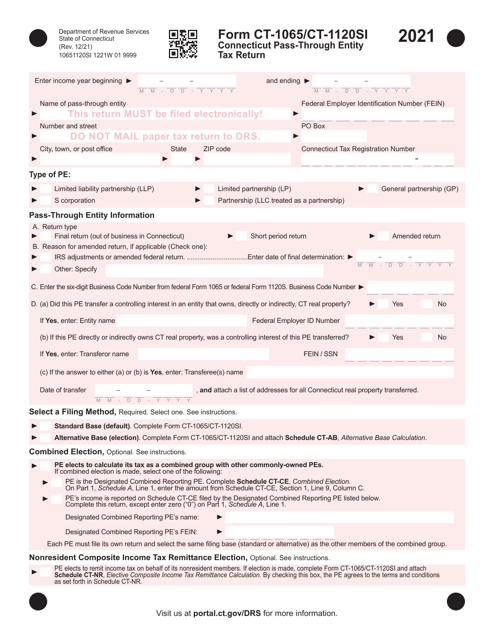

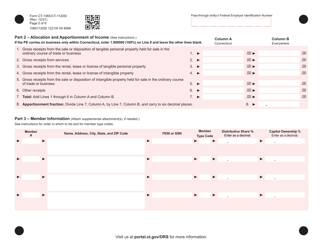

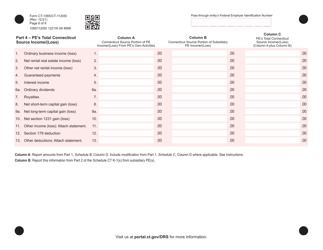

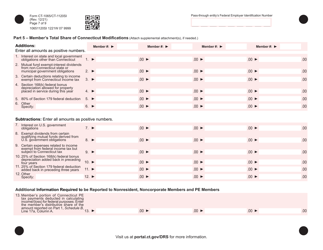

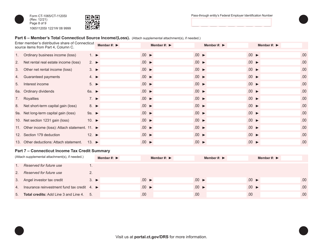

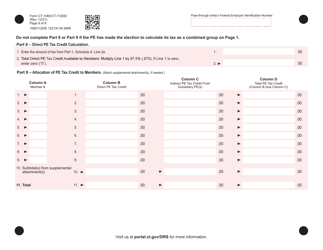

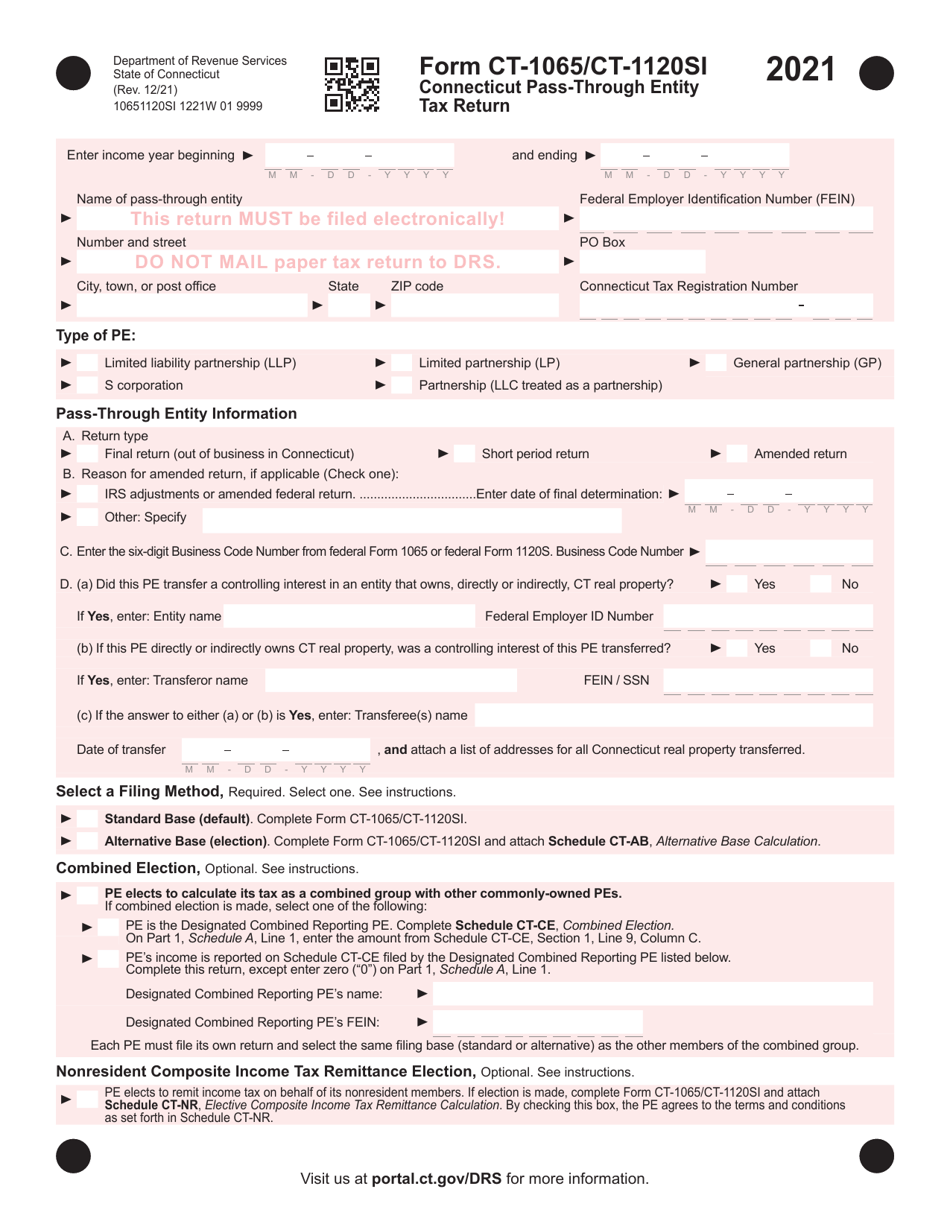

