This version of the form is not currently in use and is provided for reference only. Download this version of

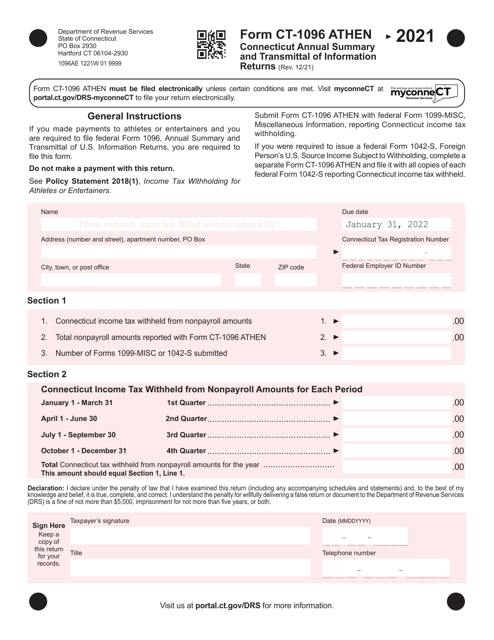

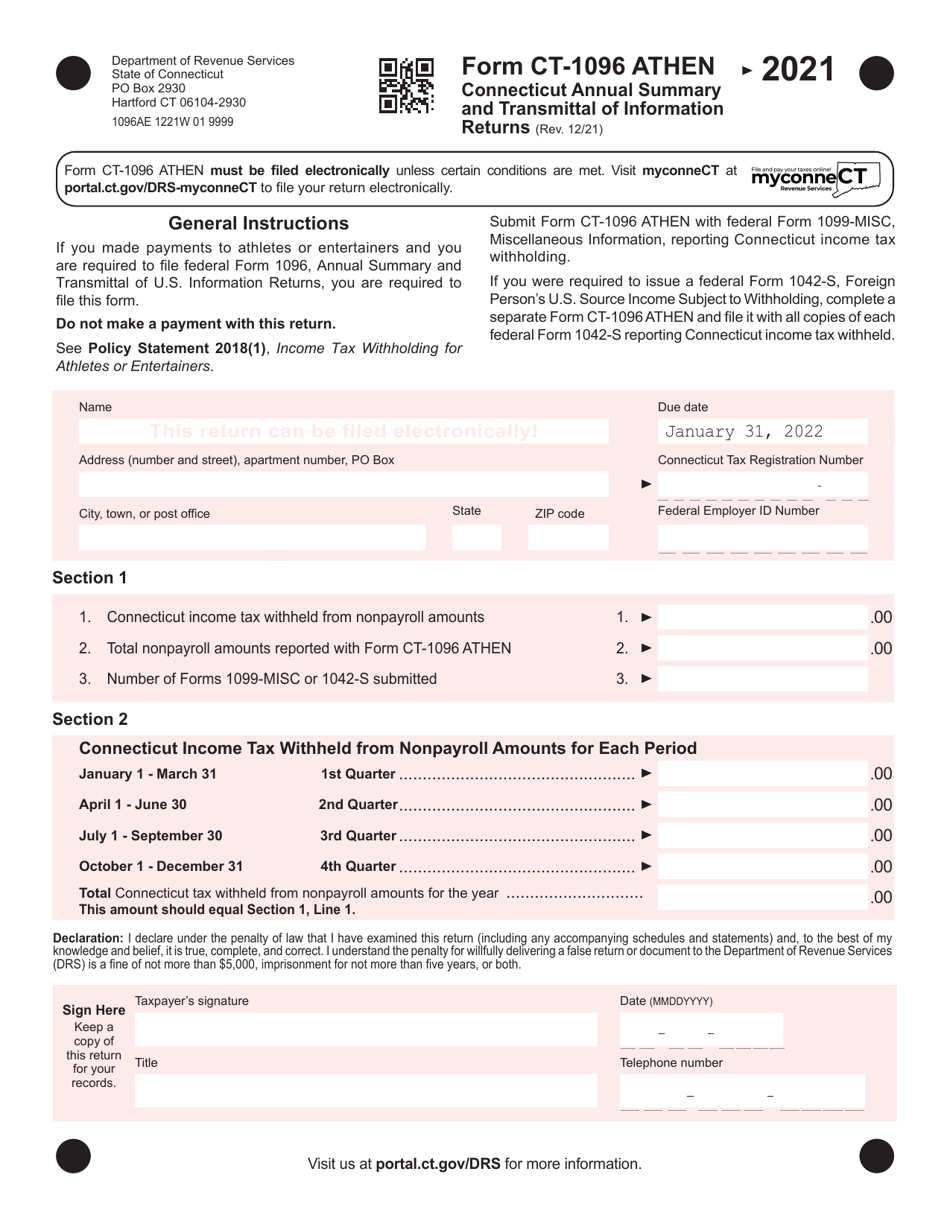

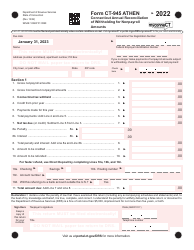

Form CT-1096 ATHEN

for the current year.

