This version of the form is not currently in use and is provided for reference only. Download this version of

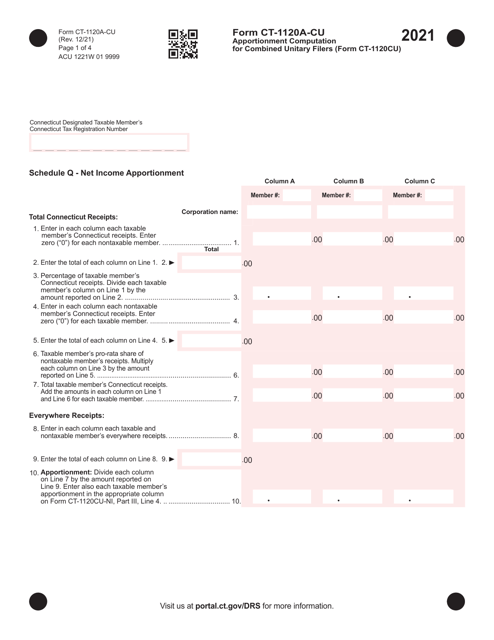

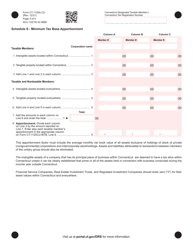

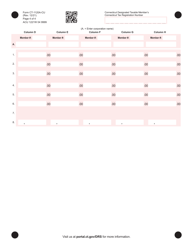

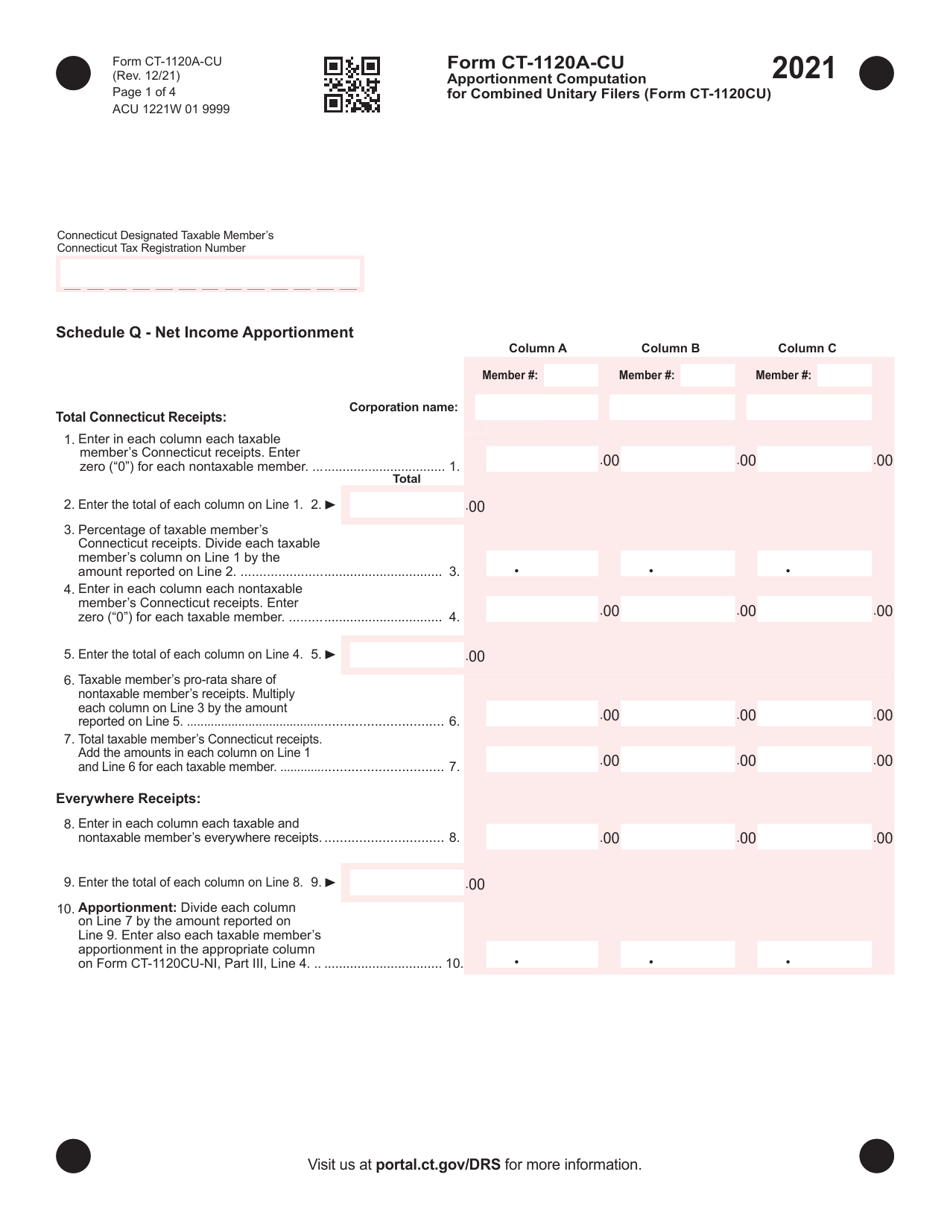

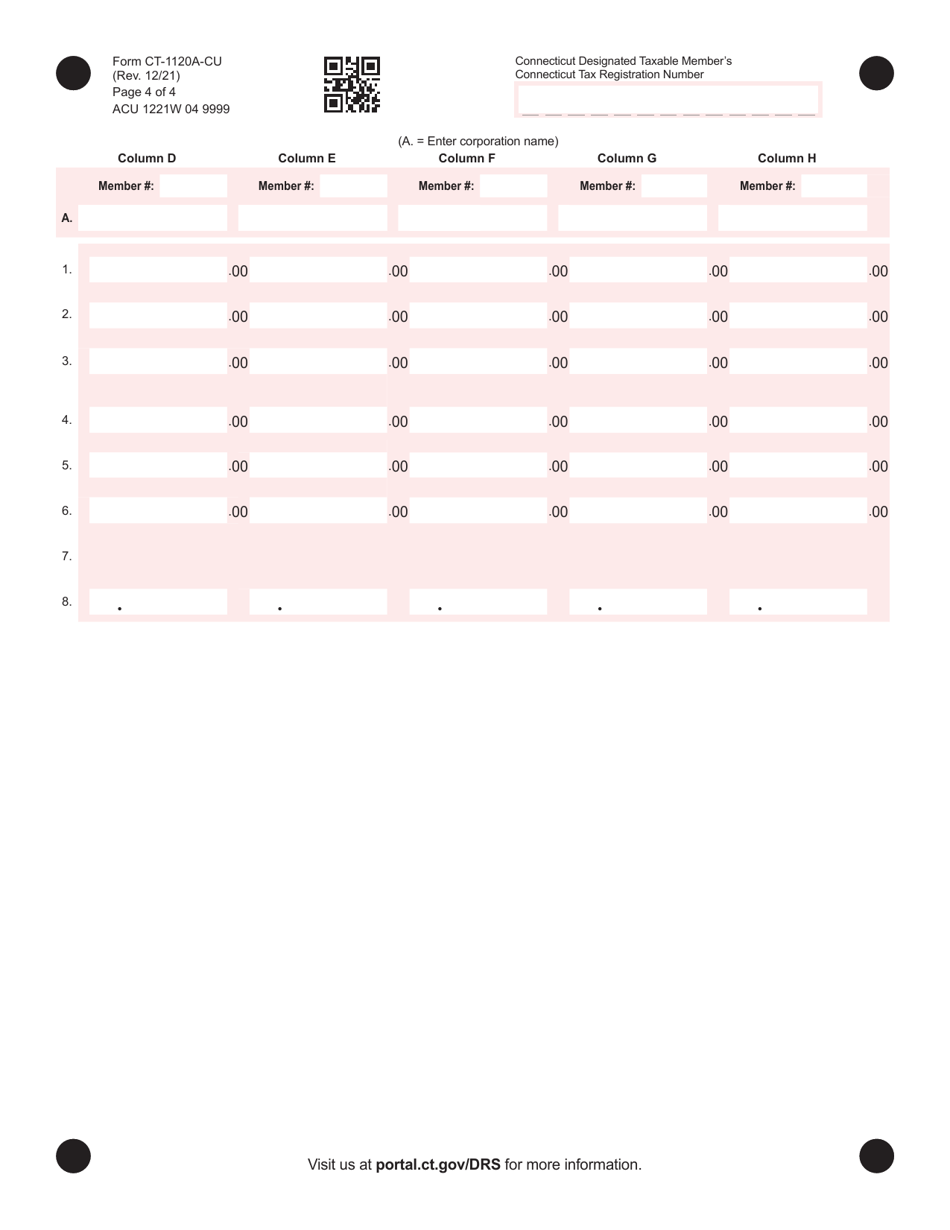

Form CT-1120A-CU

for the current year.

Form CT-1120A-CU Apportionment Computation for Combined Unitary Filers - Connecticut

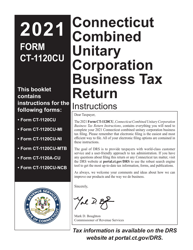

What Is Form CT-1120A-CU?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-1120A-CU?

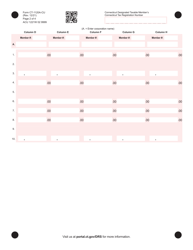

A: Form CT-1120A-CU is a tax form used for apportionment computation for combined unitary filers in the state of Connecticut.

Q: Who needs to file Form CT-1120A-CU?

A: Form CT-1120A-CU needs to be filed by combined unitary filers in Connecticut.

Q: What is apportionment computation?

A: Apportionment computation is the process of allocating income, deductions, and taxes to different jurisdictions based on a formula.

Q: What are combined unitary filers?

A: Combined unitary filers are taxpayers who are members of a unitary business group and choose to file a combined return.

Q: Why is apportionment necessary?

A: Apportionment is necessary to determine the proportion of income that should be allocated to a specific jurisdiction for tax purposes.

Q: Are there any instructions available for Form CT-1120A-CU?

A: Yes, the Connecticut Department of Revenue Services provides instructions for completing Form CT-1120A-CU.

Q: When is the deadline for filing Form CT-1120A-CU?

A: The deadline for filing Form CT-1120A-CU is the same as the deadline for filing the Connecticut corporation tax return, which is generally on or before the 15th day of the fourth month following the close of the tax year.

Q: Are there any penalties for late filing or errors on Form CT-1120A-CU?

A: Yes, there are penalties for late filing or errors on Form CT-1120A-CU. It is important to ensure accurate and timely filing to avoid these penalties.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120A-CU by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.