This version of the form is not currently in use and is provided for reference only. Download this version of

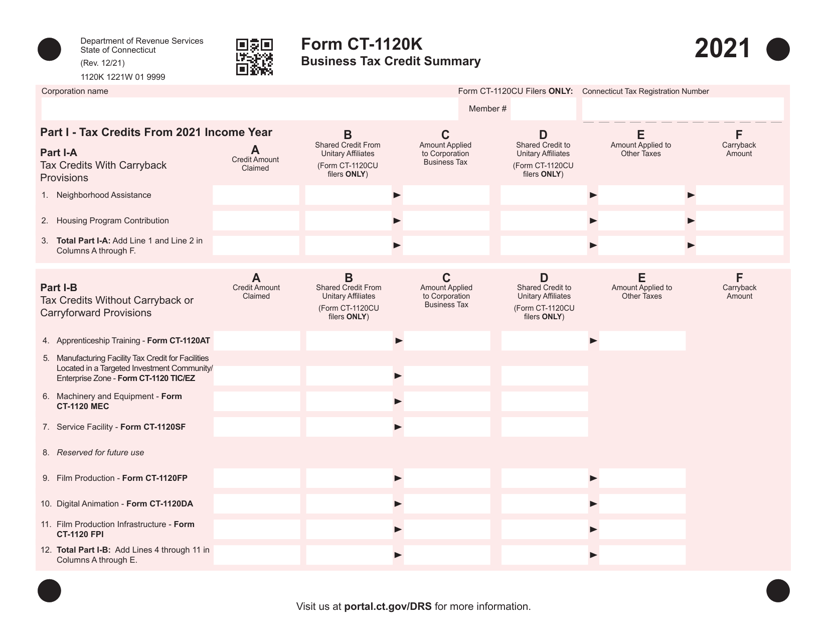

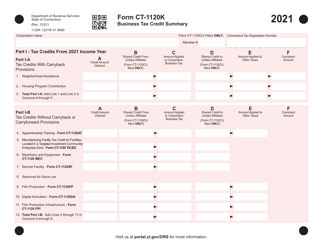

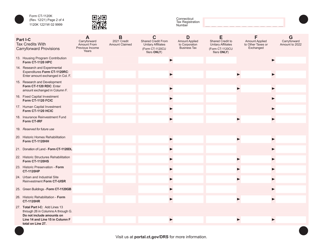

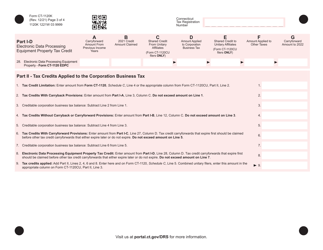

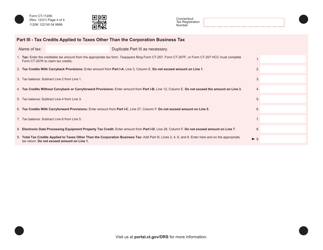

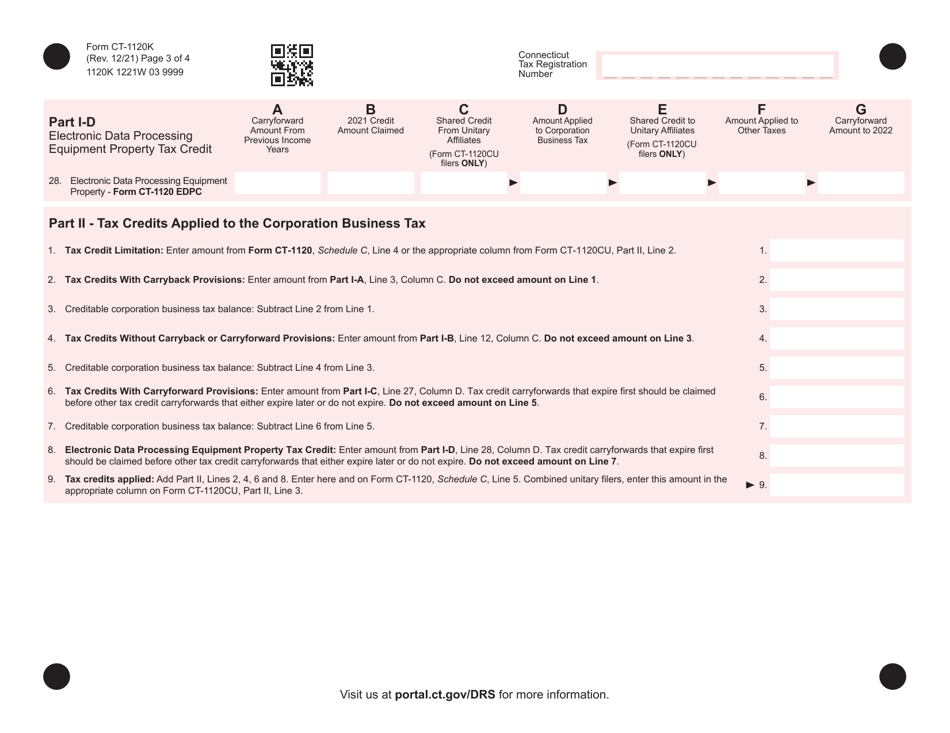

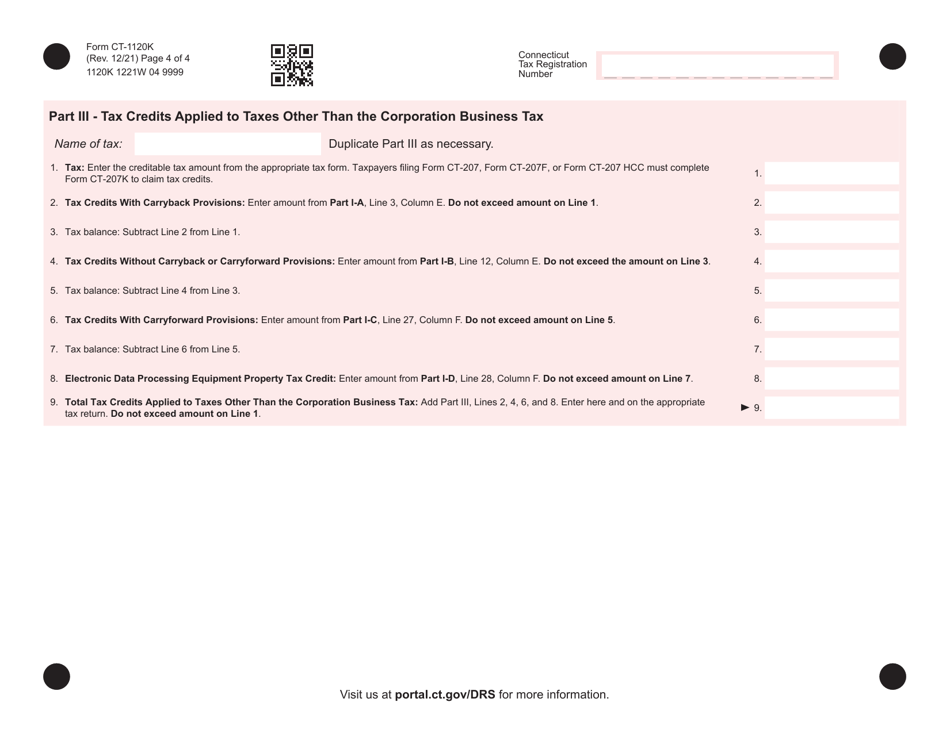

Form CT-1120K

for the current year.

Form CT-1120K Business Tax Credit Summary - Connecticut

What Is Form CT-1120K?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1120K?

A: Form CT-1120K is the Business Tax Credit Summary form used in Connecticut.

Q: Who needs to file Form CT-1120K?

A: Any business in Connecticut that wants to claim tax credits must file Form CT-1120K.

