This version of the form is not currently in use and is provided for reference only. Download this version of

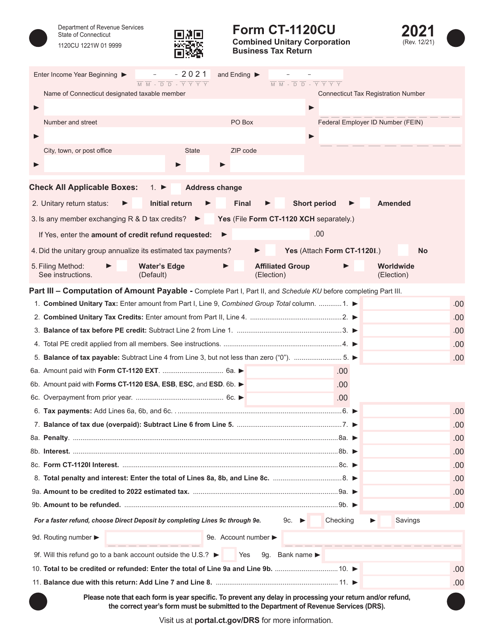

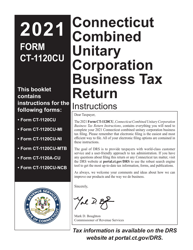

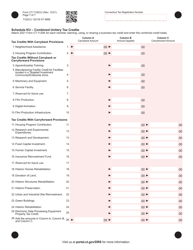

Form CT-1120CU

for the current year.

