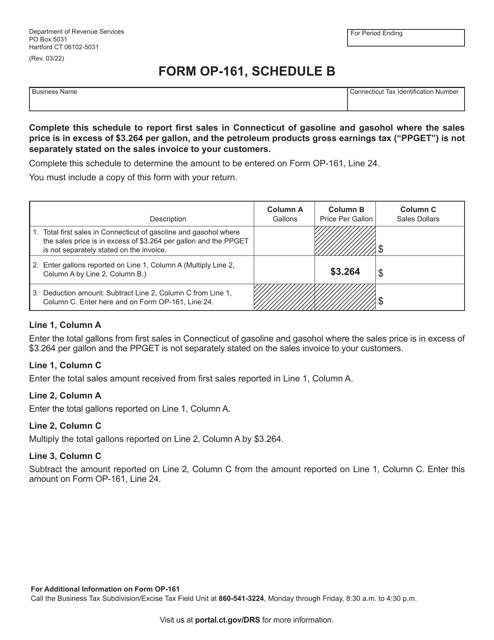

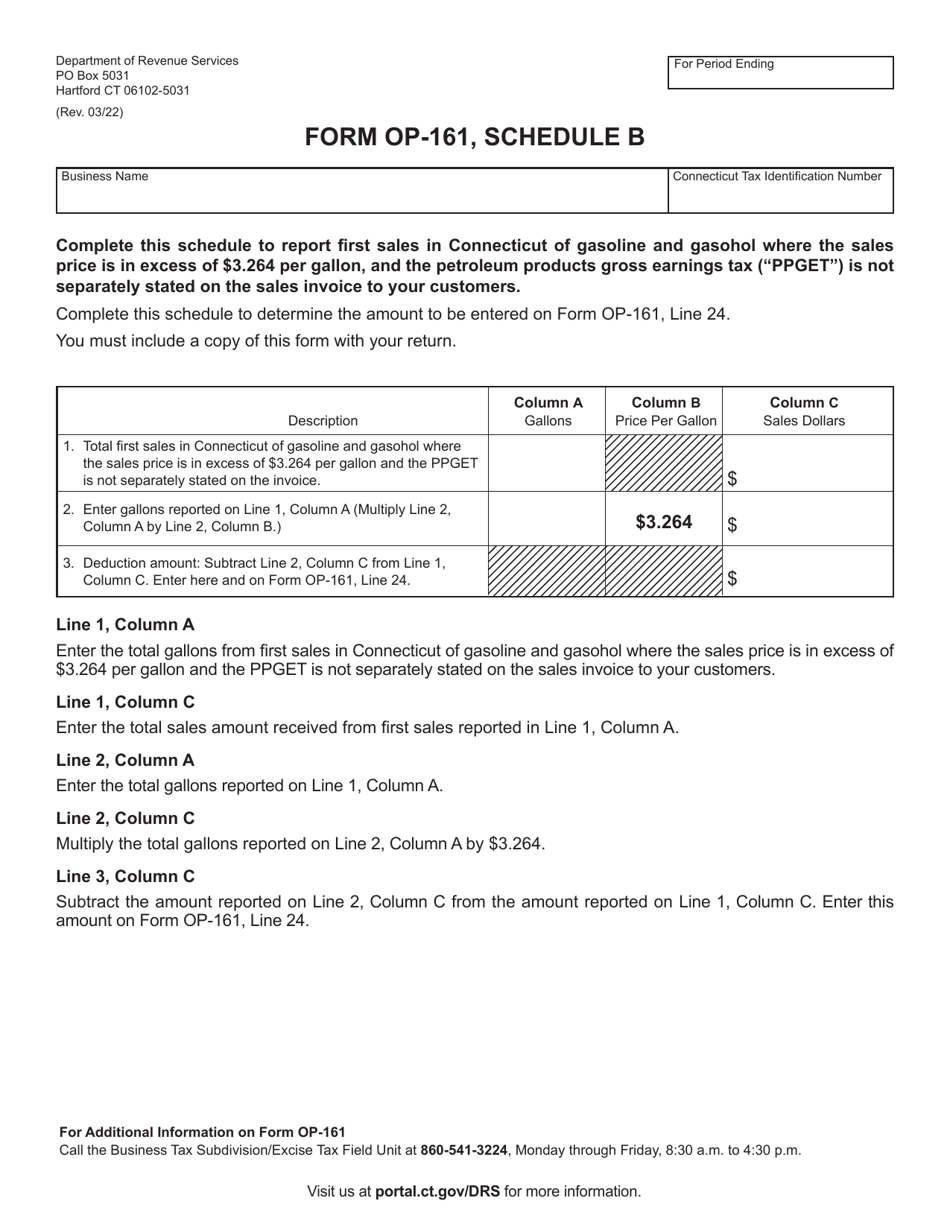

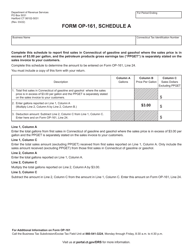

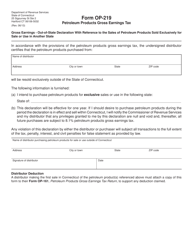

Form OP-161 Schedule B Petroleum Products Gross Earnings Tax Return - Sales Price Is in Excess of $3.225 Per Gallon - Connecticut

What Is Form OP-161 Schedule B?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut.The document is a supplement to Form OP-161, Petroleum Products Gross Earnings Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OP-161 Schedule B?

A: OP-161 Schedule B is a form used for reporting Petroleum ProductsGross Earnings Tax in Connecticut.

Q: What is the purpose of OP-161 Schedule B?

A: OP-161 Schedule B is used to report sales of petroleum products with a sales price exceeding $3.225 per gallon in Connecticut.

Q: What is the sales price threshold for using OP-161 Schedule B?

A: OP-161 Schedule B is used for sales of petroleum products with a sales price exceeding $3.225 per gallon.

Q: Which state is OP-161 Schedule B used for?

A: OP-161 Schedule B is used for reporting Petroleum Products Gross Earnings Tax in Connecticut.

Form Details:

- Released on March 1, 2022;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form OP-161 Schedule B by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.