrastructure investments in Connecticut.

Q: When is the deadline to file Form CT-1120 FPI?

A: The deadline to file Form CT-1120 FPI is the same as the deadline for filing the regular Connecticut corporation tax return, which is generally March 15th.

Q: What is the benefit of claiming the Film Production Infrastructure Tax Credit?

A: By claiming the tax credit, film production companies can reduce their tax liability and potentially save money on their Connecticut state taxes.

Q: Can I claim both the Film Production Infrastructure Tax Credit and other film production credits?

A: Yes, you may be able to claim both the Film Production Infrastructure Tax Credit and other film production credits, as long as you meet the eligibility requirements for each credit.

Q: Who can I contact for more information about Form CT-1120 FPI and the Film Production Infrastructure Tax Credit?

A: You can contact the Connecticut Department of Revenue Services for more information about Form CT-1120 FPI and the Film Production Infrastructure Tax Credit.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120 FPI by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.