This version of the form is not currently in use and is provided for reference only. Download this version of

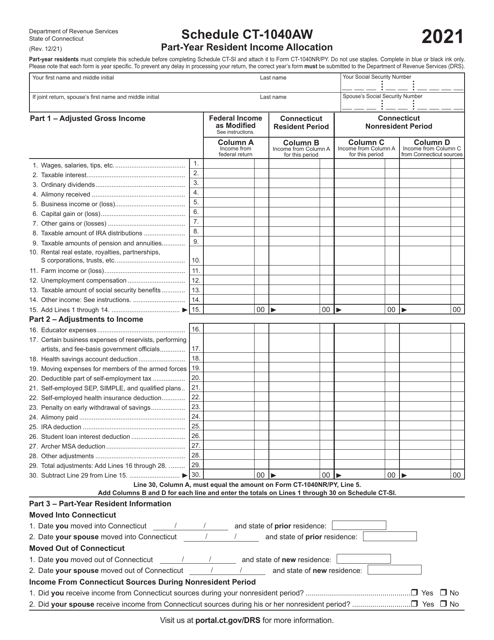

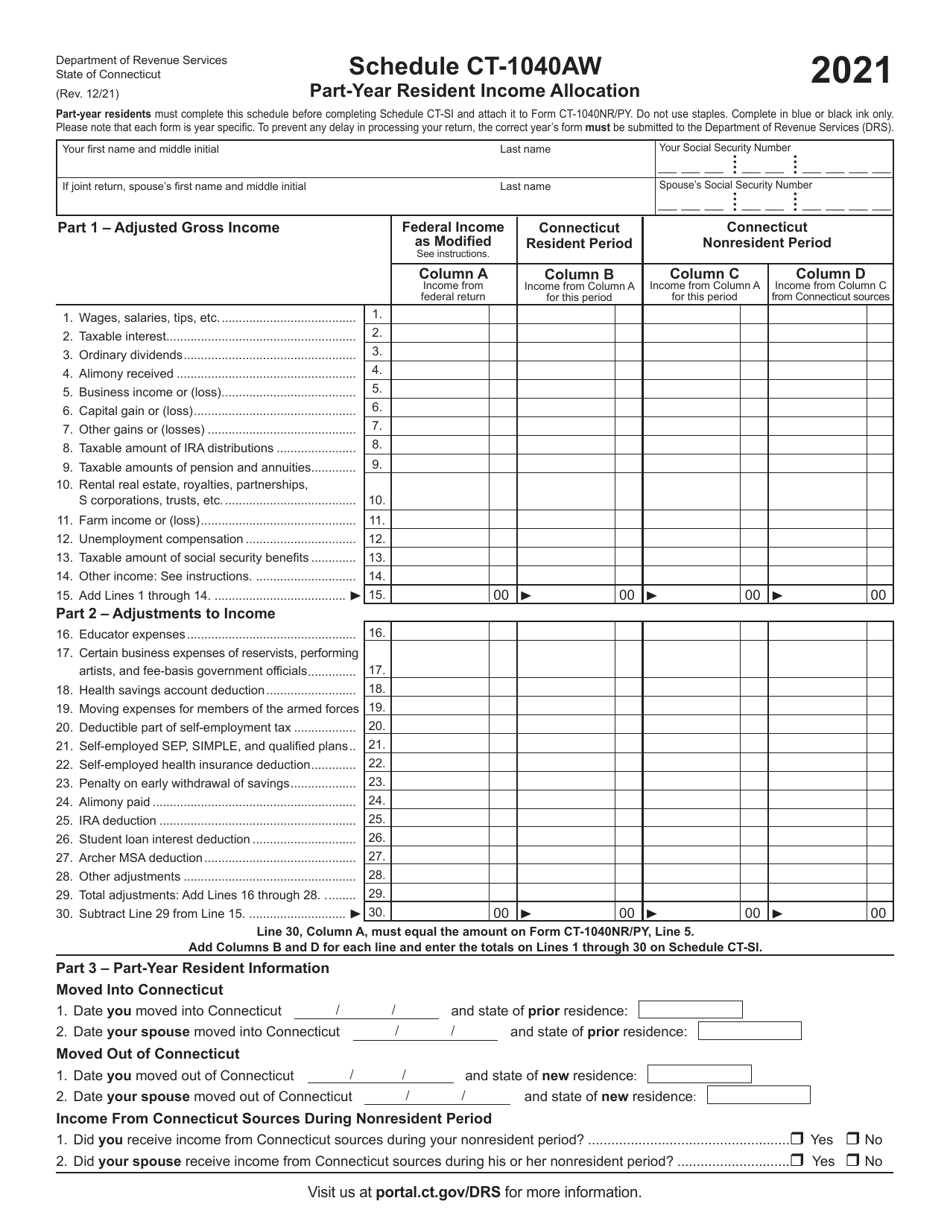

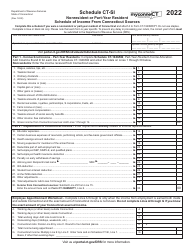

Schedule CT-1040AW

for the current year.

Schedule CT-1040AW Part-Year Resident Income Allocation - Connecticut

What Is Schedule CT-1040AW?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CT-1040AW?

A: CT-1040AW is the Schedule you use to allocate your income as a part-year resident in Connecticut.

Q: Who needs to file CT-1040AW?

A: Part-year residents of Connecticut who have income from sources both inside and outside Connecticut need to file CT-1040AW.

Q: What is the purpose of CT-1040AW?

A: The purpose of CT-1040AW is to determine the portion of your income that is subject to Connecticut state tax.

Q: How do I complete CT-1040AW?

A: To complete CT-1040AW, you will need to calculate the ratio of your Connecticut income to your total income and allocate the appropriate amounts to each.

Q: When is the deadline to file CT-1040AW?

A: The deadline to file CT-1040AW is the same as the deadline to file your Connecticut income tax return, which is usually April 15th of the following year.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule CT-1040AW by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.