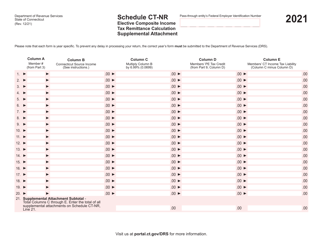

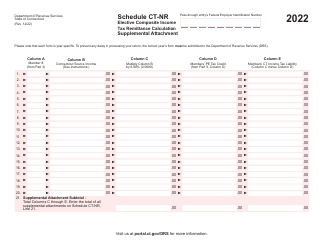

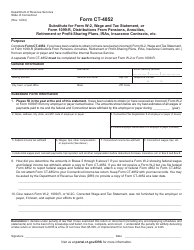

This version of the form is not currently in use and is provided for reference only. Download this version of

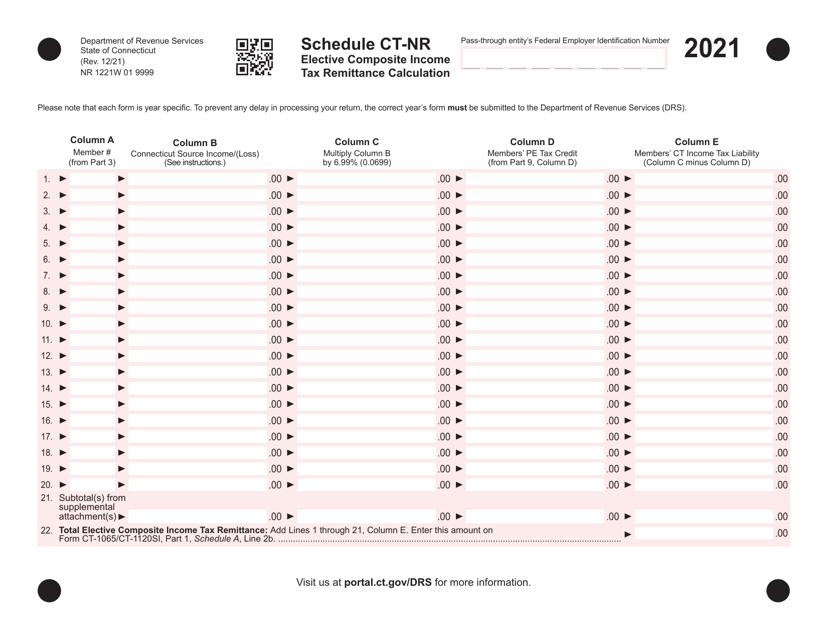

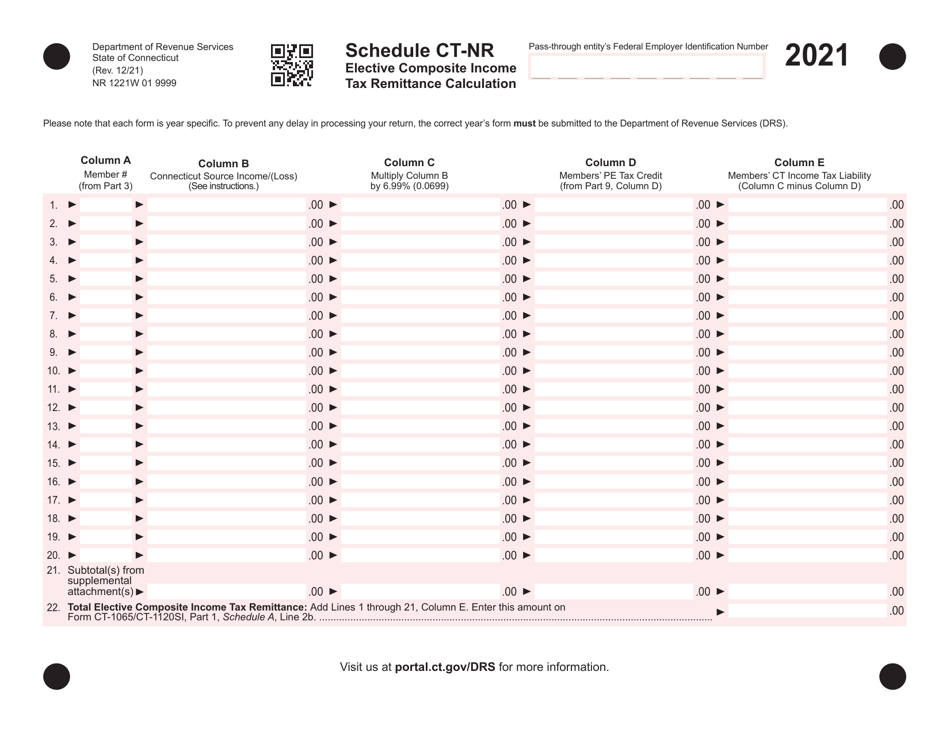

Schedule CT-NR

for the current year.

