This version of the form is not currently in use and is provided for reference only. Download this version of

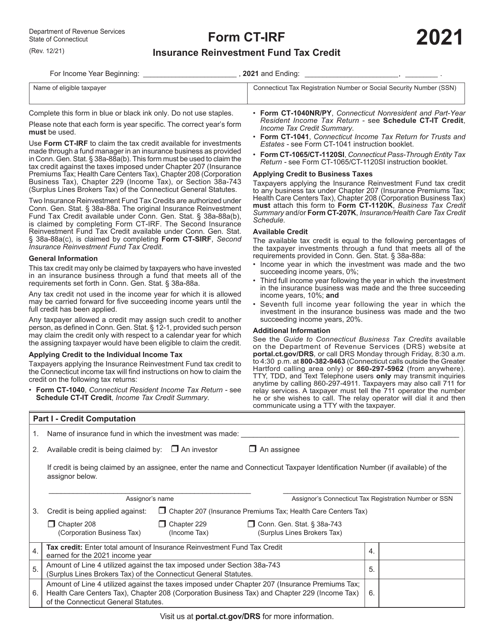

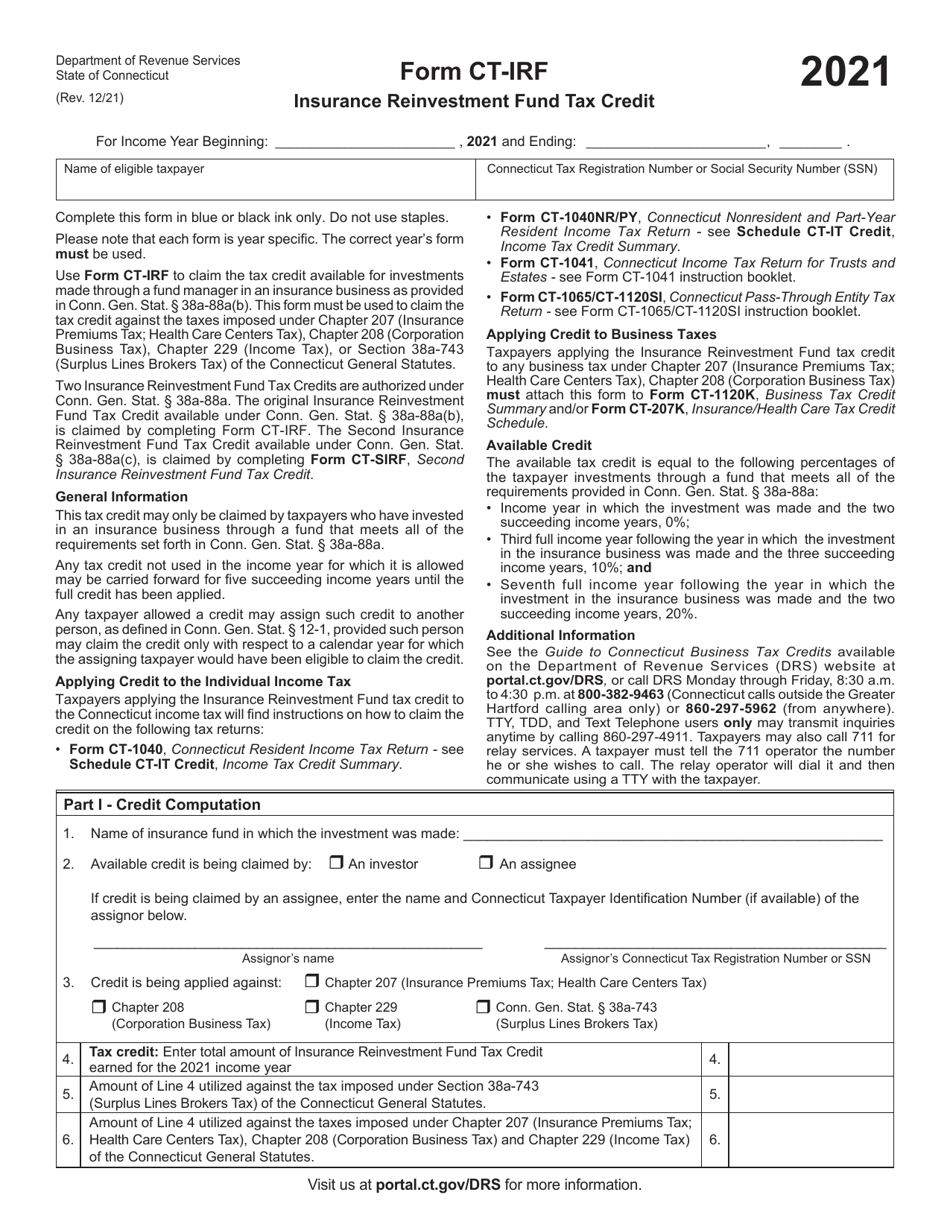

Form CT-IRF

for the current year.

Form CT-IRF Insurance Reinvestment Fund Tax Credit - Connecticut

What Is Form CT-IRF?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-IRF?

A: Form CT-IRF is a form used in Connecticut to claim the Insurance Reinvestment Fund Tax Credit.

