This version of the form is not currently in use and is provided for reference only. Download this version of

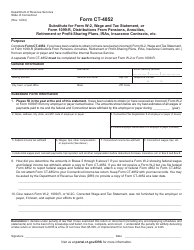

Schedule CT-1040WH

for the current year.

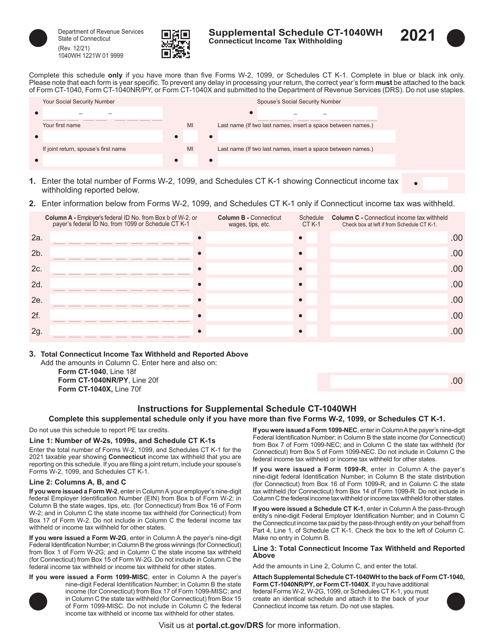

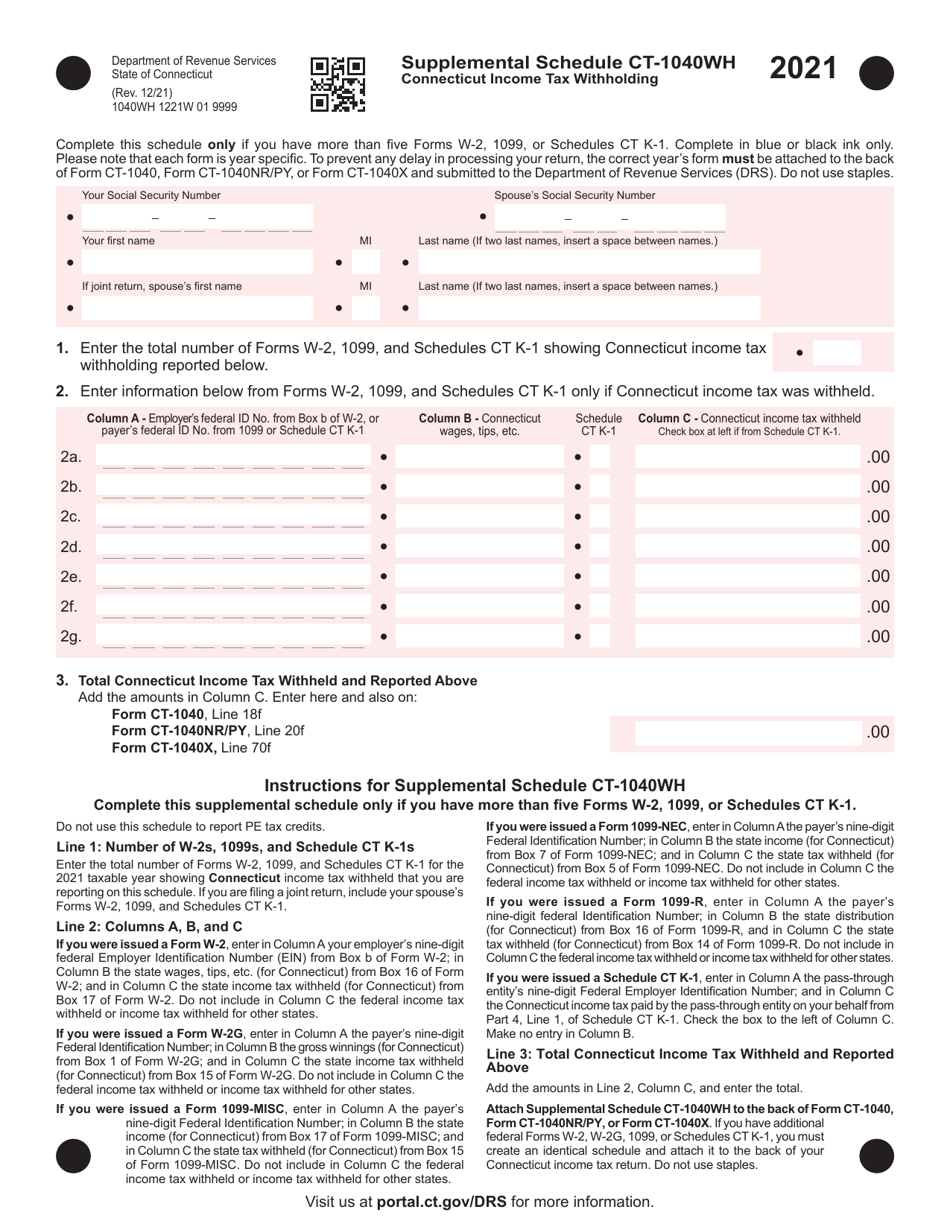

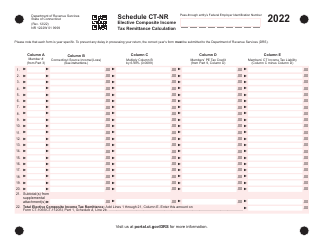

Schedule CT-1040WH Connecticut Income Tax Withholdin - Connecticut

What Is Schedule CT-1040WH?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

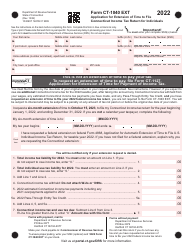

Q: What is the CT-1040WH form?

A: The CT-1040WH form is the Connecticut Income Tax Withholding Form.

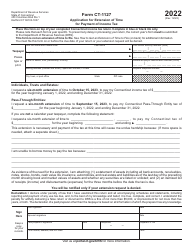

Q: Who needs to file Form CT-1040WH?

A: Employers in Connecticut need to file Form CT-1040WH to report and remit income taxes withheld from their employees' wages.

Q: What is the purpose of Form CT-1040WH?

A: The purpose of Form CT-1040WH is to calculate and report the amount of Connecticut income tax that has been withheld from an employee's wages.

Q: What information is required on Form CT-1040WH?

A: Form CT-1040WH requires information about the employer, such as the employer's name, address, and Federal Employer Identification Number (FEIN), as well as information about the employees, such as their names, Social Security numbers, and the amount of Connecticut income tax withheld from their wages.

Q: When is Form CT-1040WH due?

A: Form CT-1040WH is due on a quarterly basis, with the due dates falling on the last day of April, July, October, and January.

Q: Is Form CT-1040WH the same as Form CT-1040?

A: No, Form CT-1040WH is a separate form used for reporting and remitting income taxes withheld from employees' wages, while Form CT-1040 is used by individual taxpayers to report their own income and calculate their state income tax liability.

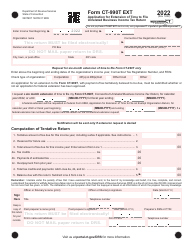

Q: What happens if I fail to file Form CT-1040WH or pay the withholding tax?

A: Failure to file Form CT-1040WH or pay the withholding tax can result in penalties and interest charges imposed by the Connecticut Department of Revenue Services.

Q: Can I claim a refund of the withholding tax on Form CT-1040WH?

A: No, Form CT-1040WH is used only for reporting and remitting income taxes withheld, and does not provide a mechanism for claiming a refund. Refunds of overpaid withholding tax can be claimed on the employee's individual income tax return, using Form CT-1040.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule CT-1040WH by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.