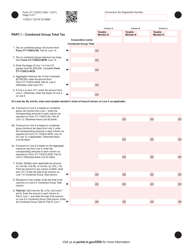

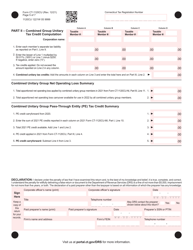

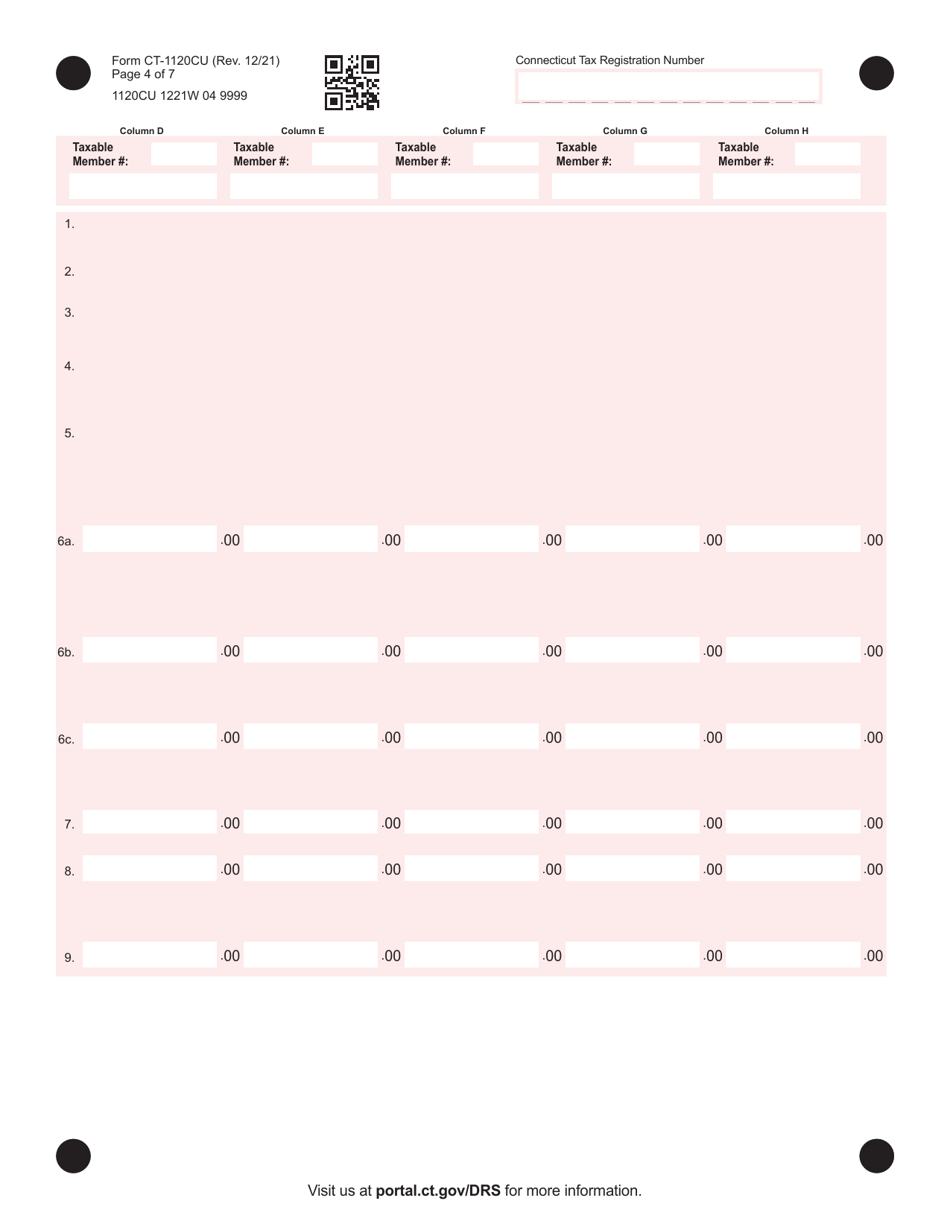

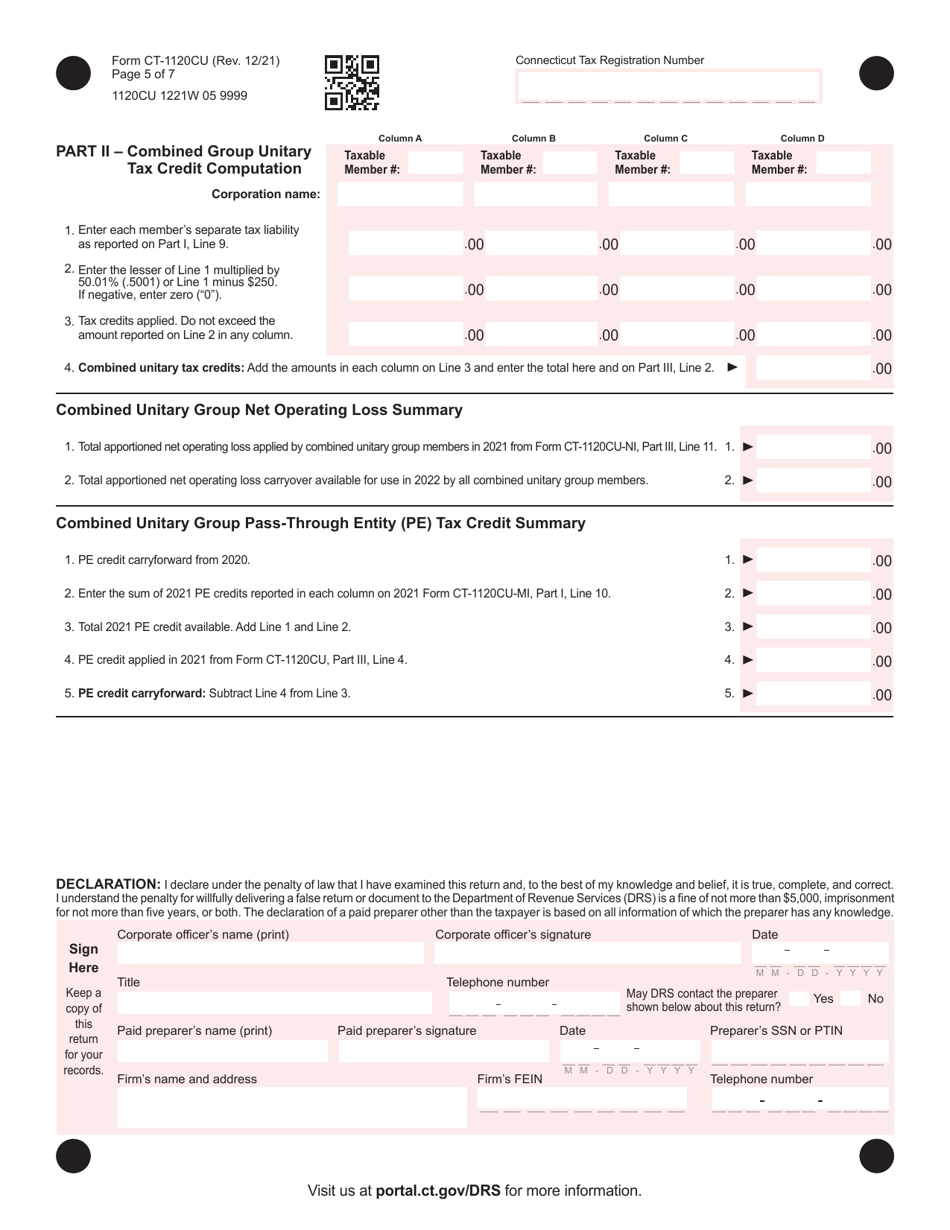

