This version of the form is not currently in use and is provided for reference only. Download this version of

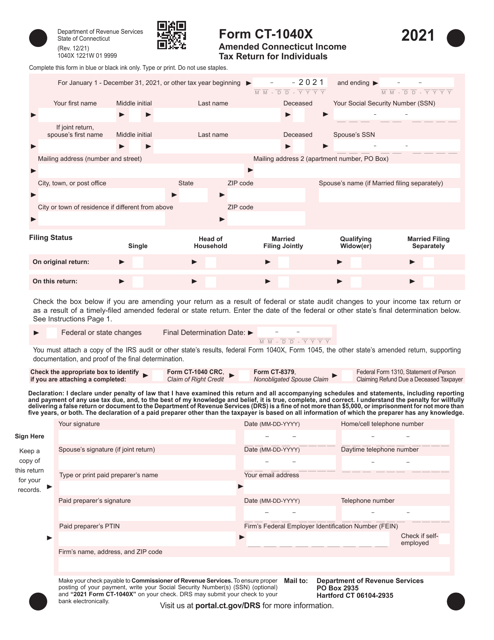

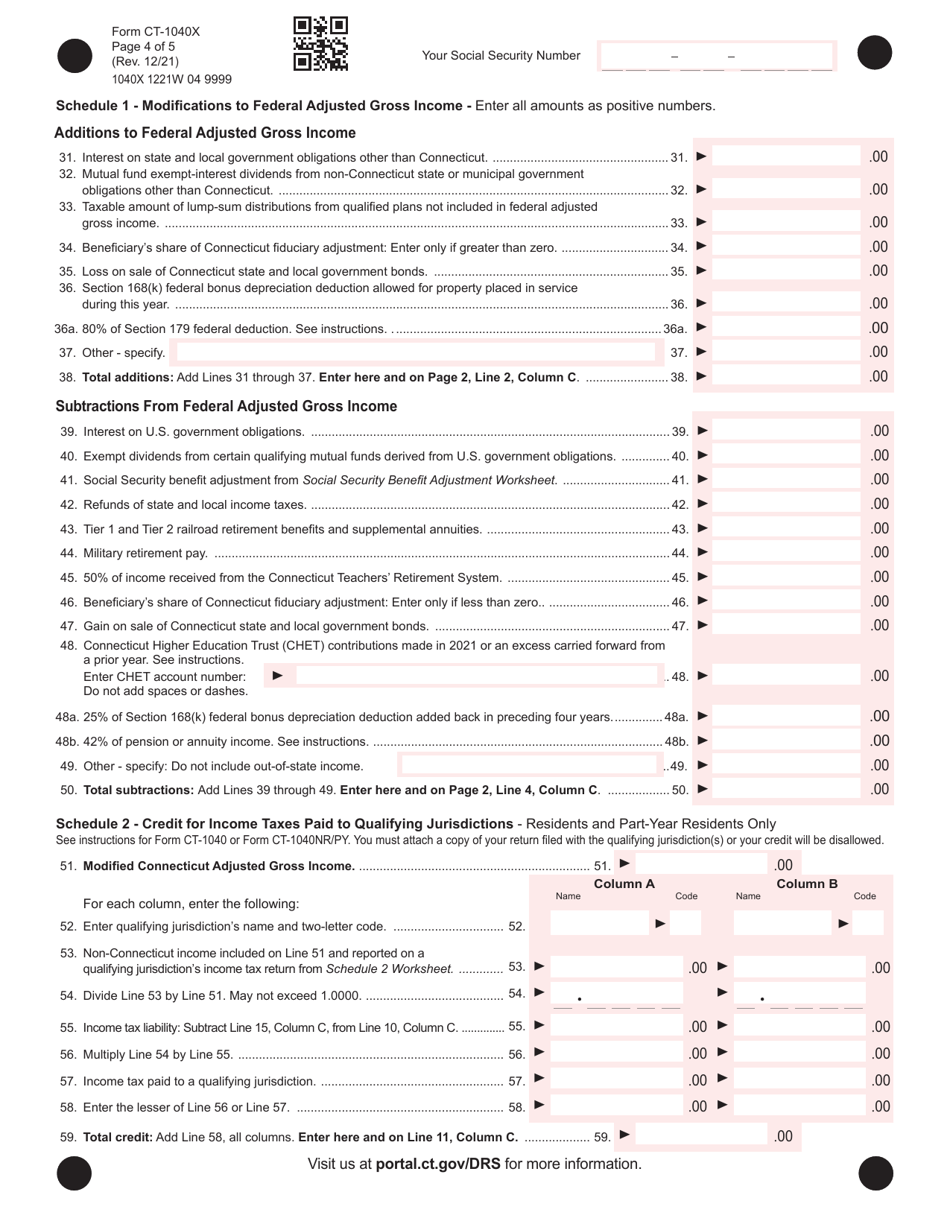

