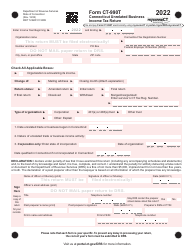

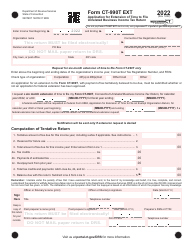

This version of the form is not currently in use and is provided for reference only. Download this version of

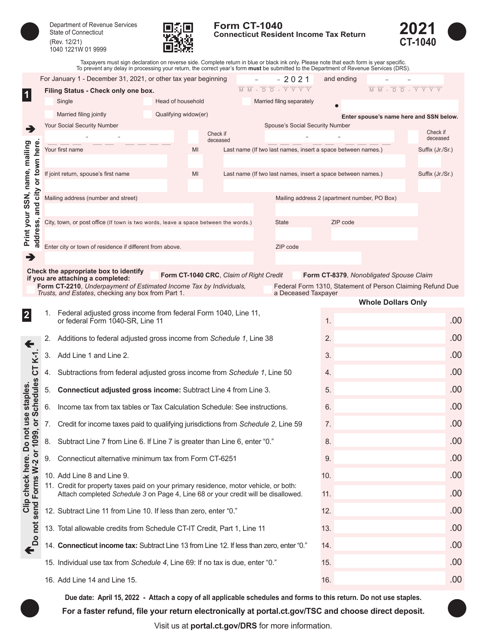

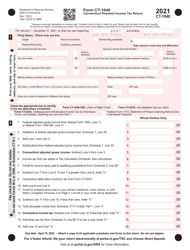

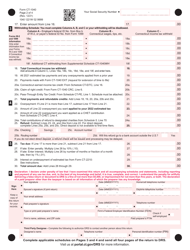

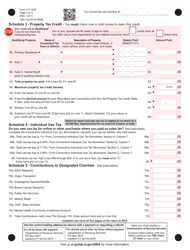

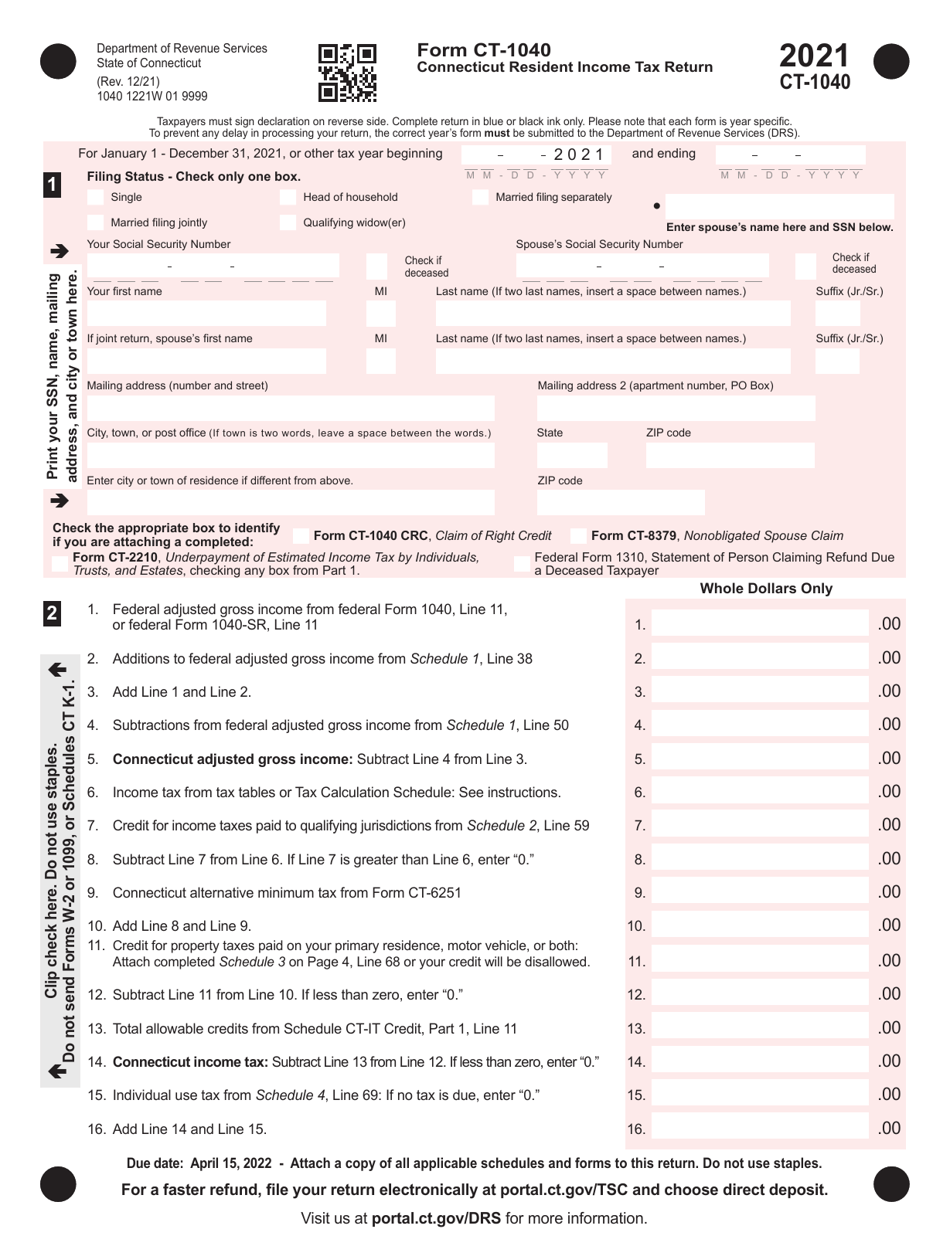

Form CT-1040

for the current year.

Form CT-1040 Connecticut Resident Income Tax Return - Connecticut

What Is Form CT-1040?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

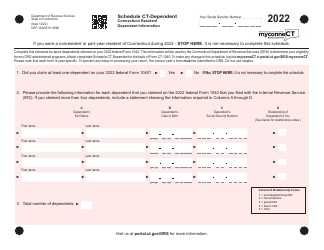

Q: Who is required to file Form CT-1040?

A: Connecticut residents who have taxable income must file Form CT-1040.

Q: What is the deadline for filing Form CT-1040?

A: The deadline for filing Form CT-1040 is April 15th, or the next business day if April 15th falls on a weekend or holiday.

Q: What income is taxable in Connecticut?

A: All income earned or received by Connecticut residents is generally subject to Connecticut income tax, including wages, self-employment income, and investment income.

