This version of the form is not currently in use and is provided for reference only. Download this version of

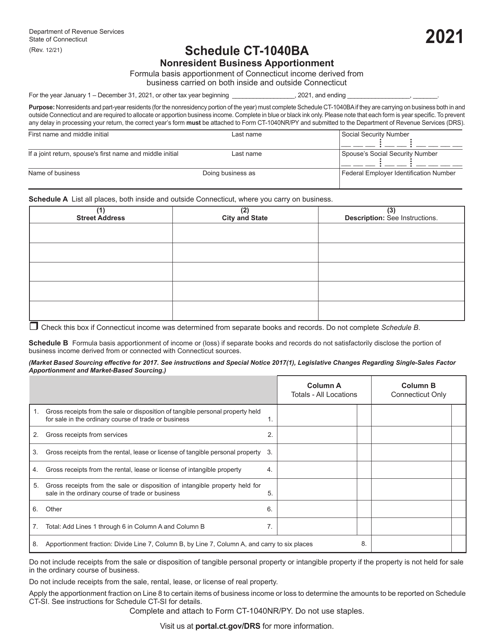

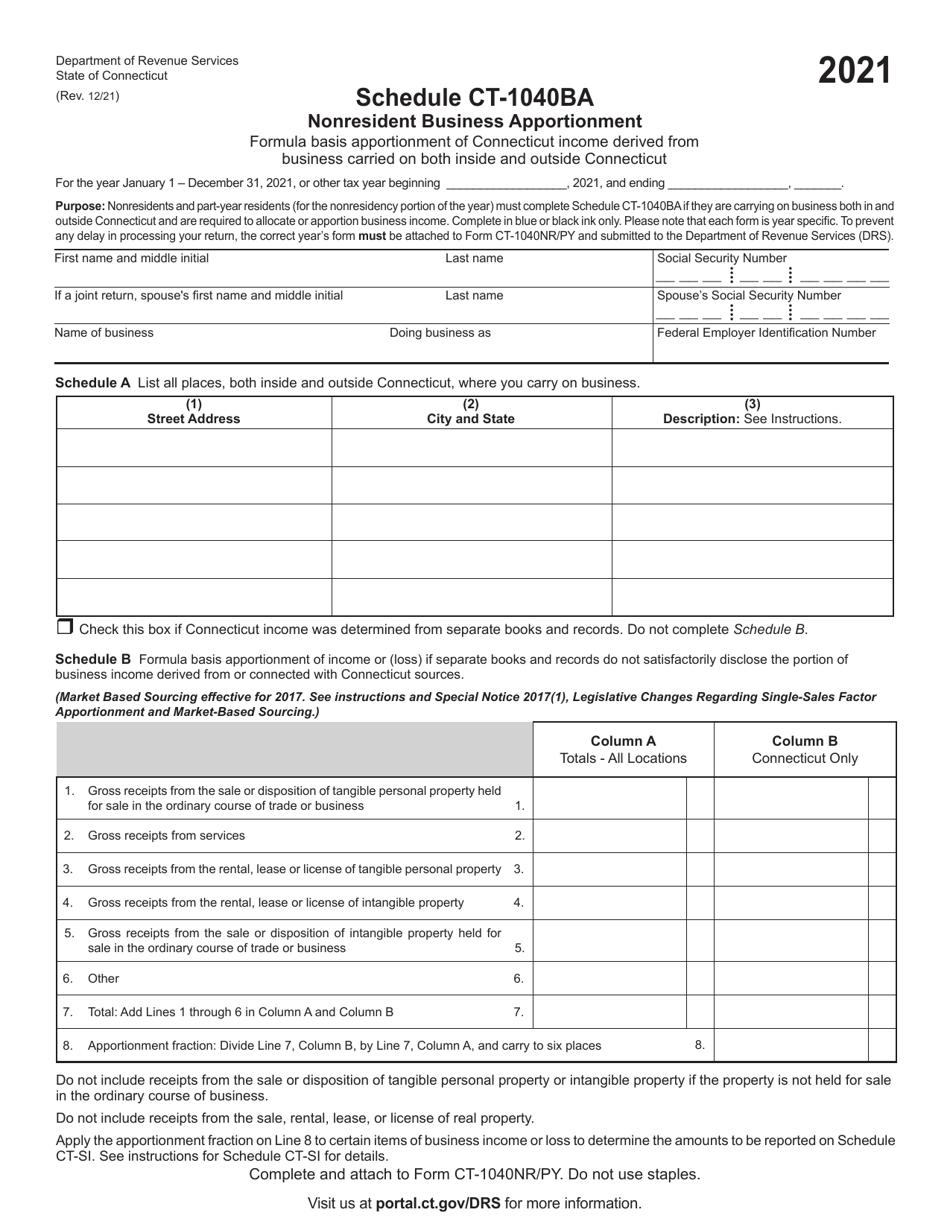

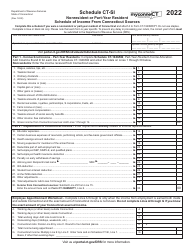

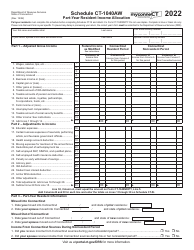

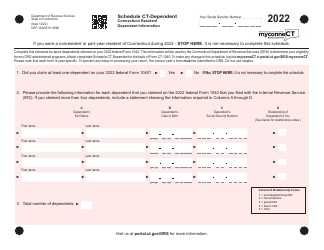

Schedule CT-1040BA

for the current year.