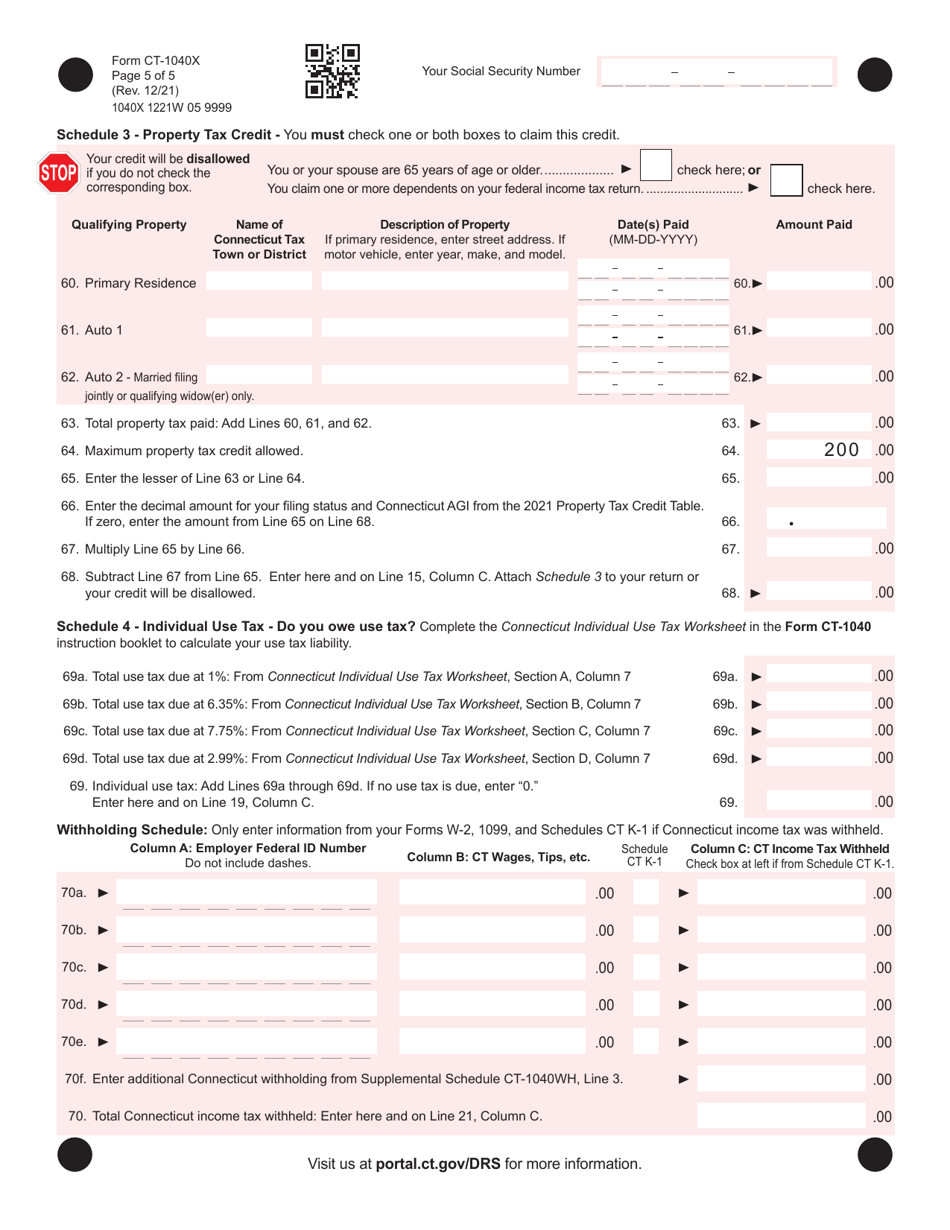

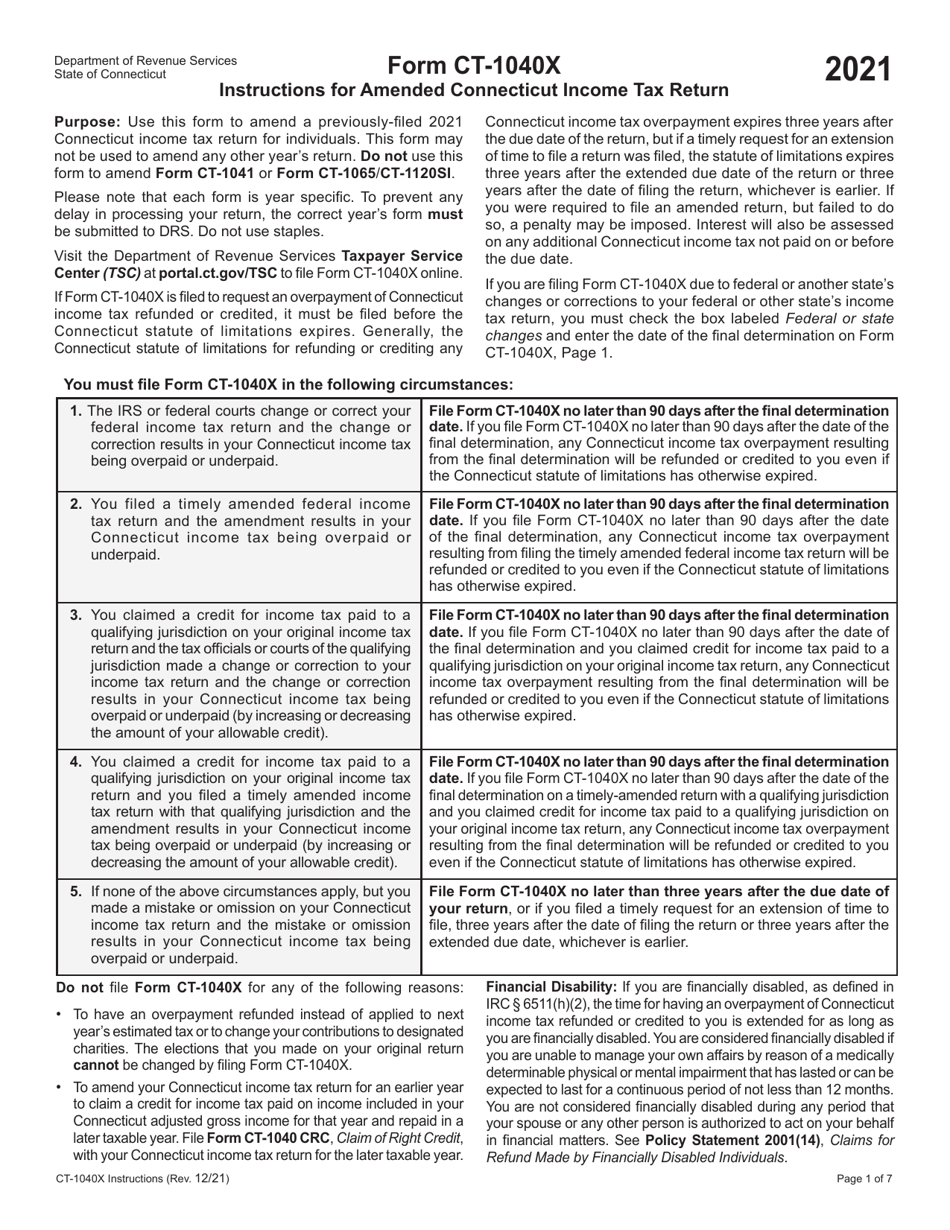

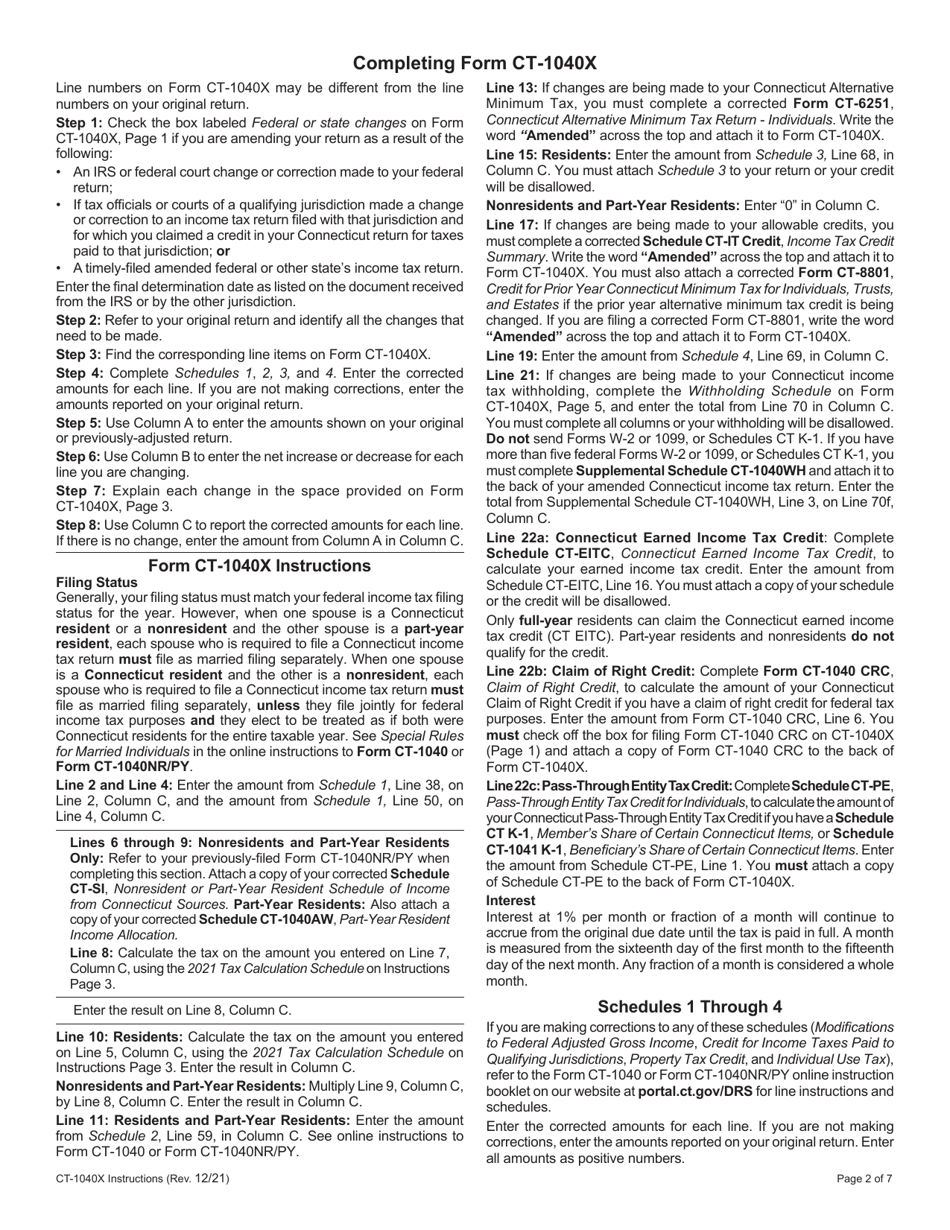

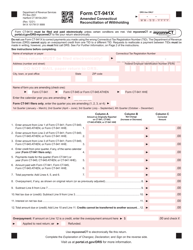

Form CT-1040X

for the current year.

