This version of the form is not currently in use and is provided for reference only. Download this version of

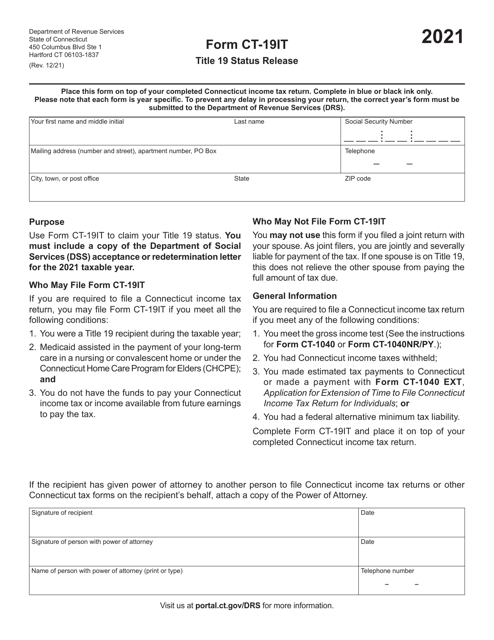

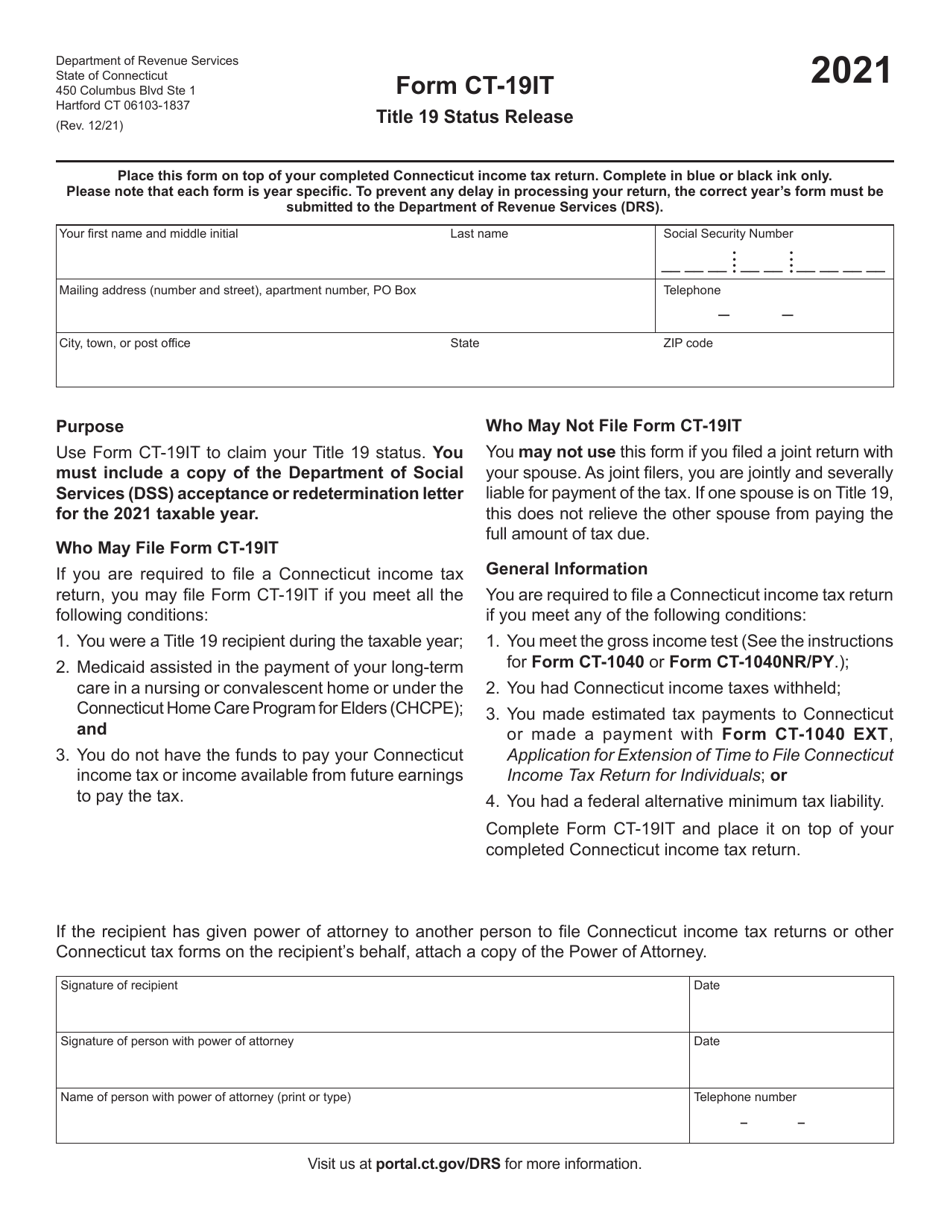

Form CT-19IT

for the current year.

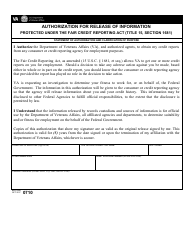

Form CT-19IT Title 19 Status Release - Connecticut

What Is Form CT-19IT?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-19IT?

A: Form CT-19IT is a tax form used by residents of Connecticut to claim Title 19 status release.

Q: Who needs to file Form CT-19IT?

A: Residents of Connecticut who wish to claim Title 19 status release need to file Form CT-19IT.

Q: What is Title 19 status release?

A: Title 19 status release is a program that provides financial assistance for medical costs to eligible residents of Connecticut.

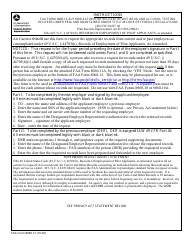

Q: What information is required on Form CT-19IT?

A: Form CT-19IT requires information about the individual, their income, assets, and medical expenses.

Q: When is the deadline to file Form CT-19IT?

A: The deadline to file Form CT-19IT is usually April 15th, unless an extension has been granted.

Q: Can I file Form CT-19IT electronically?

A: Yes, Form CT-19IT can be filed electronically through the Connecticut Taxpayer Service Center.

Q: Are there any eligibility requirements to claim Title 19 status release?

A: Yes, there are eligibility requirements based on income, assets, and medical expenses.

Q: What happens after I file Form CT-19IT?

A: After filing Form CT-19IT, the Connecticut Department of Revenue Services will review the application and determine eligibility for Title 19 status release.

Q: Can I appeal if my Form CT-19IT application is denied?

A: Yes, if your Form CT-19IT application is denied, you can appeal the decision through the appropriate channels.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-19IT by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.