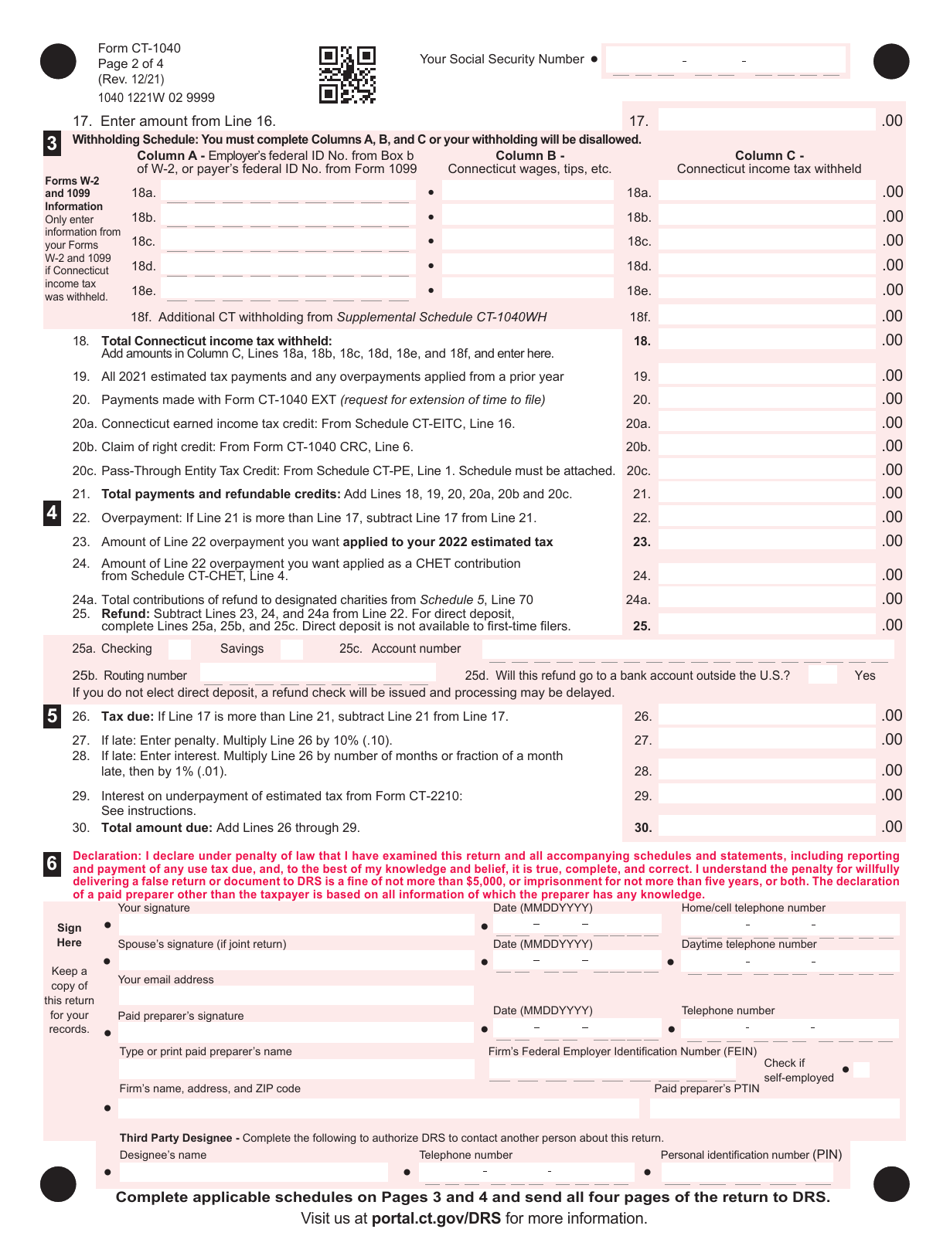

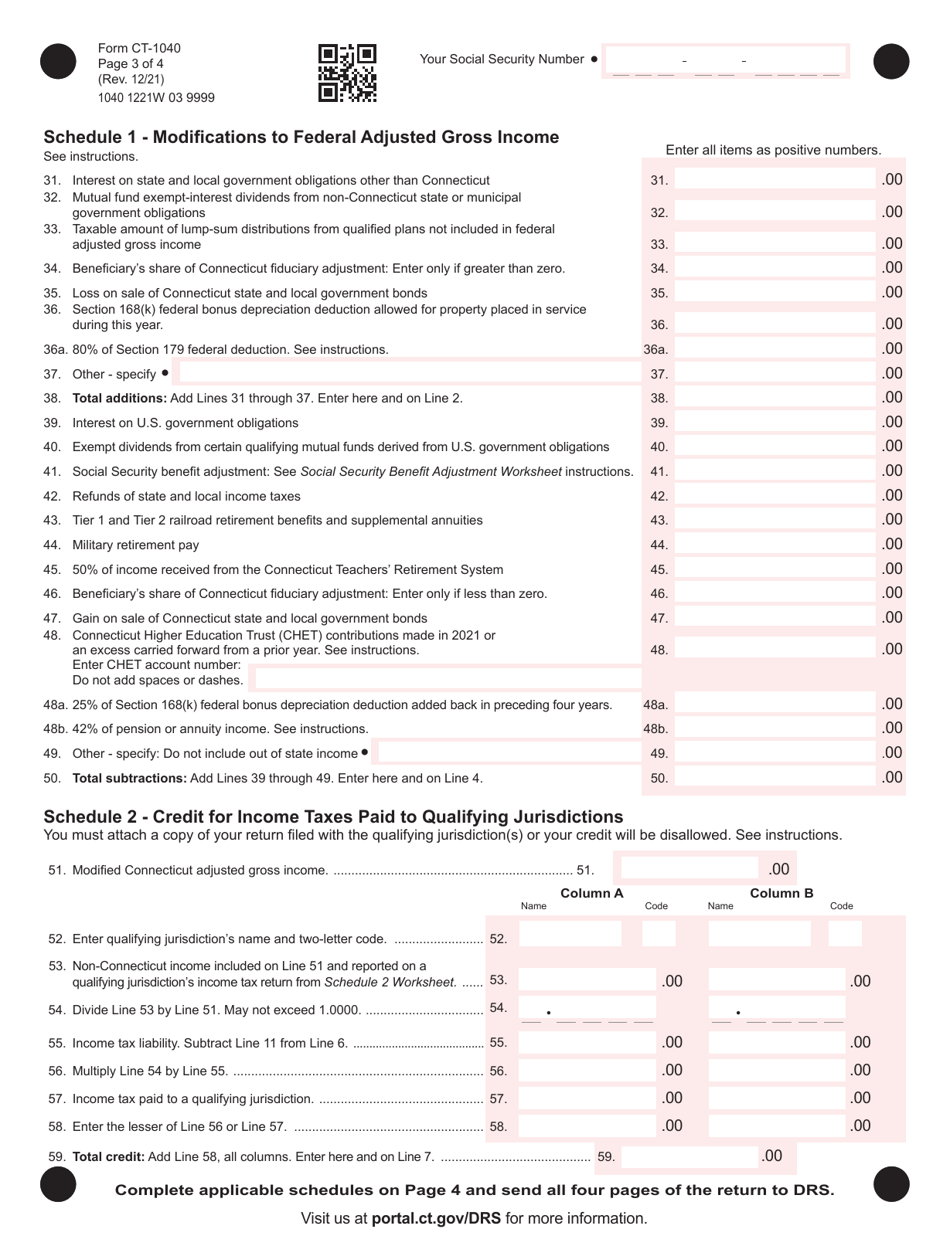

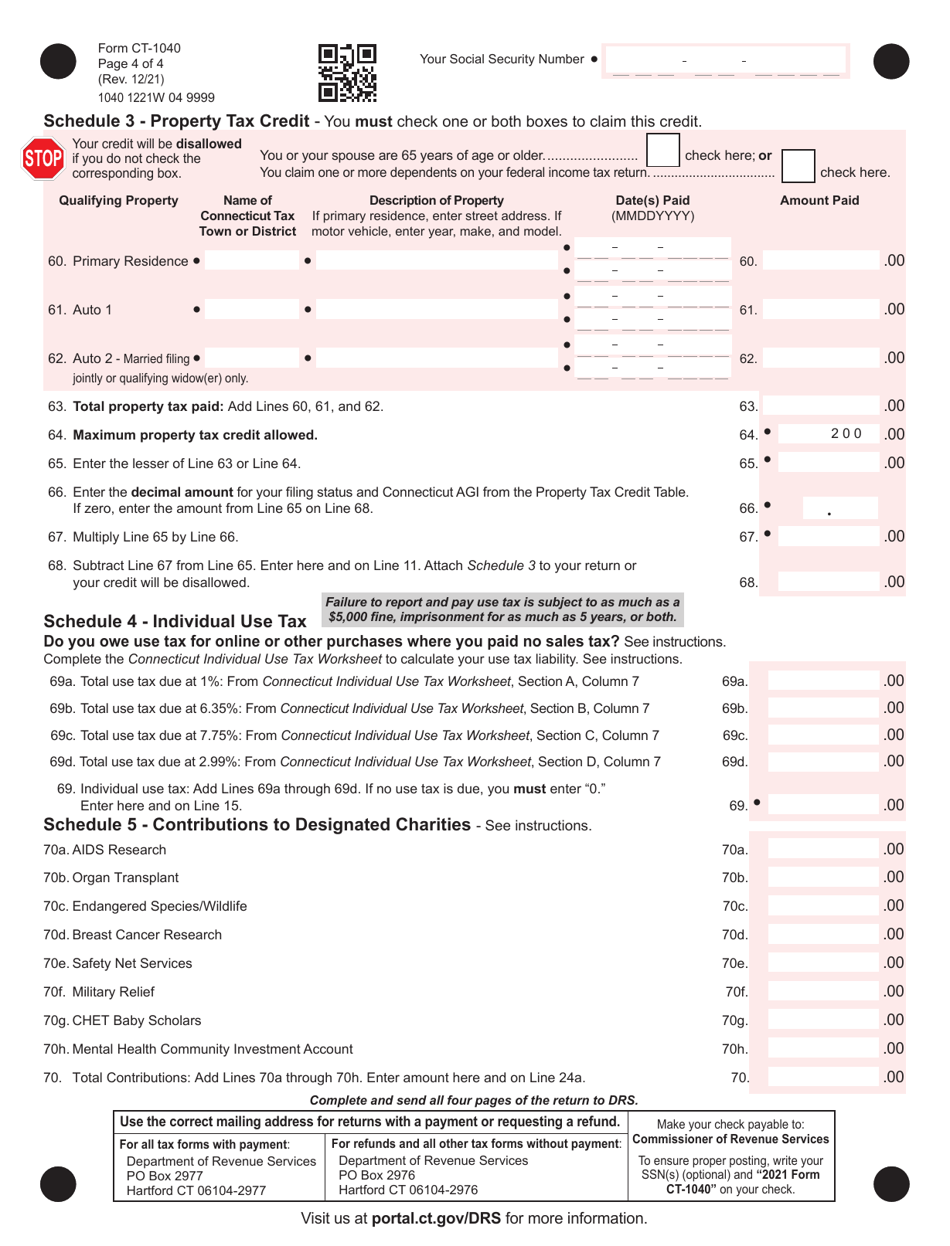

Q: Are there any deductions or credits available on Form CT-1040?

A: Yes, there are deductions and credits available on Form CT-1040, such as the standard deduction, itemized deductions, and various tax credits.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1040 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.