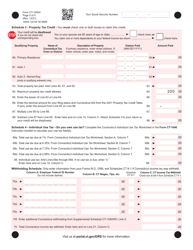

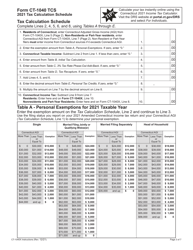

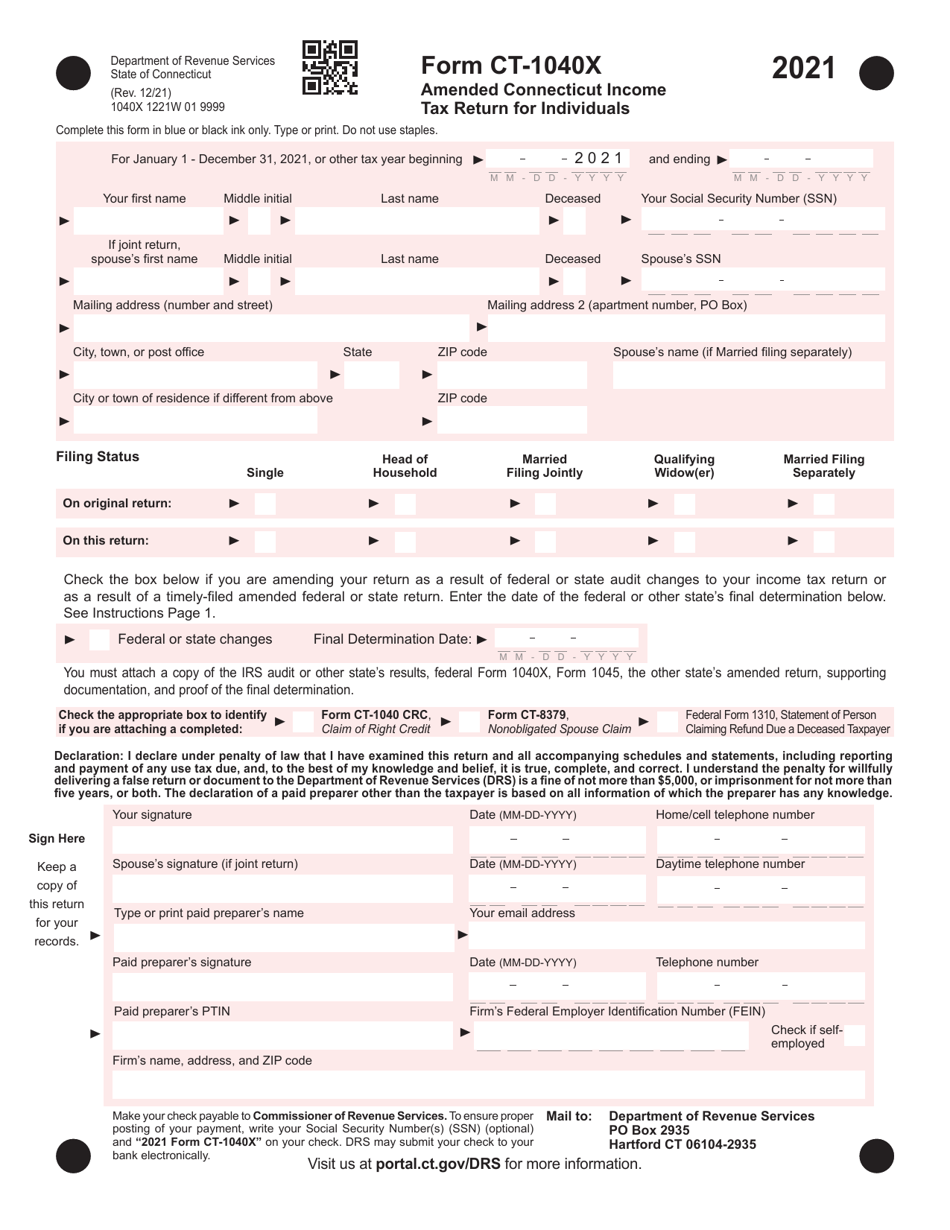

Form CT-1040X Amended Connecticut Income Tax Return for Individuals - Connecticut

What Is Form CT-1040X?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1040X?

A: Form CT-1040X is the amended Connecticut Income Tax Return for Individuals.

Q: Who should file Form CT-1040X?

A: Individuals who need to make changes or corrections to their previously filed Connecticut income tax return should file Form CT-1040X.

Q: Why would someone need to file Form CT-1040X?

A: Someone may need to file Form CT-1040X if they made an error on their original Connecticut income tax return, or if they need to report additional income, deductions, or credits.

