This version of the form is not currently in use and is provided for reference only. Download this version of

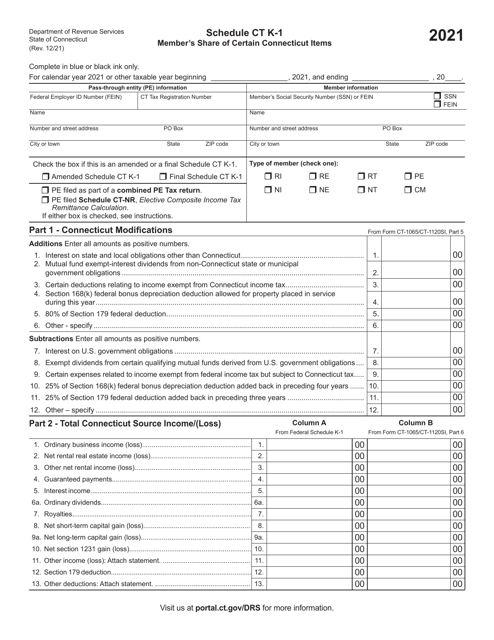

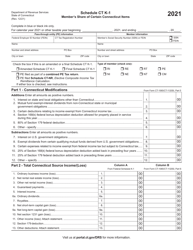

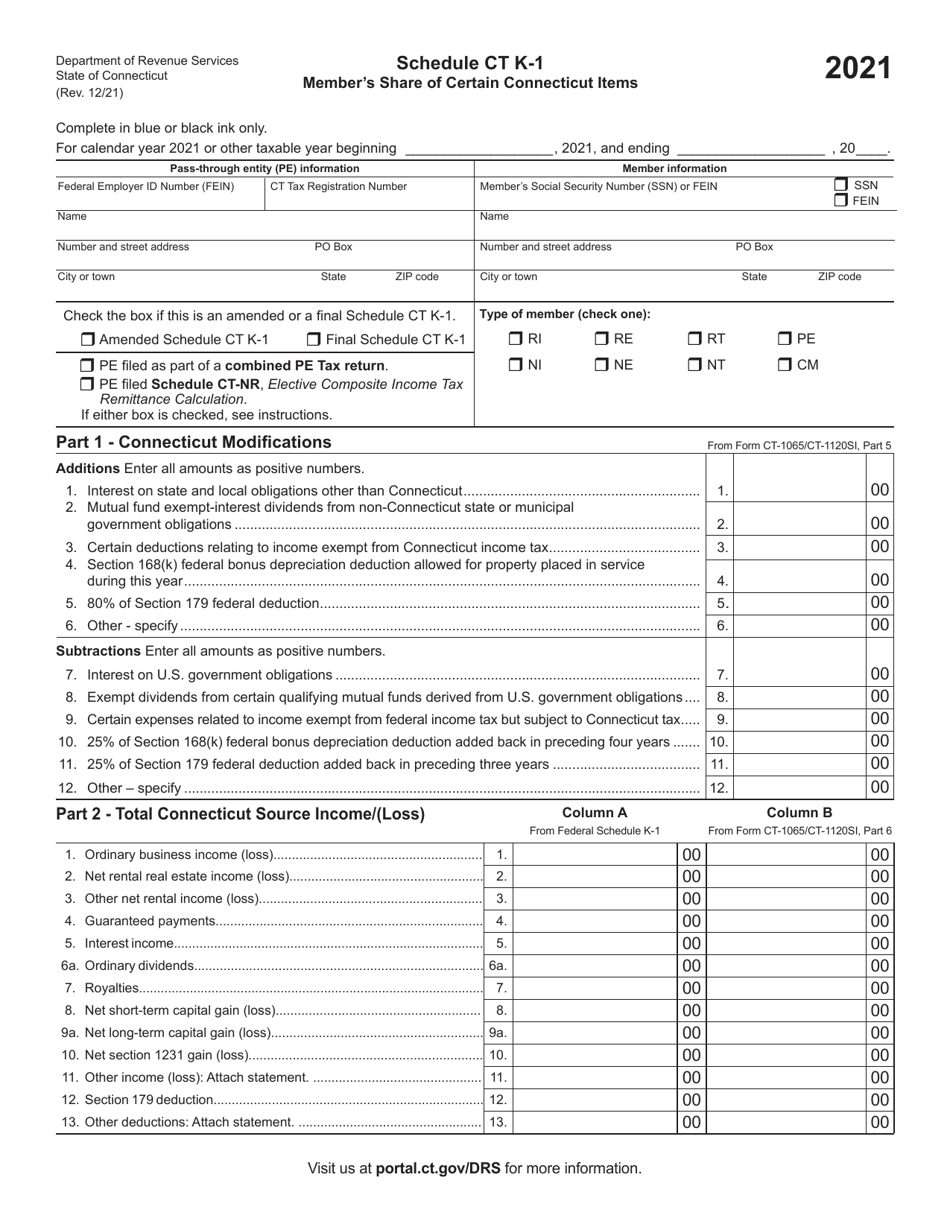

Schedule CT K-1

for the current year.

Schedule CT K-1 Member's Share of Certain Connecticut Items - Connecticut

What Is Schedule CT K-1?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

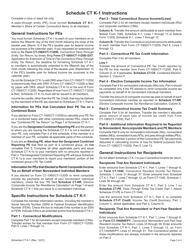

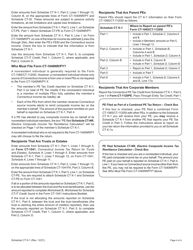

Q: What is a CT K-1?

A: A CT K-1 is a tax form that reports a individual's share of income, deductions, and credits from a pass-through entity in Connecticut.

Q: Who receives a CT K-1?

A: CT K-1s are typically received by individuals who are members of a Connecticut pass-through entity, such as a partnership or S corporation.

Q: What is a pass-through entity?

A: A pass-through entity is a business structure, such as a partnership or S corporation, where the profits and losses of the business are passed through to the individual owners.

Q: What does the CT K-1 report?

A: The CT K-1 reports the individual's share of income, deductions, and credits from the pass-through entity in Connecticut.

Q: Why is the CT K-1 important?

A: The CT K-1 is important because it determines the individual's Connecticut tax liability based on their share of income from the pass-through entity.

Q: Do I need to file the CT K-1 with my tax return?

A: The CT K-1 does not need to be filed with your tax return, but it should be kept for your records and may be requested by the Connecticut Department of Revenue Services.

Q: How do I report the information from the CT K-1 on my tax return?

A: The information from the CT K-1 should be reported on the appropriate lines of your Connecticut tax return, such as the Schedule CT K-1.

Q: Can I have multiple CT K-1s?

A: Yes, if you are a member of multiple pass-through entities in Connecticut, you may receive multiple CT K-1s.

Q: Are there any deadlines for filing the CT K-1?

A: The deadlines for filing the CT K-1 are determined by the pass-through entity and the Connecticut Department of Revenue Services. It is important to review the instructions provided with the CT K-1 to ensure you meet the deadlines.

Q: What if there is an error on my CT K-1?

A: If you believe there is an error on your CT K-1, you should contact the pass-through entity's tax advisor or the Connecticut Department of Revenue Services for assistance.

Q: What if I have additional questions about the CT K-1?

A: If you have additional questions about the CT K-1, you should contact the pass-through entity's tax advisor or the Connecticut Department of Revenue Services for further guidance.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule CT K-1 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.