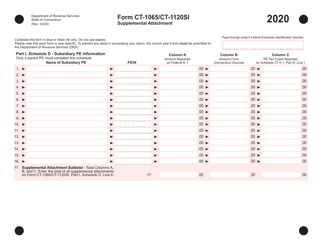

This version of the form is not currently in use and is provided for reference only. Download this version of

Form CT-1065 (CT-1120SI)

for the current year.

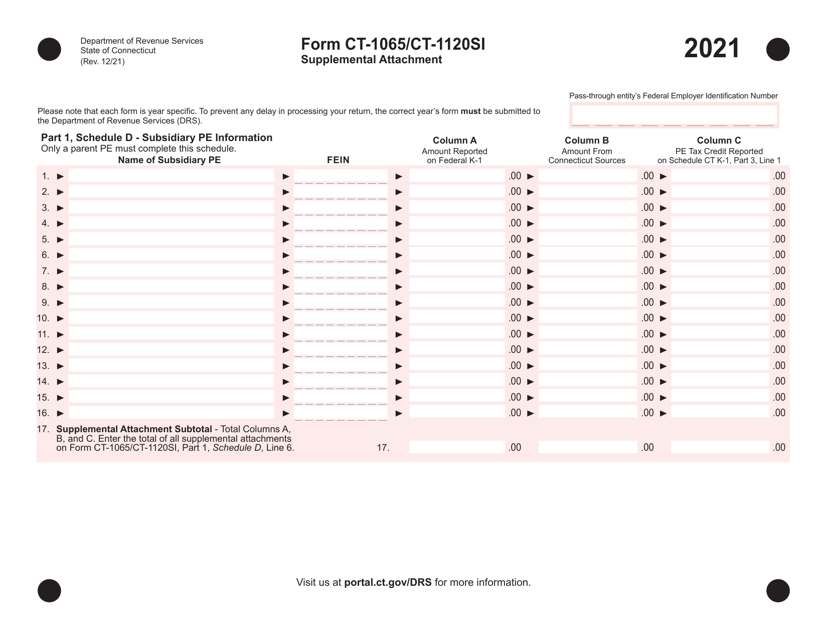

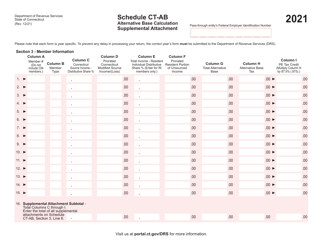

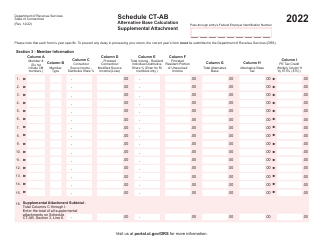

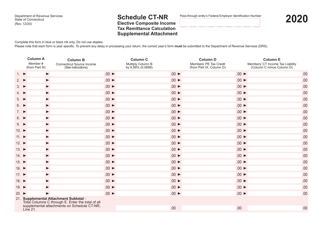

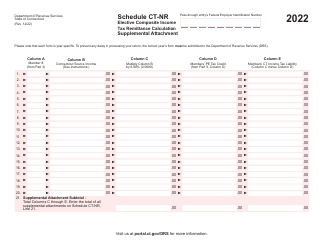

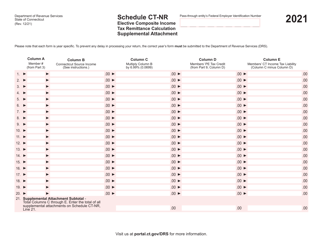

Form CT-1065 (CT-1120SI) Supplemental Attachment - Connecticut

What Is Form CT-1065 (CT-1120SI)?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-1065?

A: Form CT-1065 is the Connecticut Partnership Return of Income form.

Q: What is Form CT-1120SI?

A: Form CT-1120SI is the Connecticut Supplemental Income Tax form.