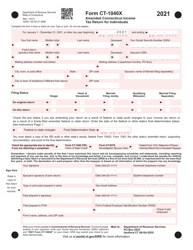

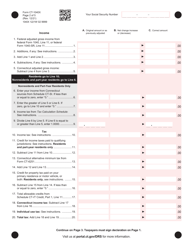

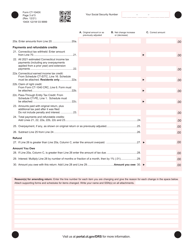

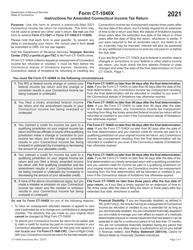

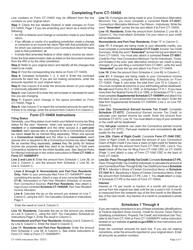

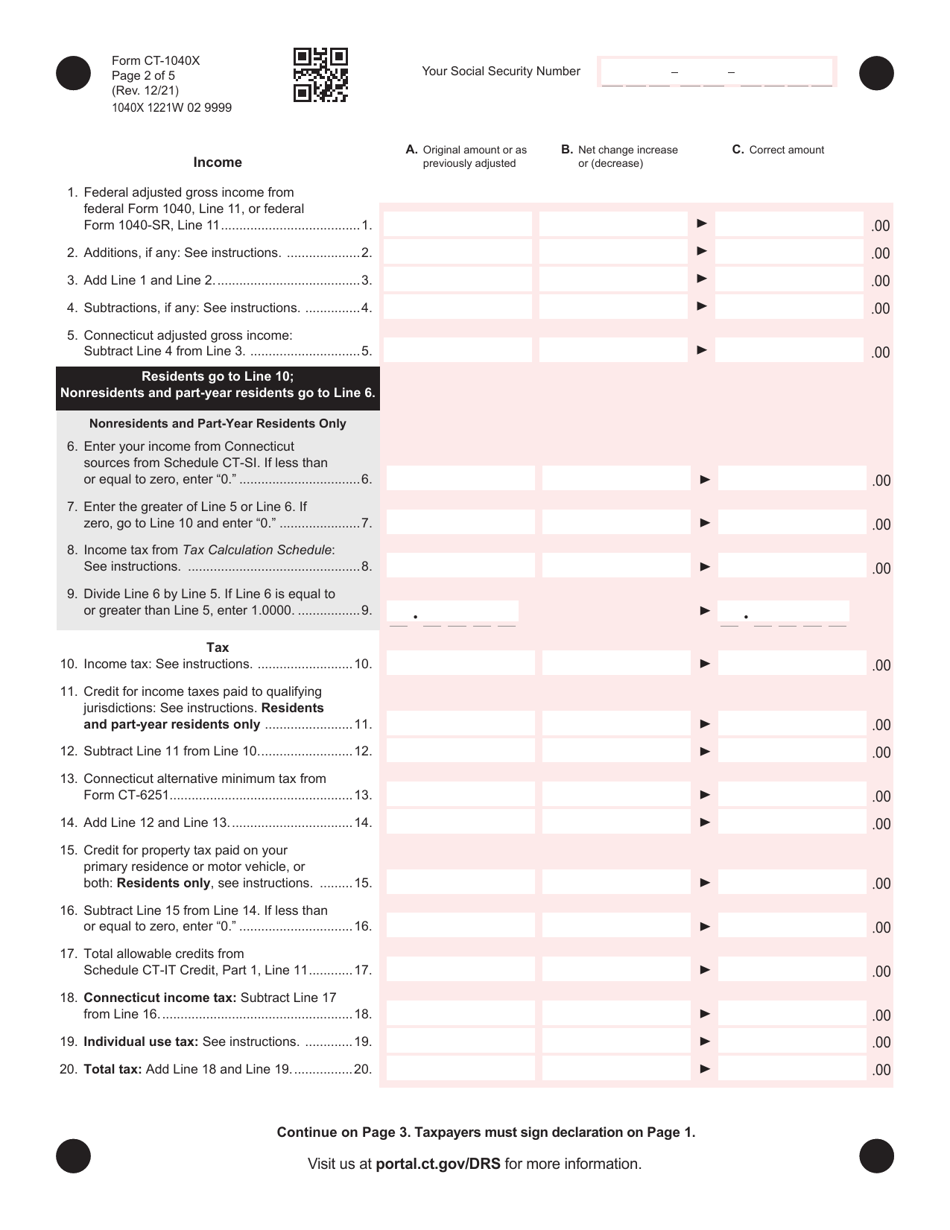

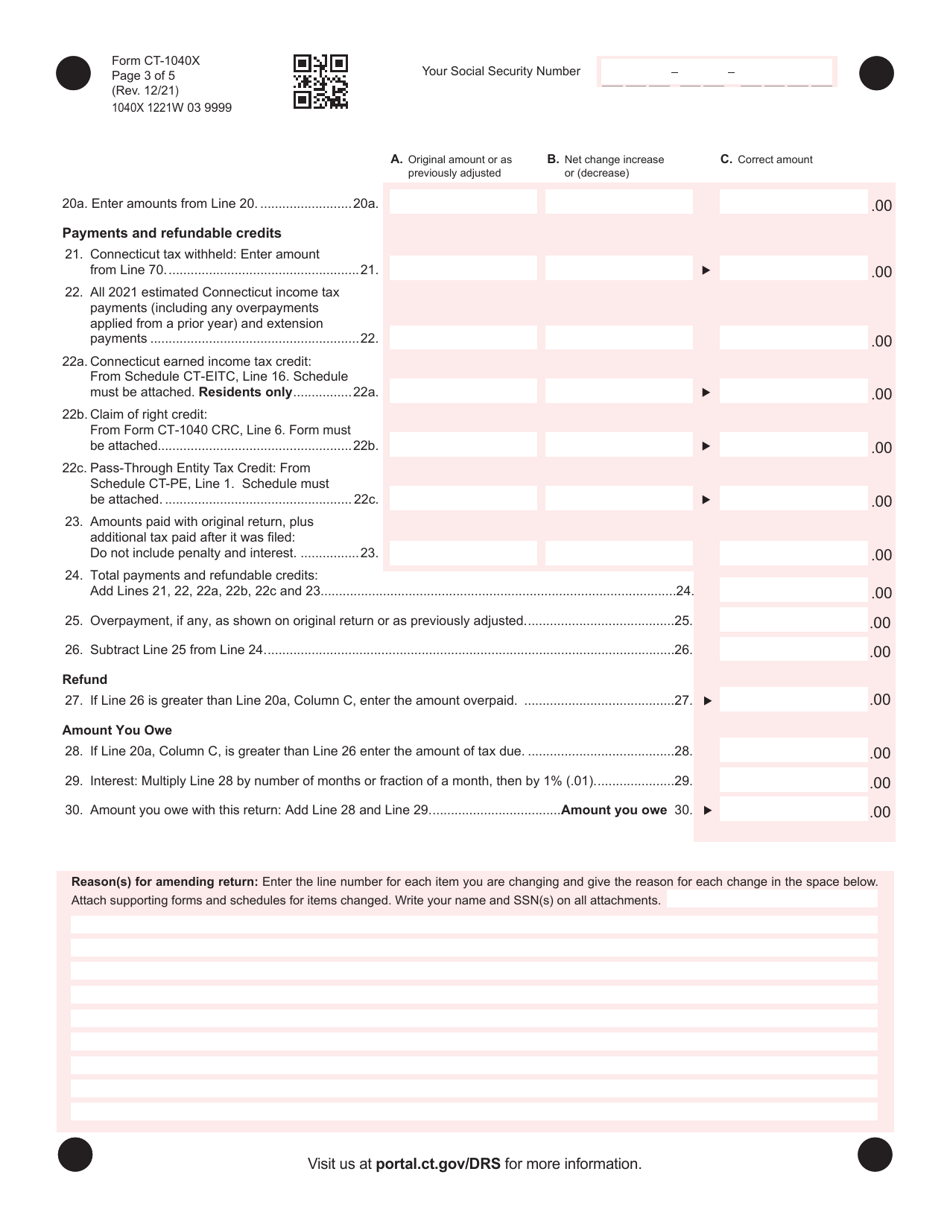

Q: What information is required to complete Form CT-1040X?

A: To complete Form CT-1040X, you will need information from your original Connecticut income tax return, as well as any additional documentation or forms related to the changes or corrections you are making.

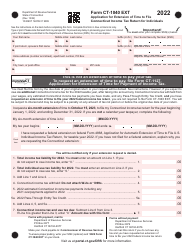

Q: Is there a deadline for filing Form CT-1040X?

A: Yes, the deadline for filing Form CT-1040X is the same as the deadline for filing your original Connecticut income tax return, which is typically April 15th of each year.

Q: Do I need to attach any supporting documents to Form CT-1040X?

A: Yes, you may need to attach supporting documents to Form CT-1040X, depending on the changes or corrections you are making. This may include copies of W-2 forms, 1099 forms, or other relevant documentation.

