This version of the form is not currently in use and is provided for reference only. Download this version of

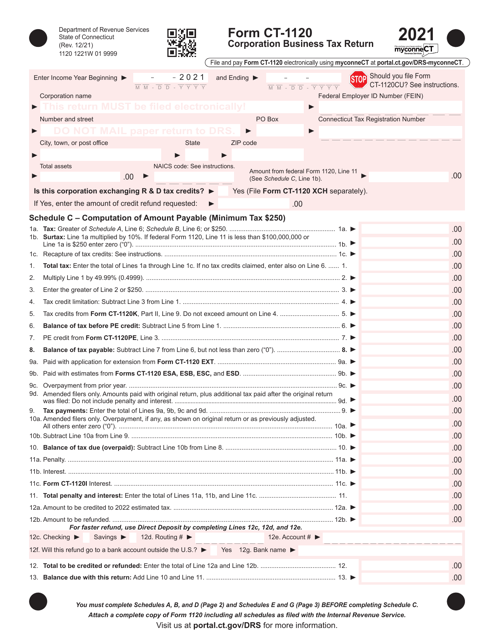

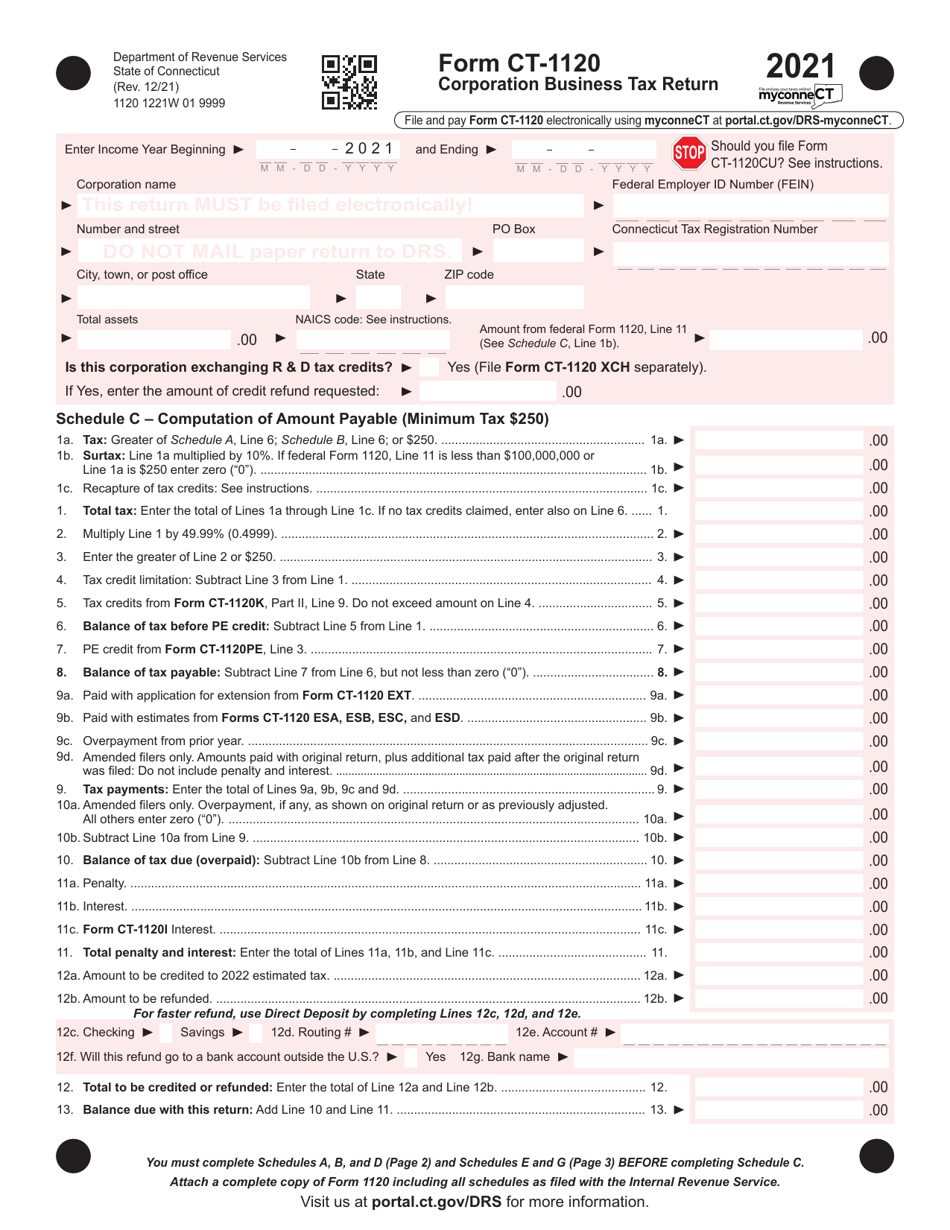

Form CT-1120

for the current year.

