This version of the form is not currently in use and is provided for reference only. Download this version of

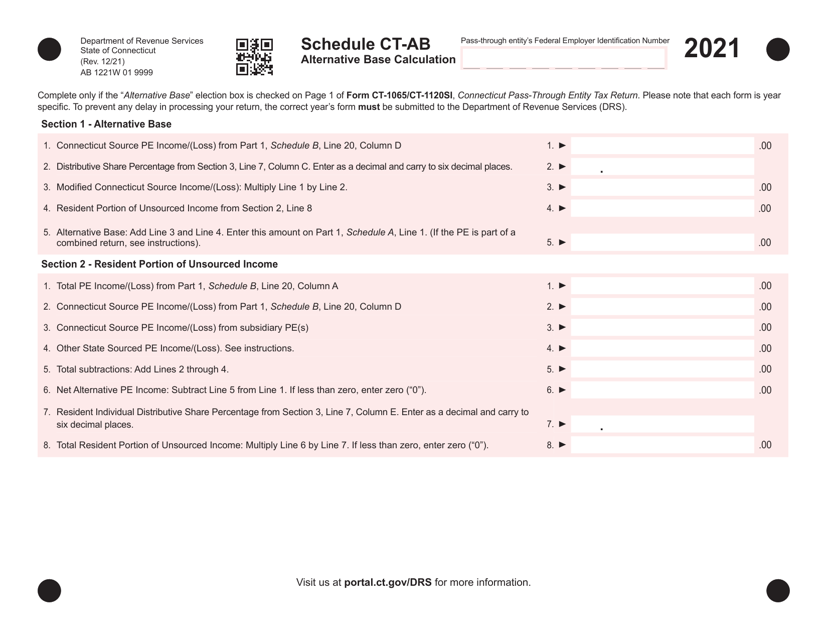

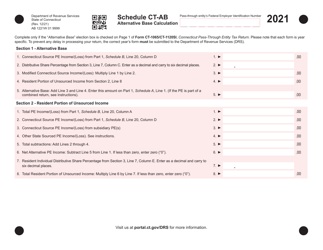

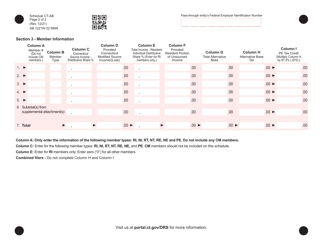

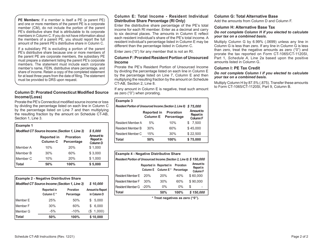

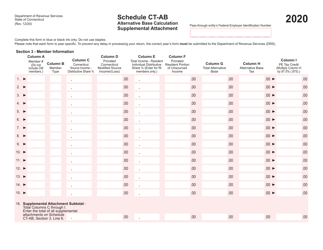

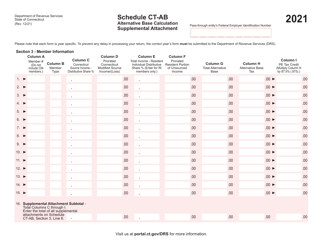

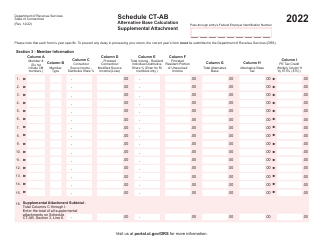

Schedule CT-AB

for the current year.

