This version of the form is not currently in use and is provided for reference only. Download this version of

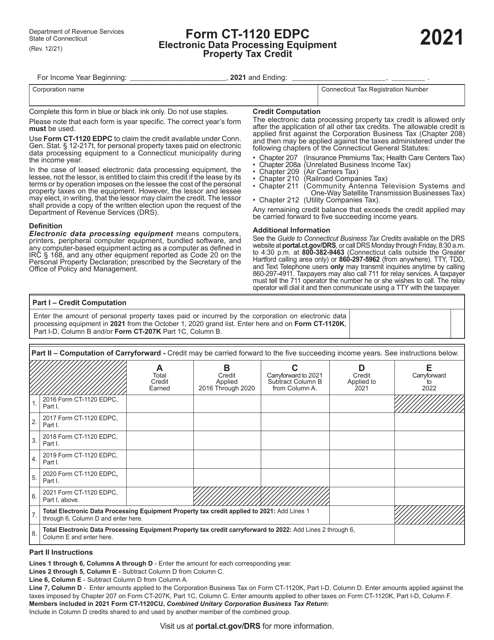

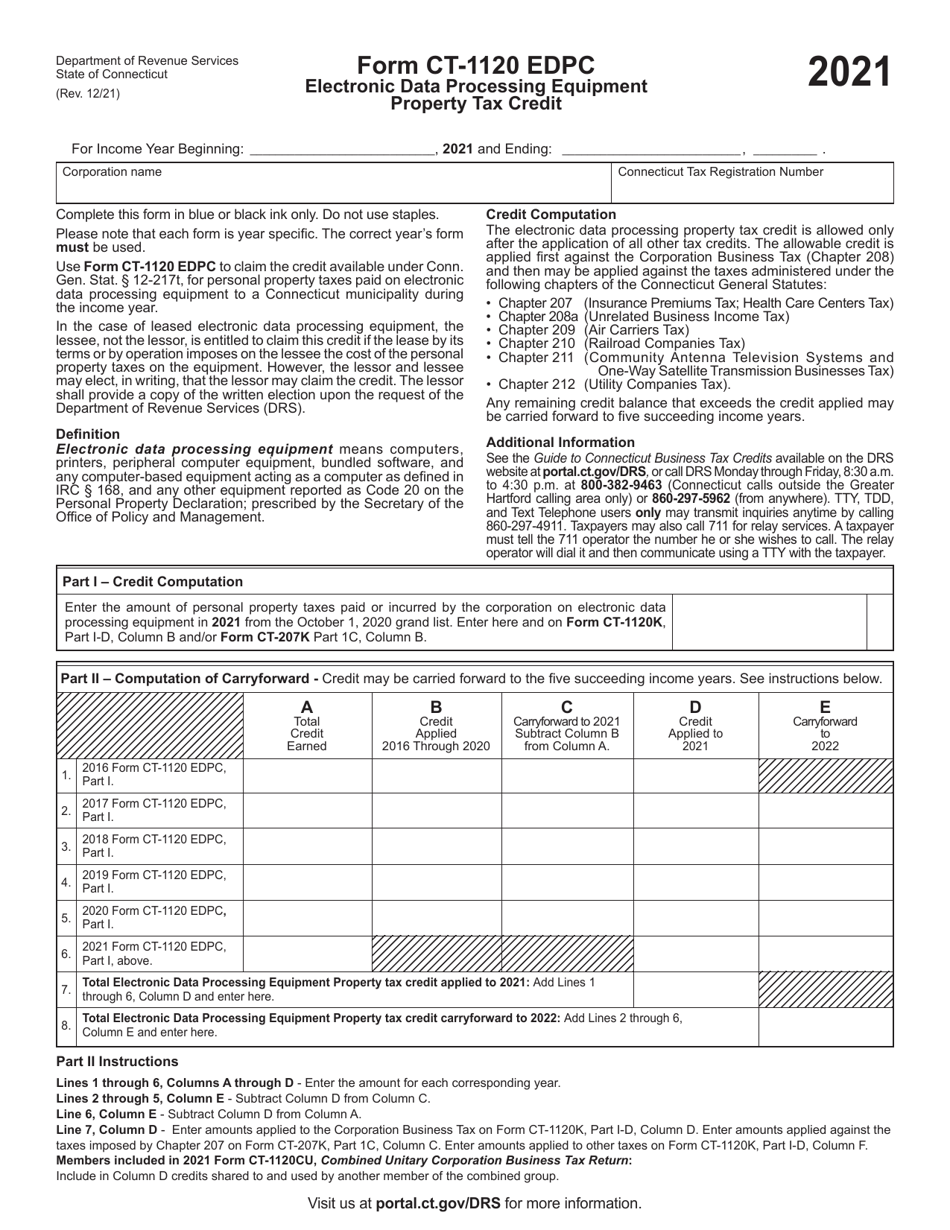

Form CT-1120 EDPC

for the current year.

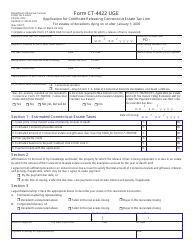

Form CT-1120 EDPC Electronic Data Processing Equipment Property Tax Credit - Connecticut

What Is Form CT-1120 EDPC?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1120 EDPC?

A: Form CT-1120 EDPC is a form used in Connecticut to claim the Electronic Data Processing Equipment Property Tax Credit.

Q: What is the Electronic Data Processing Equipment Property Tax Credit?

A: The Electronic Data Processing Equipment Property Tax Credit is a tax credit in Connecticut that allows businesses to claim a credit for qualified investments in electronic data processing equipment.

Q: Who can claim the Electronic Data Processing Equipment Property Tax Credit?

A: Businesses in Connecticut that make qualified investments in electronic data processing equipment can claim the tax credit.

Q: What qualifies as electronic data processing equipment?

A: Electronic data processing equipment includes computers, computer hardware, software, and peripheral equipment used for data processing.

Q: How much is the tax credit?

A: The amount of the tax credit is based on a percentage of the qualified investment in electronic data processing equipment.

Q: How do I claim the tax credit?

A: To claim the tax credit, businesses must file Form CT-1120 EDPC with the Connecticut Department of Revenue Services.

Q: Are there any limitations or requirements to claim the tax credit?

A: Yes, there are limitations and requirements for claiming the tax credit. Businesses must meet certain criteria and provide documentation to support their claim.

Q: Can individuals claim the Electronic Data Processing Equipment Property Tax Credit?

A: No, the tax credit is only available for businesses in Connecticut.

Q: Is the tax credit refundable?

A: No, the tax credit is not refundable. It can only be used to offset the business's tax liability.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120 EDPC by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.