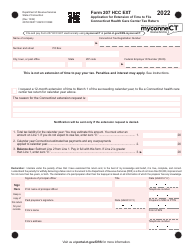

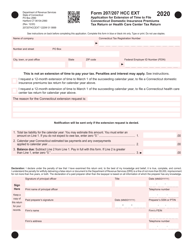

This version of the form is not currently in use and is provided for reference only. Download this version of

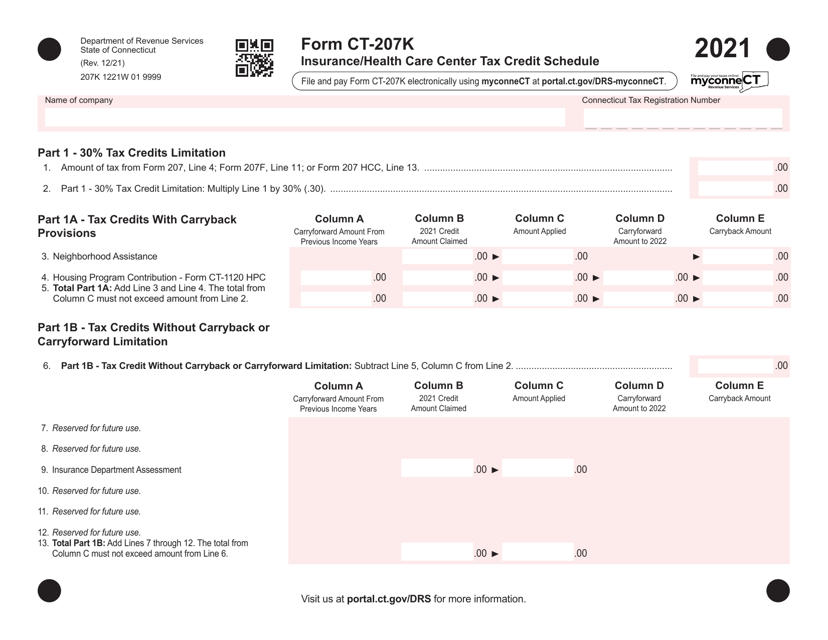

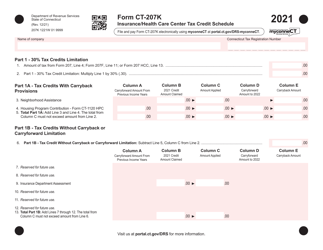

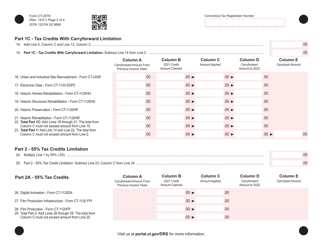

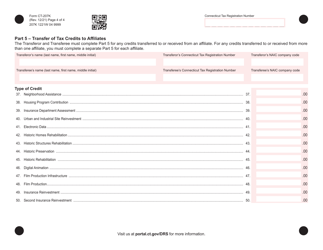

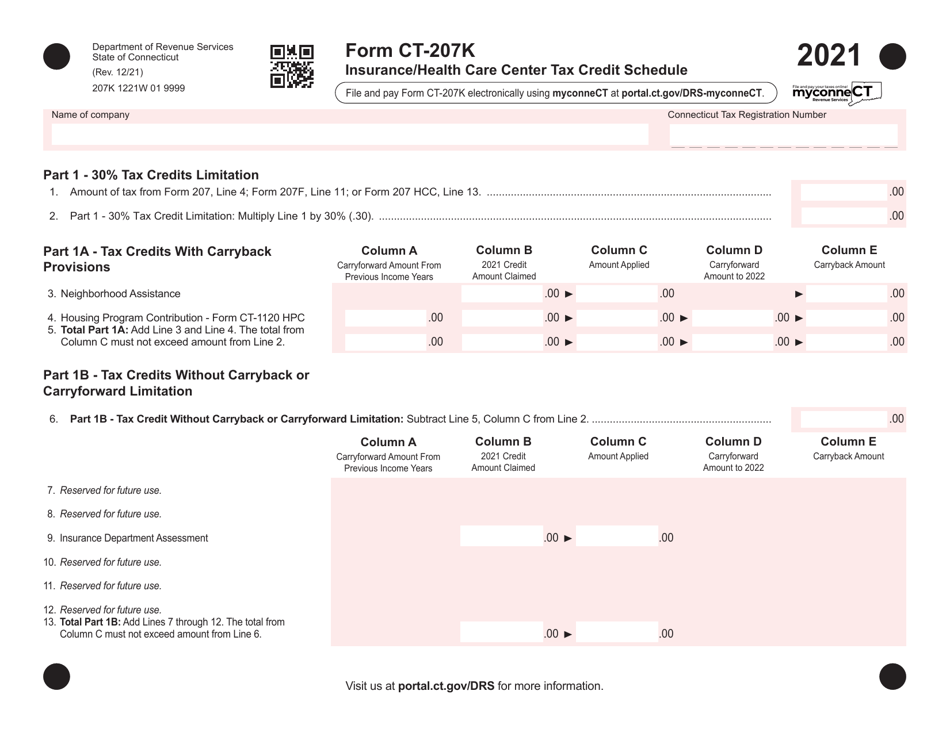

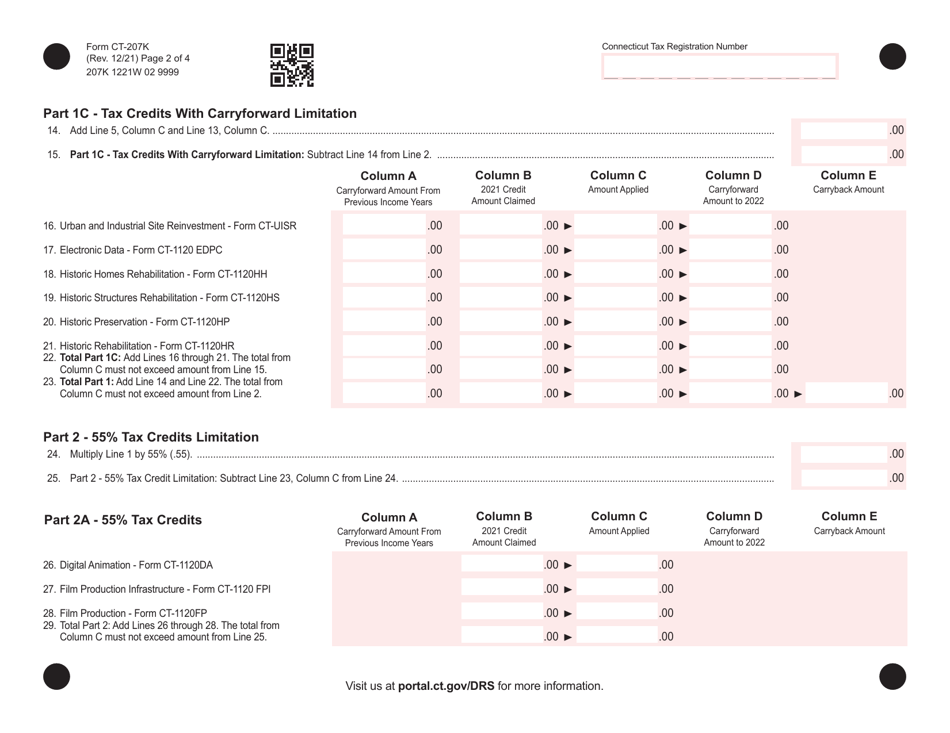

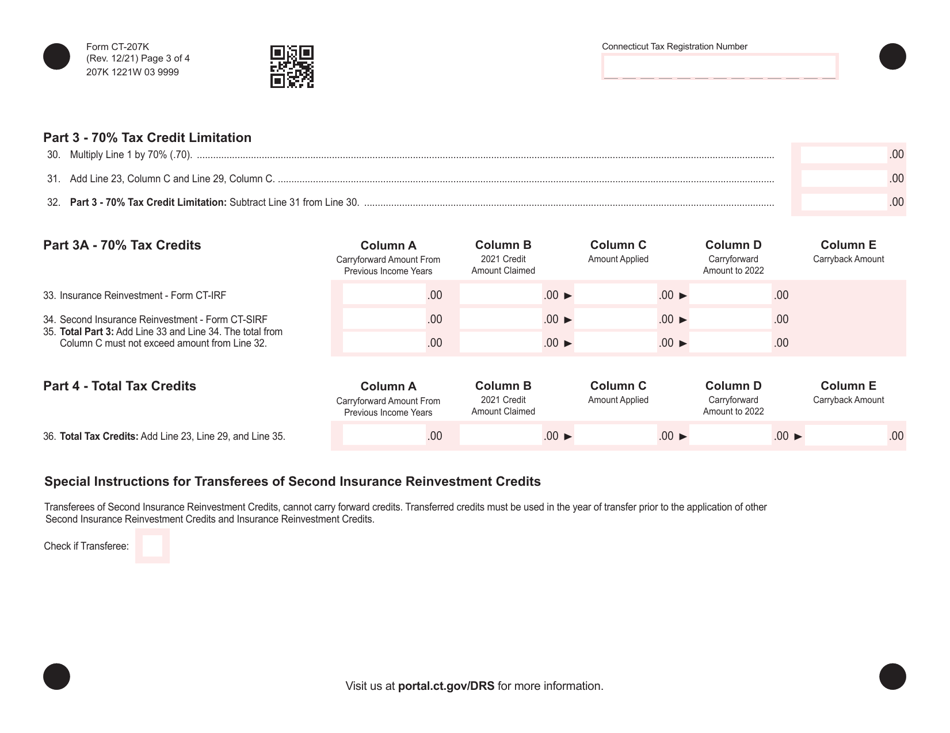

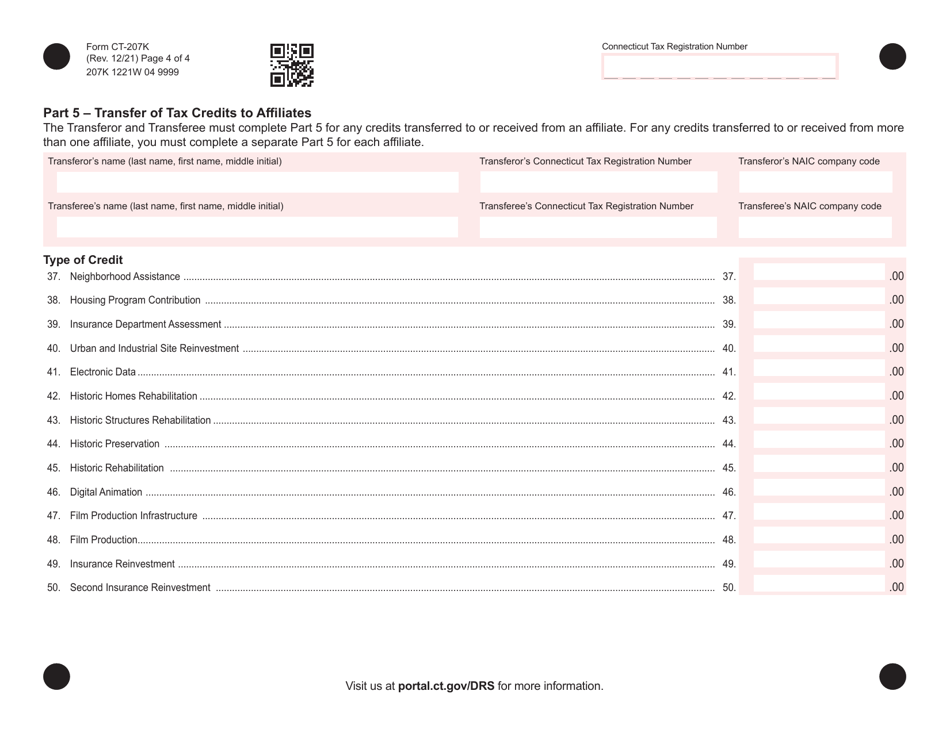

Form CT-207K

for the current year.

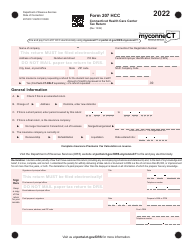

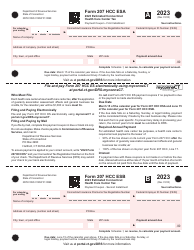

Form CT-207K Insurance / Health Care Center Tax Credit Schedule - Connecticut

What Is Form CT-207K?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-207K?