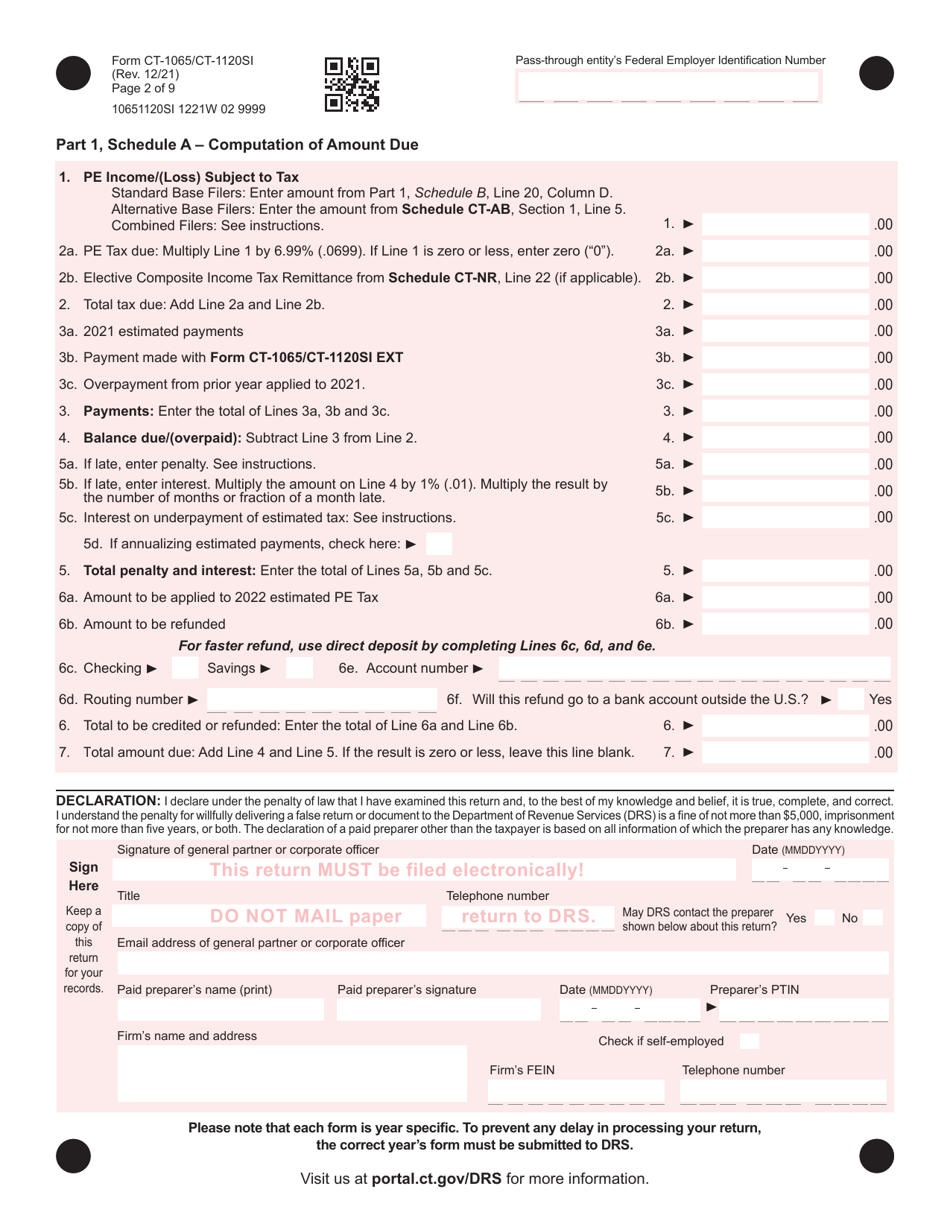

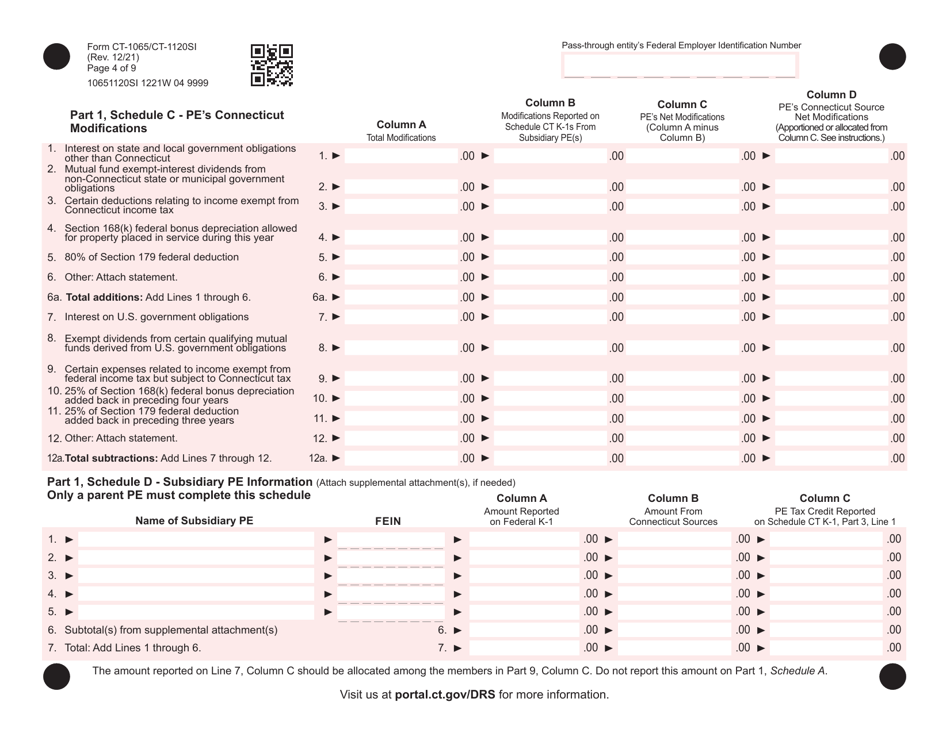

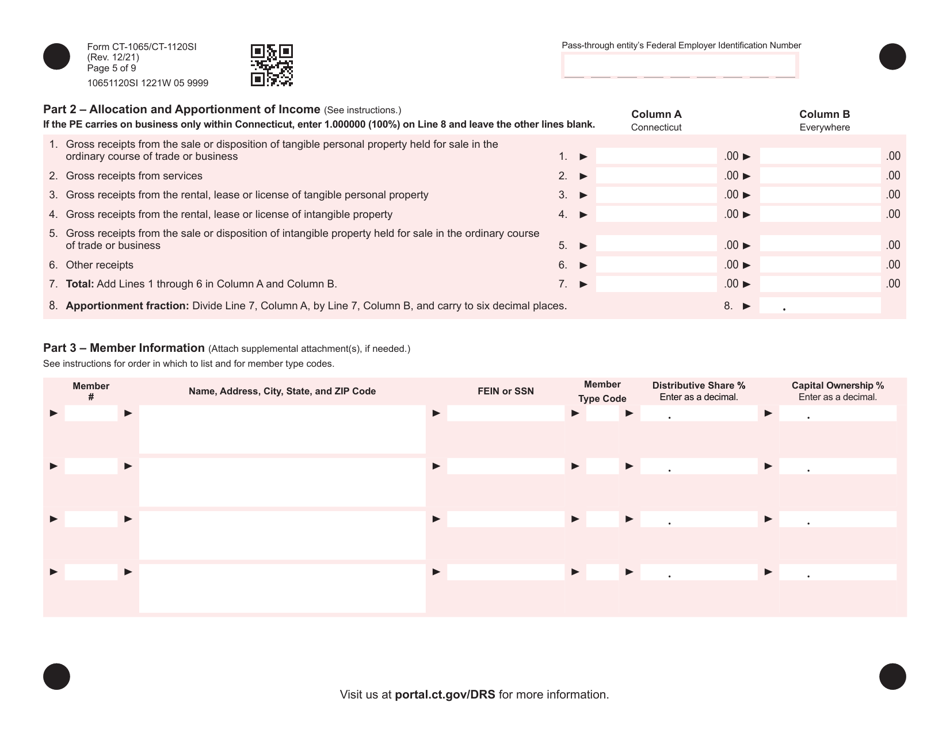

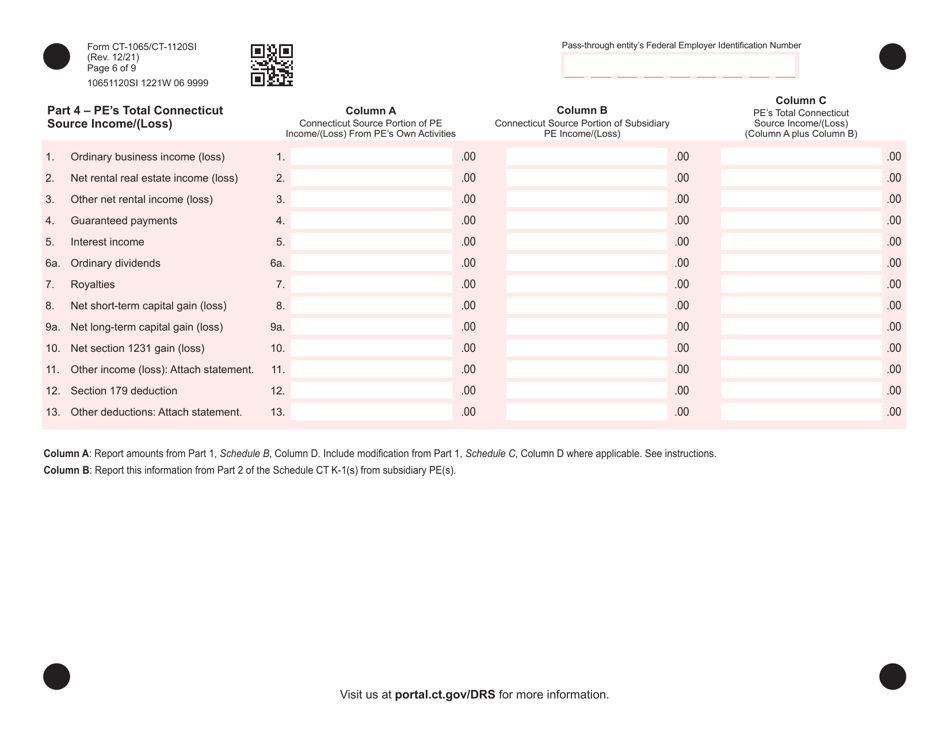

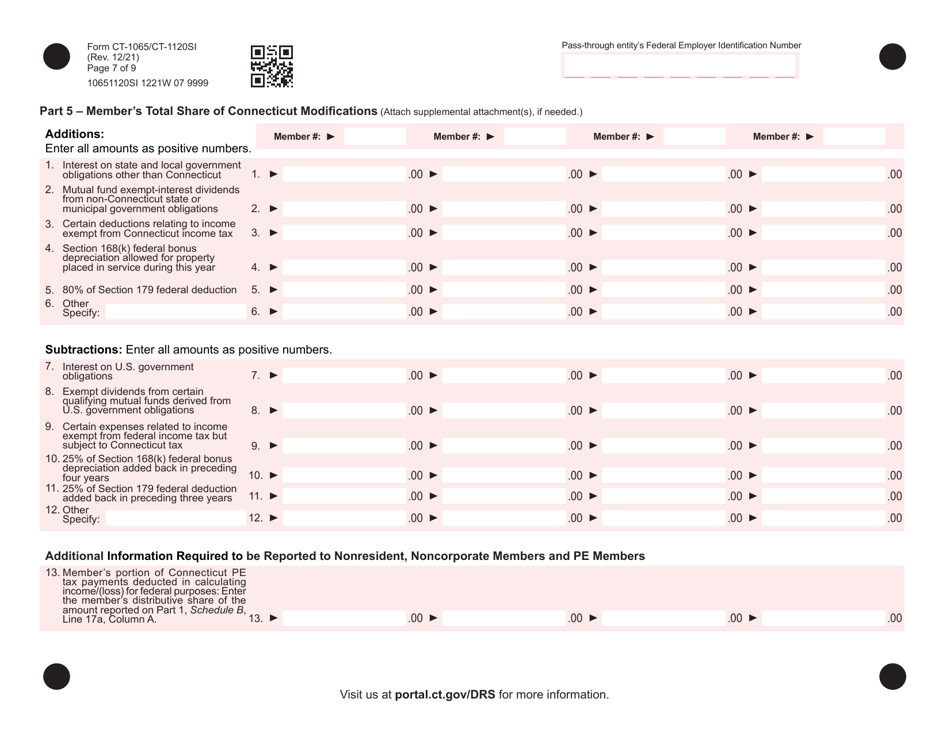

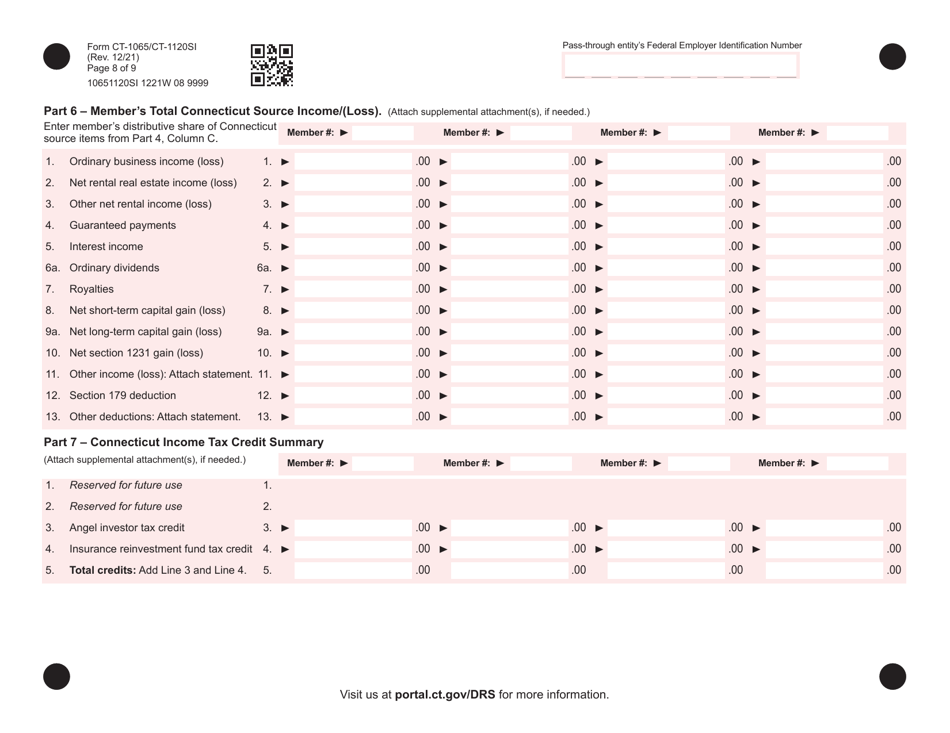

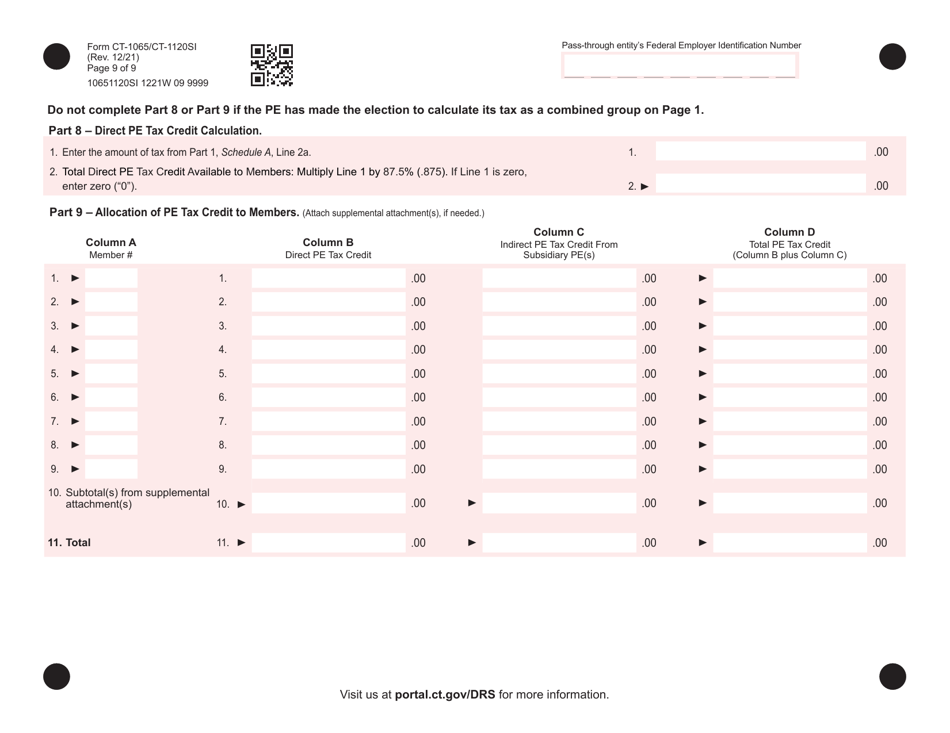

