This version of the form is not currently in use and is provided for reference only. Download this version of

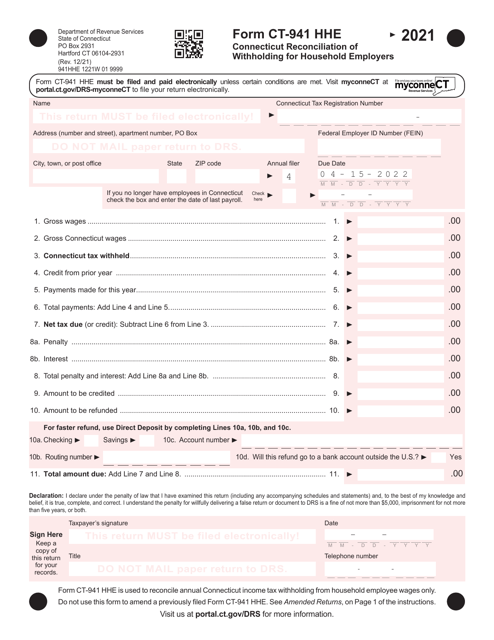

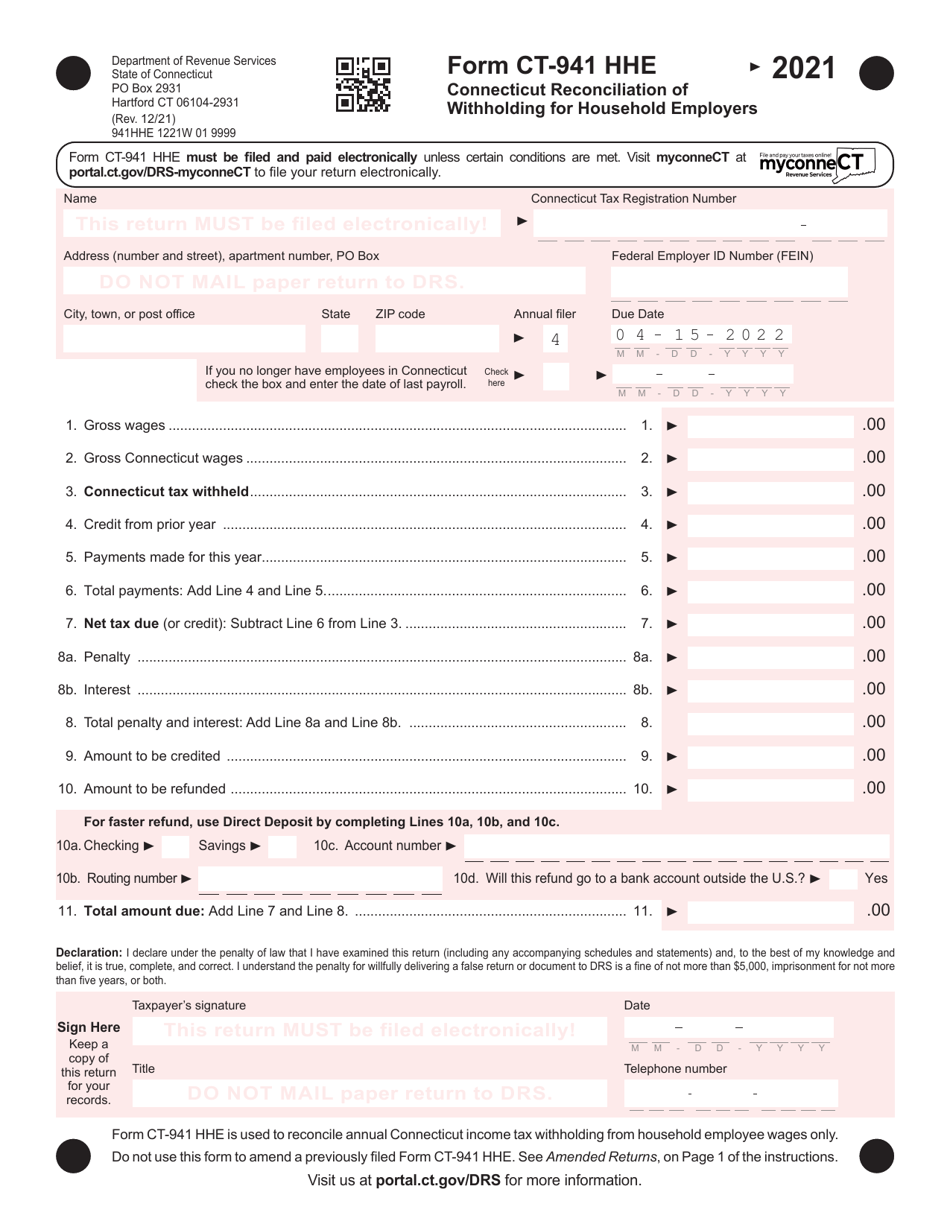

Form CT-941 HHE

for the current year.

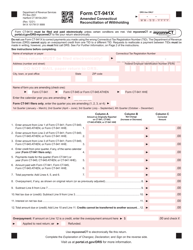

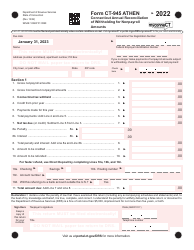

Form CT-941 HHE Connecticut Reconciliation of Withholding for Household Employers - Connecticut

What Is Form CT-941 HHE?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-941 HHE?

A: Form CT-941 HHE is a form used in Connecticut for household employers to reconcile withholding.

Q: Who should file Form CT-941 HHE?

A: Household employers in Connecticut should file Form CT-941 HHE.

Q: What is the purpose of Form CT-941 HHE?

A: Form CT-941 HHE is used to reconcile the amount of withholding for household employees in Connecticut.

Q: What information is required on Form CT-941 HHE?

A: Form CT-941 HHE requires information about the household employer, the household employees, and the amount of withholding.

Q: When is Form CT-941 HHE due?

A: Form CT-941 HHE is due quarterly, with the same due dates as the Form CT-941 for other employers.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-941 HHE by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.