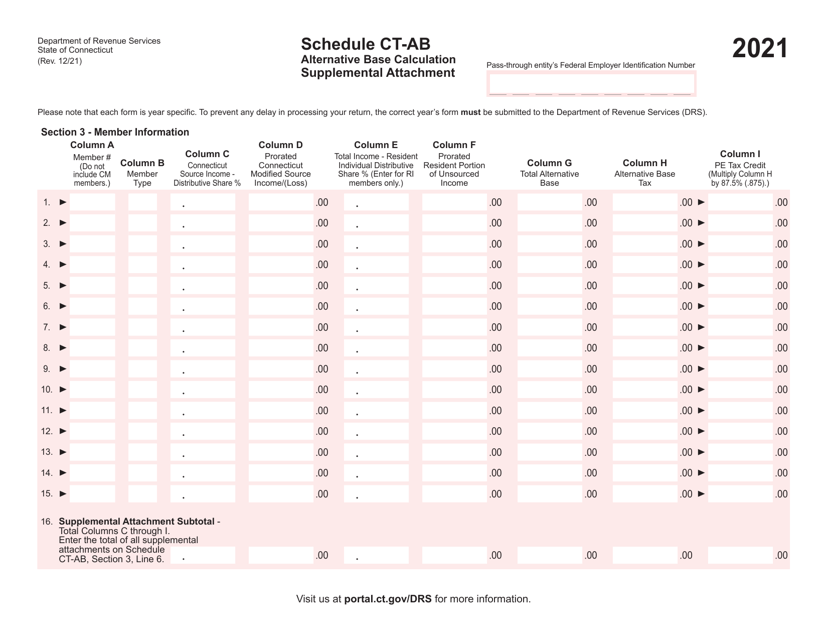

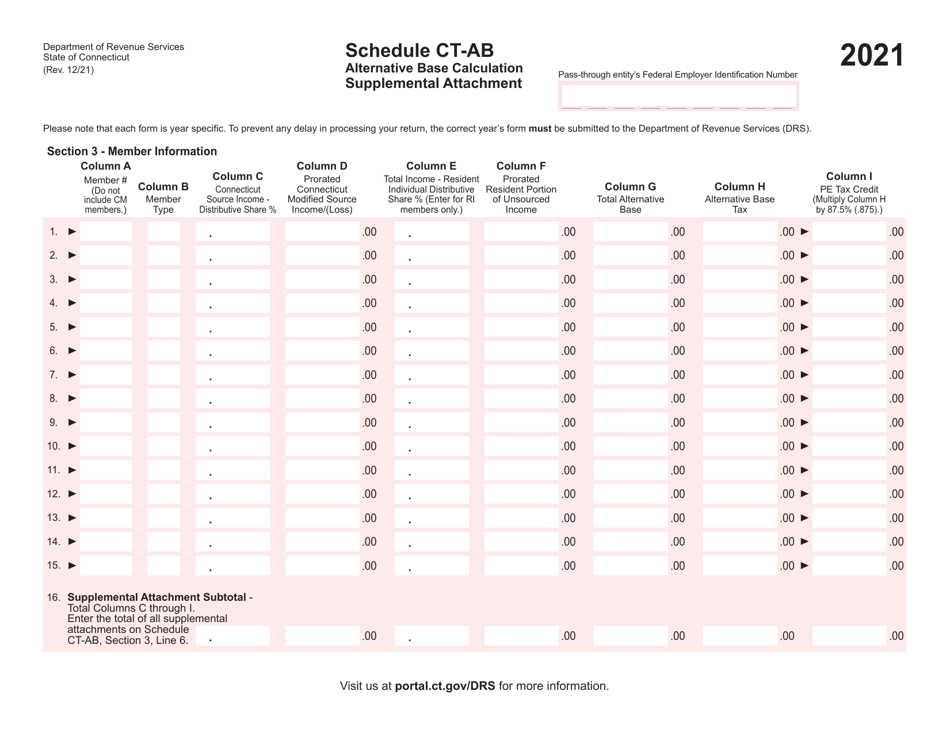

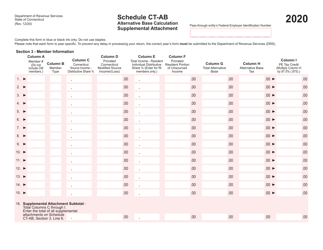

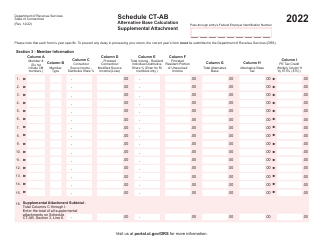

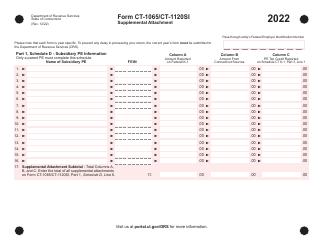

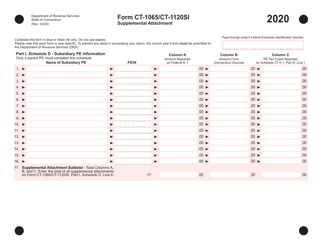

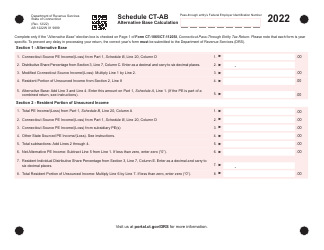

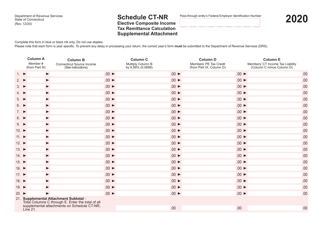

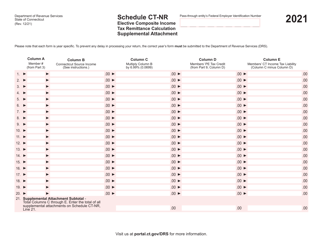

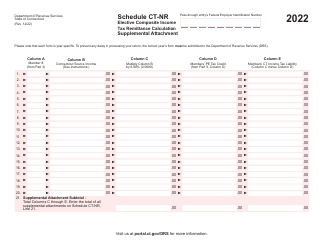

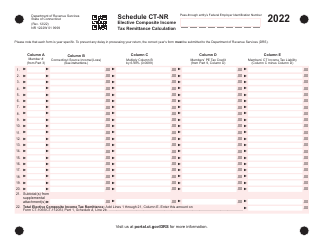

Schedule CT-AB Alternative Base Calculation Supplemental Attachment - Connecticut

What Is Schedule CT-AB?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the CT-AB Alternative Base Calculation Supplemental Attachment?

A: The CT-AB Alternative Base Calculation Supplemental Attachment is a schedule that helps calculate the alternative base for Connecticut taxes.

Q: What is the alternative base calculation?

A: The alternative base calculation is a method used to determine the taxable base for Connecticut taxes when the standard calculation method does not apply.

Q: When is the CT-AB Alternative Base Calculation Supplemental Attachment used?

A: The CT-AB Alternative Base Calculation Supplemental Attachment is used when the standard calculation method does not apply to determine the taxable base for Connecticut taxes.

Q: Who needs to file the CT-AB Alternative Base Calculation Supplemental Attachment?

A: Individuals or businesses who need to use the alternative base calculation method for Connecticut taxes.

Q: Do I need to submit any additional documentation with the CT-AB Alternative Base Calculation Supplemental Attachment?

A: You may need to submit supporting documentation depending on your specific situation. Check the instructions for the attachment for more information.

Q: Can I e-file the CT-AB Alternative Base Calculation Supplemental Attachment?

A: Yes, you can e-file the CT-AB Alternative Base Calculation Supplemental Attachment if you are filing your Connecticut taxes electronically.

Q: Are there any penalties for not filing the CT-AB Alternative Base Calculation Supplemental Attachment if required?

A: Failure to file the CT-AB Alternative Base Calculation Supplemental Attachment when required may result in penalties or interest charges.

Q: Is the CT-AB Alternative Base Calculation Supplemental Attachment only applicable to Connecticut taxes?

A: Yes, the CT-AB Alternative Base Calculation Supplemental Attachment is specific to calculating the alternative base for Connecticut taxes.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule CT-AB by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.