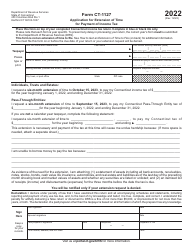

This version of the form is not currently in use and is provided for reference only. Download this version of

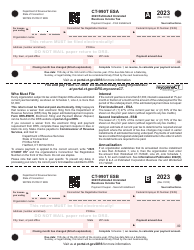

Form CT-8109

for the current year.

Form CT-8109 Connecticut Income Tax Withholding Payment Form for Nonpayroll Amounts - Connecticut

What Is Form CT-8109?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

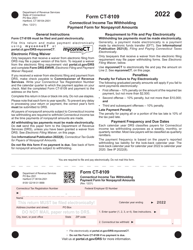

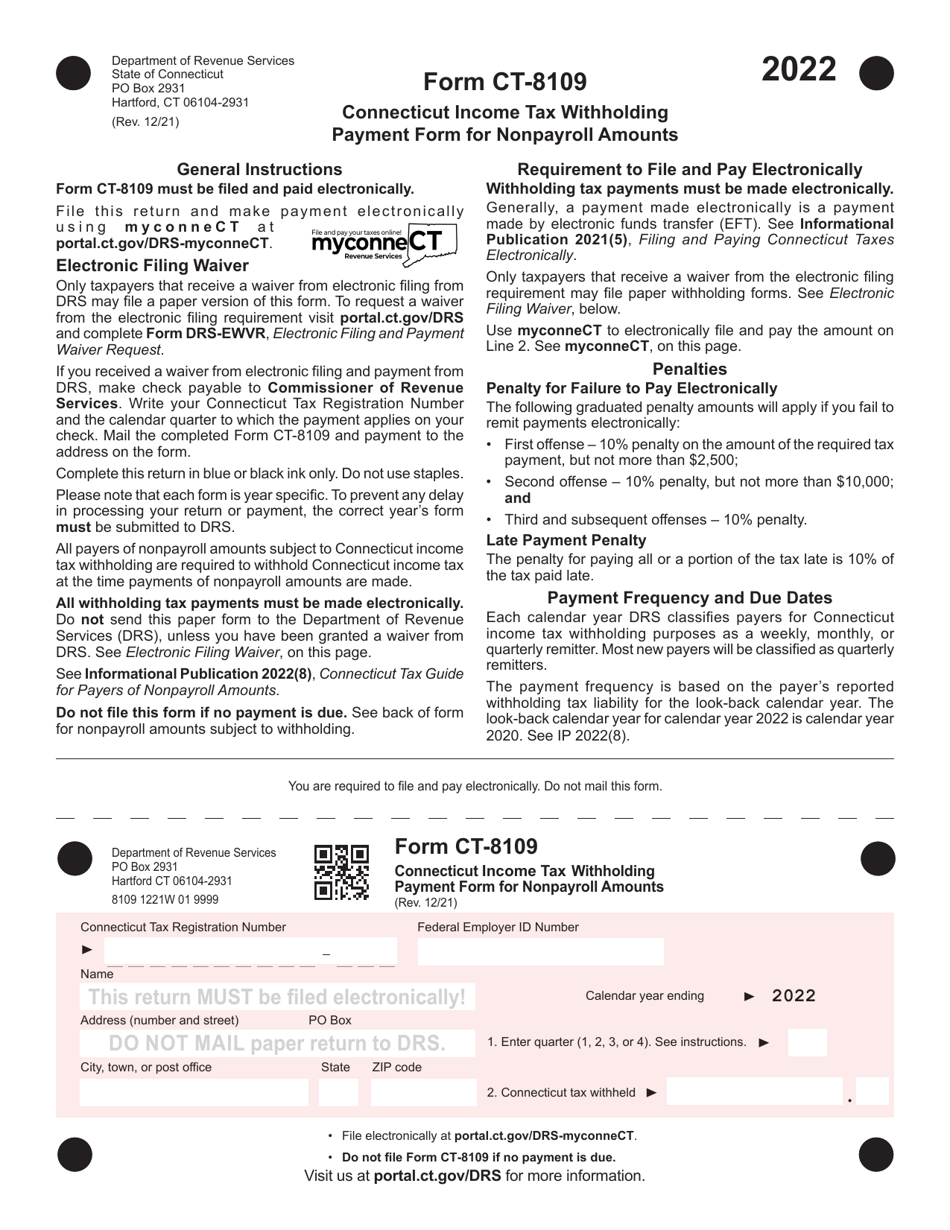

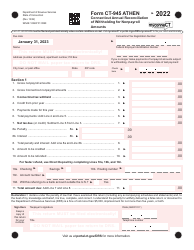

Q: What is Form CT-8109?

