This version of the form is not currently in use and is provided for reference only. Download this version of

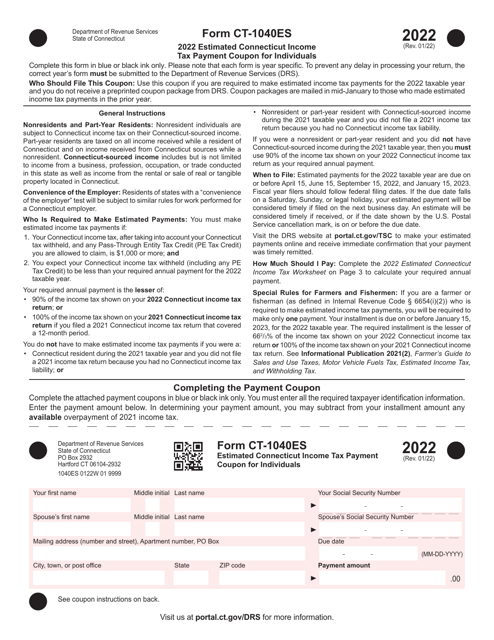

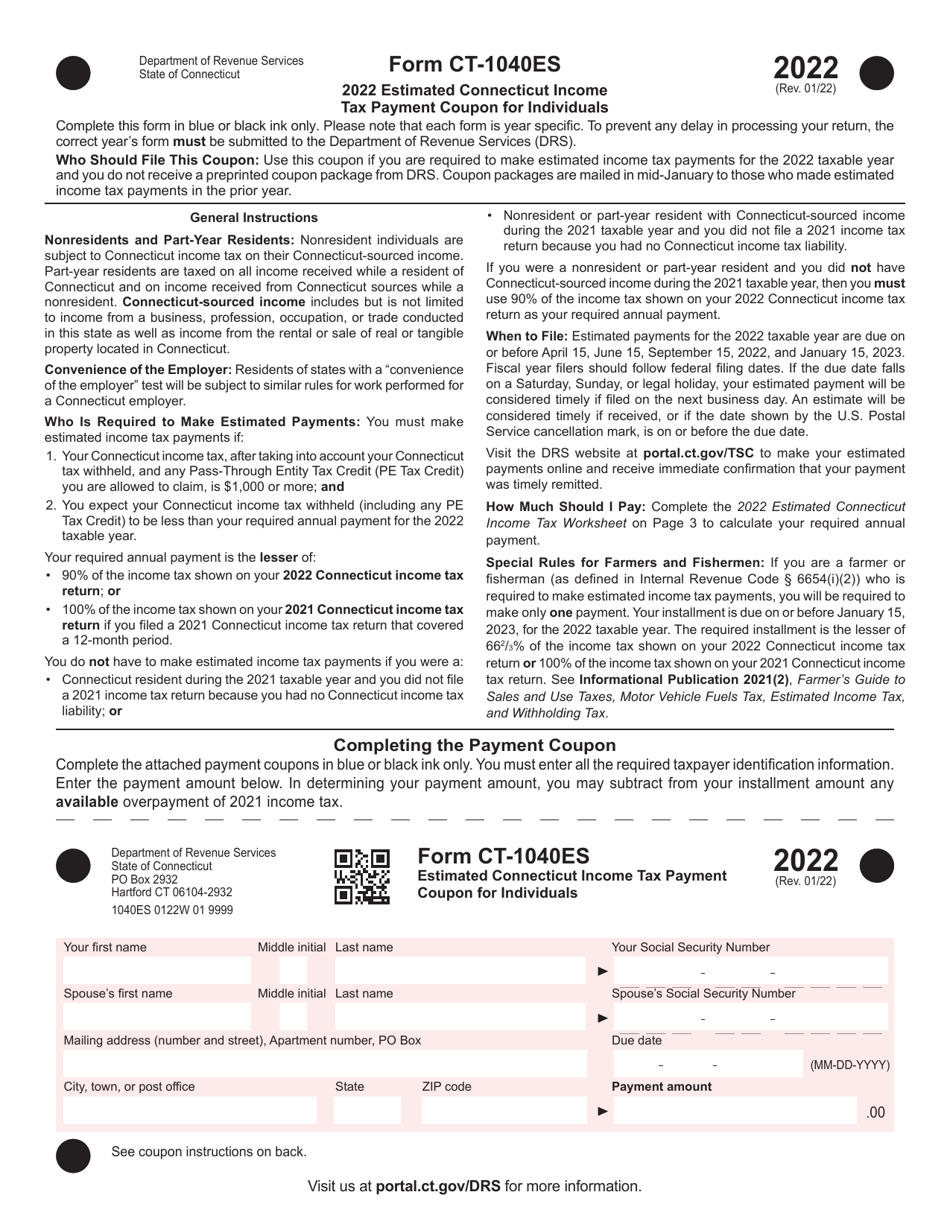

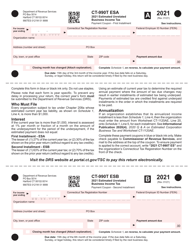

Form CT-1040ES

for the current year.

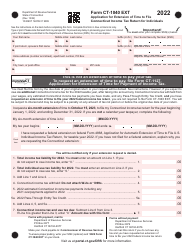

Form CT-1040ES Estimated Connecticut Income Tax Payment Coupon for Individuals - Connecticut

What Is Form CT-1040ES?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

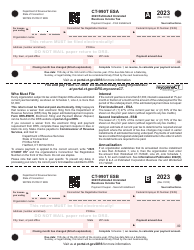

Q: What is Form CT-1040ES?

A: Form CT-1040ES is a payment coupon for individuals to make estimated Connecticut income tax payments.

Q: Who needs to file Form CT-1040ES?

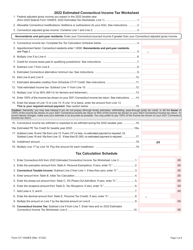

A: Connecticut residents who have income that is not subject to withholding tax and is expected to exceed $1,000 in a calendar year.

Q: What is the purpose of Form CT-1040ES?

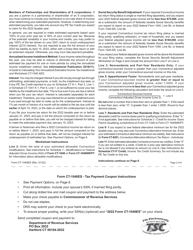

A: The purpose of Form CT-1040ES is to ensure that individuals pay their estimated Connecticut income taxes throughout the year, rather than in one lump sum.

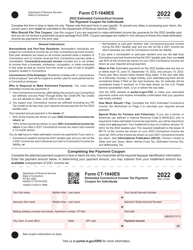

Q: What information is required on Form CT-1040ES?

A: Form CT-1040ES requires the individual's name, address, Social Security number, and estimated tax payment amount.

Q: When is Form CT-1040ES due?

A: Form CT-1040ES is generally due on a quarterly basis, with due dates falling on April 15th, June 15th, September 15th, and January 15th of the following year.

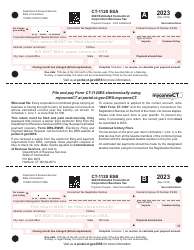

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1040ES by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.