This version of the form is not currently in use and is provided for reference only. Download this version of

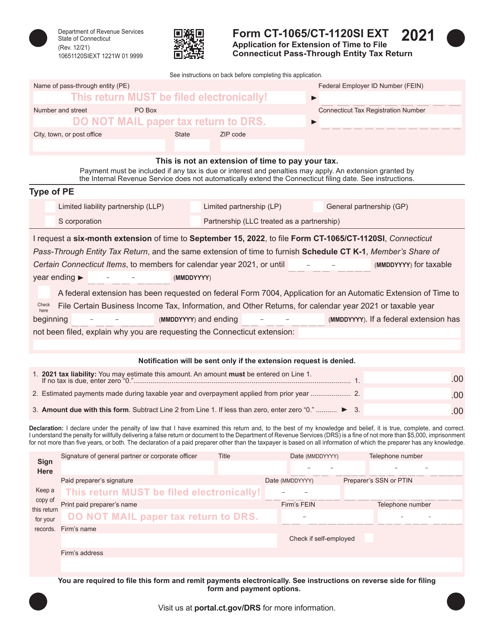

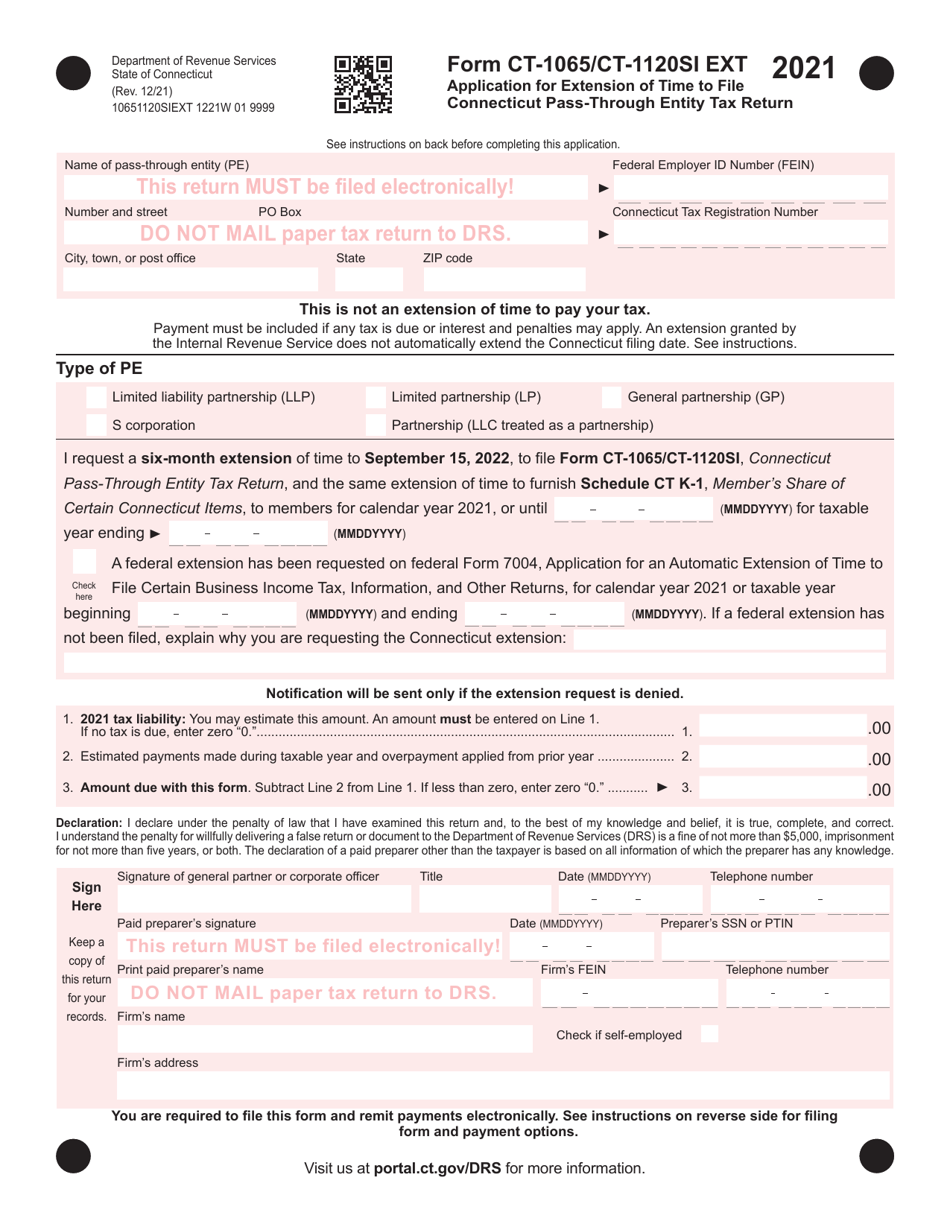

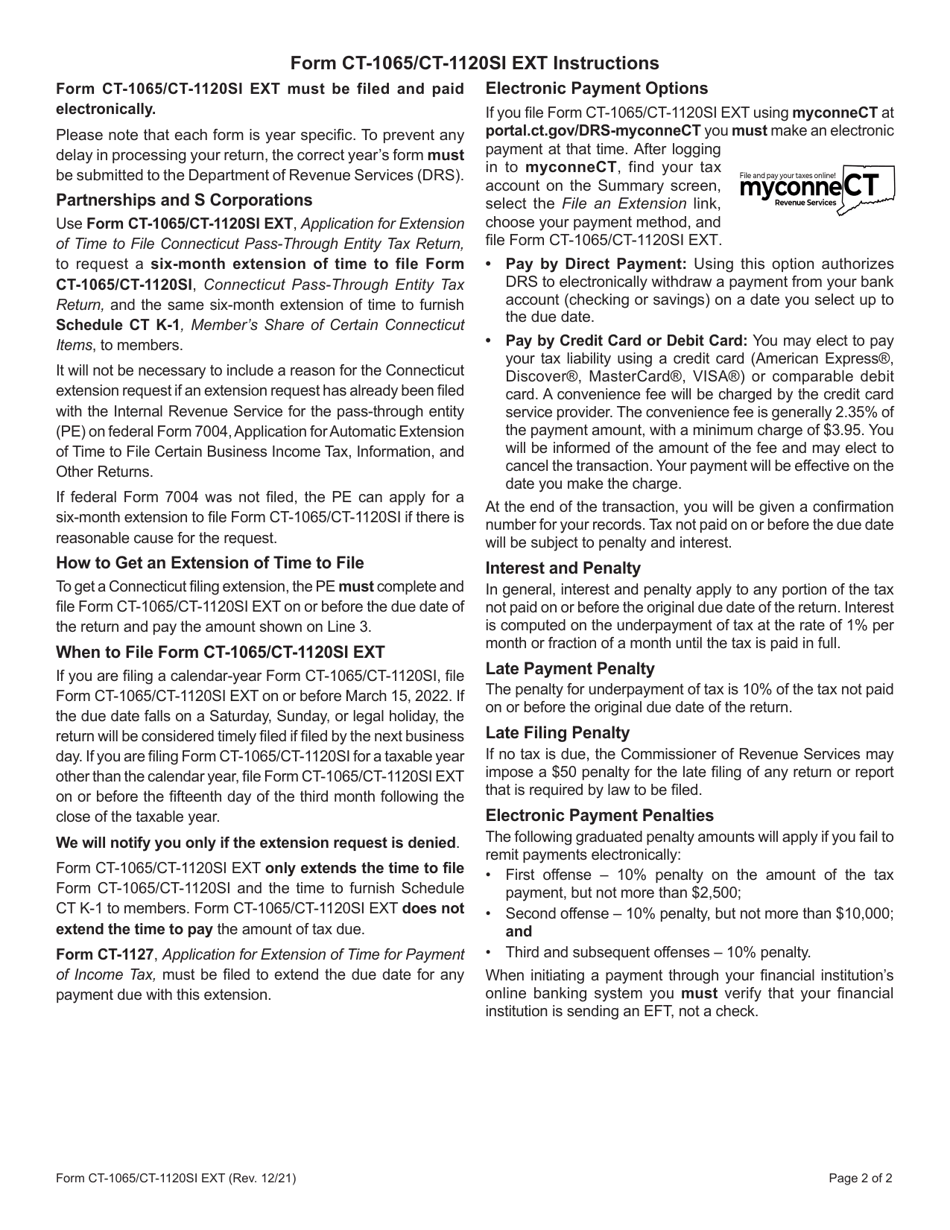

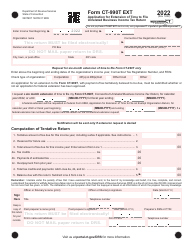

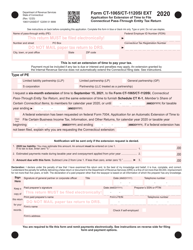

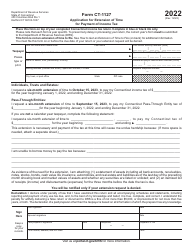

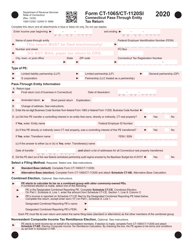

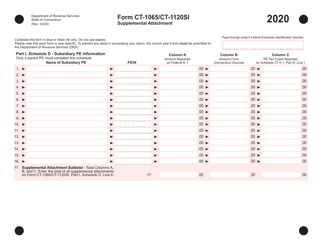

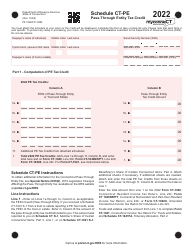

Form CT-1065 (CT-1120SI EXT)

for the current year.

Form CT-1065 (CT-1120SI EXT) Application for Extension of Time to File Connecticut Pass-Through Entity Tax Return - Connecticut

What Is Form CT-1065 (CT-1120SI EXT)?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-1065?

A: Form CT-1065 is an application for extension of time to file Connecticut Pass-Through Entity Tax Return.

Q: What is the purpose of Form CT-1120SI EXT?