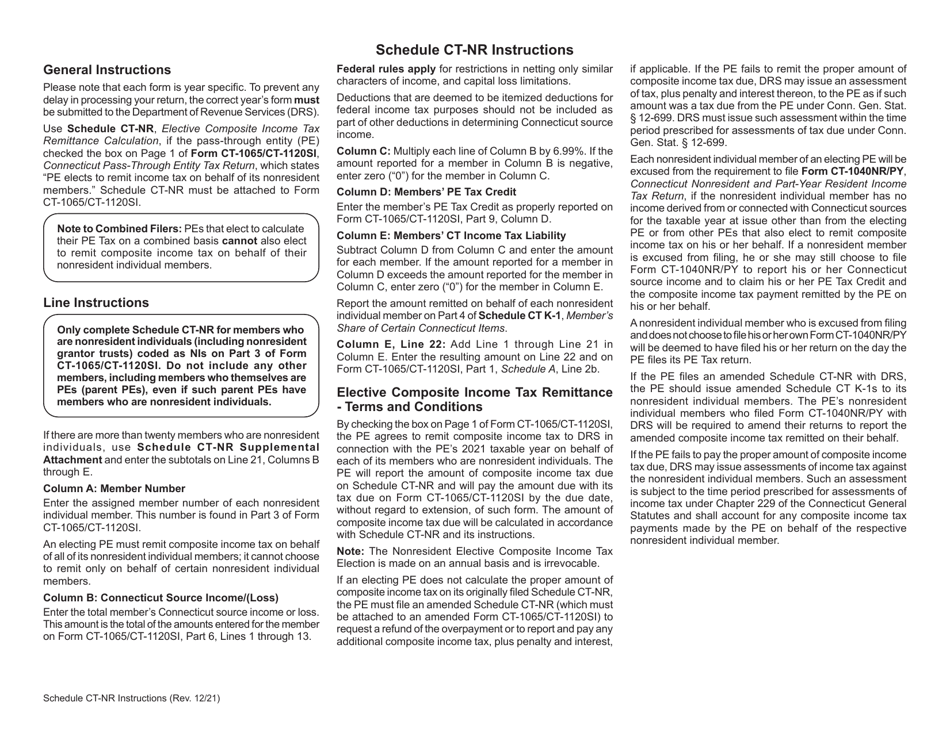

Schedule CT-NR Elective Composite Income Tax Remittance Calculation - Connecticut

What Is Schedule CT-NR?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

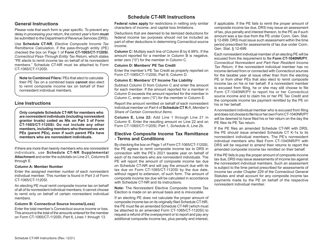

Q: What is a CT-NR Elective Composite Income Tax Remittance Calculation?

A: CT-NR Elective Composite Income Tax Remittance Calculation is a method used in Connecticut to calculate and remit the state income tax for non-resident individuals who elect to be taxed under the composite return provisions.

Q: Who is required to do a CT-NR Elective Composite Income Tax Remittance Calculation?

A: Non-resident individuals who elect to be taxed under the composite return provisions in Connecticut are required to do a CT-NR Elective Composite Income Tax Remittance Calculation.

Q: How is the CT-NR Elective Composite Income Tax Remittance Calculation used?

A: The CT-NR Elective Composite Income Tax Remittance Calculation is used to determine the amount of income tax owed by the non-resident individuals who choose to be taxed under the composite return provisions.

Q: What is the purpose of the CT-NR Elective Composite Income Tax Remittance Calculation?

A: The CT-NR Elective Composite Income Tax Remittance Calculation is used to ensure that non-resident individuals who elect to be taxed under the composite return provisions properly calculate and remit their state income tax in Connecticut.

Q: Are there any specific forms required for the CT-NR Elective Composite Income Tax Remittance Calculation?

A: Yes, non-resident individuals who elect to be taxed under the composite return provisions in Connecticut must complete and file Form CT-1040NR/PY and Form CT-NRPY, along with any additional required documentation.

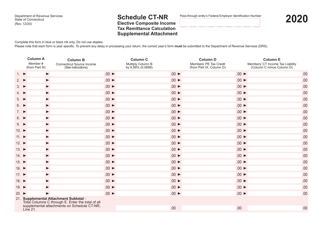

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule CT-NR by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.