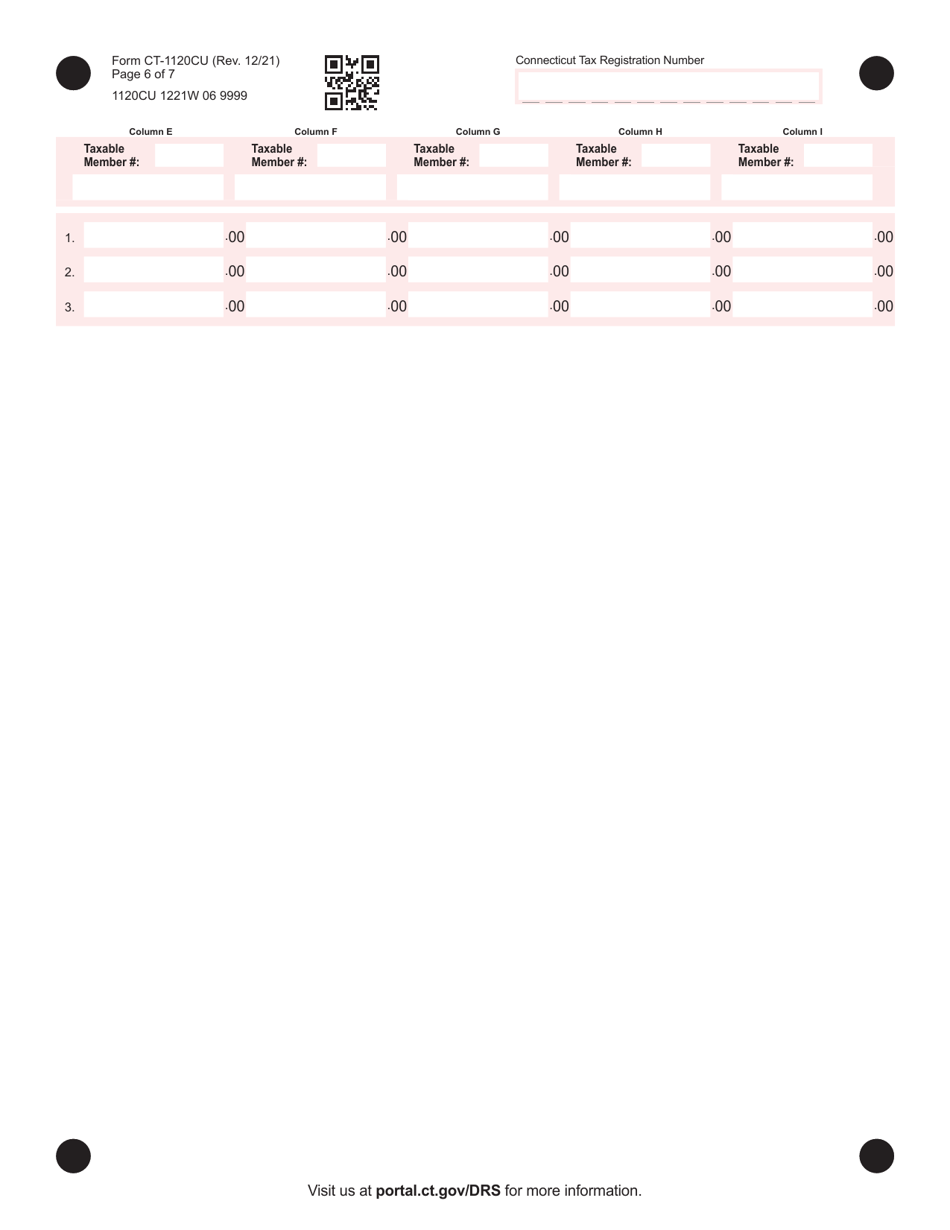

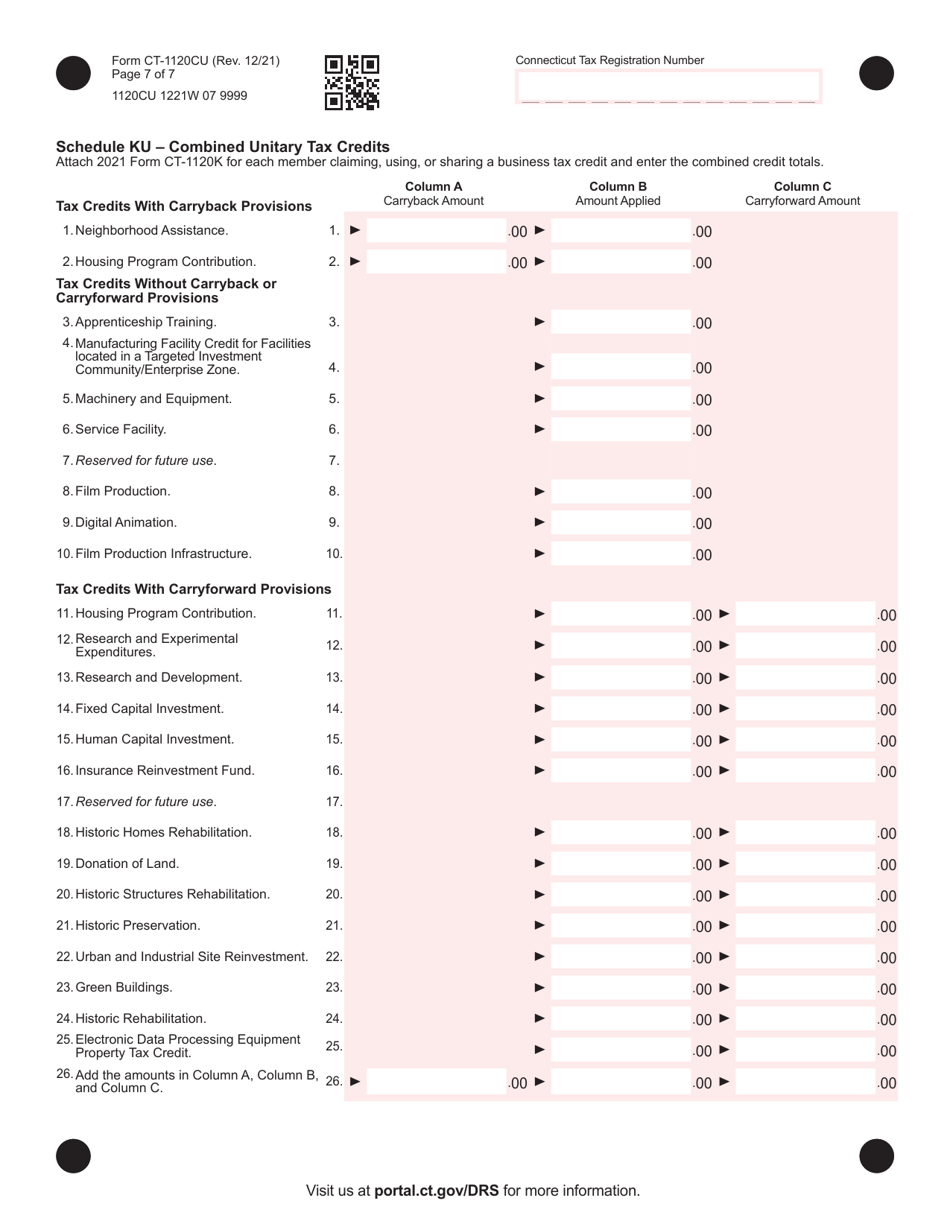

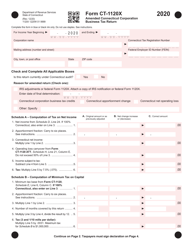

Form CT-1120CU Combined Unitary Corporation Business Tax Return - Connecticut

What Is Form CT-1120CU?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-1120CU?

A: Form CT-1120CU is the Combined Unitary Corporation Business Tax Return for corporations in Connecticut.

