This version of the form is not currently in use and is provided for reference only. Download this version of

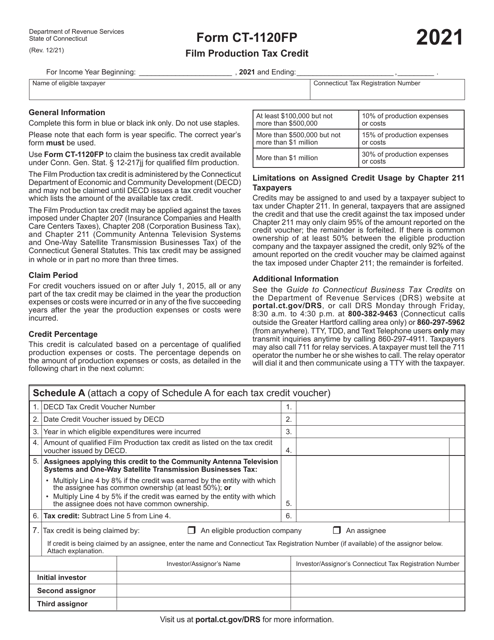

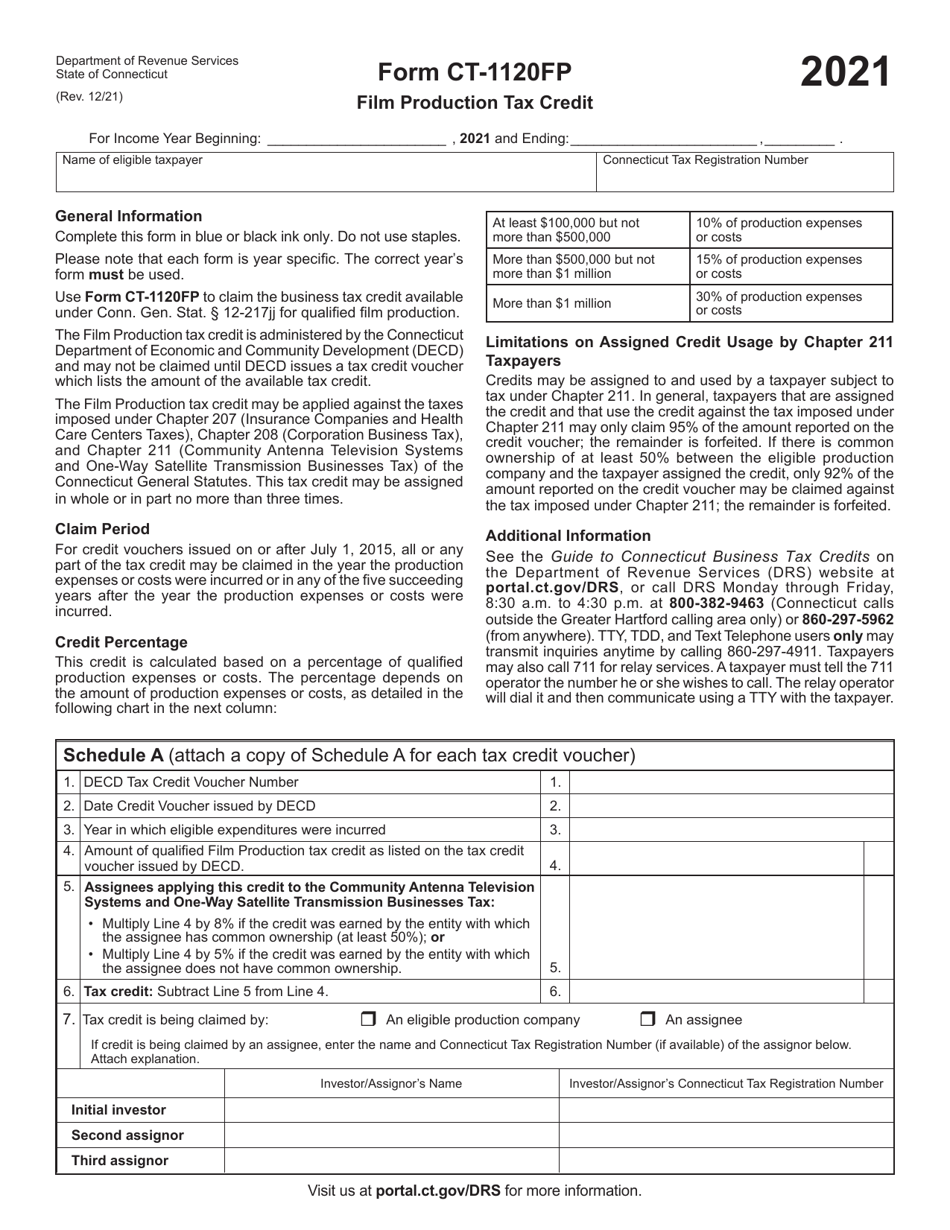

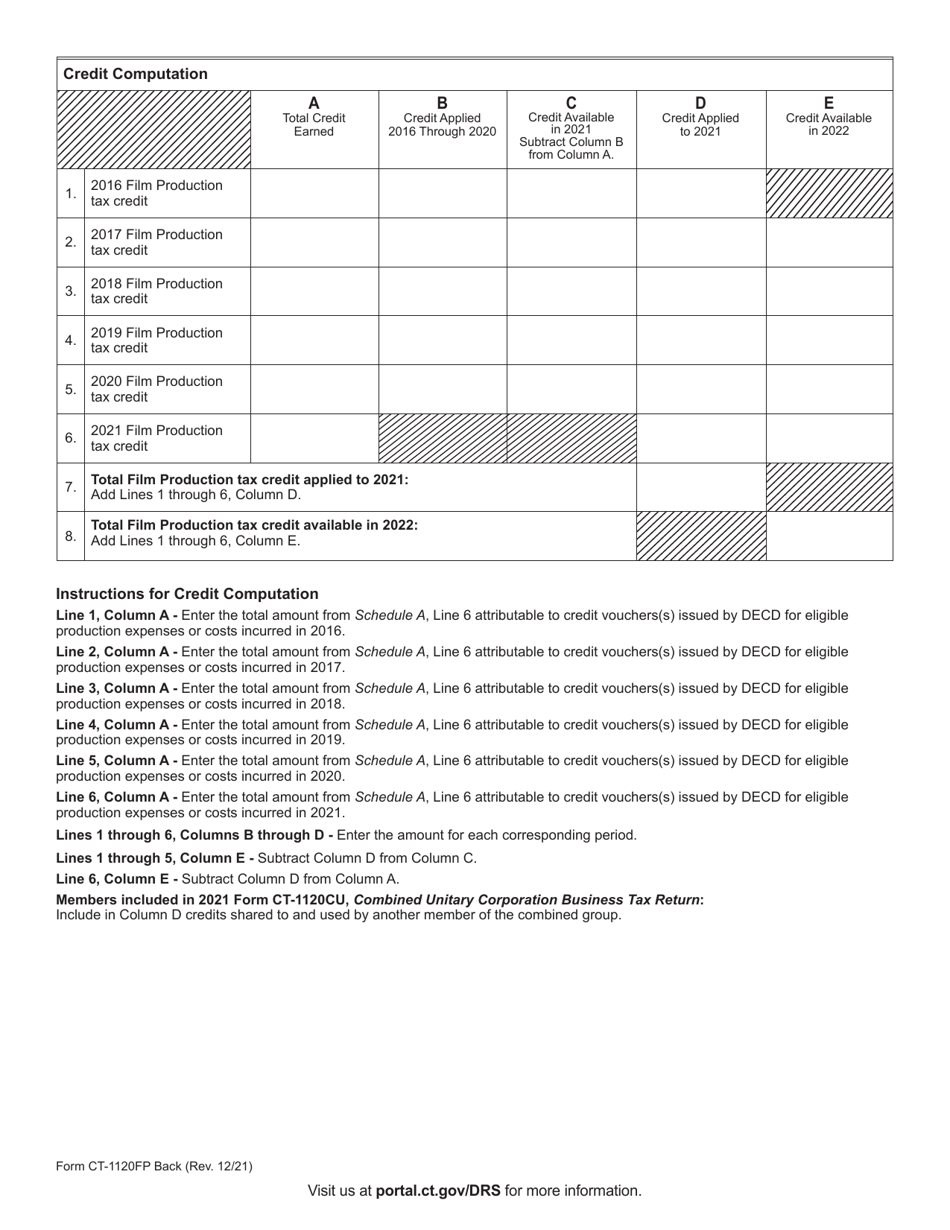

Form CT-1120FP

for the current year.

Form CT-1120FP Film Production Tax Credit - Connecticut

What Is Form CT-1120FP?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1120FP?

A: Form CT-1120FP is a tax form used for claiming the Film ProductionTax Credit in Connecticut.

Q: What is the Film Production Tax Credit?

A: The Film Production Tax Credit is a tax incentive provided by the state of Connecticut to encourage film production companies to conduct their business in the state.

Q: Who can use Form CT-1120FP?

A: Film production companies that qualify for the Film Production Tax Credit in Connecticut can use Form CT-1120FP.

Q: What information is required on Form CT-1120FP?

A: Form CT-1120FP requires information about the film production company, its production activities in Connecticut, and the expenses related to those activities.

Q: When is the deadline for filing Form CT-1120FP?

A: The deadline for filing Form CT-1120FP is the same as the deadline for filing the company's Connecticut corporation business tax return, which is usually the 15th day of the fourth month following the close of the tax year.

Q: Are there any limitations or restrictions on the Film Production Tax Credit?

A: Yes, there are limitations and restrictions on the Film Production Tax Credit in Connecticut, such as minimum expenditure requirements, maximum credit amounts, and certain eligibility criteria.

Q: Can the Film Production Tax Credit be carried forward or refunded?

A: Yes, any unused Film Production Tax Credit can be carried forward for up to five years, or refunded under certain circumstances.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120FP by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.