This version of the form is not currently in use and is provided for reference only. Download this version of

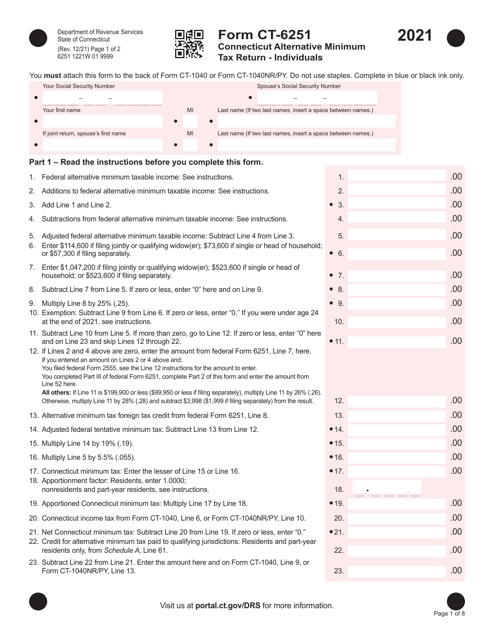

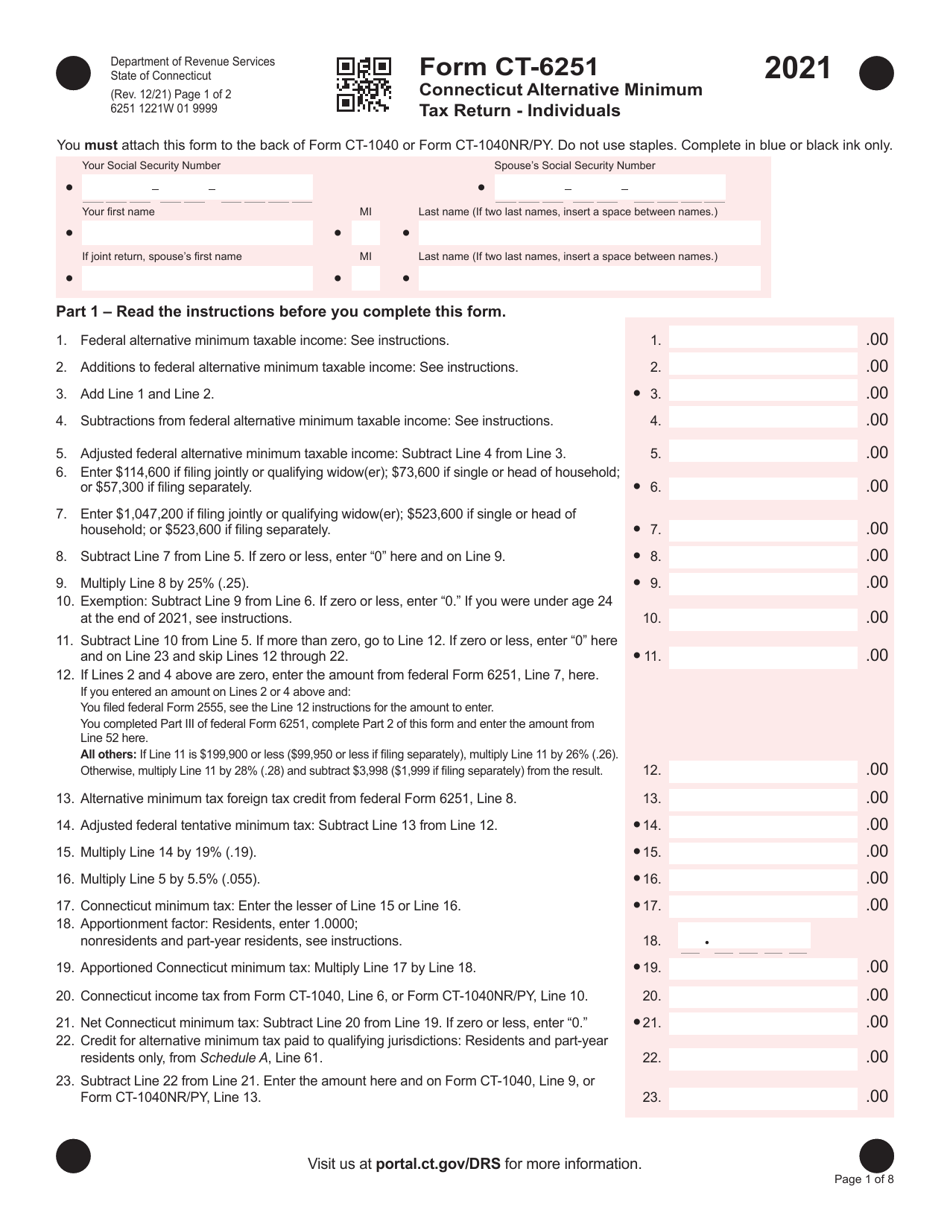

