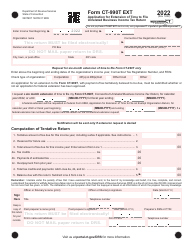

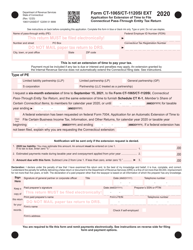

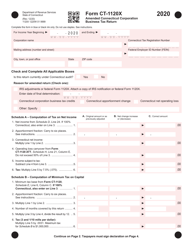

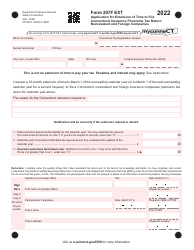

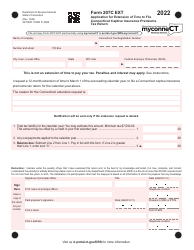

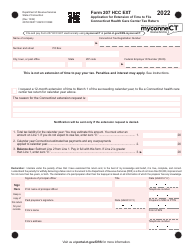

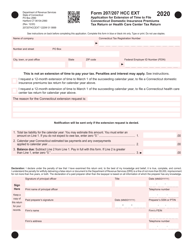

This version of the form is not currently in use and is provided for reference only. Download this version of

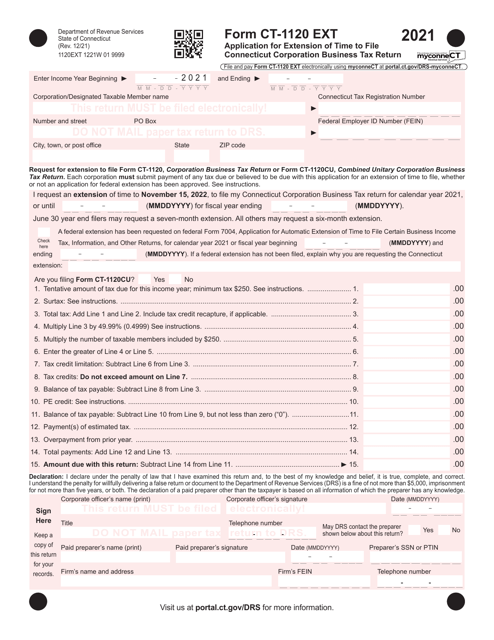

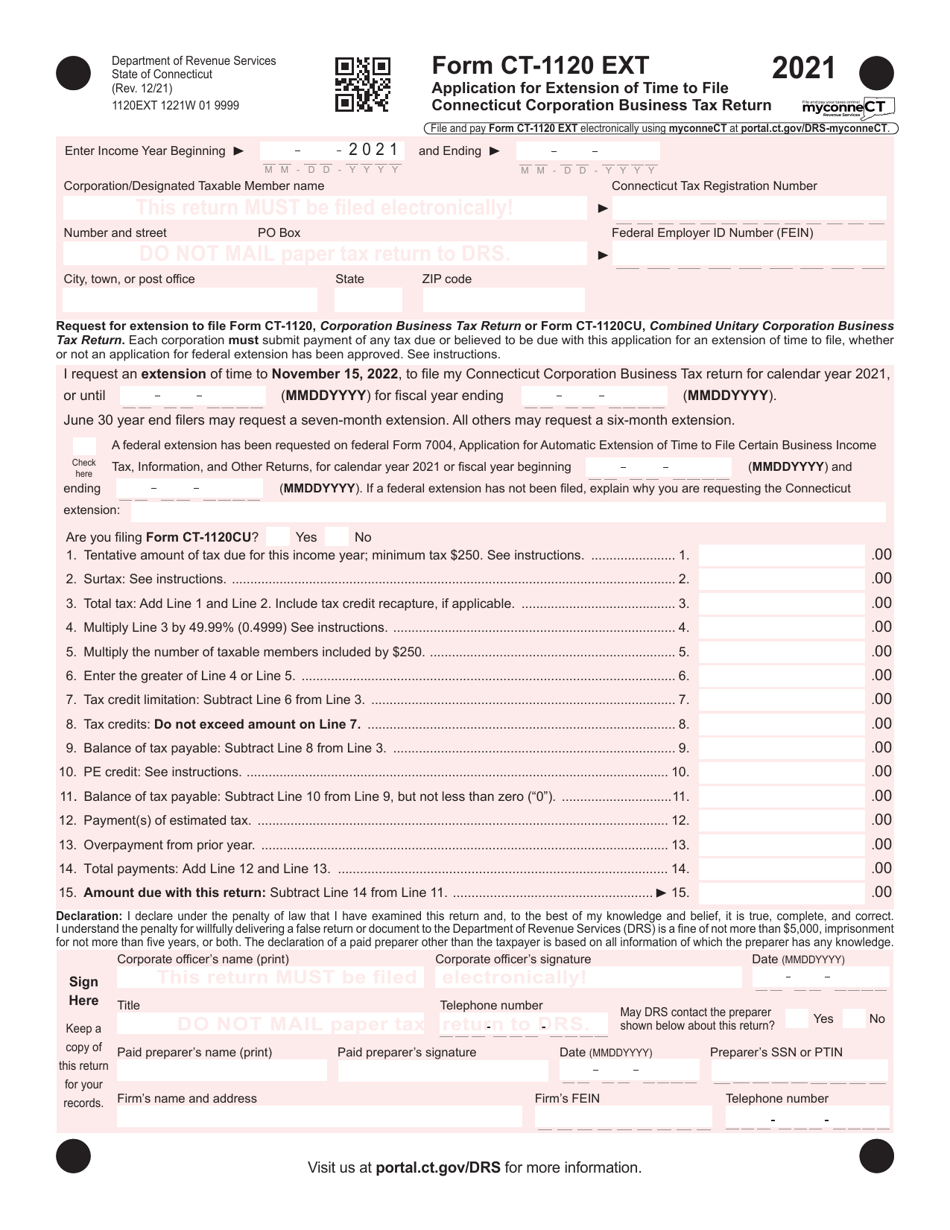

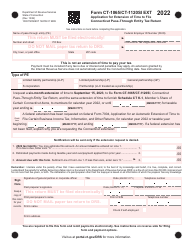

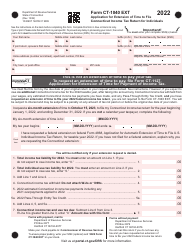

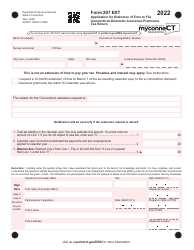

Form CT-1120 EXT

for the current year.

Form CT-1120 EXT Application for Extension of Time to File Connecticut Corporation Business Tax Return - Connecticut

What Is Form CT-1120 EXT?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1120 EXT?

A: Form CT-1120 EXT is an application for extension of time to file the Connecticut Corporation Business Tax return.

Q: Who should file Form CT-1120 EXT?

A: Connecticut corporations that need additional time to file their Corporation Business Tax return.

Q: What is the purpose of filing an extension?

A: Filing an extension allows corporations to request additional time to submit their tax return.

Q: When is Form CT-1120 EXT due?

A: Form CT-1120 EXT must be filed on or before the original due date of the corporation's tax return.

Q: Is there a penalty for late filing?

A: Yes, if Form CT-1120 EXT is not filed by the original due date, a late filing penalty may be imposed.

Q: How long is the extension period?

A: The extension period for filing the Connecticut Corporation Business Tax return is 6 months.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120 EXT by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.