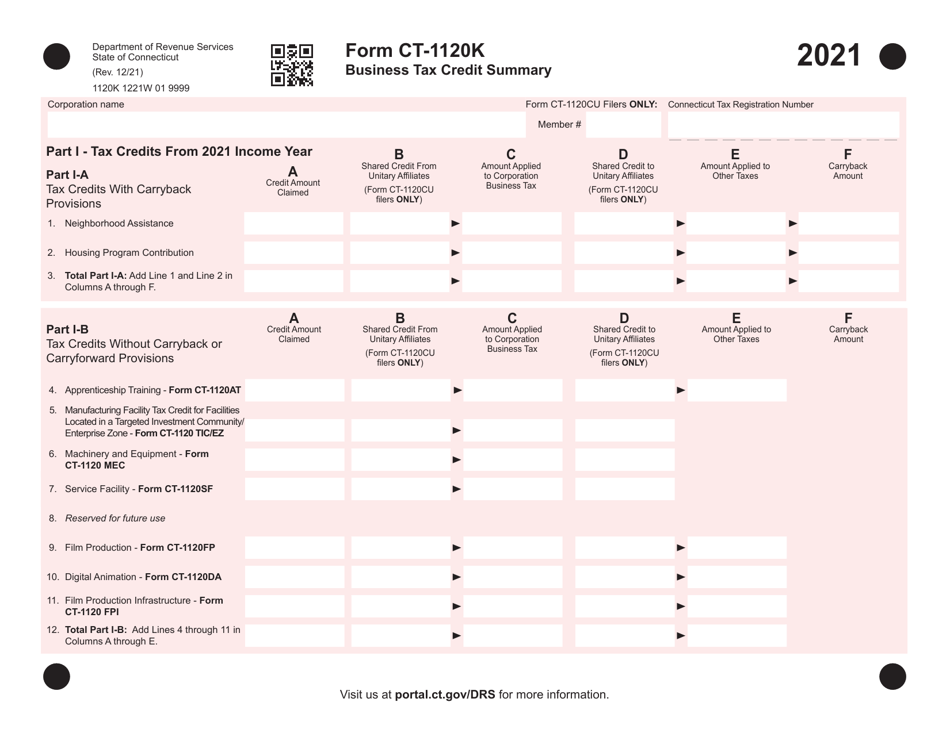

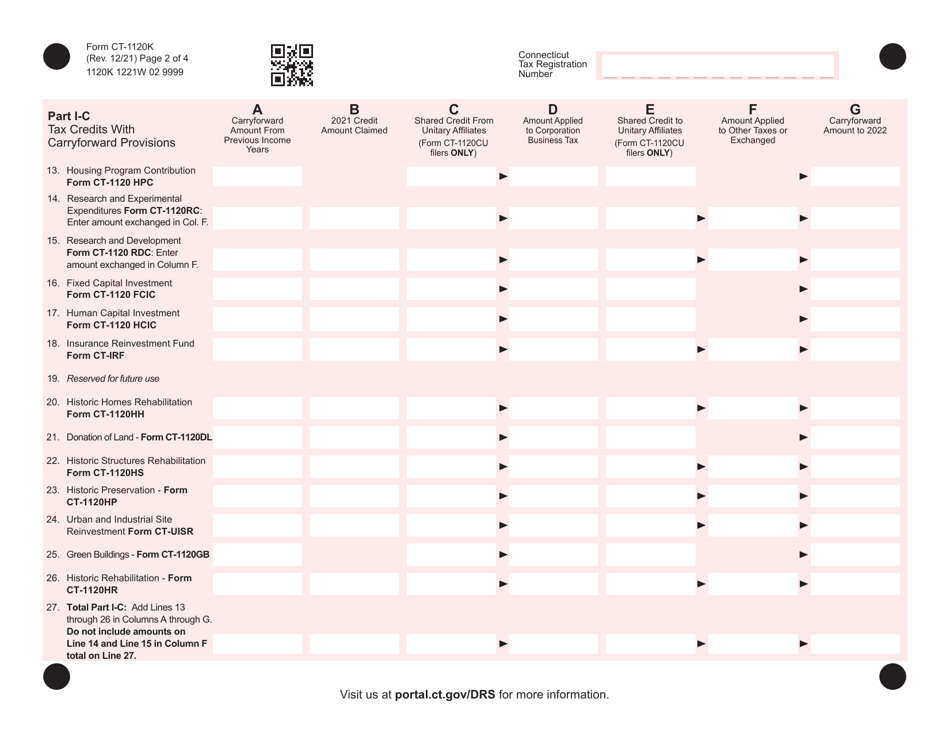

Q: What is the purpose of Form CT-1120K?

A: The purpose of Form CT-1120K is to summarize the tax credits claimed by a business in Connecticut.

Q: When is the deadline to file Form CT-1120K?

A: Form CT-1120K is due on or before the due date of the Connecticut Corporation Business Tax return.

Q: What are some common tax credits that can be claimed on Form CT-1120K?

A: Some common tax credits that can be claimed on Form CT-1120K include the Research and Development Credit, the Film ProductionTax Credit, and the Urban and Industrial Site Reinvestment Credit.