Q: Who needs to file Form CT-1120CU?

A: Corporations engaged in a unitary business with other corporations must file Form CT-1120CU.

Q: What is a unitary business?

A: A unitary business is a group of corporations that are interdependent and function as a single entity.

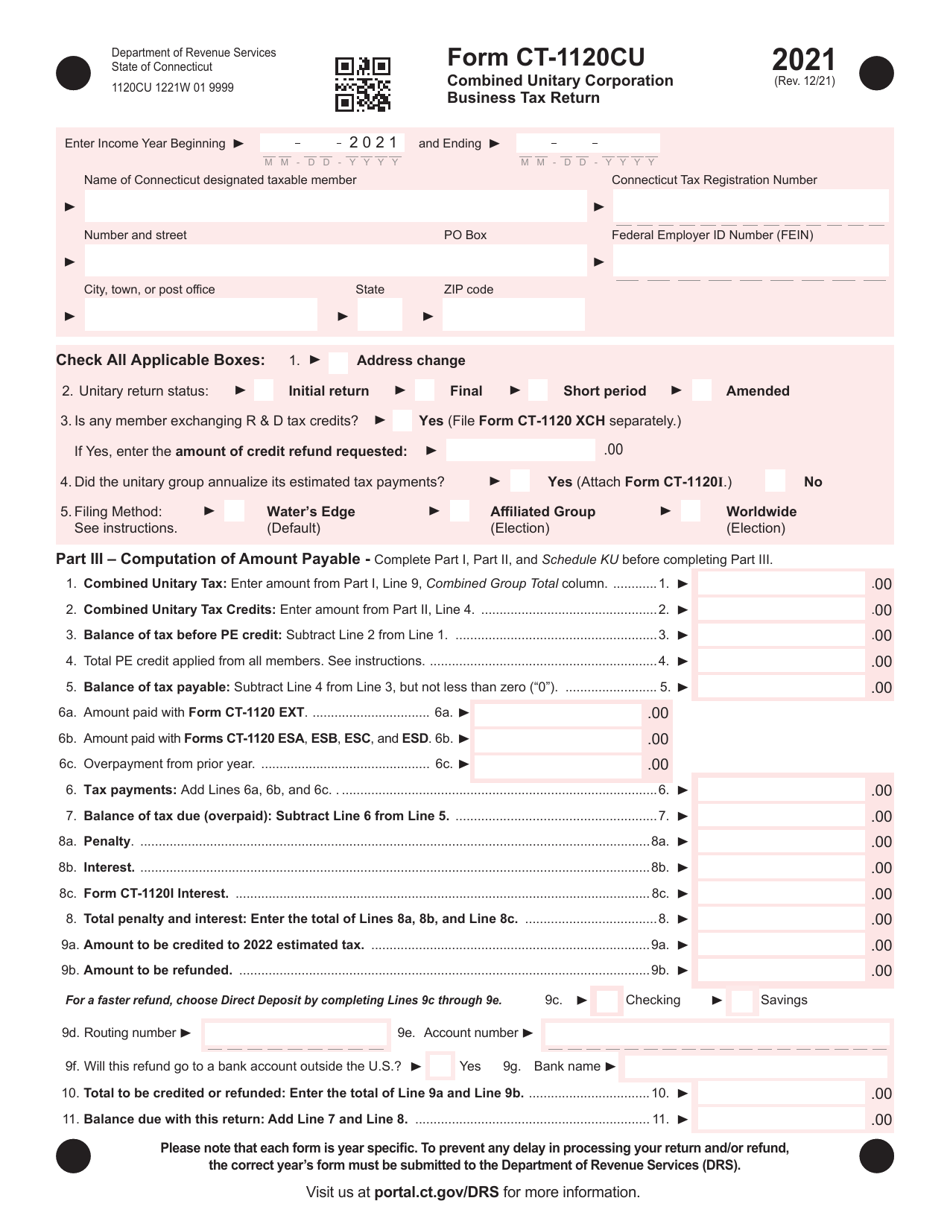

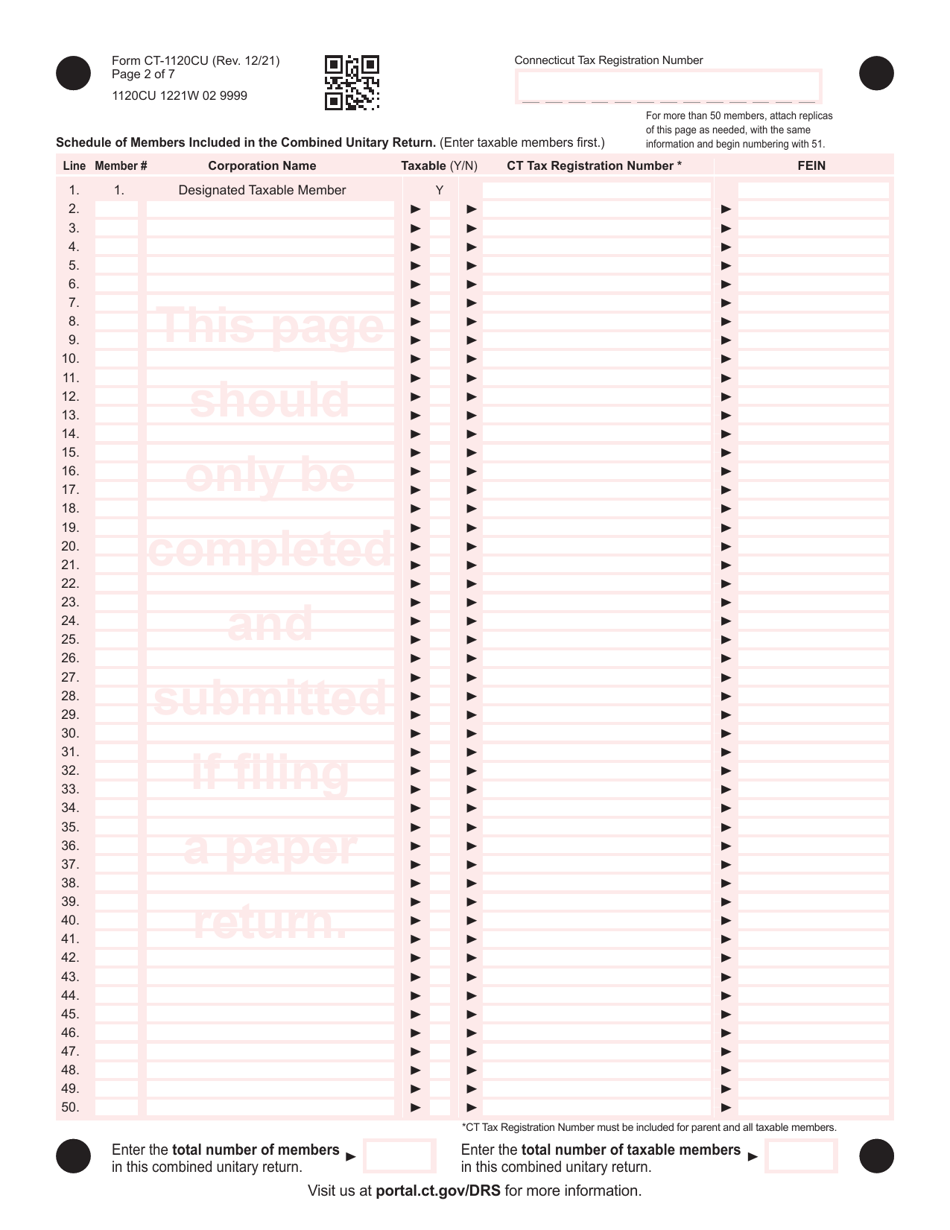

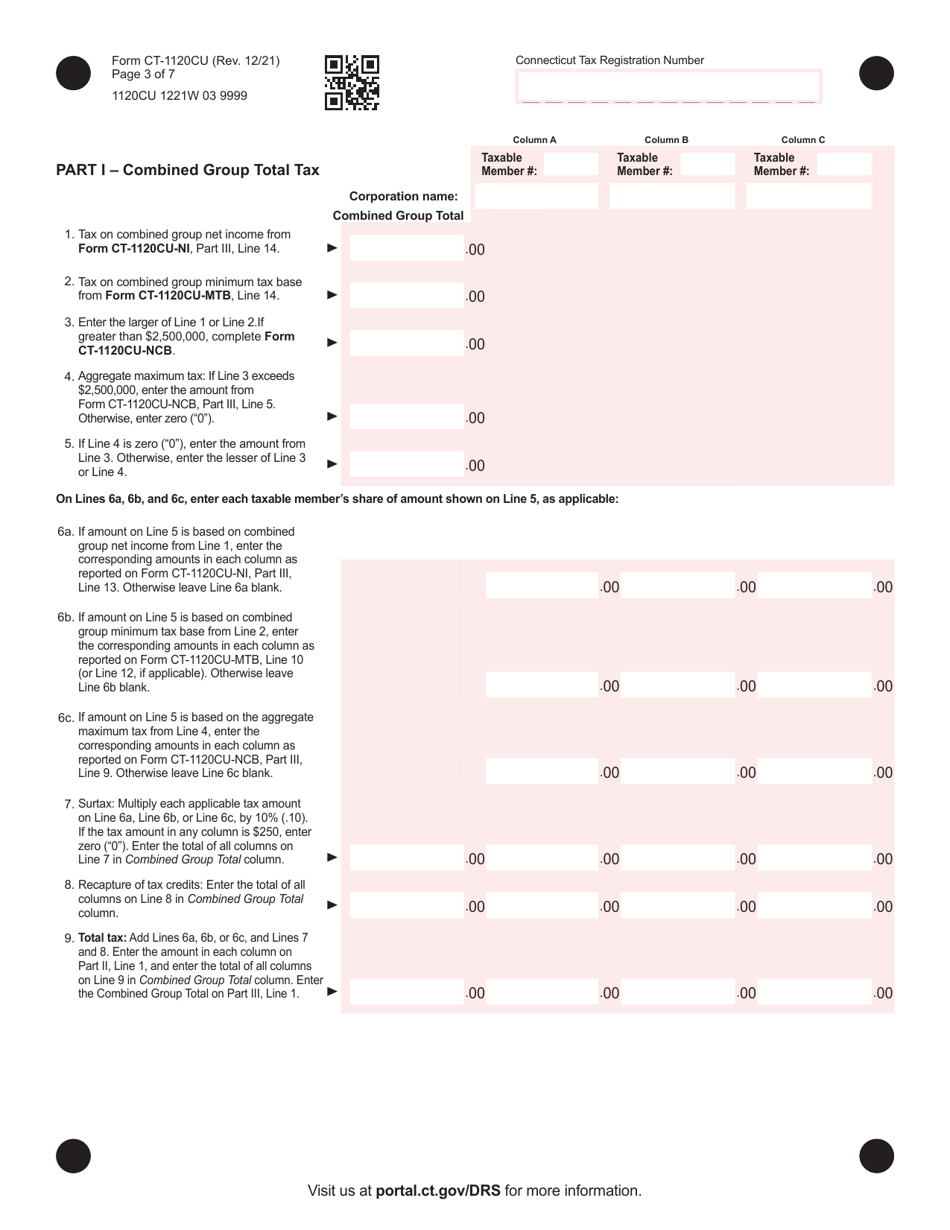

