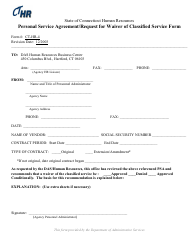

This version of the form is not currently in use and is provided for reference only. Download this version of

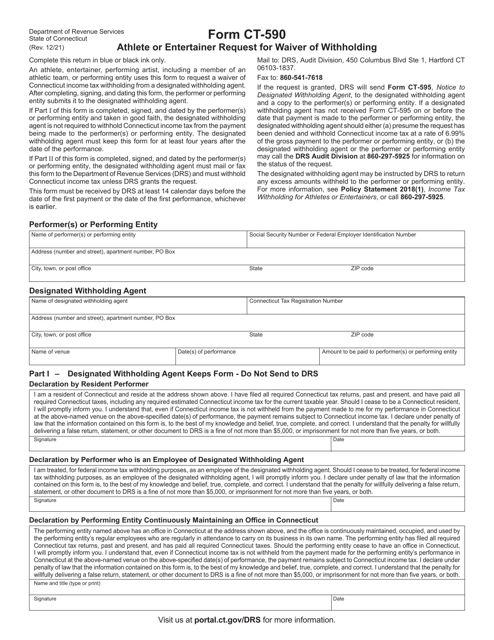

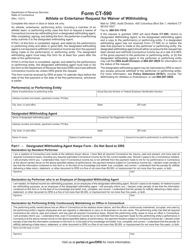

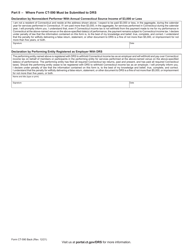

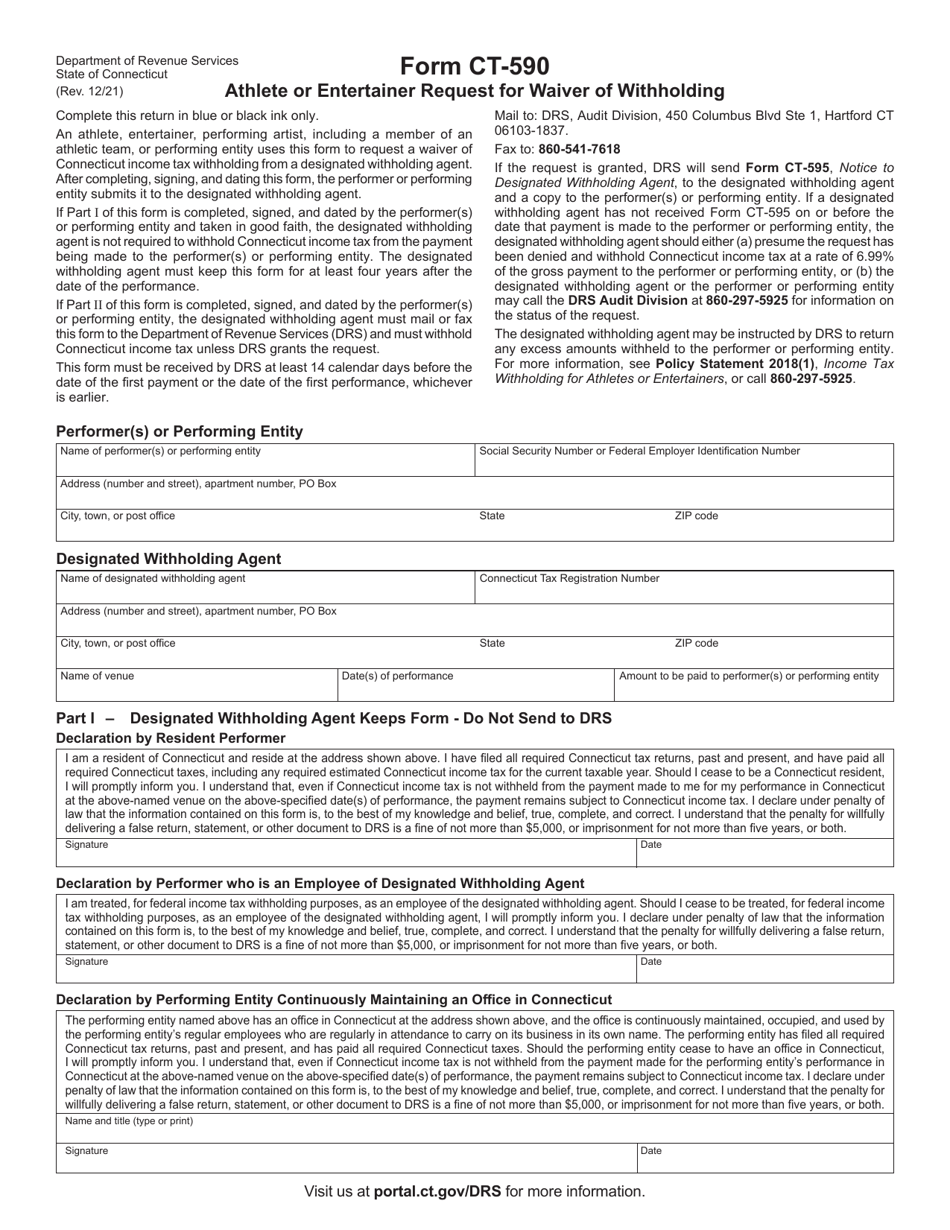

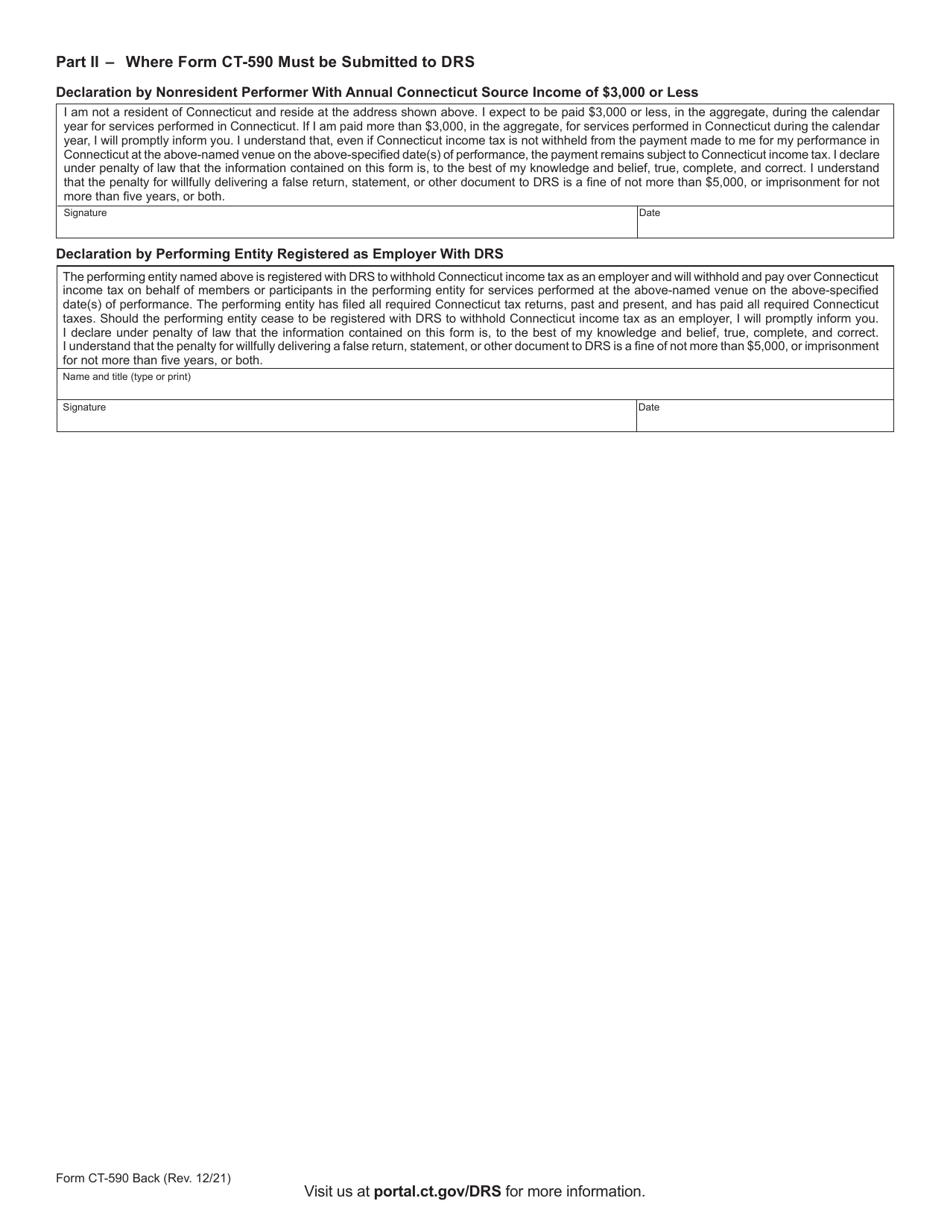

Form CT-590

for the current year.

Form CT-590 Athlete or Entertainer Request for Waiver of Withholding - Connecticut

What Is Form CT-590?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-590?

A: Form CT-590 is a tax form used in Connecticut for athletes or entertainers to request a waiver of withholding.

Q: Who can use Form CT-590?

A: Form CT-590 is specifically for athletes or entertainers who want to request a waiver of withholding in Connecticut.

Q: What is a waiver of withholding?

A: A waiver of withholding allows athletes or entertainers to not have income taxes withheld from their payments.

Q: What information is required on Form CT-590?

A: Form CT-590 requires information about the individual, the payer, the payment amount, and the reason for the waiver.

Q: How do I file Form CT-590?

A: Form CT-590 should be filled out and mailed to the Connecticut Department of Revenue Services. Instructions are included on the form.

Q: What happens after I file Form CT-590?

A: After filing Form CT-590, the department will review the request and determine if the waiver of withholding will be approved or denied.

Q: When should I file Form CT-590?

A: Form CT-590 should be filed at least 30 days before the payment is due to allow for processing time.

Q: Is there a fee to file Form CT-590?

A: No, there is no fee to file Form CT-590.

Q: Can I e-file Form CT-590?

A: No, Form CT-590 cannot be e-filed and must be submitted by mail.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-590 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.