Q: What is the Insurance Reinvestment Fund Tax Credit?

A: The Insurance Reinvestment Fund Tax Credit is a tax credit offered by the state of Connecticut to encourage investment in the insurance industry.

Q: Who is eligible to claim the Insurance Reinvestment Fund Tax Credit?

A: Insurance companies that invest in certain qualified investments in Connecticut are eligible to claim the tax credit.

Q: What is the purpose of the Insurance Reinvestment Fund Tax Credit?

A: The purpose of the tax credit is to promote economic growth and development in the insurance industry in Connecticut.

Q: How much is the Insurance Reinvestment Fund Tax Credit worth?

A: The tax credit is equal to a percentage of the qualified investments made by the insurance company.

Q: When is the deadline to file Form CT-IRF?

A: The deadline to file Form CT-IRF is typically the same as the deadline for filing the insurance company's annual tax return.

Q: Are there any additional requirements for claiming the Insurance Reinvestment Fund Tax Credit?

A: Yes, insurance companies must meet certain criteria and provide documentation to support their claim for the tax credit.

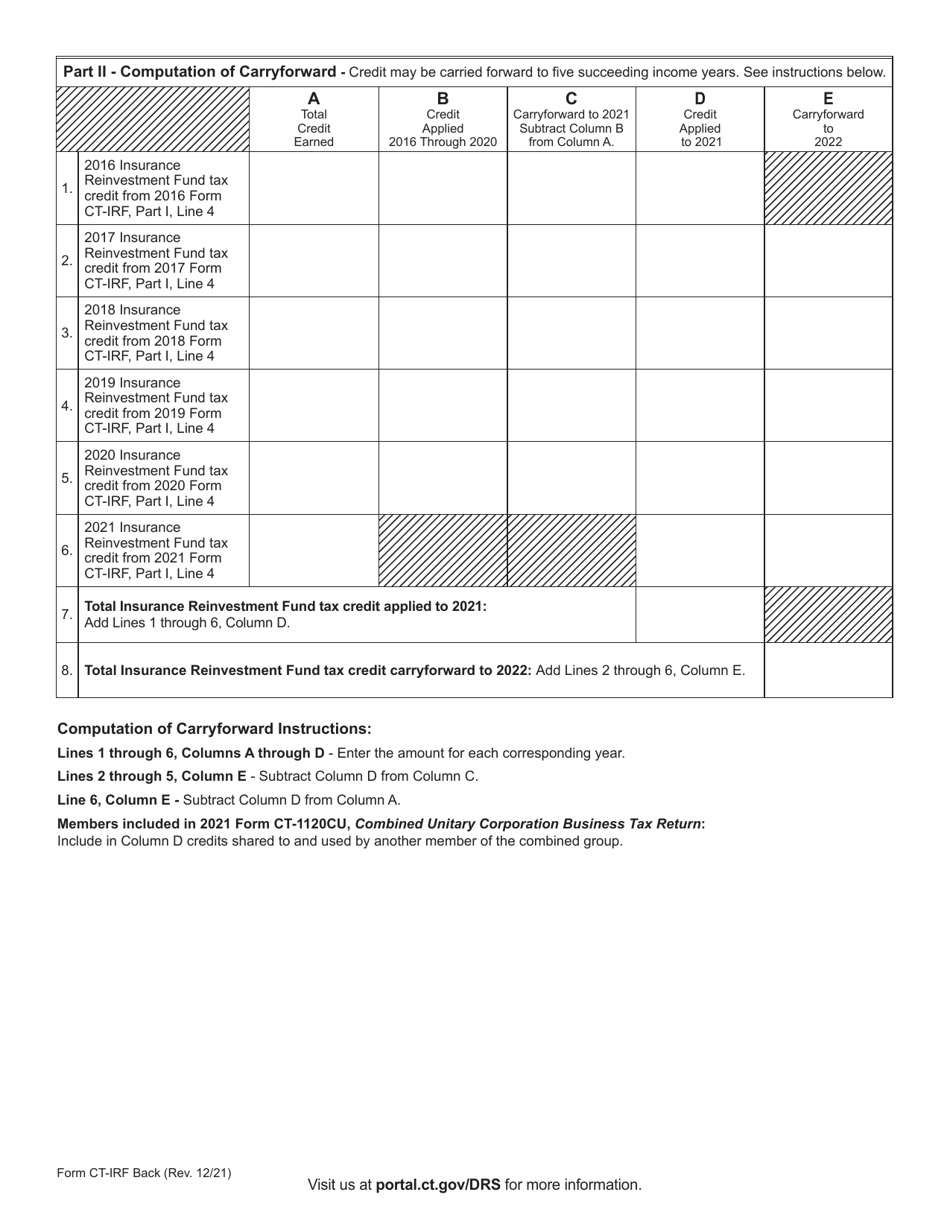

Q: Can the Insurance Reinvestment Fund Tax Credit be carried forward?

A: Yes, any unused tax credit can be carried forward for up to five years.

Q: Is there a limit on the amount of the Insurance Reinvestment Fund Tax Credit that can be claimed?

A: Yes, there is a cap on the total amount of tax credits that can be claimed by all eligible insurance companies in a given year.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-IRF by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.