Q: Can I file Form CT-1040X electronically?

A: No, currently Connecticut does not offer electronic filing for Form CT-1040X. You must mail the completed form to the Connecticut Department of Revenue Services.

Q: What should I do if I have questions or need assistance with Form CT-1040X?

A: If you have questions or need assistance with Form CT-1040X, you can contact the Connecticut Department of Revenue Services or seek help from a qualified tax professional.

Q: Is there a fee for filing Form CT-1040X?

A: No, there is no fee for filing Form CT-1040X.

Q: Can I amend my federal income tax return using Form CT-1040X?

A: No, Form CT-1040X is specifically for amending your Connecticut income tax return. To amend your federal income tax return, you must use the appropriate federal form.

Q: What if I need to amend my Connecticut income tax return for multiple years?

A: If you need to amend your Connecticut income tax return for multiple years, you will need to file a separate Form CT-1040X for each year.

Q: Is Form CT-1040X available in languages other than English?

A: No, currently Form CT-1040X is only available in English.

Q: Can I file Form CT-1040X if I e-filed my original Connecticut income tax return?

A: No, if you e-filed your original Connecticut income tax return, you cannot file Form CT-1040X. You must file a paper return and mail it to the Connecticut Department of Revenue Services.

Q: What happens after I file Form CT-1040X?

A: After you file Form CT-1040X, the Connecticut Department of Revenue Services will review your amended return and notify you of any changes, additional amounts due, or refunds.

Q: Can I file Form CT-1040X if I have already received my refund for my original Connecticut income tax return?

A: Yes, if you have already received your refund for your original Connecticut income tax return, you can still file Form CT-1040X to make changes or corrections.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1040X by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.