This version of the form is not currently in use and is provided for reference only. Download this version of

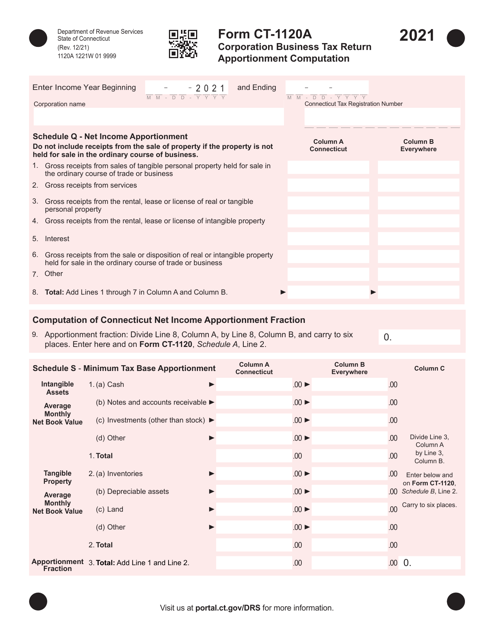

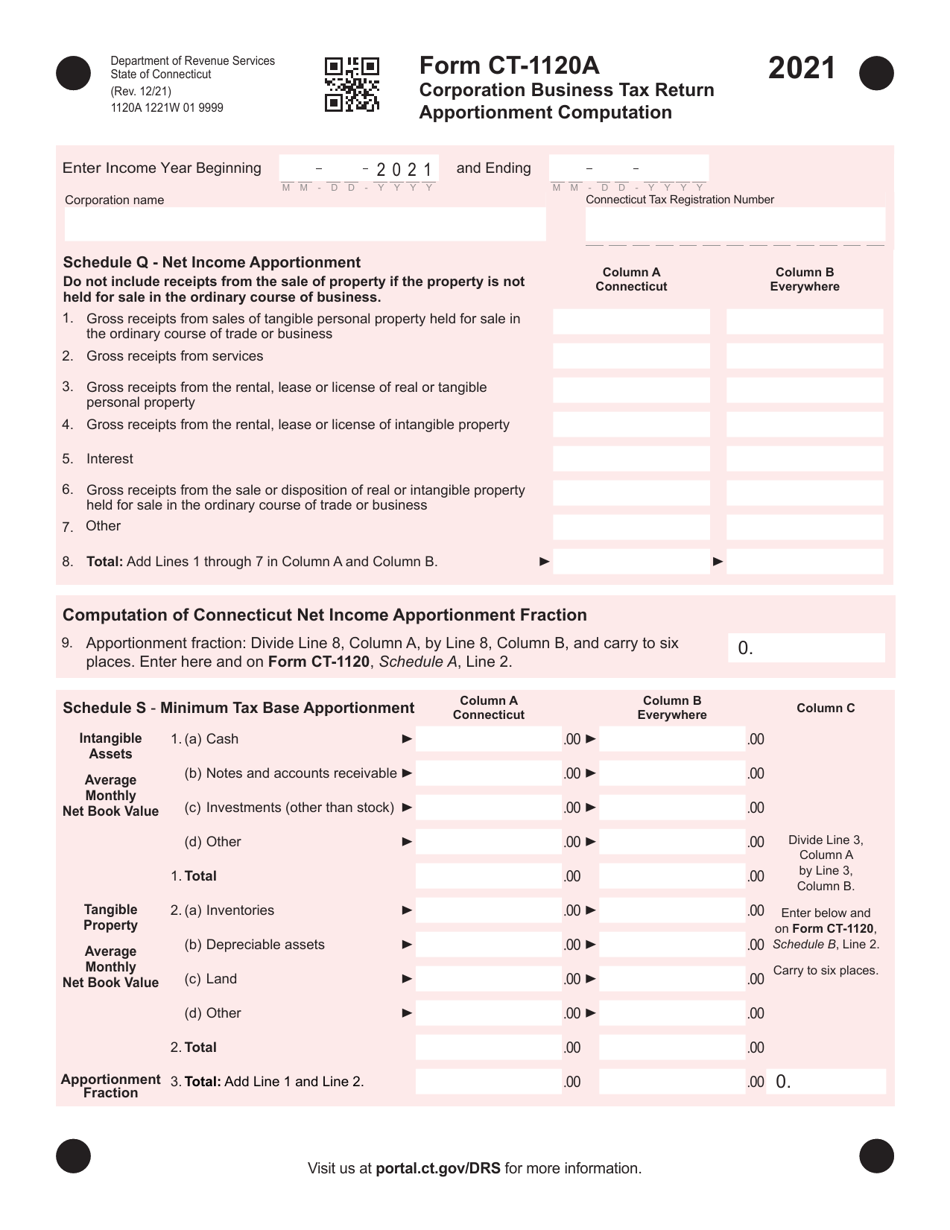

Form CT-1120A

for the current year.

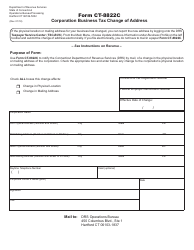

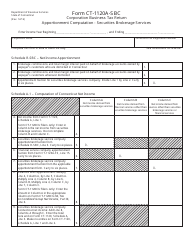

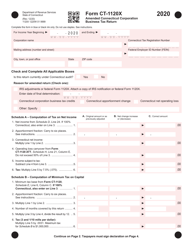

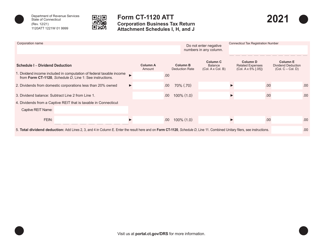

Form CT-1120A Corporation Business Tax Return Apportionment Computation - Connecticut

What Is Form CT-1120A?