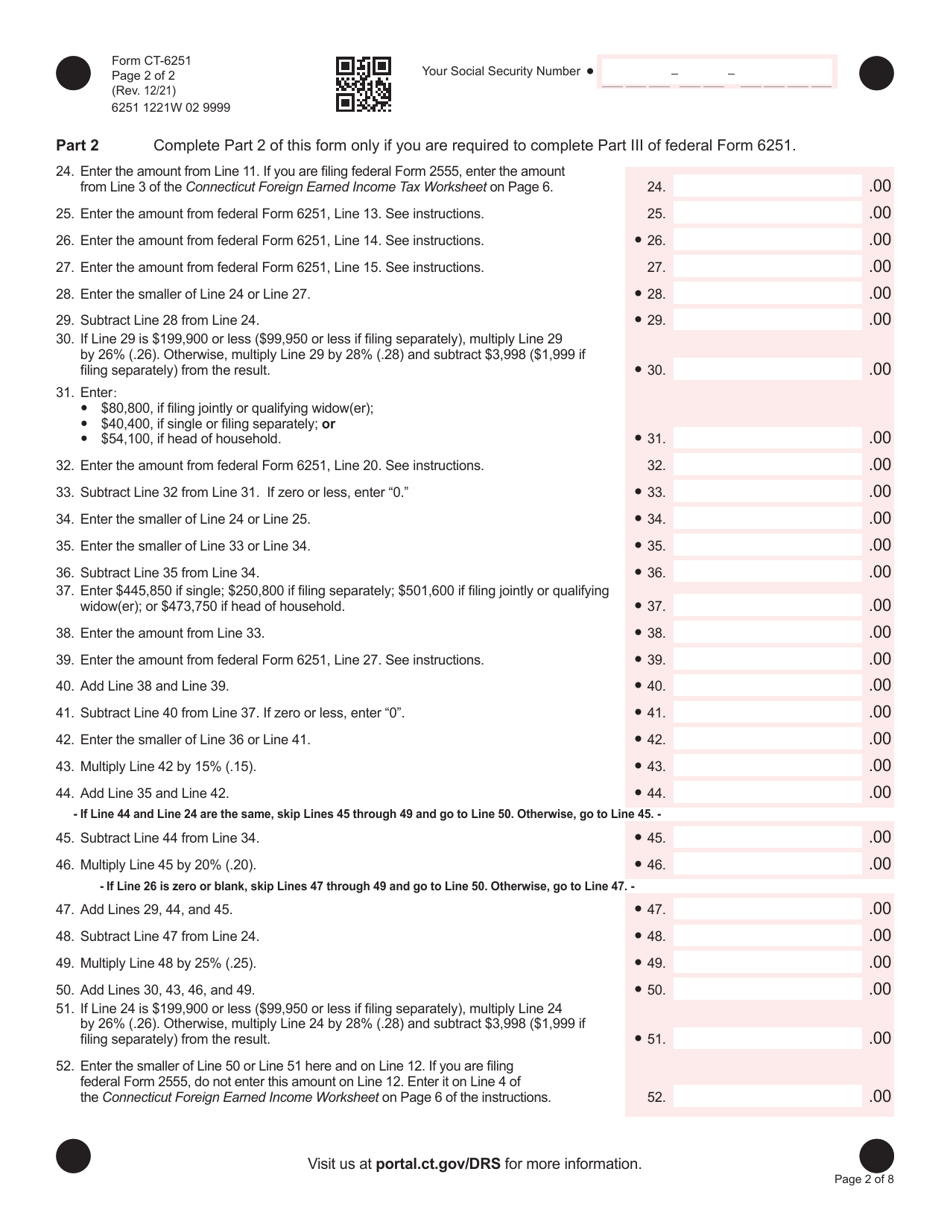

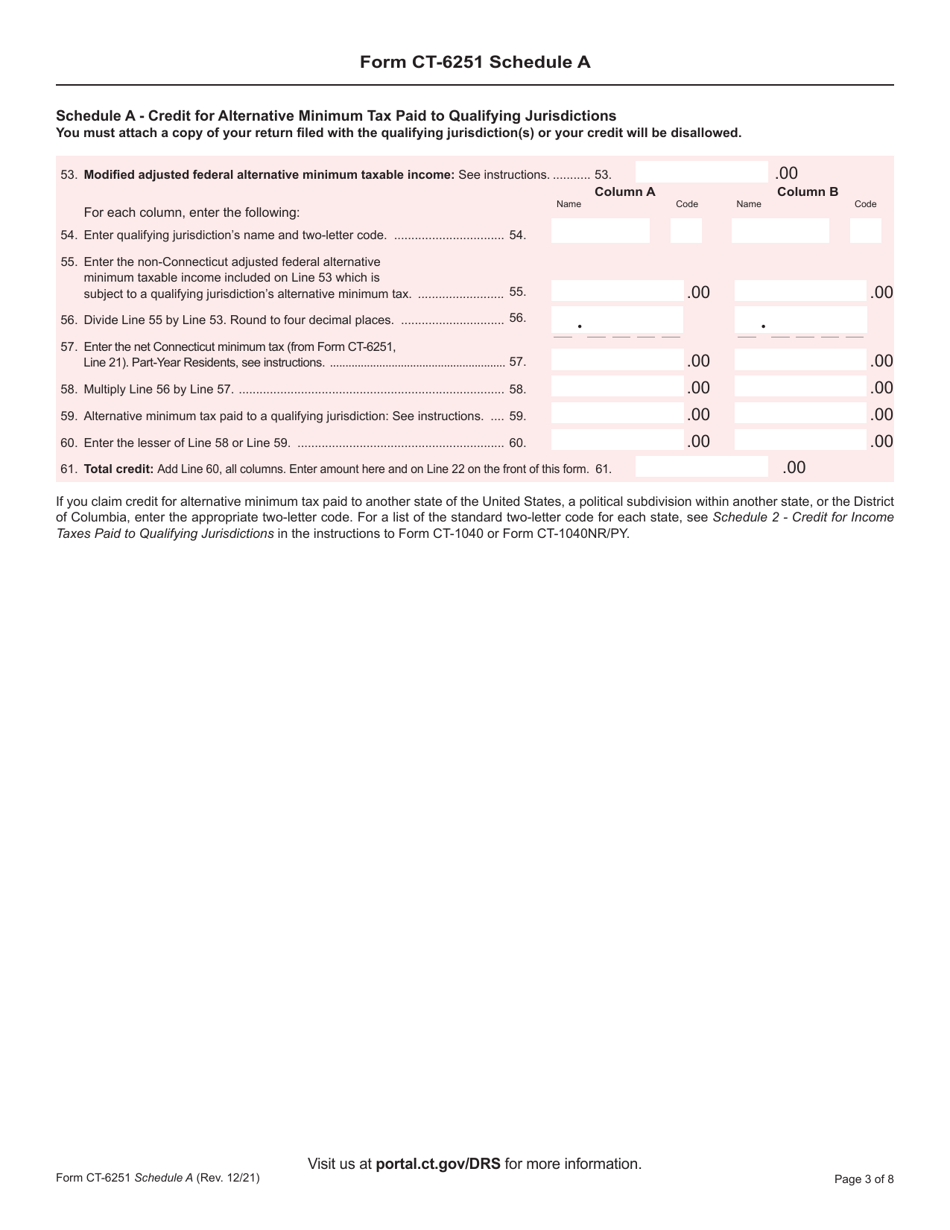

Form CT-6251

for the current year.