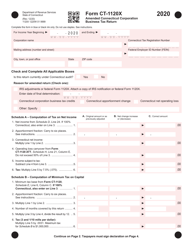

Form CT-1120 Corporation Business Tax Return - Connecticut

What Is Form CT-1120?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1120?

A: Form CT-1120 is the Corporation Business Tax Return for businesses in Connecticut.

Q: Who needs to file Form CT-1120?

A: Corporations that do business in Connecticut are required to file Form CT-1120.

Q: When is the due date for filing Form CT-1120?

A: The due date for filing Form CT-1120 is the 15th day of the third month following the close of the tax year.

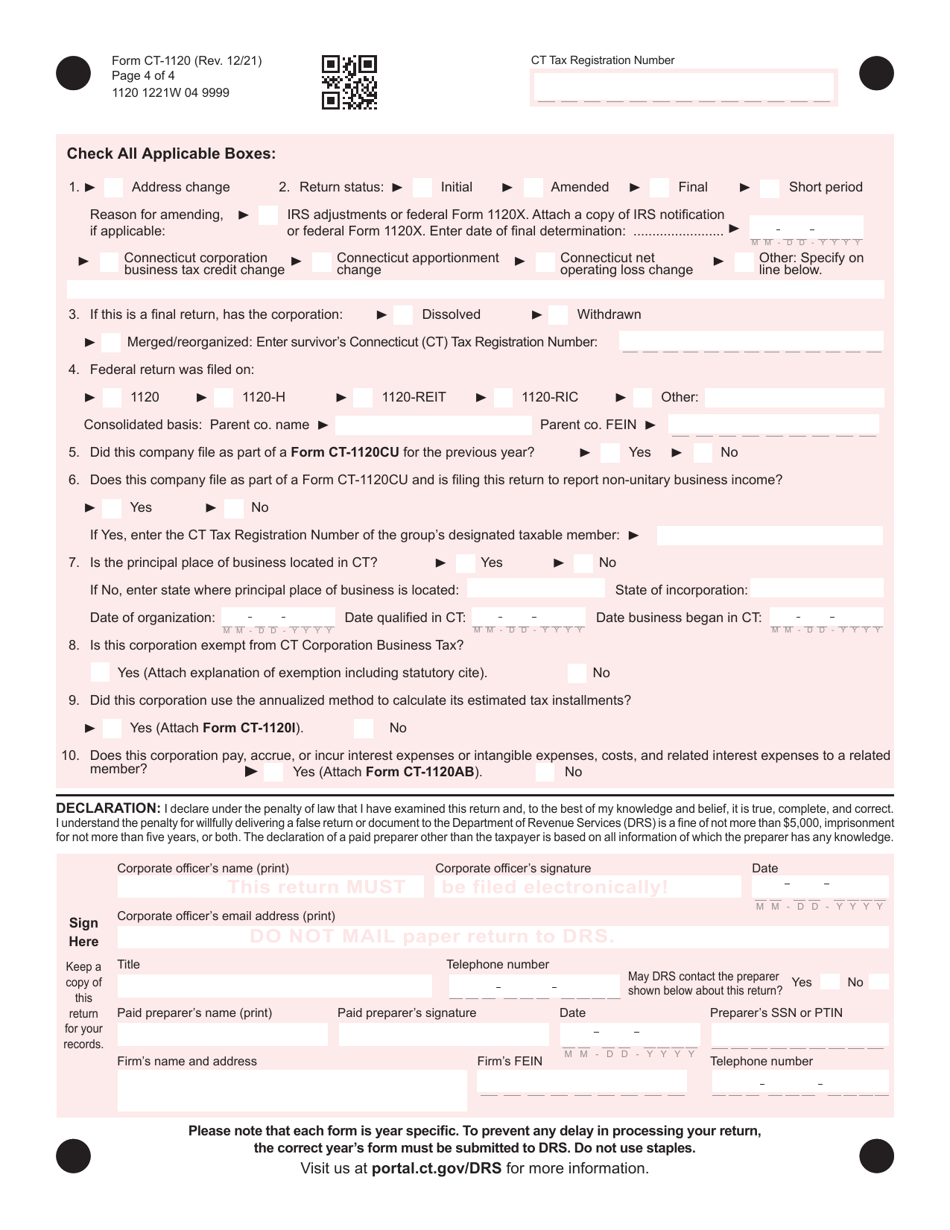

Q: Can I file Form CT-1120 electronically?