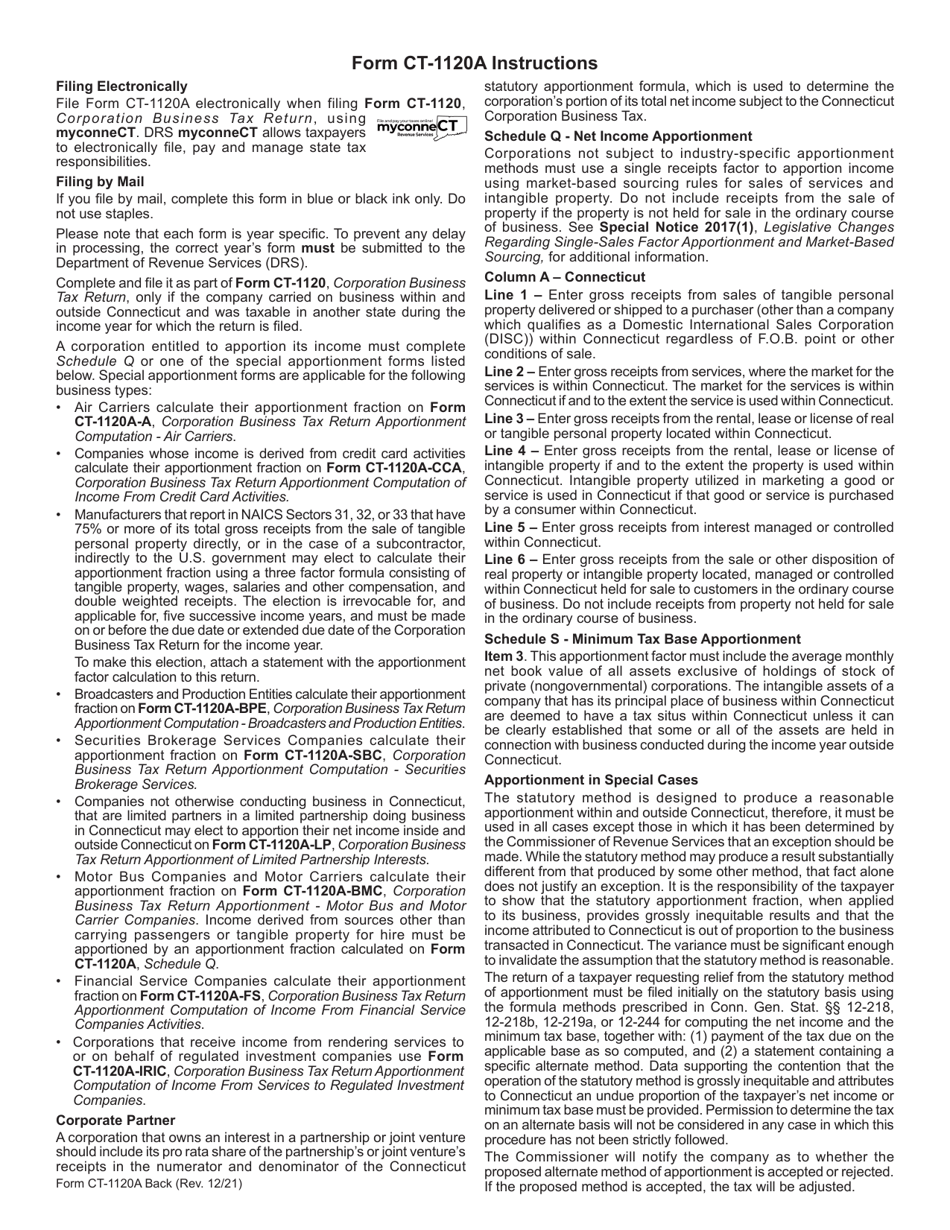

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1120A?

A: Form CT-1120A is the Corporation Business Tax Return Apportionment Computation form for businesses in Connecticut.

Q: What is the purpose of Form CT-1120A?

A: The purpose of Form CT-1120A is to calculate the apportionment of a corporation's income and determine the portion allocated to Connecticut for tax purposes.

Q: Who needs to file Form CT-1120A?

A: Businesses that conduct business in Connecticut and are subject to the Corporation Business Tax need to file Form CT-1120A.

Q: When is Form CT-1120A due?

A: Form CT-1120A is due on the same date as the Corporation Business Tax Return, which is typically on or before the due date of the federal income tax return.

Q: Are there any penalties for not filing Form CT-1120A?

A: Yes, there are penalties for not filing Form CT-1120A or filing it late. It is important to comply with the filing requirements to avoid penalties and potential legal consequences.

Q: What supporting documents do I need to include with Form CT-1120A?

A: You may need to include supporting documents such as financial statements, schedules, and other documentation that support the apportionment computation on Form CT-1120A.

Q: What should I do if I have questions or need assistance with Form CT-1120A?

A: If you have questions or need assistance with Form CT-1120A, you can contact the Connecticut Department of Revenue Services or consult a tax professional for guidance.

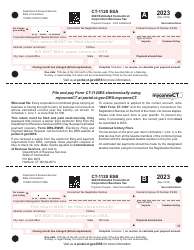

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120A by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.