This version of the form is not currently in use and is provided for reference only. Download this version of

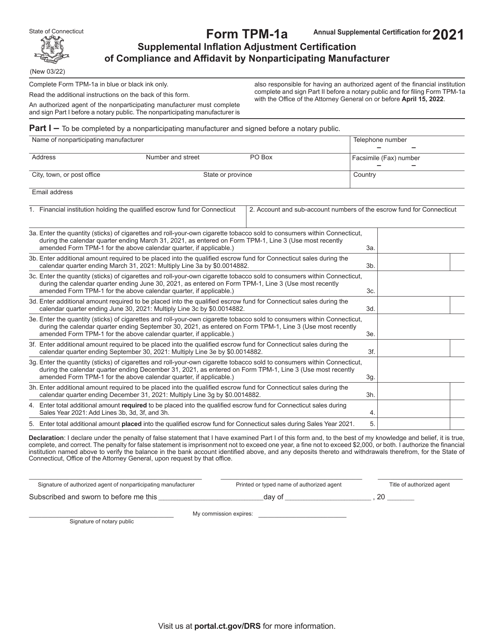

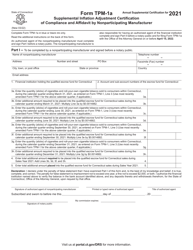

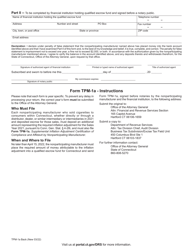

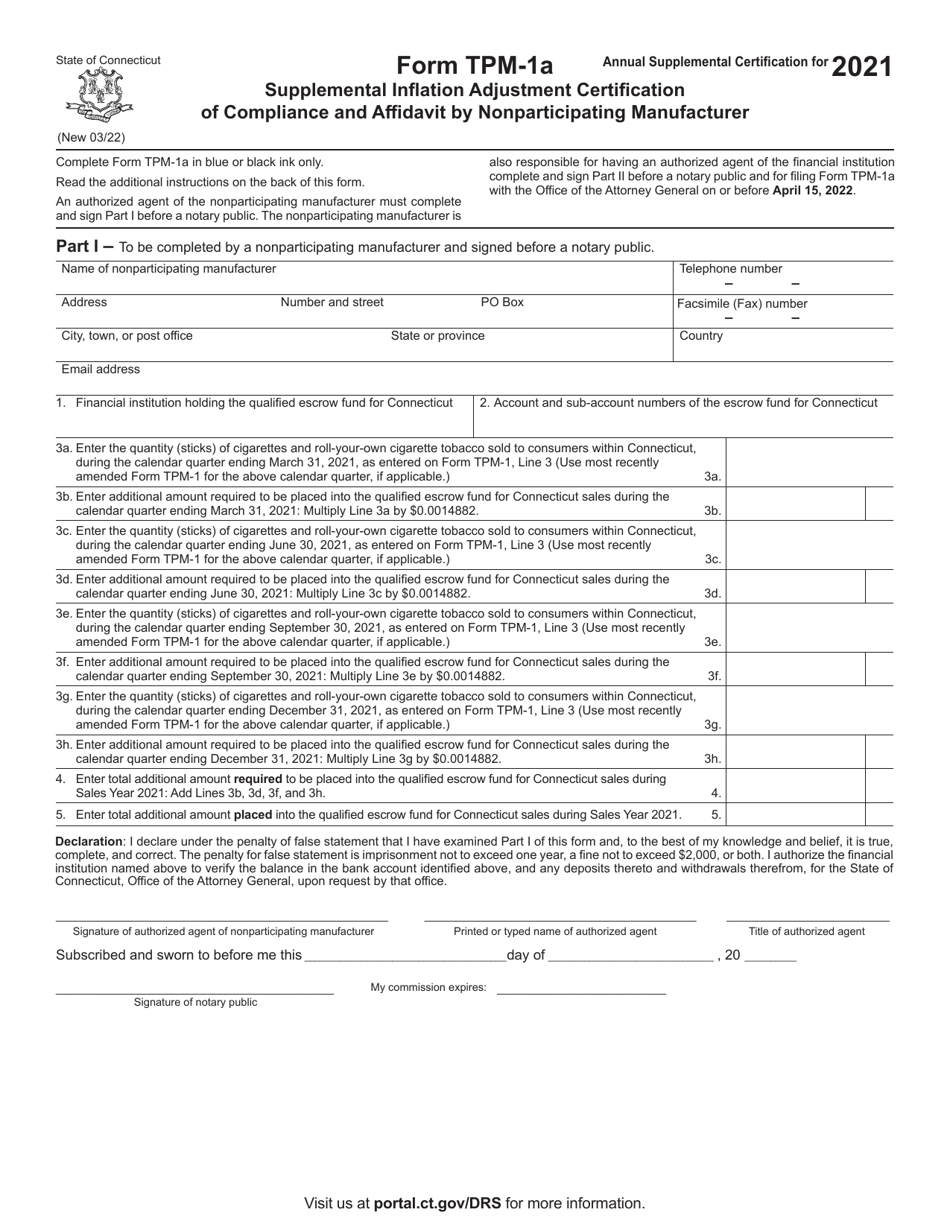

Form TPM-1A

for the current year.