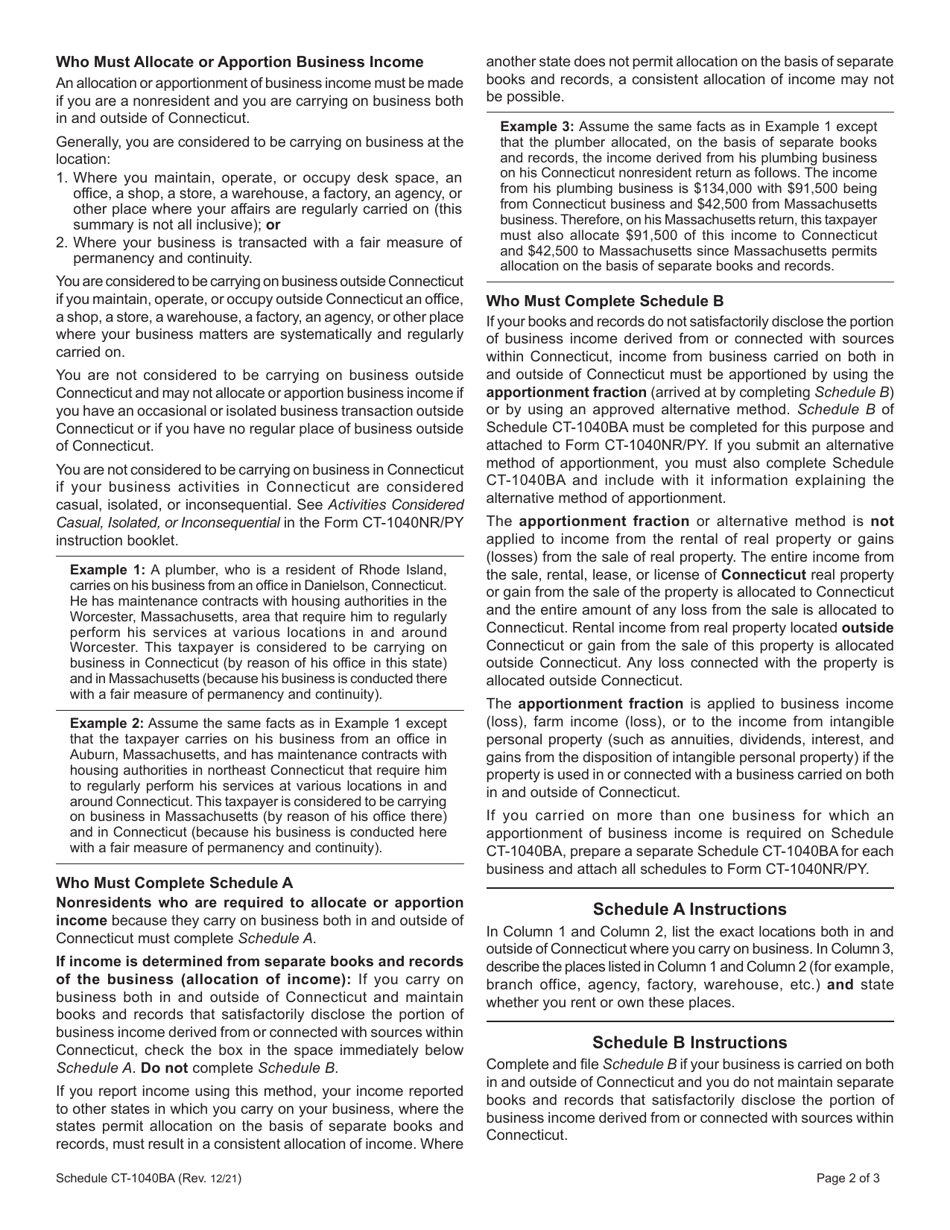

Schedule CT-1040BA Nonresident Business Apportionment - Connecticut

What Is Schedule CT-1040BA?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a CT-1040BA form?

A: CT-1040BA is a form used to schedule nonresident business apportionment in Connecticut.

Q: Who needs to file a CT-1040BA form?

A: Nonresidents who have income from a business in Connecticut need to file a CT-1040BA form.

Q: What is nonresident business apportionment?

A: Nonresident business apportionment is the process of determining the portion of a nonresident's business income that is subject to Connecticut taxation.

Q: What information is required on a CT-1040BA form?

A: A CT-1040BA form requires information about the nonresident's business income, the amount of income derived from Connecticut sources, and the apportionment percentage.

Q: When is the deadline to file a CT-1040BA form?

A: The deadline to file a CT-1040BA form is the same as the deadline for filing the Connecticut resident or nonresident income tax return, which is typically April 15th.

Q: Are there any penalties for not filing a CT-1040BA form?

A: Yes, failure to file a CT-1040BA form when required may result in penalties and interest being assessed by the Connecticut Department of Revenue Services.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule CT-1040BA by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.