A: Yes, Connecticut allows electronic filing of Form CT-1120.

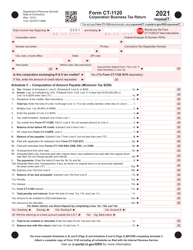

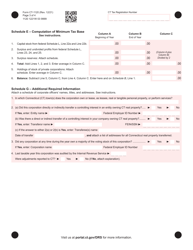

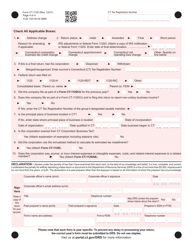

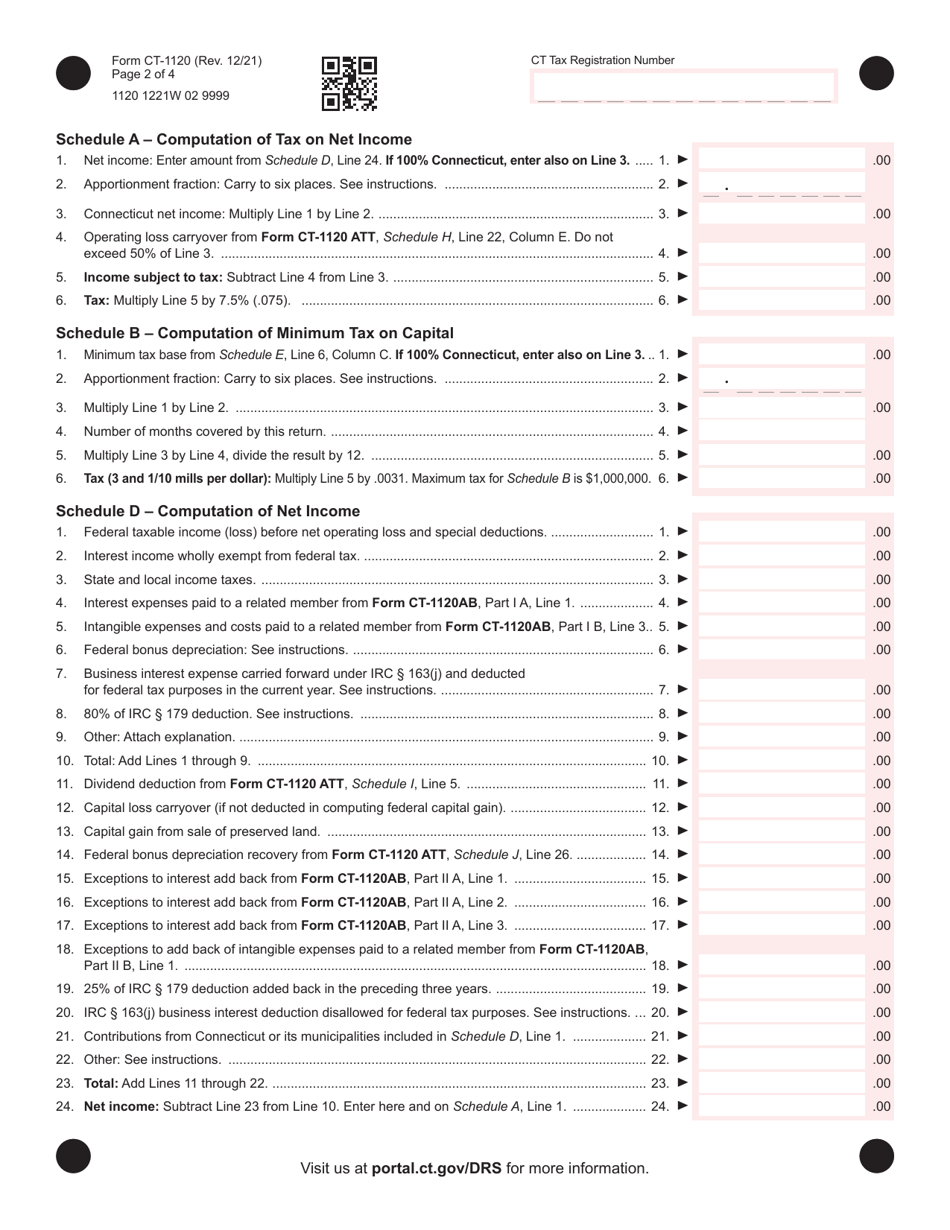

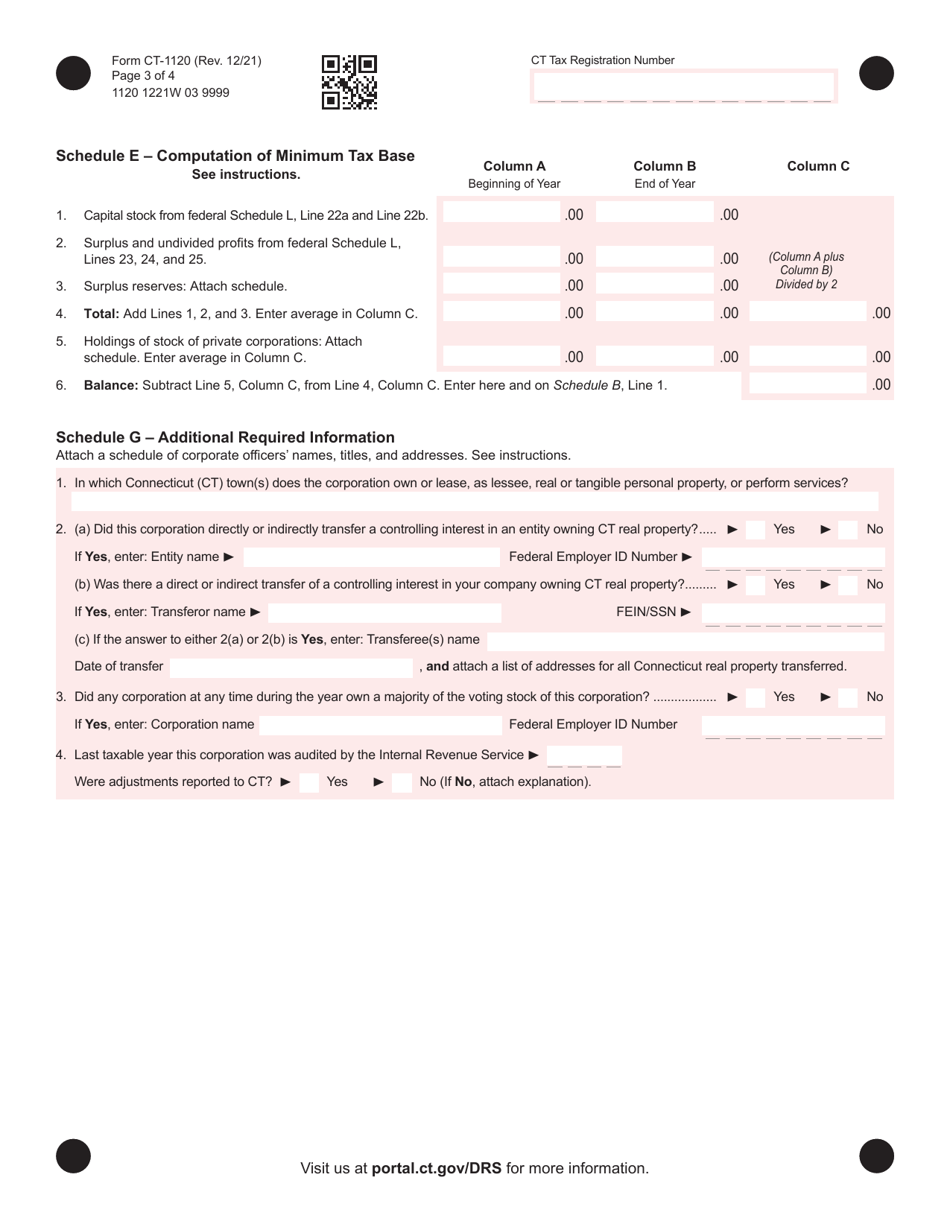

Q: What information do I need to complete Form CT-1120?

A: You will need to provide information about your corporation's income, deductions, credits, and other pertinent details.

Q: Are there any penalties for late filing of Form CT-1120?

A: Yes, there are penalties for late filing of Form CT-1120. It is important to file the return on time to avoid penalties and interest charges.

Q: Are there any specific instructions for filling out Form CT-1120?

A: Yes, the Connecticut Department of Revenue Services provides instructions for filling out Form CT-1120.

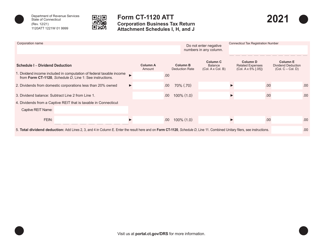

Q: What other forms may be required to be filed with Form CT-1120?

A: Depending on the specifics of your corporation's tax situation, you may need to file additional forms and schedules along with Form CT-1120.

Q: Can I amend my Form CT-1120 if I made a mistake?

A: Yes, if you made an error on your Form CT-1120, you can file an amended return using Form CT-1120X.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.