This version of the form is not currently in use and is provided for reference only. Download this version of

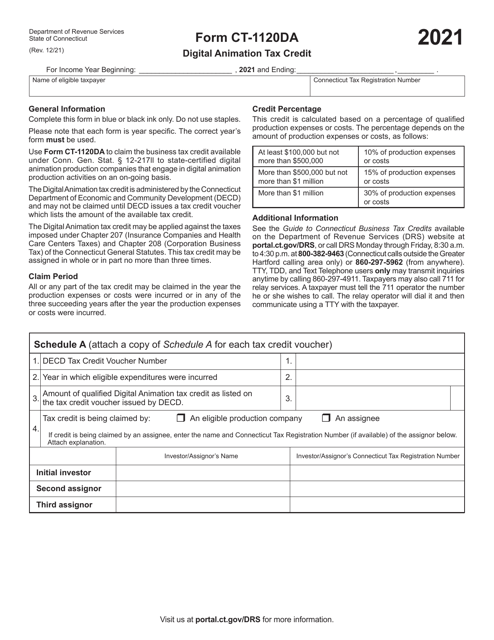

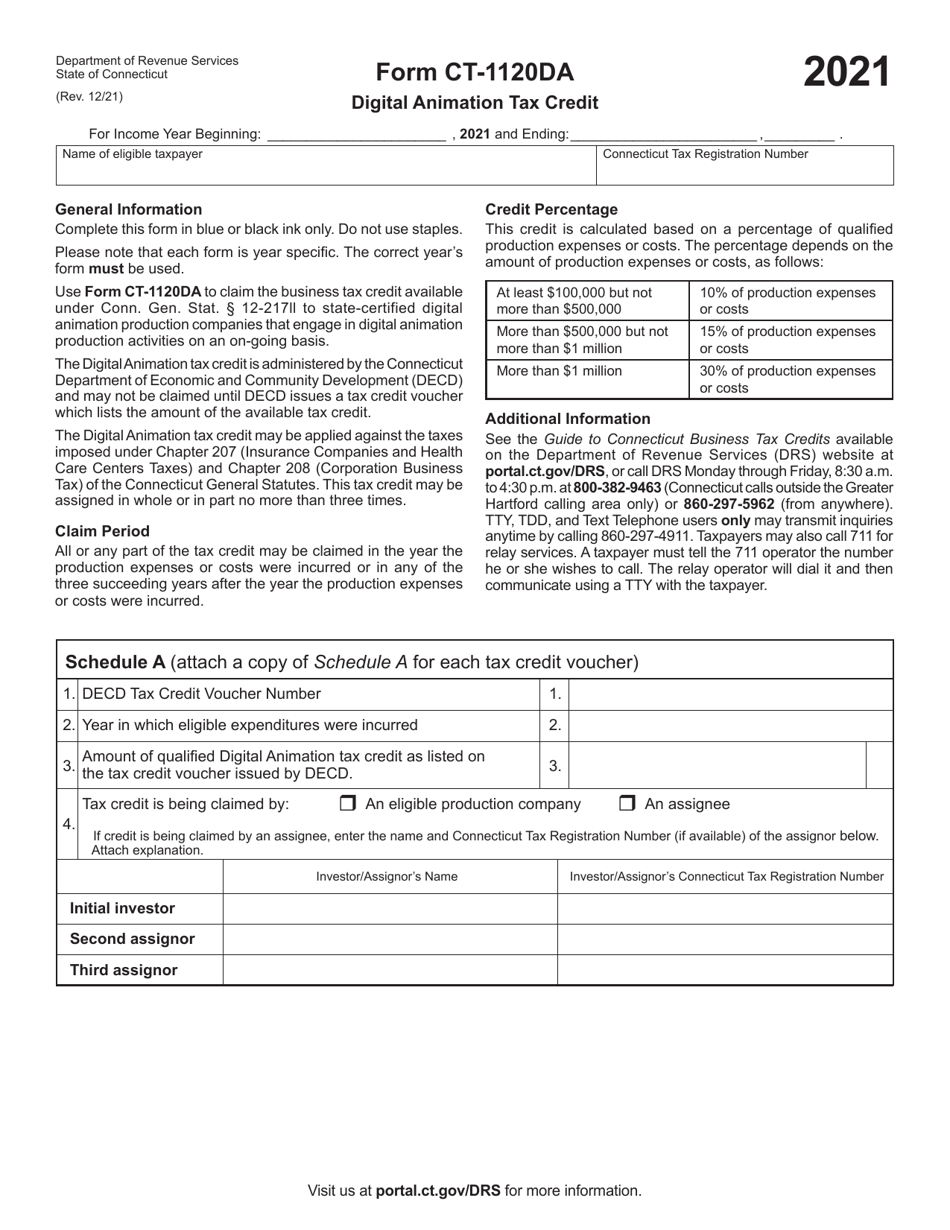

Form CT-1120DA

for the current year.

Form CT-1120DA Digital Animation Tax Credit - Connecticut

What Is Form CT-1120DA?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1120DA?

A: Form CT-1120DA is the Digital Animation Tax Credit form specifically designed for businesses in Connecticut.

Q: Who can use Form CT-1120DA?