Q: What information is required on Form CT-1120CU?

A: Form CT-1120CU requires information about the unitary business, including income, expenses, and apportionment factors.

Q: When is Form CT-1120CU due?

A: Form CT-1120CU is due on the 15th day of the fourth month following the close of the tax year.

Q: Are there any penalties for late filing?

A: Yes, there are penalties for late filing, including interest charges on any unpaid tax balance.

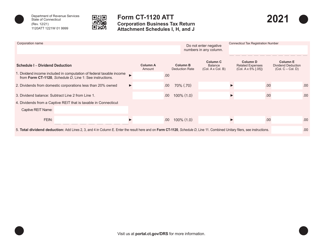

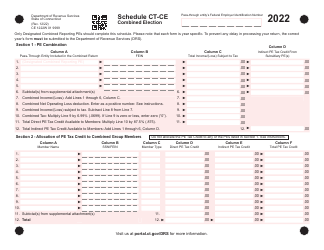

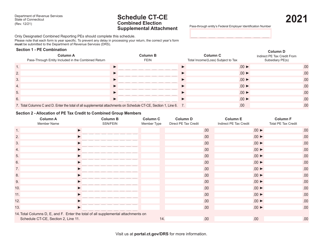

Q: Are there any other related forms to be filed with Form CT-1120CU?

A: Yes, some related forms may need to be filed, such as Schedule K-1 and Form CT-1120CU-PT.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120CU by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.