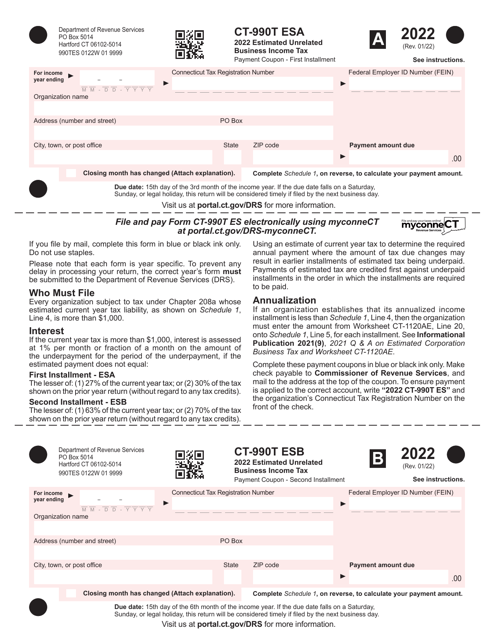

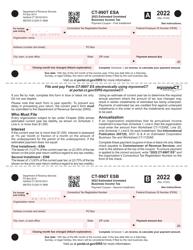

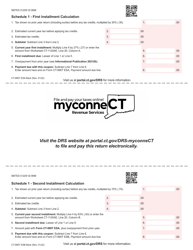

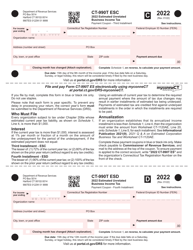

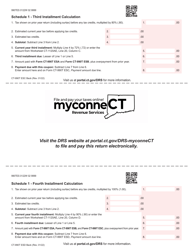

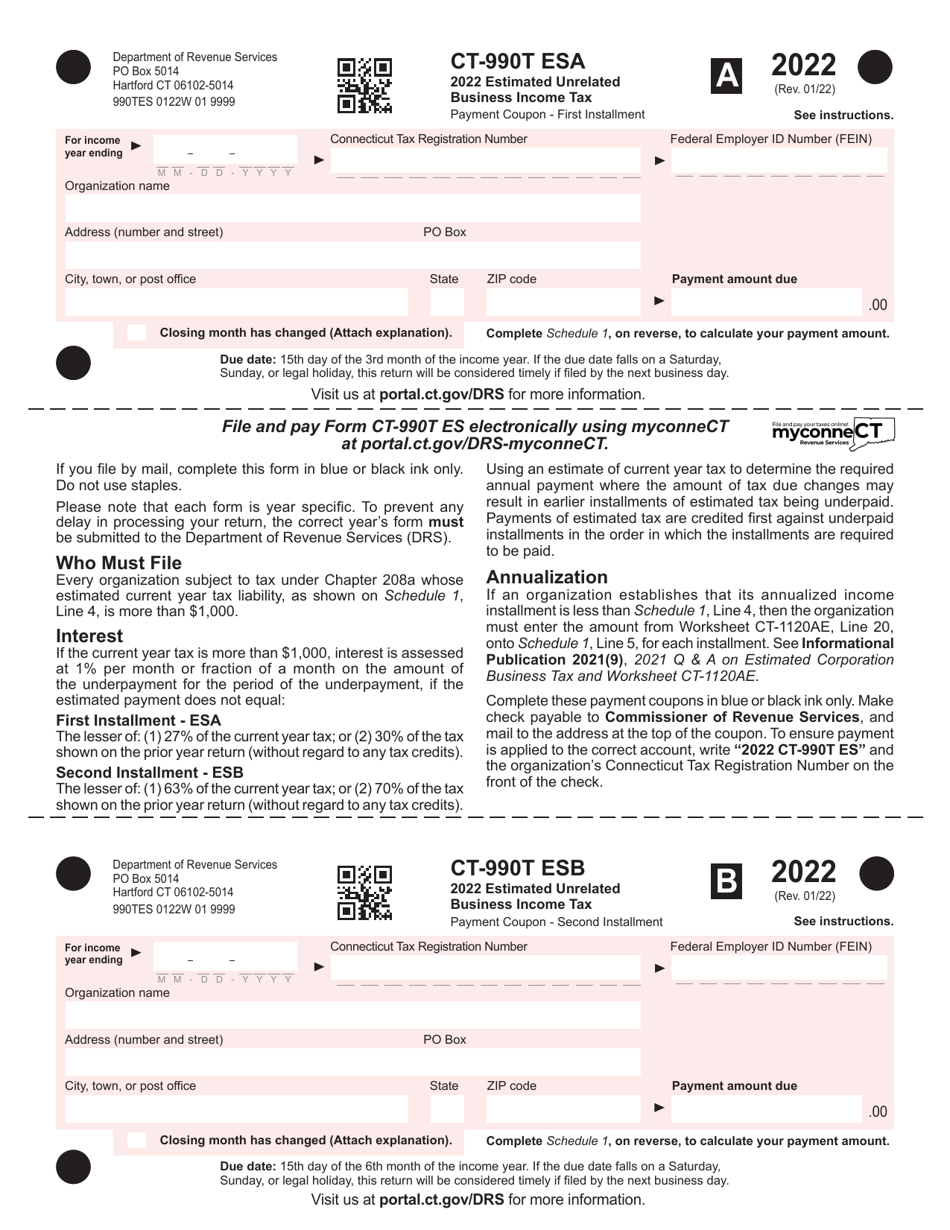

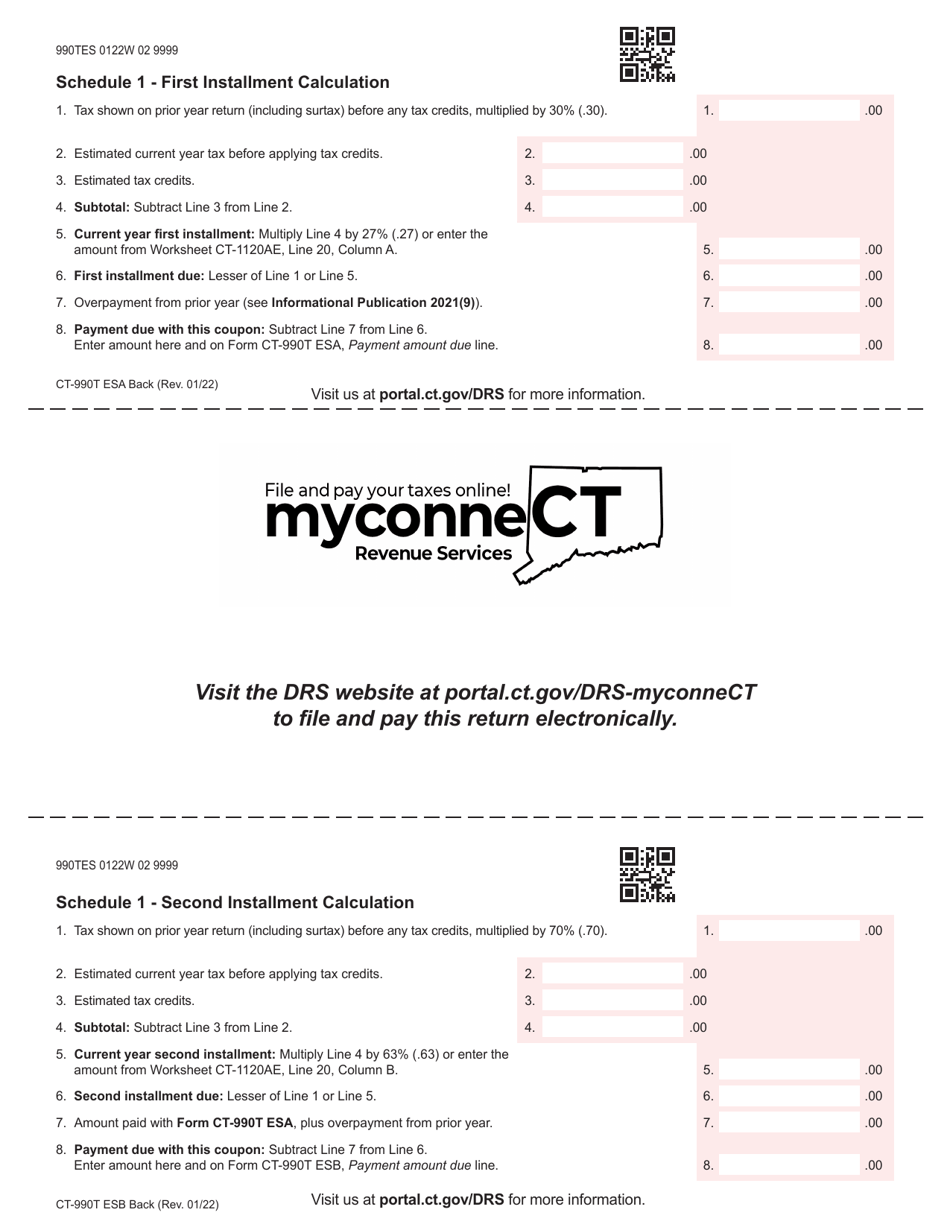

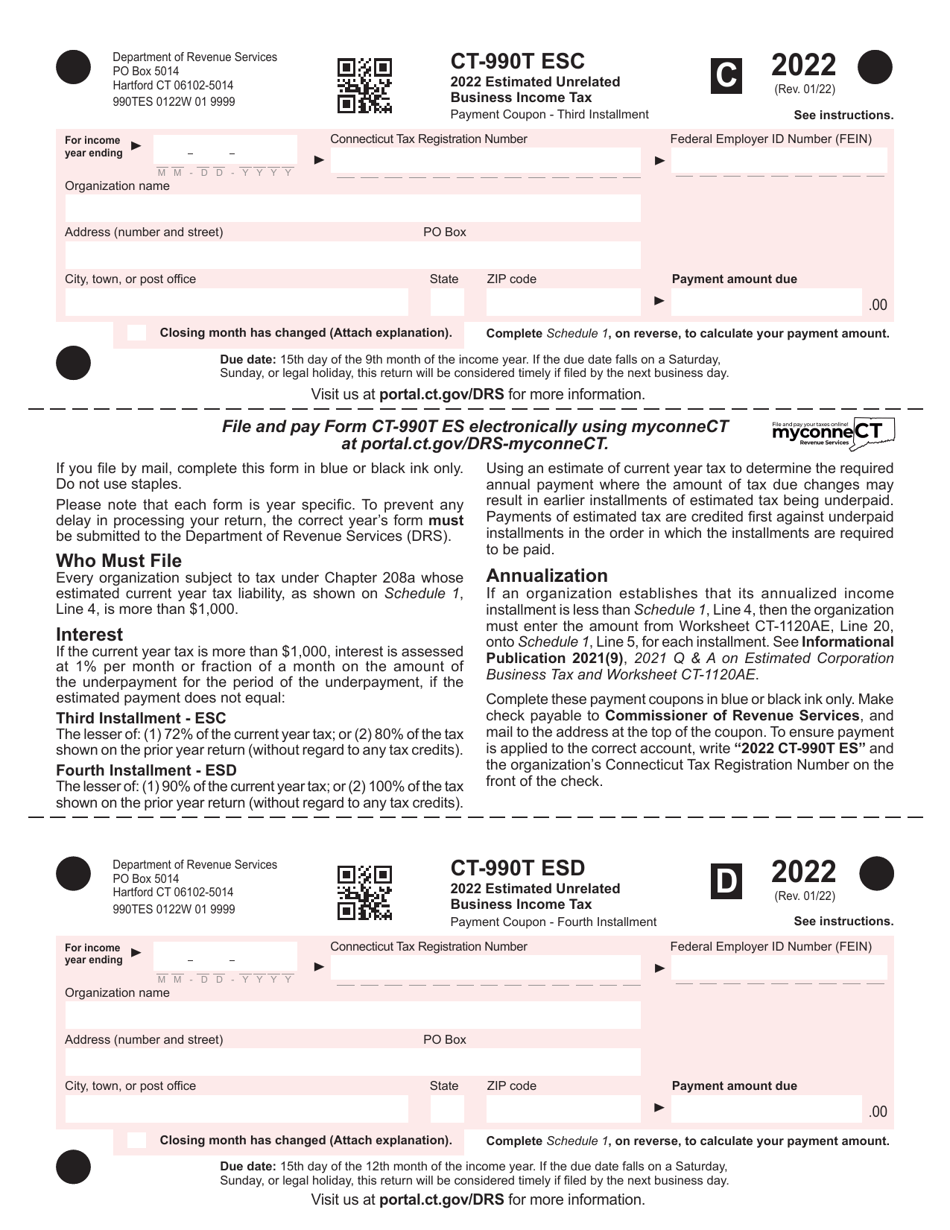

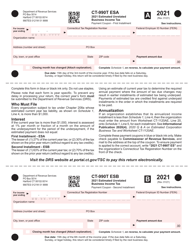

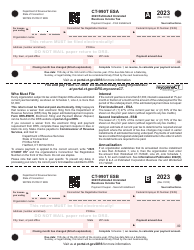

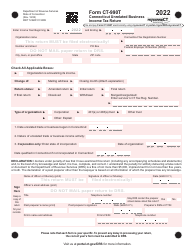

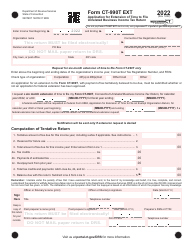

Form CT-990T ESA Estimated Unrelated Business Income Tax - Connecticut

What Is Form CT-990T ESA?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-990T ESA?

A: Form CT-990T ESA is a tax form used to report estimated unrelated business income tax in Connecticut.

Q: Who needs to file Form CT-990T ESA?

A: Tax-exempt organizations in Connecticut that have unrelated business income of $1,000 or more need to file Form CT-990T ESA.

Q: What is unrelated business income?

A: Unrelated business income is income from a trade or business conducted by a tax-exempt organization that is not substantially related to its exempt purpose.

Q: What is the purpose of filing Form CT-990T ESA?

A: The purpose of filing Form CT-990T ESA is to calculate and report the estimated unrelated business income tax owed by a tax-exempt organization in Connecticut.

Q: When is Form CT-990T ESA due?

A: Form CT-990T ESA is due on the 15th day of the 5th month following the end of the fiscal year of the tax-exempt organization.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-990T ESA by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.