Form CT-1096 ATHEN Connecticut Annual Summary and Transmittal of Information Returns - Connecticut

What Is Form CT-1096 ATHEN?

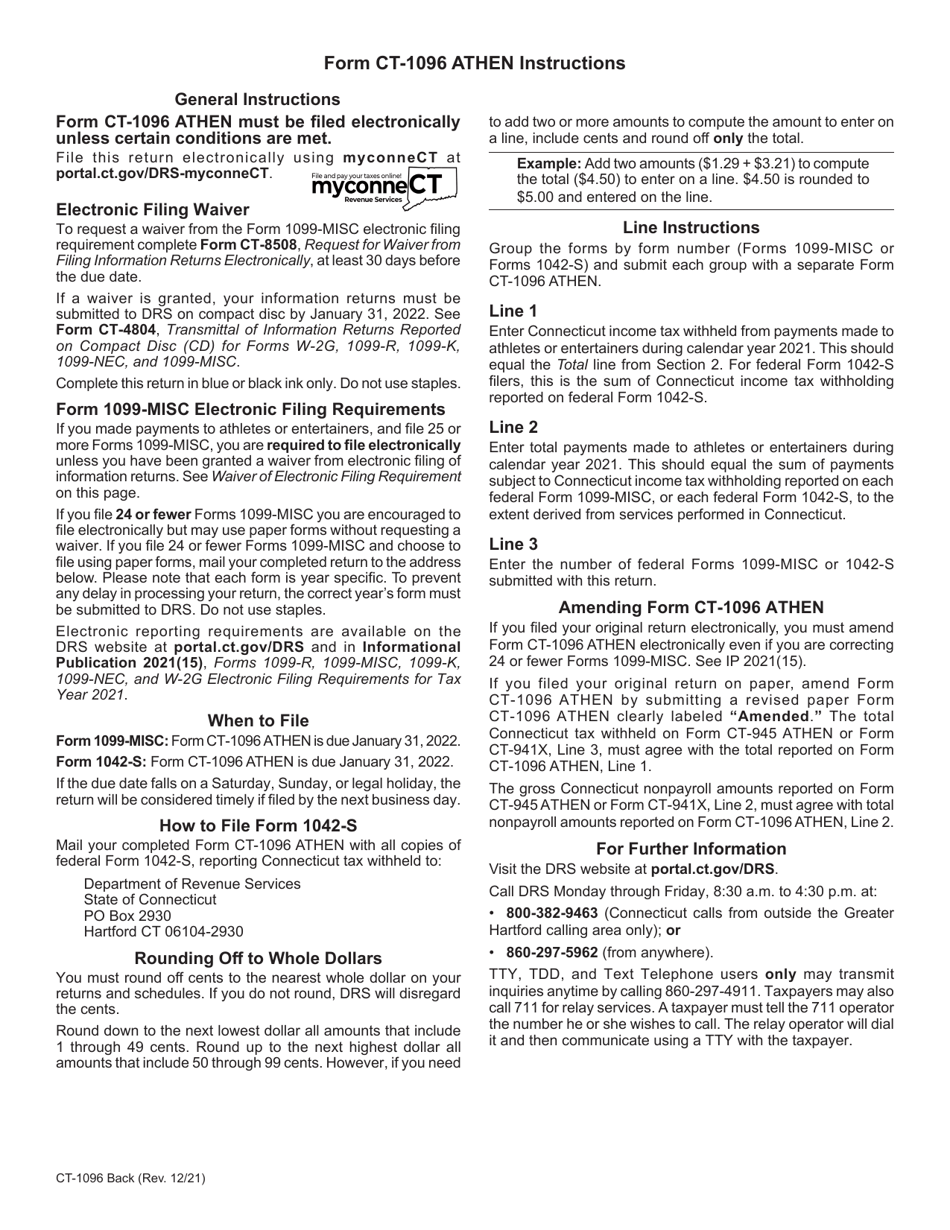

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CT-1096 ATHEN?

A: CT-1096 ATHEN is the Connecticut Annual Summary and Transmittal of Information Returns form.

Q: What is the purpose of CT-1096 ATHEN?

A: The purpose of CT-1096 ATHEN is to summarize and transmit information returns to the state of Connecticut.

Q: Who needs to file CT-1096 ATHEN?

A: Anyone who is required to file information returns with the state of Connecticut needs to file CT-1096 ATHEN.

Q: What are information returns?

A: Information returns are forms that report certain types of income, payments, or transactions to the government.

Q: When is the deadline for filing CT-1096 ATHEN?

A: The deadline for filing CT-1096 ATHEN is January 31st of the year following the calendar year being reported.

Q: Are there any penalties for late filing of CT-1096 ATHEN?

A: Yes, there may be penalties for late filing of CT-1096 ATHEN. It is important to file the form on time to avoid any penalties.

Q: What information is required on CT-1096 ATHEN?

A: CT-1096 ATHEN requires information such as taxpayer identification numbers, total amounts, and other details about the information returns being reported.

Q: Do I need to include copies of the information returns with CT-1096 ATHEN?

A: No, you do not need to include copies of the information returns with CT-1096 ATHEN. However, you should keep them for your records.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1096 ATHEN by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.