A: Businesses in Connecticut that are specifically engaged in digital animation production and meet certain criteria can use Form CT-1120DA.

Q: What is the purpose of Form CT-1120DA?

A: Form CT-1120DA is used to claim the Digital Animation Tax Credit, which provides a tax credit for eligible businesses that engage in digital animation production in Connecticut.

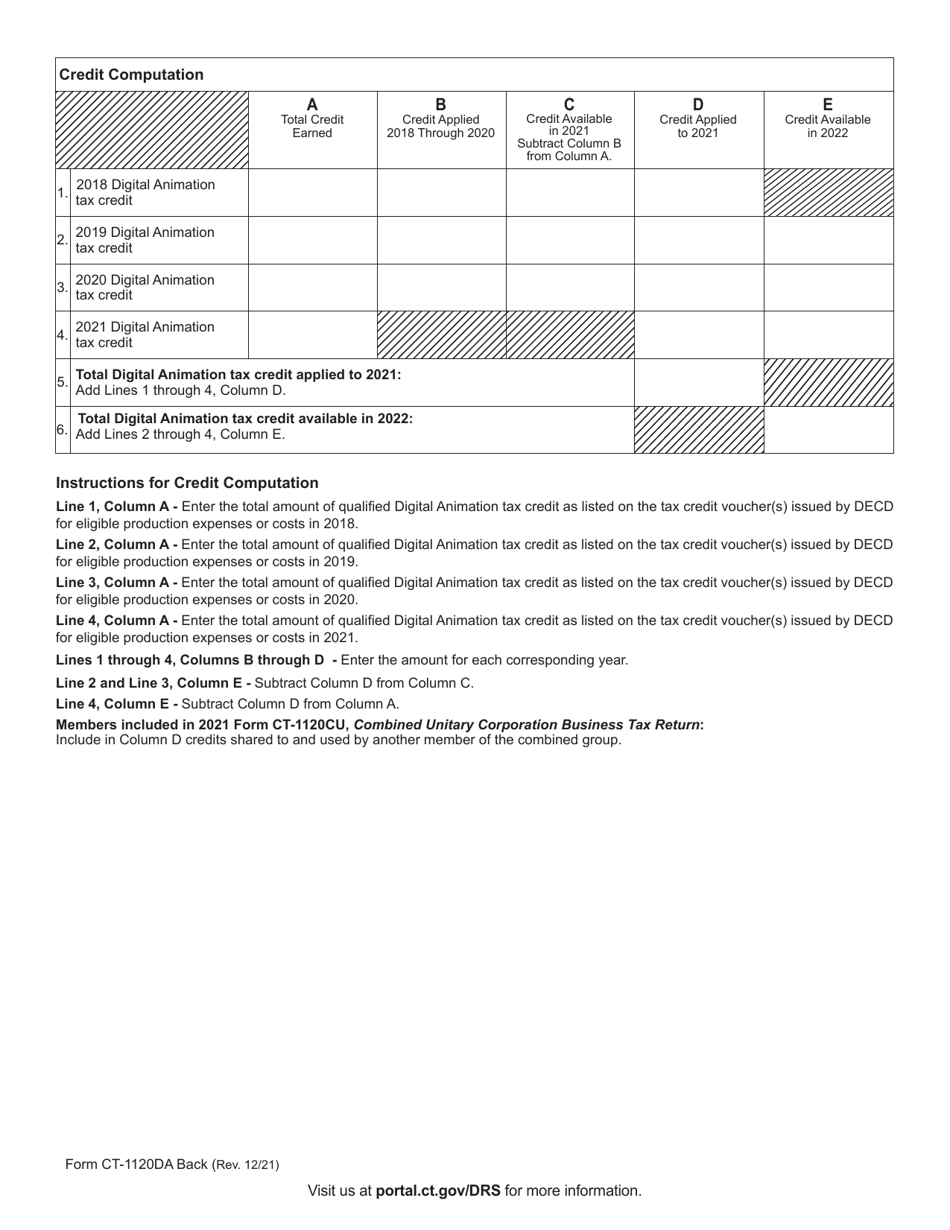

Q: How do I fill out Form CT-1120DA?

A: Form CT-1120DA requires you to provide details about your business, digital animation production activities, qualified expenses, and supporting documentation.

Q: When is Form CT-1120DA due?

A: Form CT-1120DA is typically due on the same date as the annual Connecticut corporation tax return, which is usually March 15th for calendar year taxpayers.

Q: What documentation do I need to submit with Form CT-1120DA?

A: Along with Form CT-1120DA, you may need to submit additional documentation such as production schedules, invoices, and copies of contracts to support your digital animation production activities.

Q: What is the benefit of the Digital Animation Tax Credit?

A: The Digital Animation Tax Credit provides eligible businesses with a tax credit of up to 30% for qualified expenses related to digital animation production in Connecticut.

Q: Can I claim the Digital Animation Tax Credit if my business is not based in Connecticut?

A: No, the Digital Animation Tax Credit is specifically available for businesses engaged in digital animation production in Connecticut.

Q: Are there any restrictions or limitations on the Digital Animation Tax Credit?

A: Yes, there are certain limitations and restrictions on the Digital Animation Tax Credit, such as a maximum credit cap and specific requirements for eligible expenses.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120DA by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.