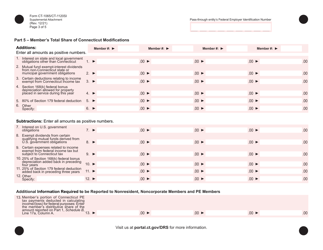

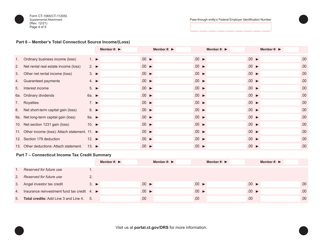

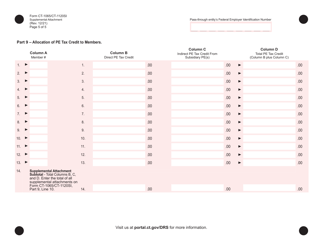

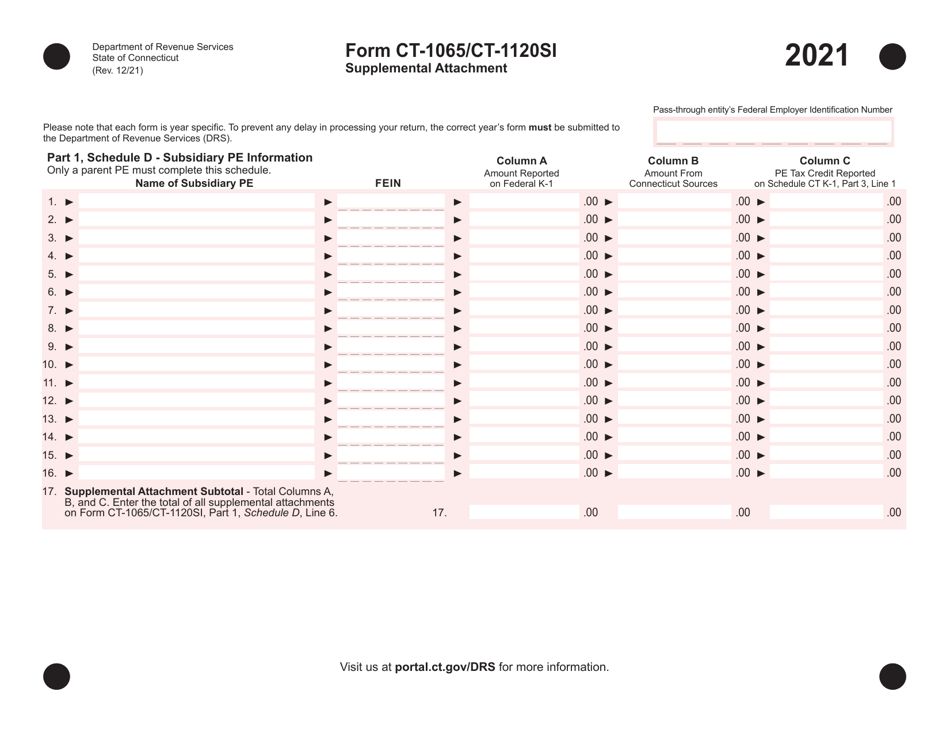

Q: What is the Supplemental Attachment?

A: The Supplemental Attachment is an additional form that must be attached to either Form CT-1065 or Form CT-1120SI, depending on the type of business entity.

Q: When is Form CT-1065 (CT-1120SI) due?

A: Form CT-1065 (CT-1120SI) is due on or before the 15th day of the fourth month following the close of the taxable year.

Q: Who needs to file Form CT-1065 (CT-1120SI) and the Supplemental Attachment?

A: Partnerships and S corporations that derive income from or have a nexus with Connecticut need to file Form CT-1065 and the Supplemental Attachment.

