This version of the form is not currently in use and is provided for reference only. Download this version of

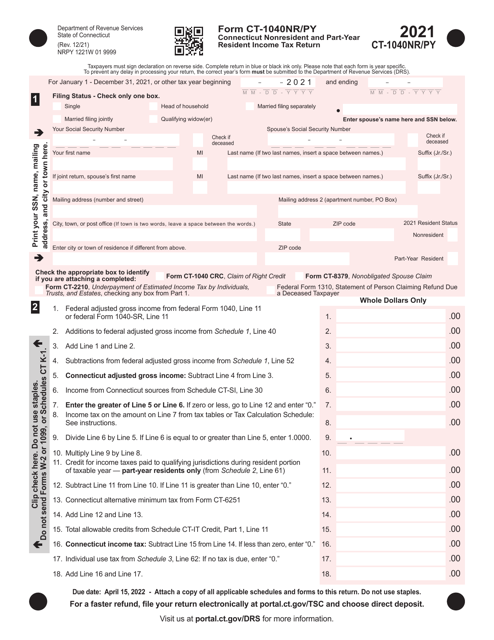

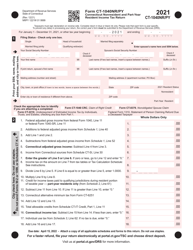

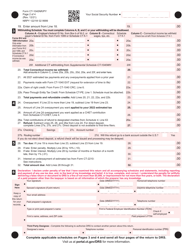

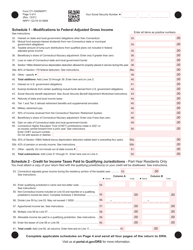

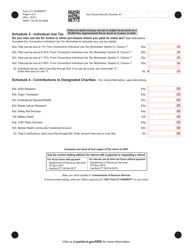

Form CT-1040NR/PY

for the current year.

Form CT-1040NR / PY Connecticut Nonresident and Part-Year Resident Income Tax Return - Connecticut

What Is Form CT-1040NR/PY?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1040NR/PY?

A: Form CT-1040NR/PY is the Connecticut Nonresident and Part-Year Resident Income Tax Return for individuals who are nonresidents or part-year residents in Connecticut.

Q: Who needs to file Form CT-1040NR/PY?

A: Individuals who are nonresidents or part-year residents in Connecticut and have income earned or received in Connecticut during the tax year need to file Form CT-1040NR/PY.