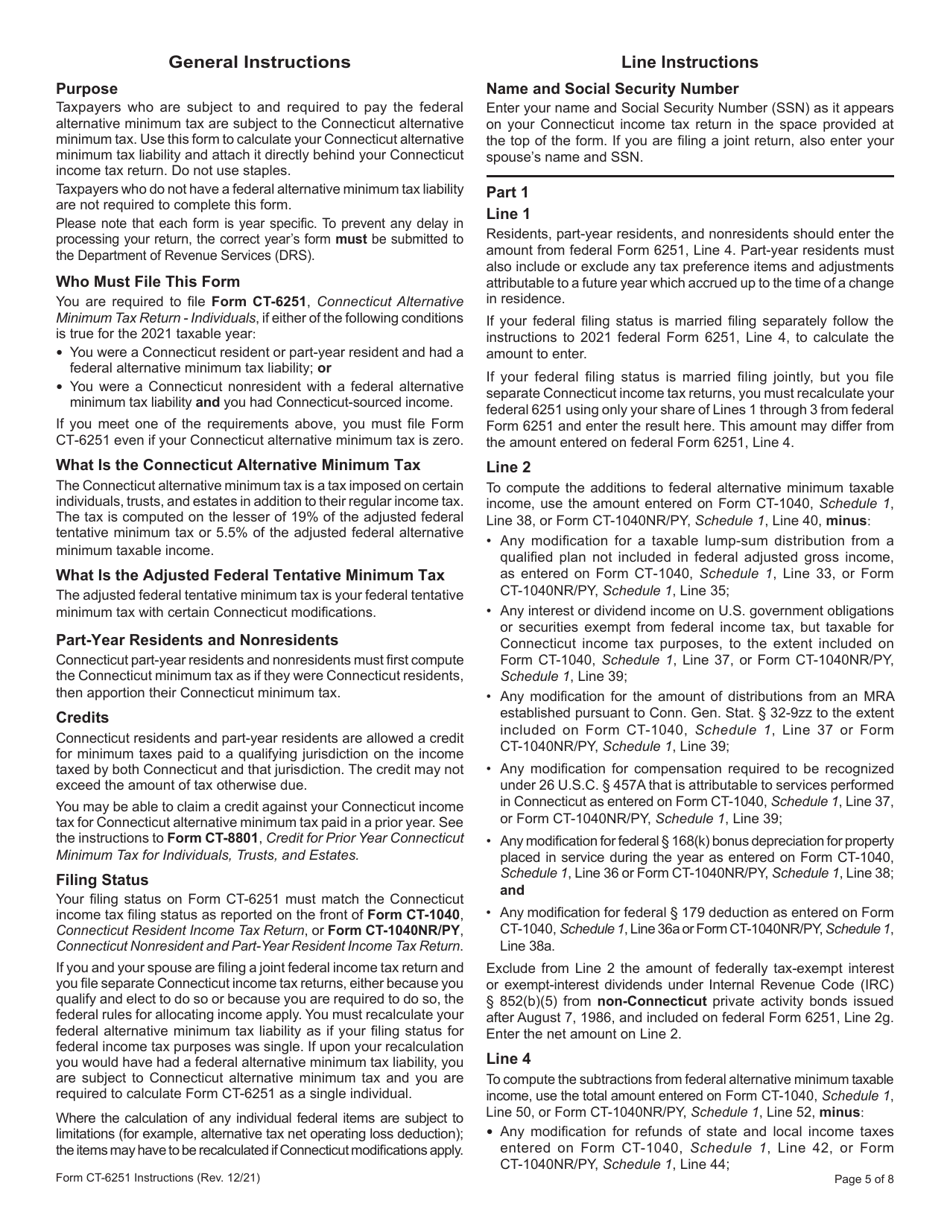

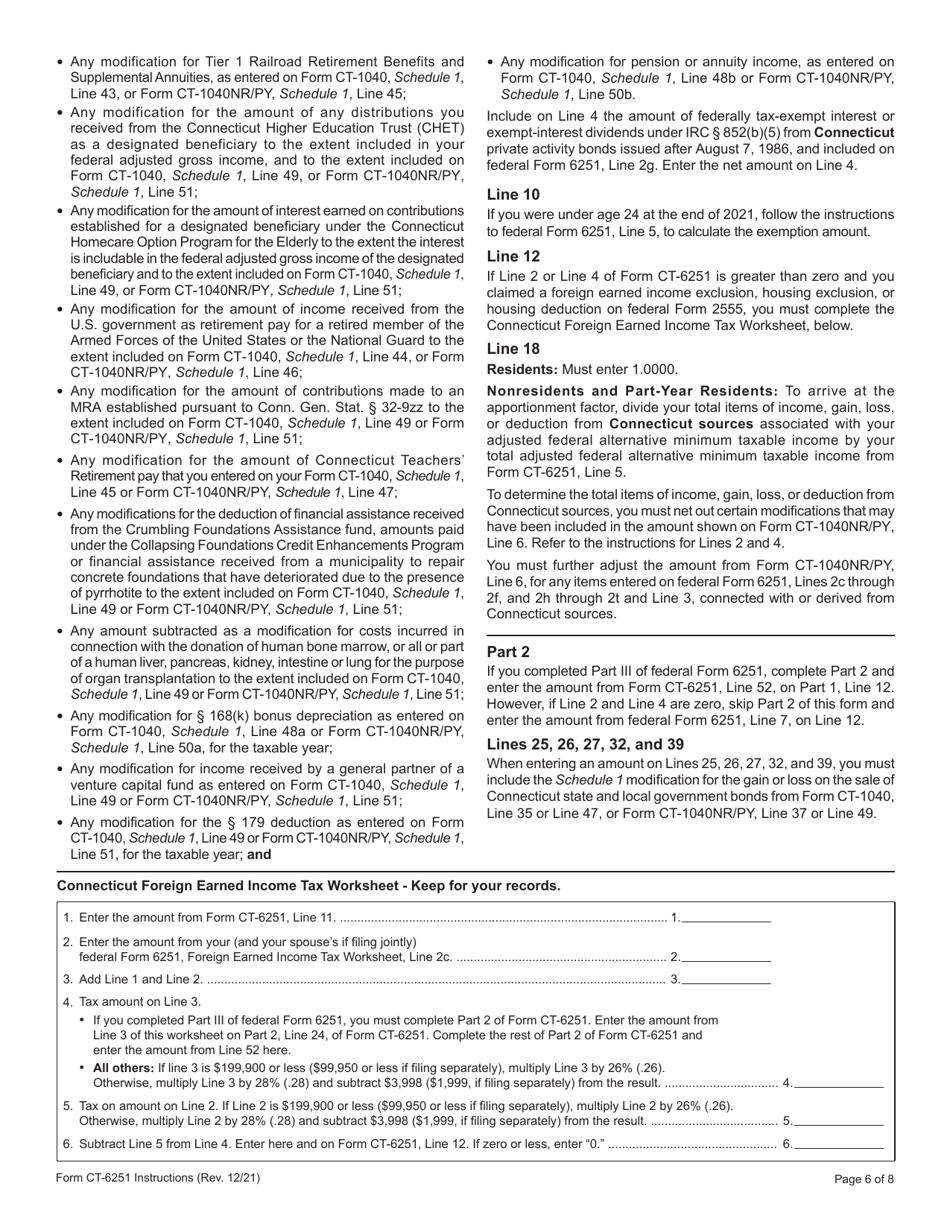

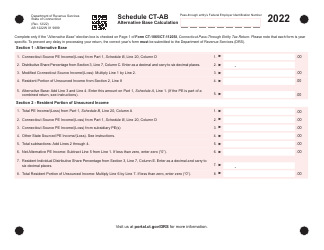

Form CT-6251 Connecticut Alternative Minimum Tax Return - Individuals - Connecticut

What Is Form CT-6251?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-6251?

A: Form CT-6251 is the Connecticut Alternative Minimum Tax Return for individuals.

Q: Who needs to file Form CT-6251?

A: Individuals who are subject to the Connecticut Alternative Minimum Tax (AMT) need to file Form CT-6251.

Q: What is the purpose of Form CT-6251?

A: The purpose of Form CT-6251 is to calculate and report the Connecticut Alternative Minimum Tax owed by individuals.

Q: What is the Connecticut Alternative Minimum Tax?

A: The Connecticut Alternative Minimum Tax is a separate tax calculation that limits certain tax deductions and credits in order to prevent taxpayers from avoiding their fair share of taxes.

Q: Is Form CT-6251 only for Connecticut residents?

A: No, Form CT-6251 is for both Connecticut residents and nonresidents who are subject to the Connecticut Alternative Minimum Tax.

Q: When is the deadline for filing Form CT-6251?

A: The deadline for filing Form CT-6251 is April 15th, or the same deadline as the federal income tax return, unless an extension has been granted.

Q: What should I do if I can't pay the Connecticut Alternative Minimum Tax?

A: If you are unable to pay the Connecticut Alternative Minimum Tax in full, you should still file Form CT-6251 and make a partial payment. You may be eligible for a payment plan or other options to resolve your outstanding tax liability.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-6251 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.