A: Form CT-1120SI EXT is an application for extension of time to file Connecticut Pass-Through Entity Tax Return.

Q: Who should use Form CT-1065?

A: Form CT-1065 should be used by pass-through entities in Connecticut that need extra time to file their tax returns.

Q: Who should use Form CT-1120SI EXT?

A: Form CT-1120SI EXT should be used by pass-through entities in Connecticut that need extra time to file their tax returns.

Q: What is the Connecticut Pass-Through Entity Tax Return?

A: The Connecticut Pass-Through Entity Tax Return is a tax return filed by pass-through entities in Connecticut to report their income and calculate their tax liability.

Q: Can I use Form CT-1065 to file my personal income tax return?

A: No, Form CT-1065 is specifically for pass-through entities and cannot be used for personal income tax returns.

Q: Can I use Form CT-1120SI EXT to file my personal income tax return?

A: No, Form CT-1120SI EXT is specifically for pass-through entities and cannot be used for personal income tax returns.

Q: What is an extension of time to file?

A: An extension of time to file allows you to request additional time beyond the original due date to submit your tax return without incurring penalties for late filing.

Q: What is the due date for filing the Connecticut Pass-Through Entity Tax Return?

A: The due date for filing the Connecticut Pass-Through Entity Tax Return is the same as the federal income tax return due date, which is April 15th (or the next business day if April 15th falls on a weekend or holiday).

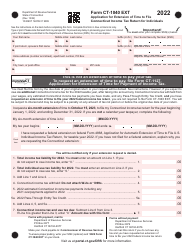

Q: How long is the extension of time granted by Form CT-1065 or Form CT-1120SI EXT?

A: Form CT-1065 and Form CT-1120SI EXT grant a 6-month extension of time to file, meaning the tax return must be submitted within 6 months after the original due date.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1065 (CT-1120SI EXT) by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.