This version of the form is not currently in use and is provided for reference only. Download this version of

Schedule GAA

for the current year.

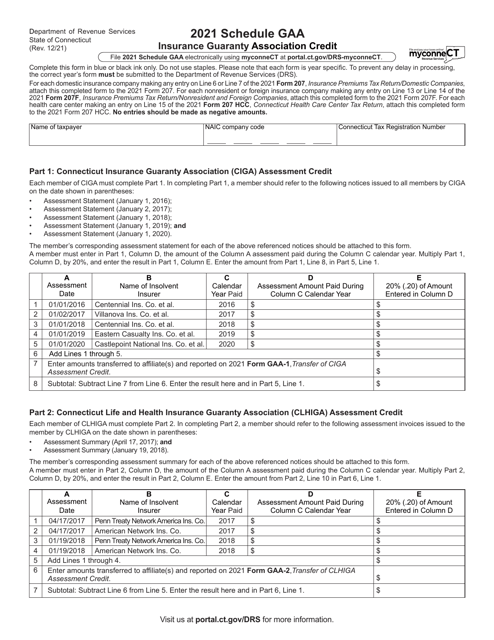

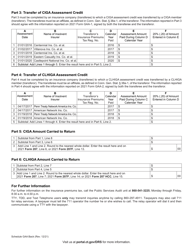

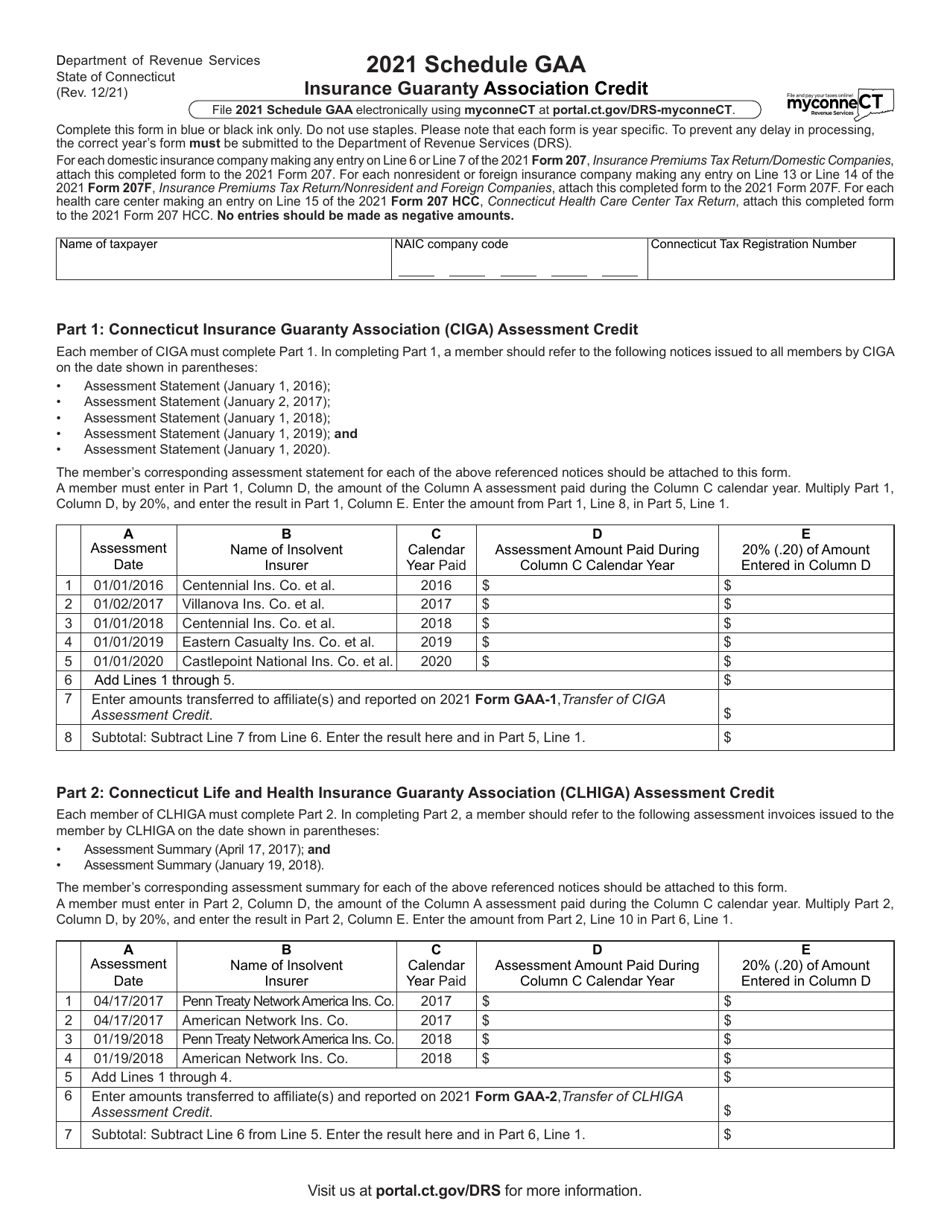

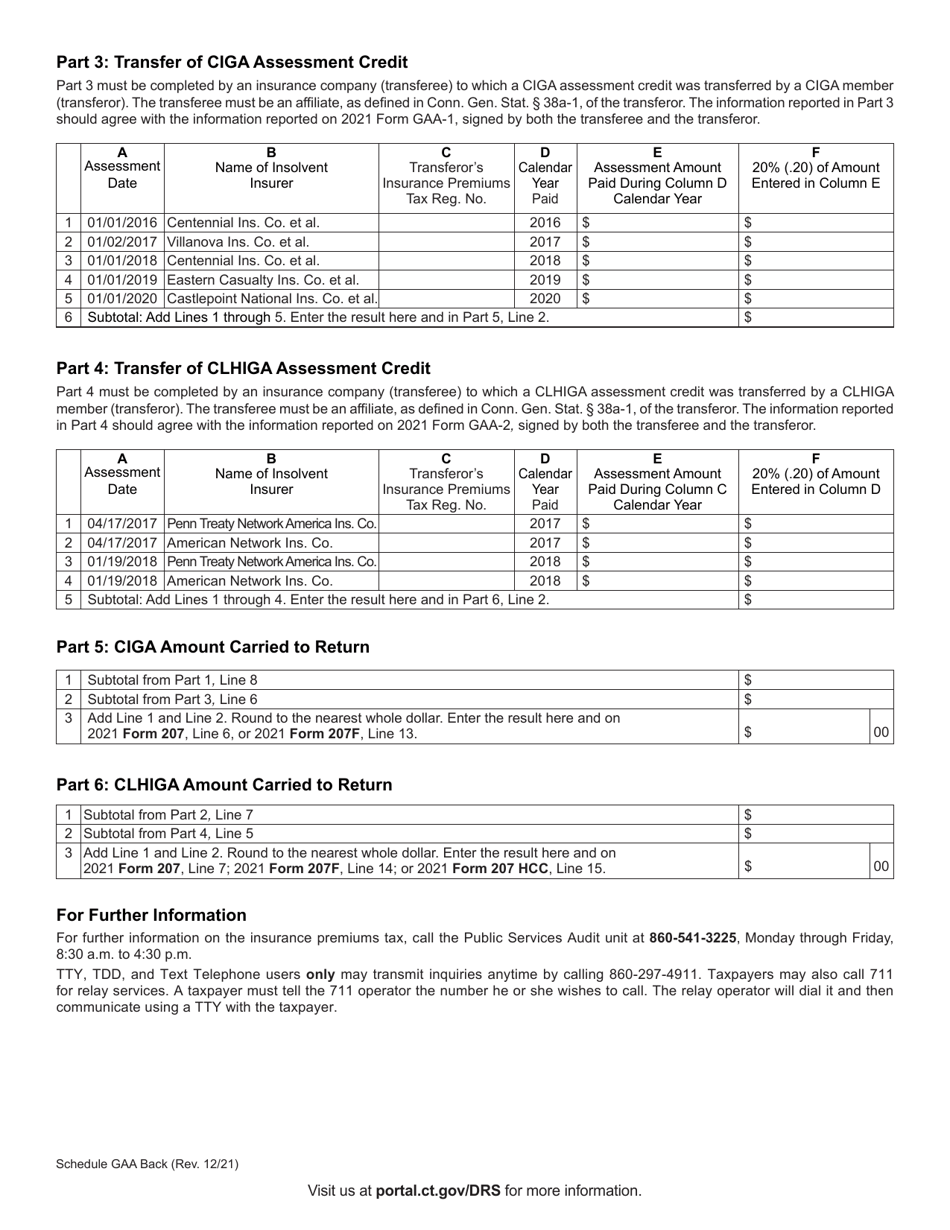

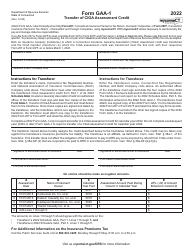

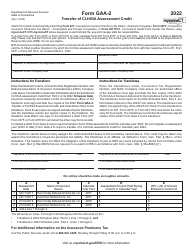

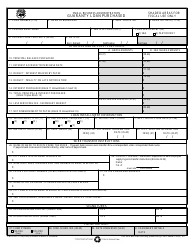

Schedule GAA Insurance Guaranty Association Credit - Connecticut

What Is Schedule GAA?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

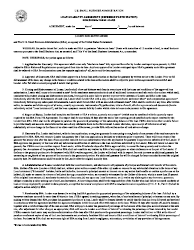

Q: What is the Schedule GAA Insurance Guaranty Association Credit?

A: The Schedule GAA Insurance Guaranty Association Credit is a form used in Connecticut to report credits related to payments made to insurance guaranty associations.

Q: What is an insurance guaranty association?

A: An insurance guaranty association is a state-mandated organization that provides protection to policyholders in case an insurance company becomes insolvent.

Q: What are credits in relation to insurance guaranty associations?

A: Credits refer to amounts paid by insurance companies to insurance guaranty associations in order to support their operations.

Q: Why do insurance companies pay credits to insurance guaranty associations?

A: Insurance companies pay credits to insurance guaranty associations as part of the guarantee that they will be able to compensate policyholders in case of insolvency.

Q: What is the purpose of filing the Schedule GAA Insurance Guaranty Association Credit?

A: The purpose of filing the Schedule GAA Insurance Guaranty Association Credit is to report and provide details of the credits paid by insurance companies to insurance guaranty associations.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule GAA by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.