This version of the form is not currently in use and is provided for reference only. Download this version of

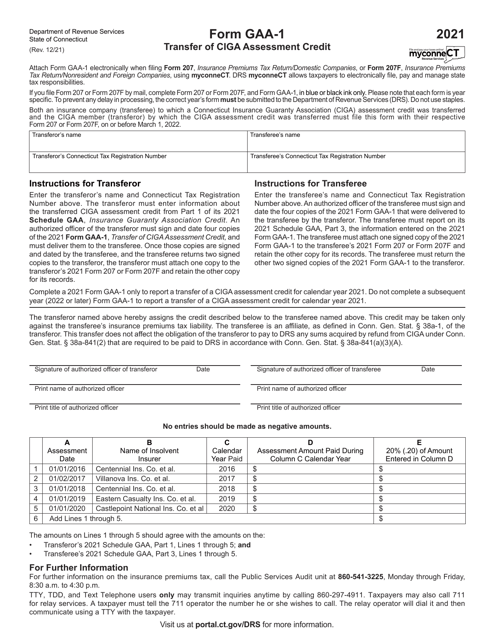

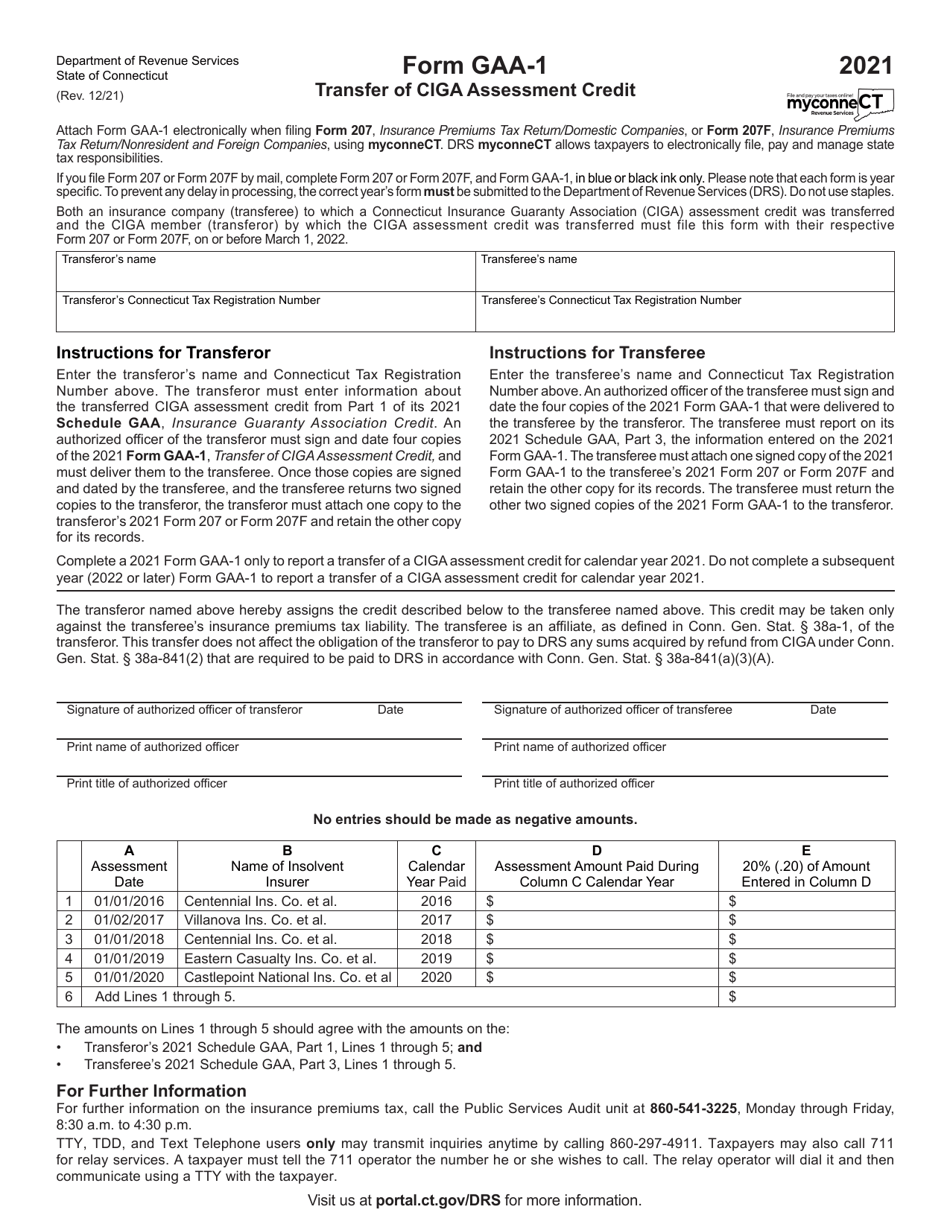

Form GAA-1

for the current year.

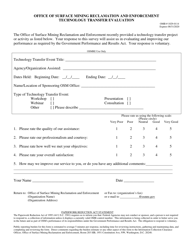

Form GAA-1 Transfer of Ciga Assessment Credit - Connecticut

What Is Form GAA-1?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

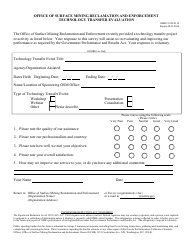

Q: What is the Form GAA-1?

A: The Form GAA-1 is a document used to transfer Cigarette Assessment Credits in Connecticut.

Q: What is a Cigarette Assessment Credit?

A: A Cigarette Assessment Credit is a credit given to cigarette wholesalers in Connecticut for certain qualifying sales.

Q: Who needs to use the Form GAA-1?

A: Cigarette wholesalers who want to transfer their Cigarette Assessment Credits need to use the Form GAA-1.

Q: What is the purpose of transferring Cigarette Assessment Credits?

A: The purpose of transferring Cigarette Assessment Credits is to allow wholesalers to use their credits to offset future tax liability or transfer them to another wholesaler.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

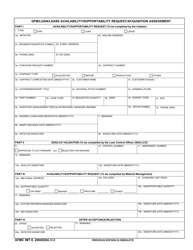

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form GAA-1 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.