A: Form CT-207K is the Insurance/Health Care Center Tax Credit Schedule in Connecticut.

Q: What is the purpose of Form CT-207K?

A: The purpose of Form CT-207K is to calculate and claim the Insurance/Health Care Center Tax Credit in Connecticut.

Q: Who needs to file Form CT-207K?

A: Taxpayers who are eligible for the Insurance/Health Care Center Tax Credit in Connecticut need to file Form CT-207K.

Q: How do I qualify for the Insurance/Health Care Center Tax Credit in Connecticut?

A: To qualify for the Insurance/Health Care Center Tax Credit in Connecticut, you must have made contributions to qualified health care centers.

Q: What expenses can be claimed on Form CT-207K?

A: Only qualifying contributions made to qualified health care centers can be claimed on Form CT-207K.

Q: Can I file Form CT-207K electronically?

A: Yes, you can file Form CT-207K electronically through the Connecticut Taxpayer Service Center.

Q: What is the deadline for filing Form CT-207K?

A: The deadline for filing Form CT-207K is the same as the deadline for filing the Connecticut income tax return, which is usually April 15th.

Q: Are there any penalties for late filing of Form CT-207K?

A: Yes, if you fail to file Form CT-207K by the deadline, you may be subject to penalties and interest.

Q: Can I claim the Insurance/Health Care Center Tax Credit if I live outside of Connecticut?

A: No, the Insurance/Health Care Center Tax Credit is only available to individuals who are Connecticut residents.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-207K by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.