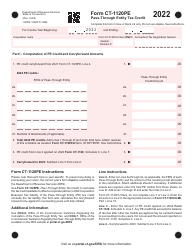

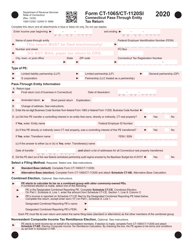

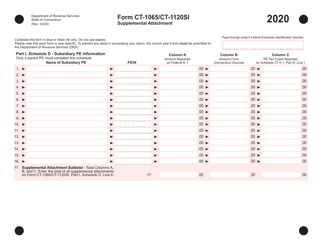

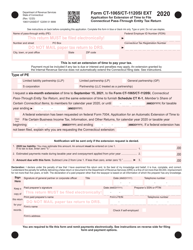

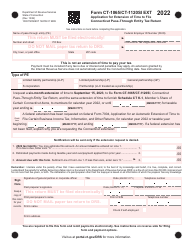

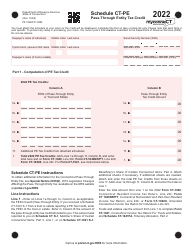

Form CT-1065 (CT-1120SI) Connecticut Pass-Through Entity Tax Return - Connecticut

What Is Form CT-1065 (CT-1120SI)?

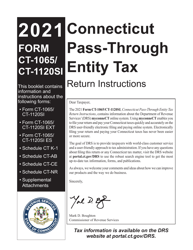

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-1065?

A: Form CT-1065 is the Connecticut Pass-Through Entity Tax Return.

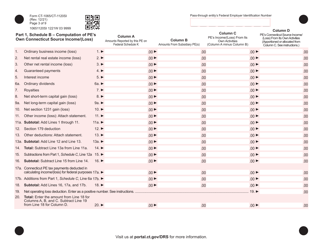

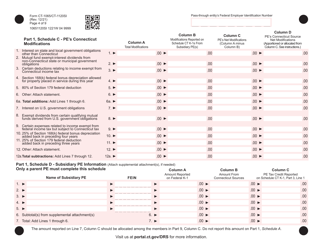

Q: What is the purpose of Form CT-1065?

A: The purpose of Form CT-1065 is to report the income, deductions, and credits of a Connecticut pass-through entity.

Q: Who needs to file Form CT-1065?

A: Connecticut pass-through entities, such as partnerships and S corporations, need to file Form CT-1065.

Q: What is the deadline for filing Form CT-1065?

A: Form CT-1065 is due on the 15th day of the third month following the close of the tax year.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1065 (CT-1120SI) by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.