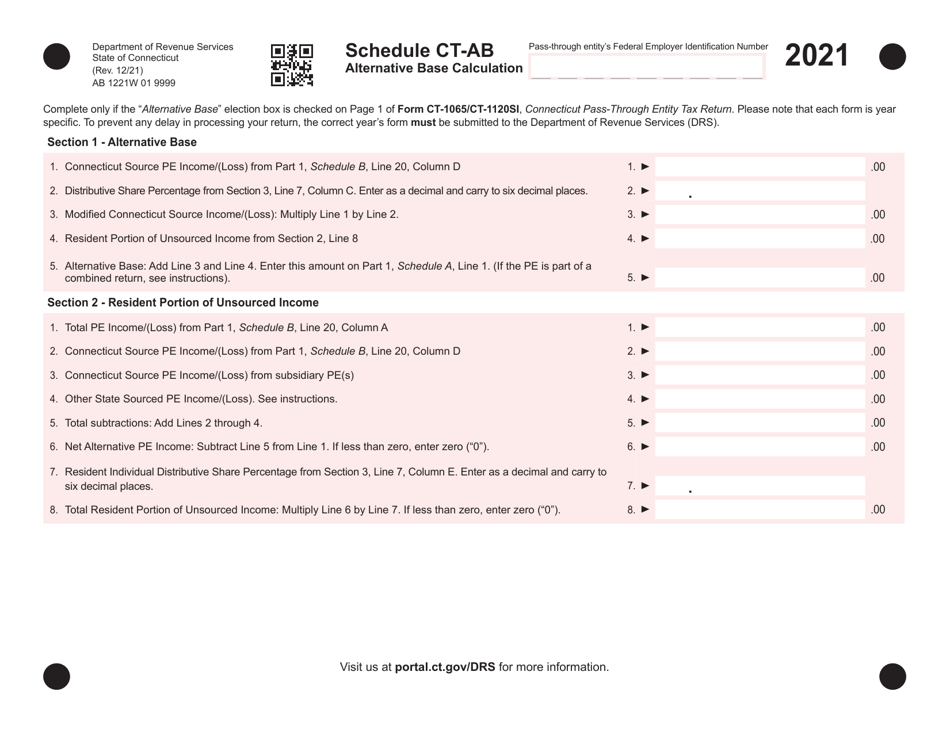

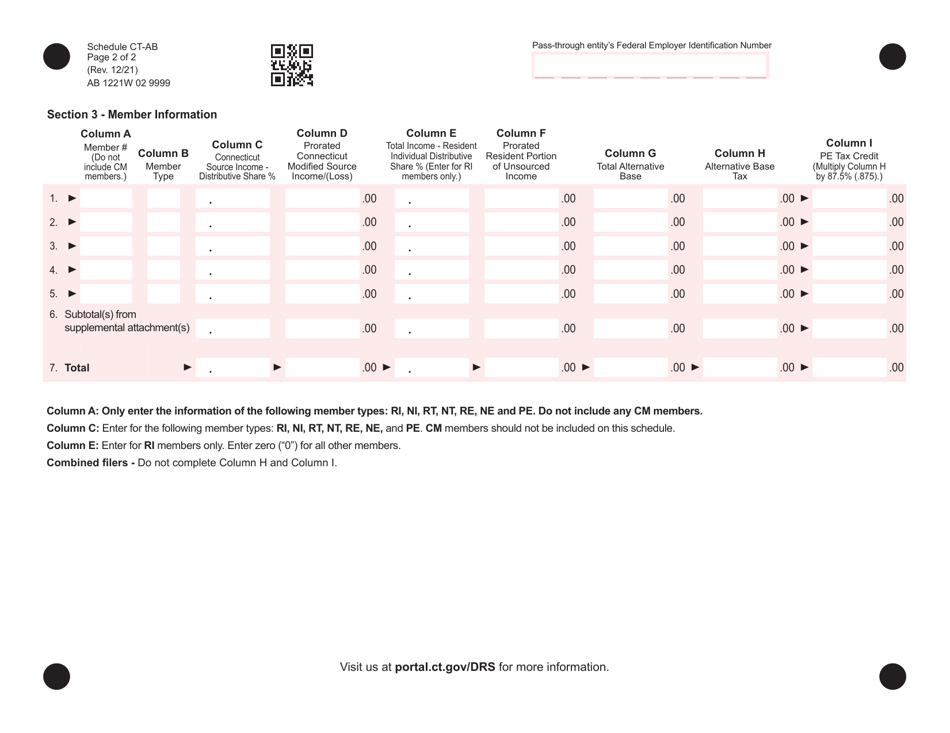

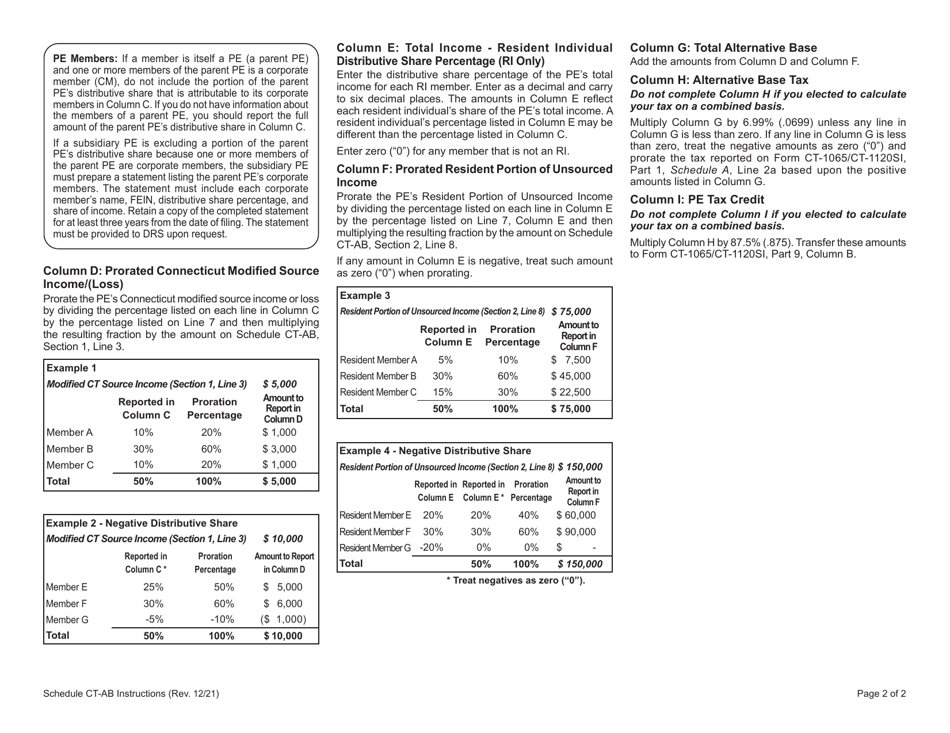

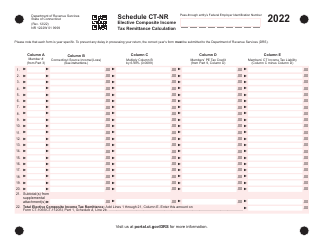

Schedule CT-AB Alternative Base Calculation - Connecticut

What Is Schedule CT-AB?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

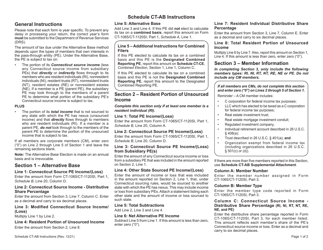

Q: What is the CT-AB Alternative Base Calculation?

A: The CT-AB Alternative Base Calculation is a method used to calculate a modified base period wage for unemployment insurance purposes in Connecticut.

Q: Why is the CT-AB Alternative Base Calculation used?

A: The CT-AB Alternative Base Calculation is used when an individual's normal base period does not accurately reflect their recent earnings due to various factors, such as seasonal employment or temporary layoffs.

Q: How is the CT-AB Alternative Base Calculation determined?

A: The CT-AB Alternative Base Calculation takes into account the individual's wages earned during a specific period, excluding any earnings outside of Connecticut.

Q: When should someone use the CT-AB Alternative Base Calculation?

A: Someone should use the CT-AB Alternative Base Calculation if their regular base period does not accurately reflect their recent earnings and they meet the specific requirements set by Connecticut's Department of Labor.

Q: Is the CT-AB Alternative Base Calculation available for all individuals?

A: No, the CT-AB Alternative Base Calculation is only available for individuals who meet certain criteria set by Connecticut's Department of Labor.

Q: How can someone apply for the CT-AB Alternative Base Calculation?

A: To apply for the CT-AB Alternative Base Calculation, individuals must contact Connecticut's Department of Labor and provide the necessary documentation and information.

Q: Are there any disadvantages to using the CT-AB Alternative Base Calculation?

A: One potential disadvantage of using the CT-AB Alternative Base Calculation is that it may result in a lower base period wage, which could impact the amount of unemployment benefits an individual is eligible to receive.

Q: Can the CT-AB Alternative Base Calculation be used for other purposes besides unemployment insurance?

A: No, the CT-AB Alternative Base Calculation is specifically used for calculating a modified base period wage for unemployment insurance purposes in Connecticut.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule CT-AB by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.