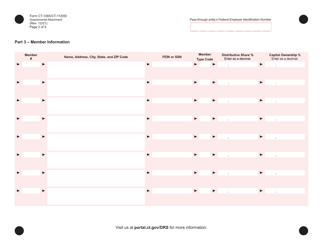

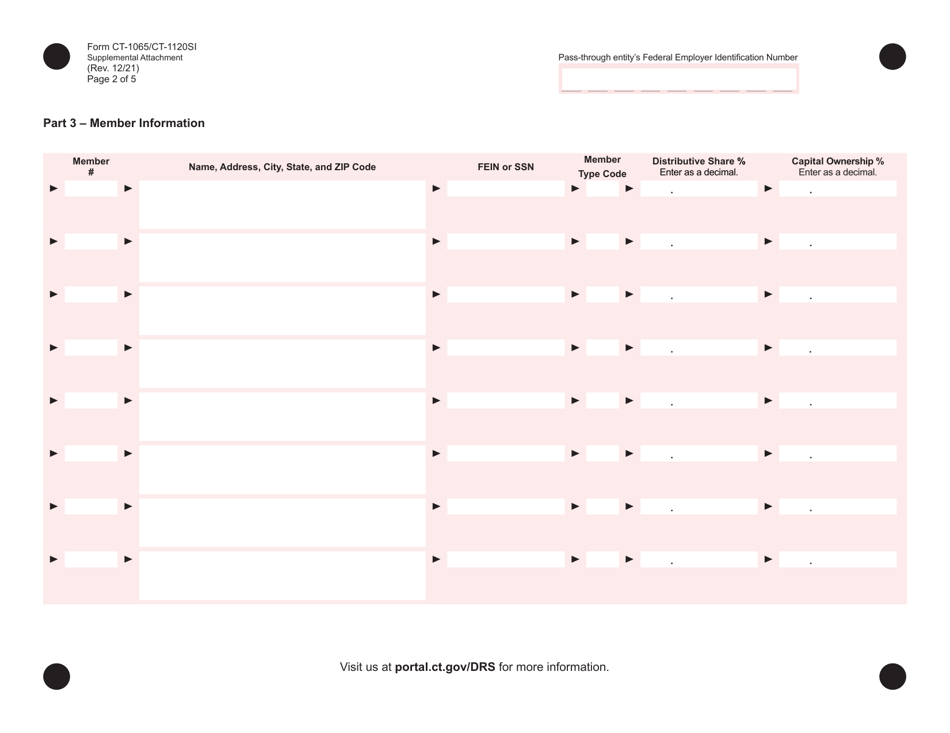

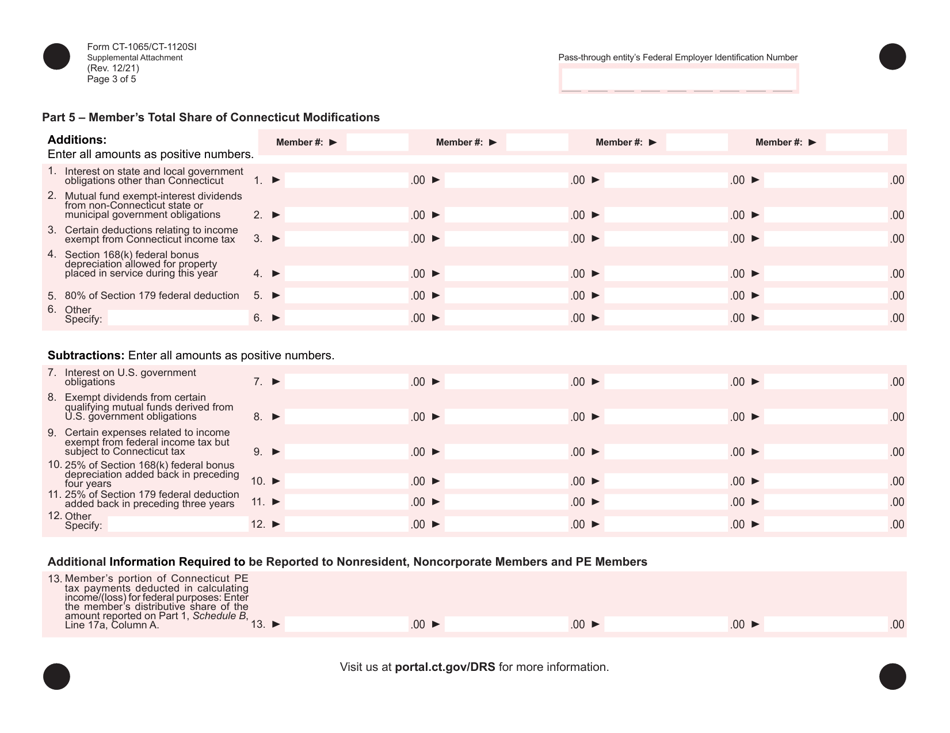

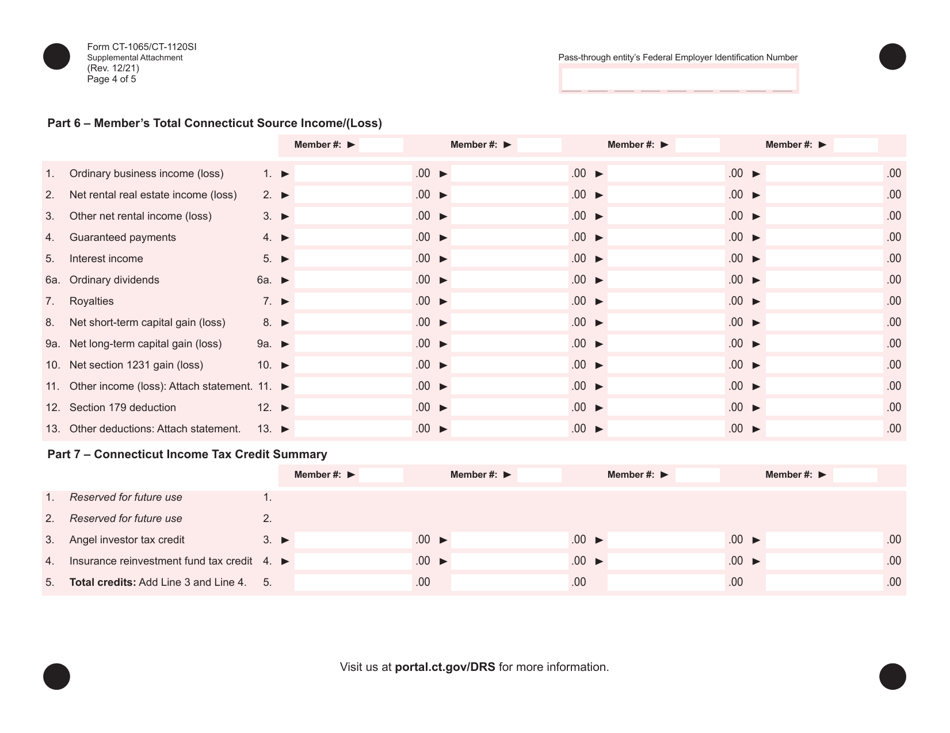

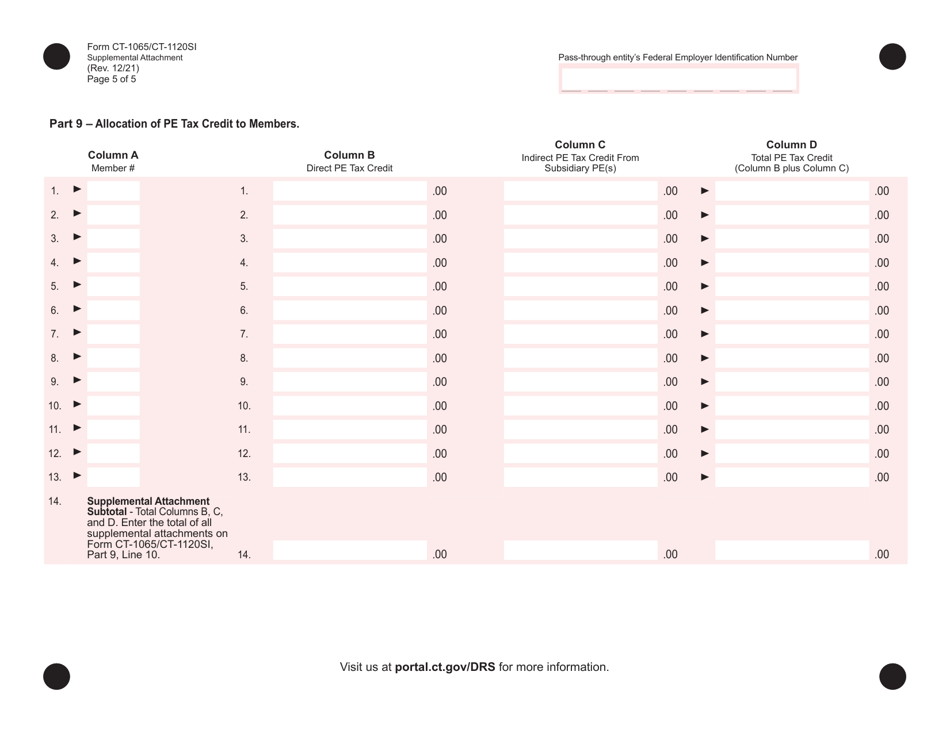

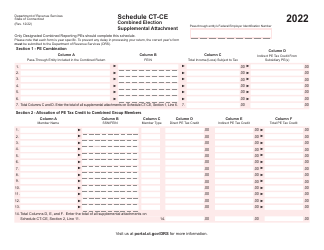

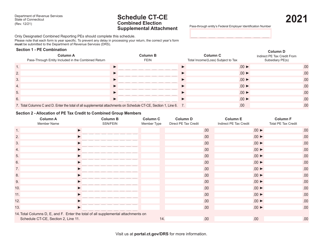

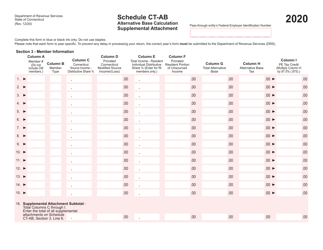

Q: What information is required on the Supplemental Attachment?

A: The Supplemental Attachment requires information such as the partnership or corporation's name, address, federal identification number, and details of the partnership or corporation's operations in Connecticut.

Q: Are there any penalties for failing to file Form CT-1065 (CT-1120SI) and the Supplemental Attachment?

A: Yes, there are penalties for late filing or failure to file Form CT-1065 (CT-1120SI) and the Supplemental Attachment. It is important to file the forms accurately and on time to avoid these penalties.

Q: Can I file Form CT-1065 (CT-1120SI) and the Supplemental Attachment electronically?

A: Yes, Connecticut allows electronic filing of Form CT-1065 (CT-1120SI) and the Supplemental Attachment. Electronic filing is convenient and can help ensure timely submission of the forms.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1065 (CT-1120SI) by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.