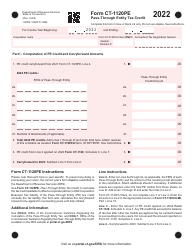

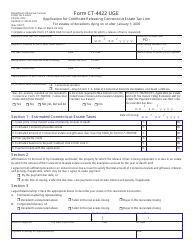

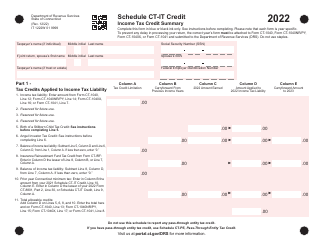

This version of the form is not currently in use and is provided for reference only. Download this version of

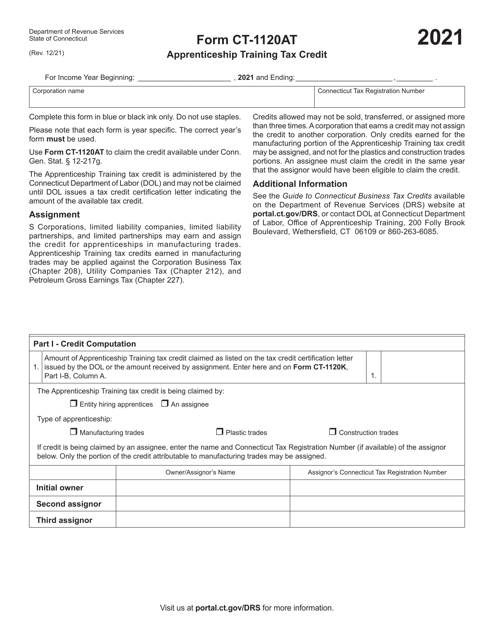

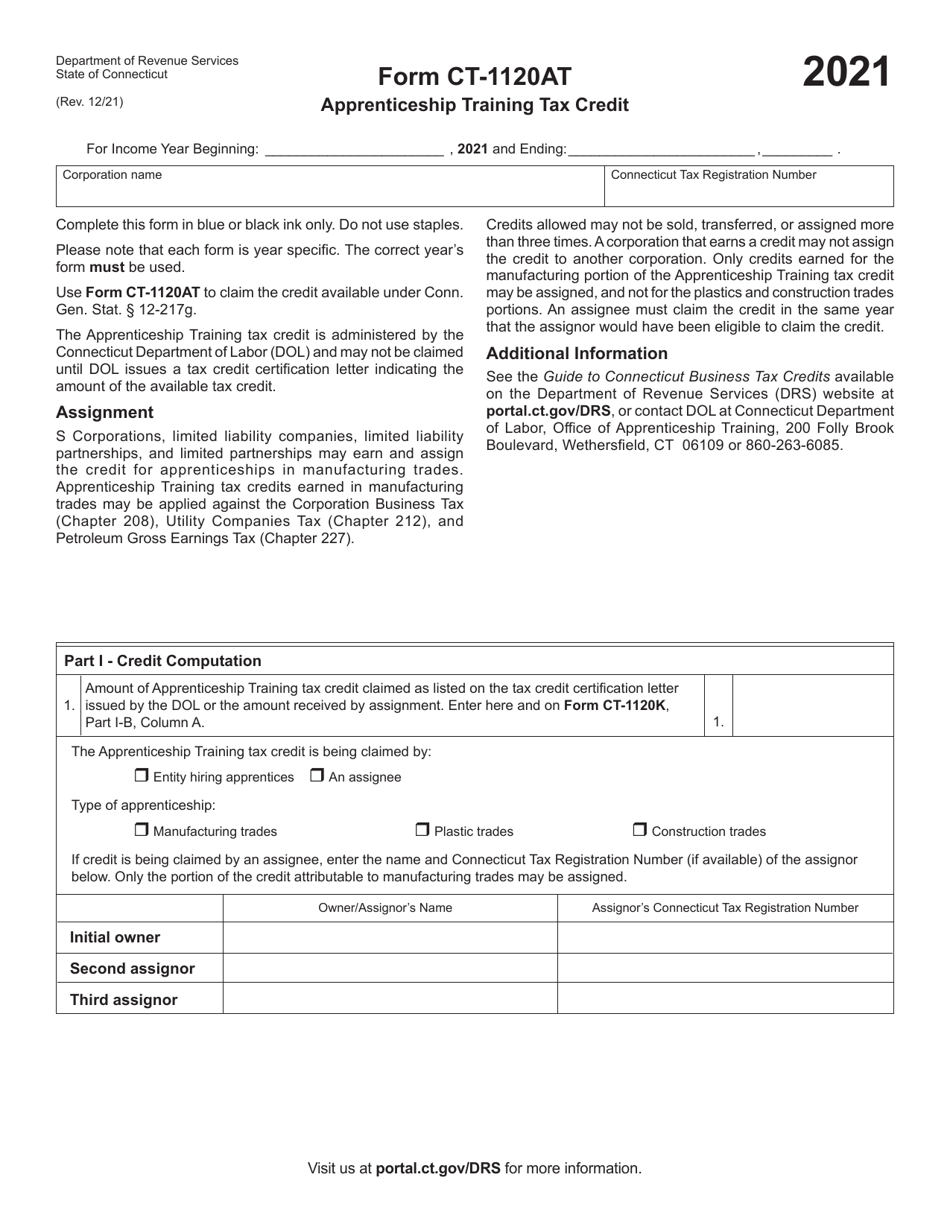

Form CT-1120AT

for the current year.

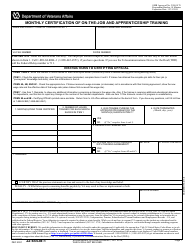

Form CT-1120AT Apprenticeship Training Tax Credit - Connecticut

What Is Form CT-1120AT?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1120AT?

A: Form CT-1120AT is the form used in Connecticut to claim the Apprenticeship Training Tax Credit.

Q: What is the Apprenticeship Training Tax Credit?

A: The Apprenticeship Training Tax Credit is a credit available to businesses in Connecticut that hire and train qualified apprentices.

Q: Who is eligible for the Apprenticeship Training Tax Credit?

A: Businesses in Connecticut that have hired and trained qualified apprentices may be eligible for the credit.

Q: How much is the Apprenticeship Training Tax Credit?

A: The credit is equal to 125% of the wages paid to qualified apprentices during their first 1,040 hours of employment.

Q: How do I claim the Apprenticeship Training Tax Credit?

A: To claim the credit, businesses must complete and submit Form CT-1120AT along with their annual Connecticut business tax return.

Q: Are there any limitations on the Apprenticeship Training Tax Credit?

A: Yes, the credit cannot exceed $4,800 per qualified apprentice per year.

Q: Are there any deadlines for claiming the Apprenticeship Training Tax Credit?

A: Yes, businesses must file Form CT-1120AT and claim the credit within three years from the close of the tax year in which the wages were paid.

Q: Are there any other requirements to claim the Apprenticeship Training Tax Credit?

A: Yes, businesses must meet additional requirements, such as being registered with the Connecticut Department of Labor's Apprenticeship Training Program and having a written training agreement with the apprentice.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120AT by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.