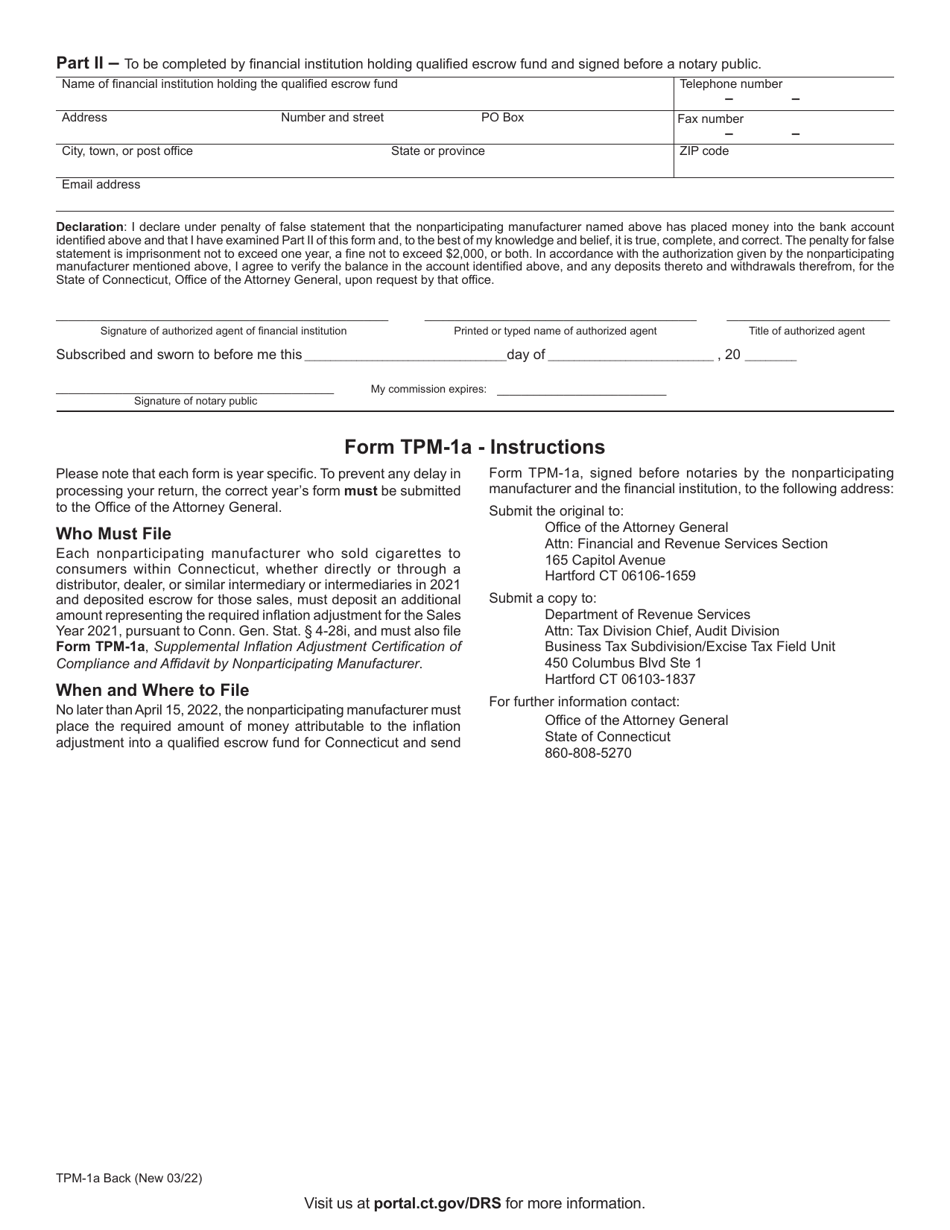

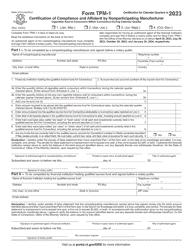

Form TPM-1A Supplemental Inflation Adjustment Certification of Compliance and Affidavit by Nonparticipating Manufacturer - Connecticut

What Is Form TPM-1A?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of Form TPM-1A?

A: Form TPM-1A is used for supplemental inflation adjustment certification of compliance and affidavit by nonparticipating manufacturer in Connecticut.

Q: Who is required to file Form TPM-1A?

A: Nonparticipating manufacturers in Connecticut are required to file Form TPM-1A.

Q: What does the form certify?

A: The form certifies compliance with the state's tobacco product master settlement agreement and provides an affidavit.

Q: What are the consequences of not filing Form TPM-1A?

A: Failure to file Form TPM-1A may result in penalties or other legal consequences.

Q: Are there any fees associated with filing Form TPM-1A?

A: There are no fees associated with filing Form TPM-1A.

Q: Is Form TPM-1A specific to Connecticut only?

A: Yes, Form TPM-1A is specific to nonparticipating manufacturers in Connecticut.

Q: Can I electronically file Form TPM-1A?

A: Yes, you can electronically file Form TPM-1A.

Q: Is there a deadline for filing Form TPM-1A?

A: Yes, the form must be filed annually by April 30th.

Form Details:

- Released on March 1, 2022;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TPM-1A by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.