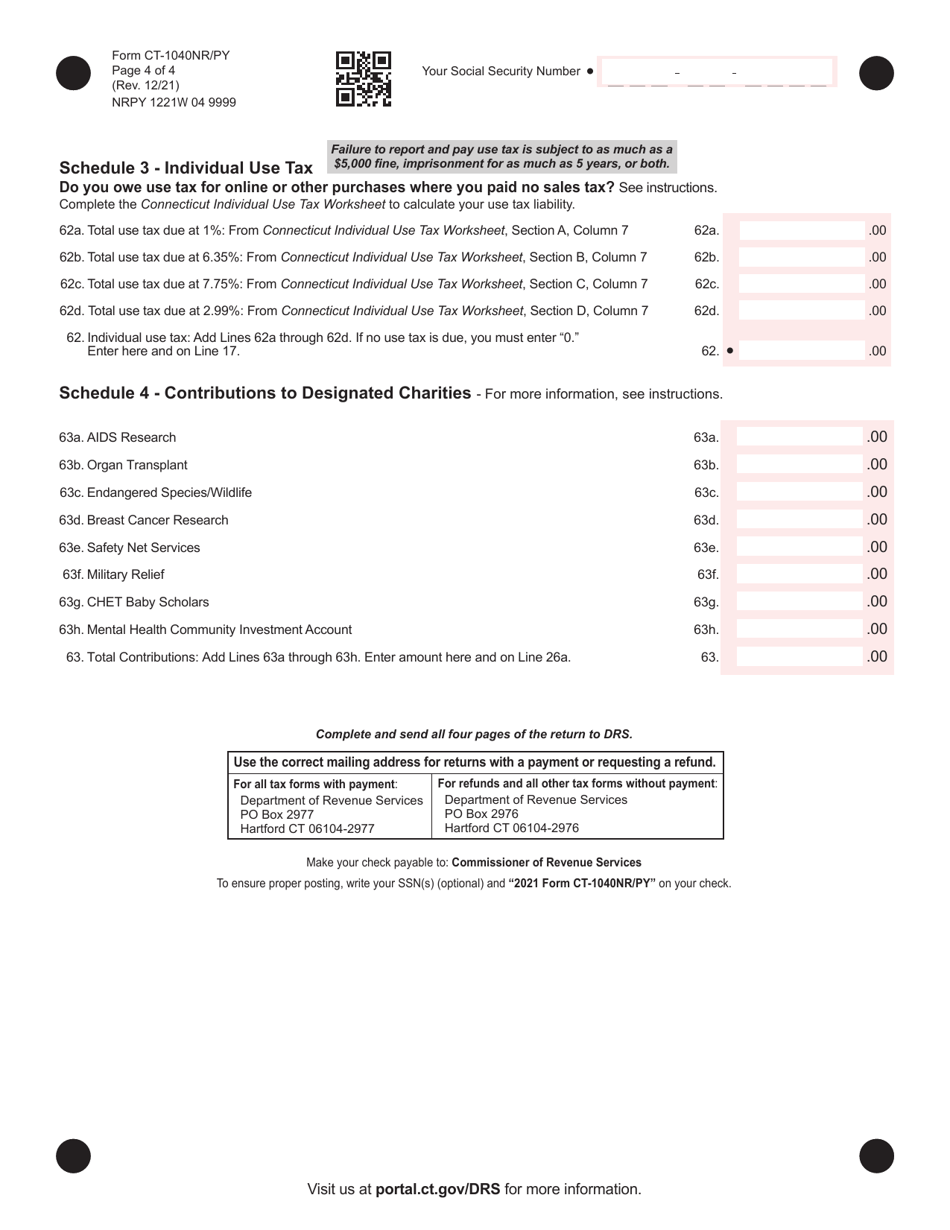

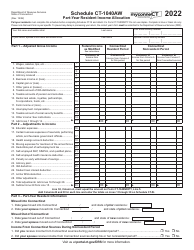

Q: What information do I need to complete Form CT-1040NR/PY?

A: You will need your personal information, income and deduction information, and any supporting documentation, such as W-2 forms or 1099 forms.

Q: When is the deadline to file Form CT-1040NR/PY?

A: The deadline to file Form CT-1040NR/PY is generally April 15th, but it may be extended to the following business day if April 15th falls on a weekend or holiday.

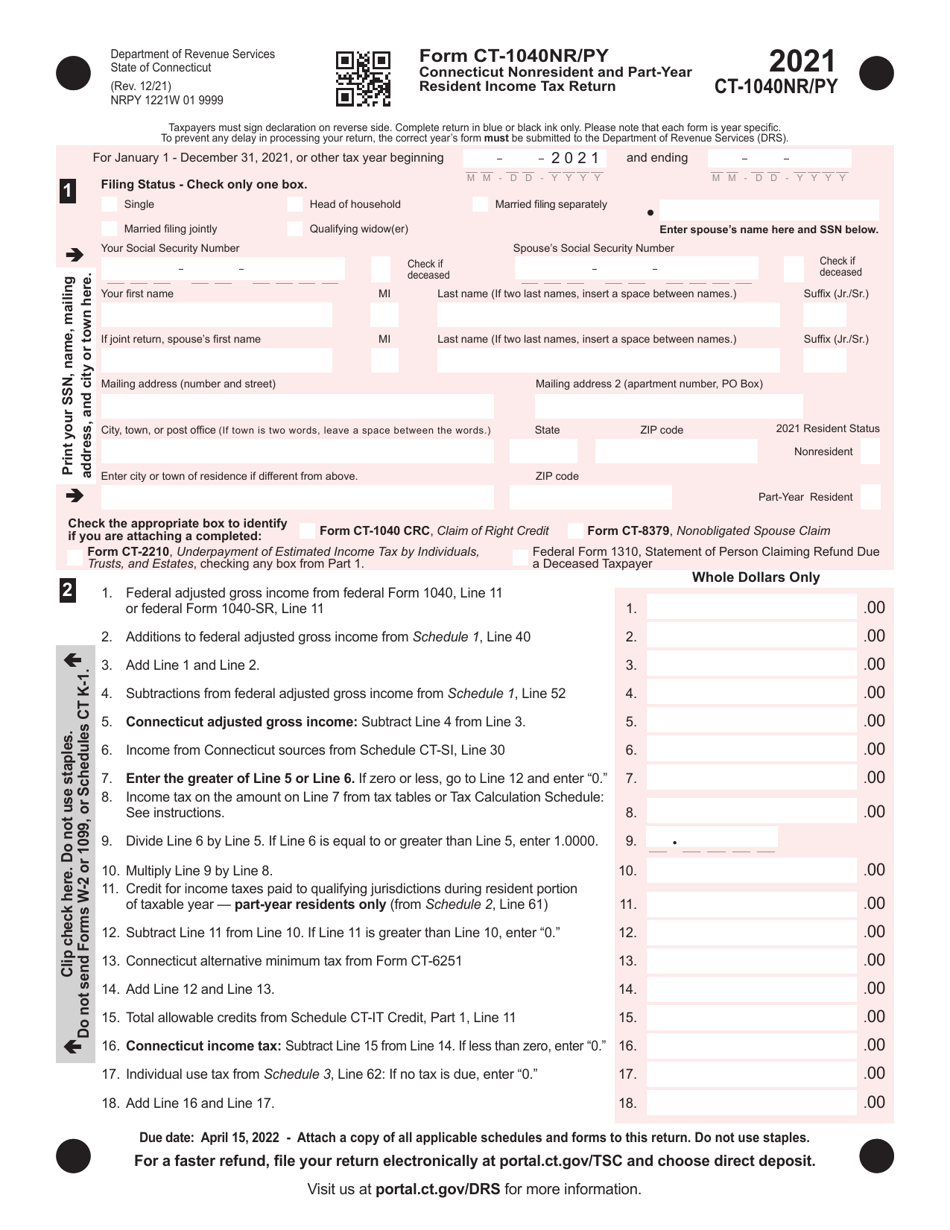

Q: Are there any tax credits or deductions available for nonresidents and part-year residents in Connecticut?

A: Yes, Connecticut offers various tax credits and deductions for nonresidents and part-year residents. Some examples include the personal exemption credit, property tax credit, and working family tax credit.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1040NR/PY by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.