This version of the form is not currently in use and is provided for reference only. Download this version of

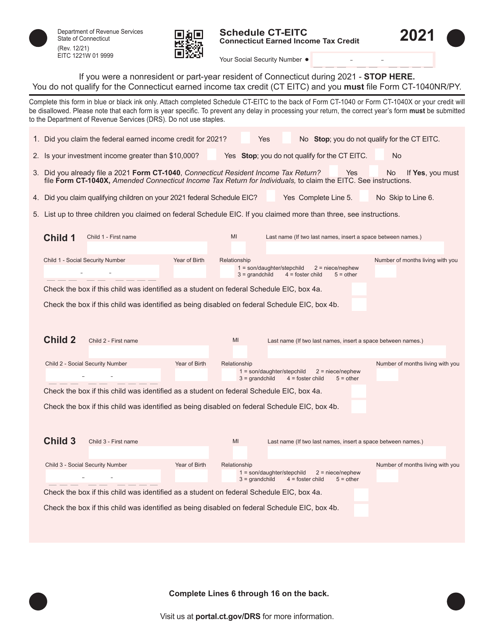

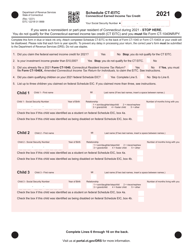

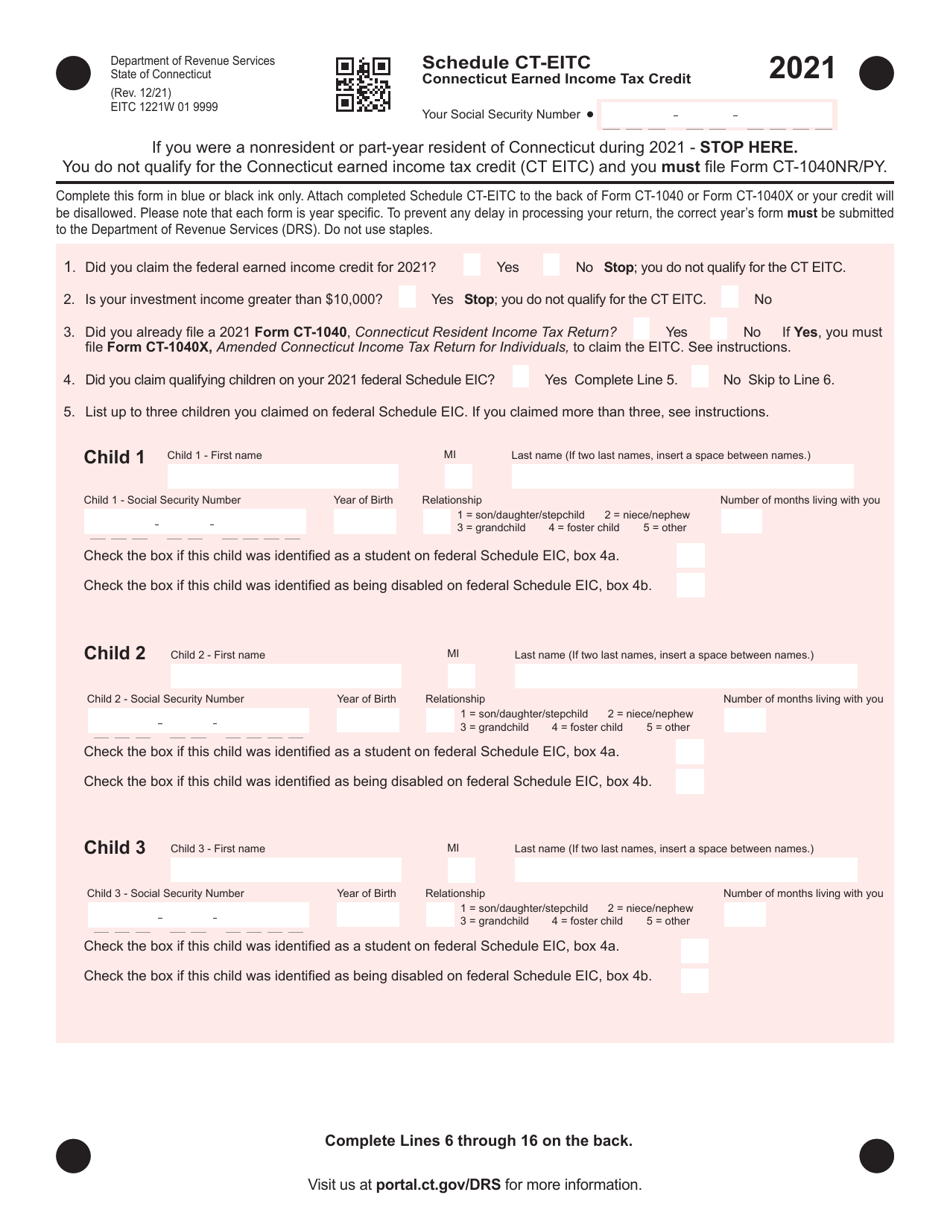

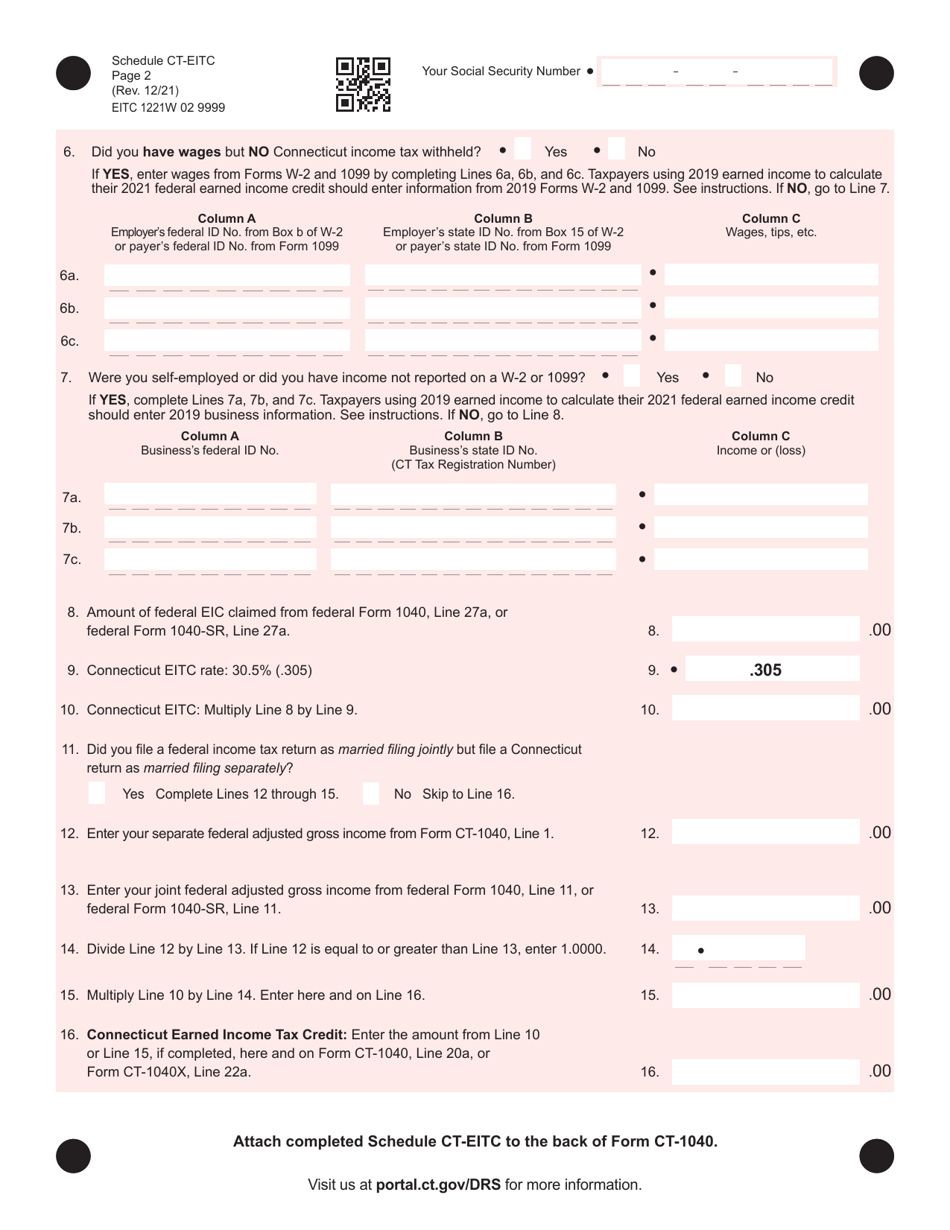

Schedule CT-EITC

for the current year.

Schedule CT-EITC Connecticut Earned Income Tax Credit - Connecticut

What Is Schedule CT-EITC?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the CT-EITC?

A: The CT-EITC stands for Connecticut Earned Income Tax Credit.

Q: What is the purpose of the CT-EITC?

A: The purpose of the CT-EITC is to provide a tax credit to eligible low-income workers in Connecticut.

Q: Who qualifies for the CT-EITC?

A: To qualify for the CT-EITC, you must meet certain income requirements and have earned income from work.

Q: How much is the CT-EITC credit?

A: The amount of the CT-EITC credit varies depending on your income and family size. It can range from a few hundred dollars to several thousand dollars.

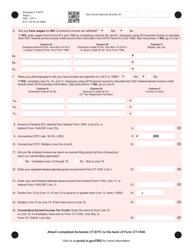

Q: How do I claim the CT-EITC?

A: To claim the CT-EITC, you must file a state income tax return and complete the necessary forms and calculations.

Q: Is the CT-EITC refundable?

A: Yes, the CT-EITC is refundable, which means that if the credit exceeds the amount of taxes you owe, you can receive the remaining credit as a refund.

Q: Are there any additional requirements for the CT-EITC?

A: In addition to meeting the income requirements, you must also have a valid Social Security number and be a resident of Connecticut.

Q: Can I claim the CT-EITC if I am married but filing separately?

A: No, you cannot claim the CT-EITC if you are married but filing separately. It is only available to those who file a joint return, as well as certain qualifying individuals.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule CT-EITC by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.