A: Form CT-8109 is the Connecticut Income Tax Withholding Payment Form for Nonpayroll Amounts.

Q: What is the purpose of Form CT-8109?

A: The purpose of Form CT-8109 is to make income tax withholding payments for nonpayroll amounts in Connecticut.

Q: Who needs to use Form CT-8109?

A: Anyone who needs to make income tax withholding payments for nonpayroll amounts in Connecticut needs to use Form CT-8109.

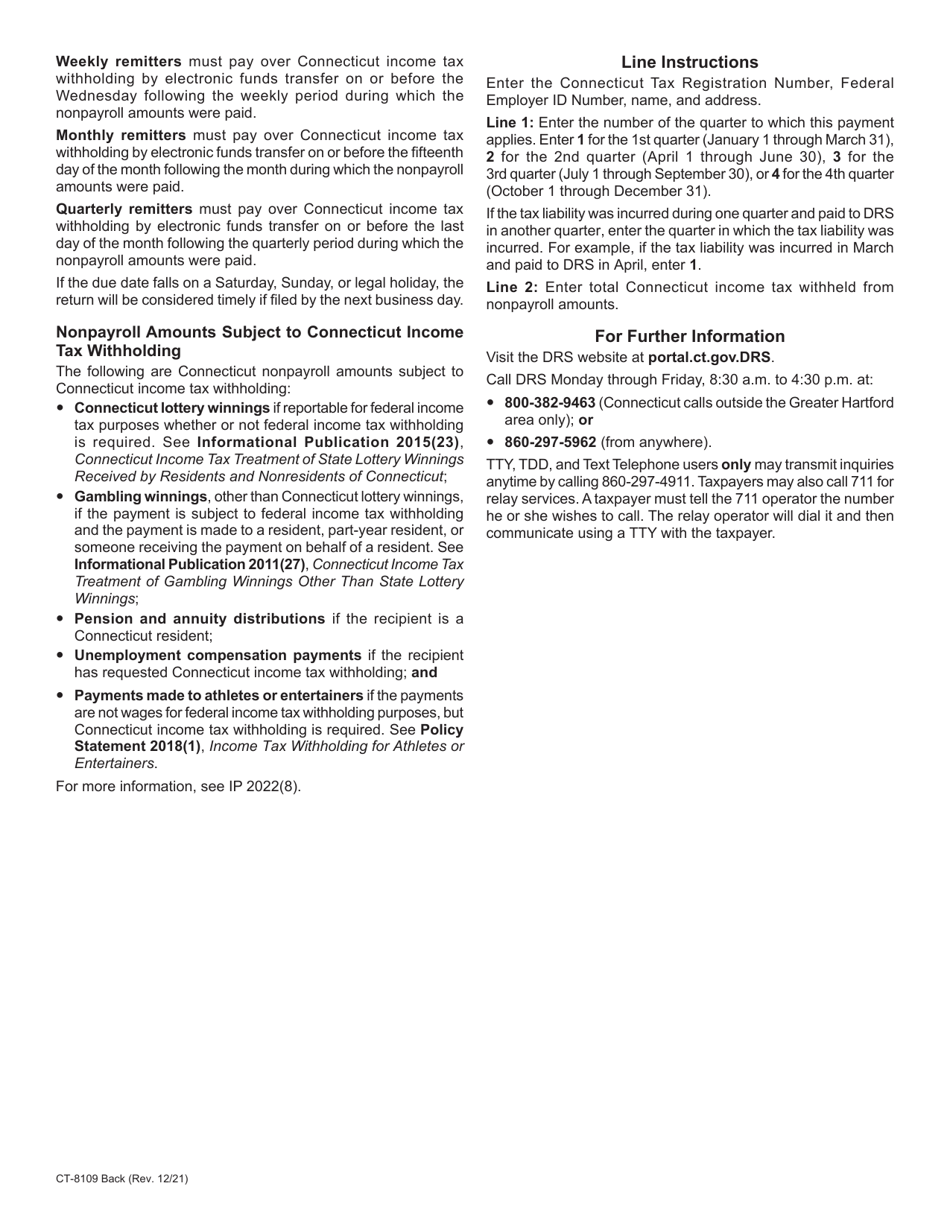

Q: What are nonpayroll amounts?

A: Nonpayroll amounts refer to income payments that are not wages or salaries, such as retirement distributions, gambling winnings, and rental income.

Q: When is Form CT-8109 due?

A: Form CT-8109 is due on a quarterly basis, with specific due dates outlined by the Connecticut Department of Revenue Services.

Q: Are there any penalties for not filing Form CT-8109?

A: Yes, there may be penalties for not filing Form CT-8109 or for filing it late. It is important to submit the form by the specified due dates to avoid penalties.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-8109 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.