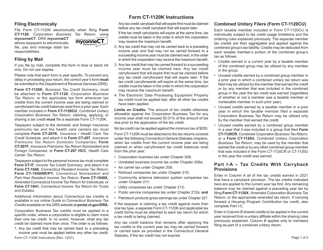

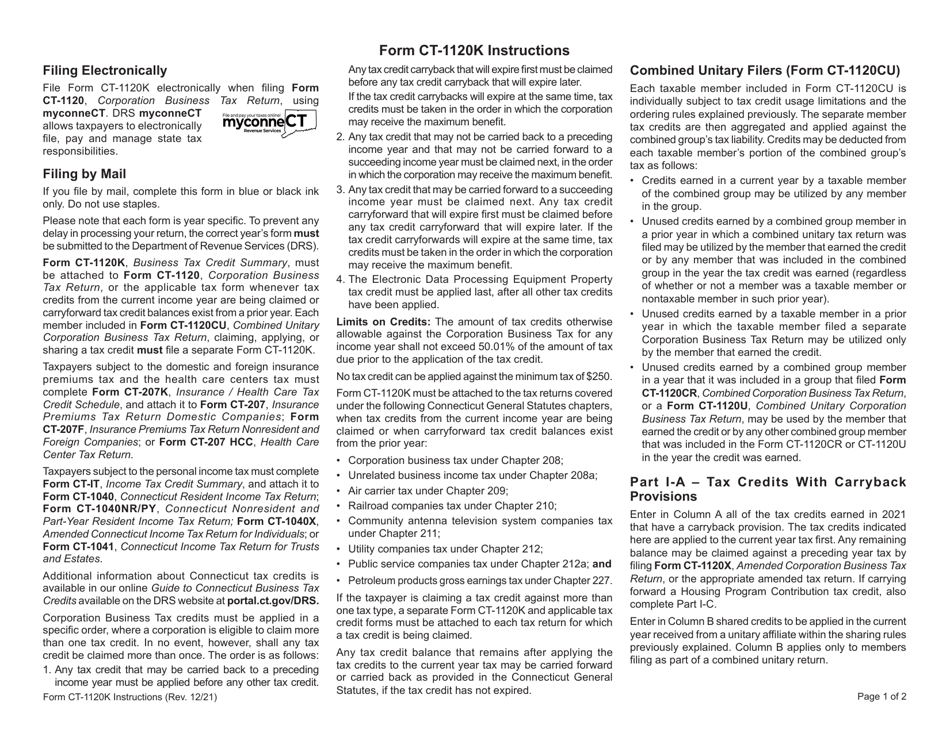

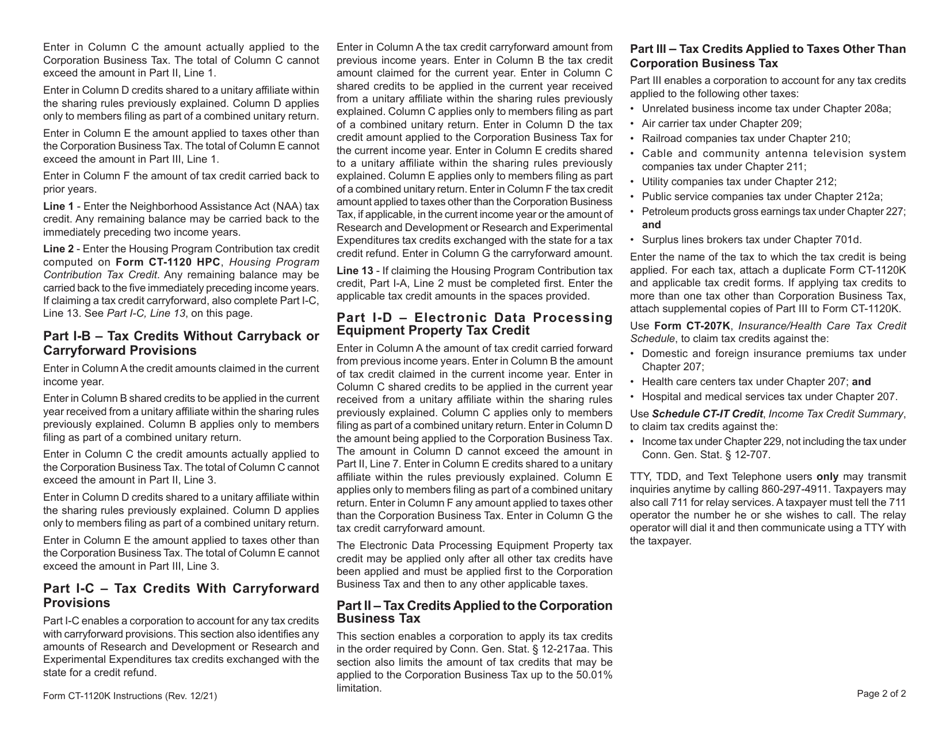

Q: Are there any instructions for filling out Form CT-1120K?

A: Yes, detailed instructions for filling out Form CT-1120K can be found in the official instruction booklet provided by the Connecticut Department of Revenue Services.

Q: Can Form CT-1120K be e-filed?

A: No, Form CT-1120K cannot be e-filed. It must be filed by mail or in person.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120K by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.