This version of the form is not currently in use and is provided for reference only. Download this version of

Form CERT-106

for the current year.

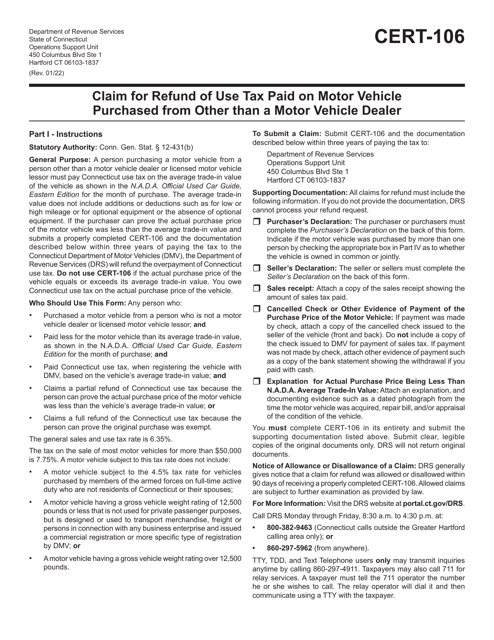

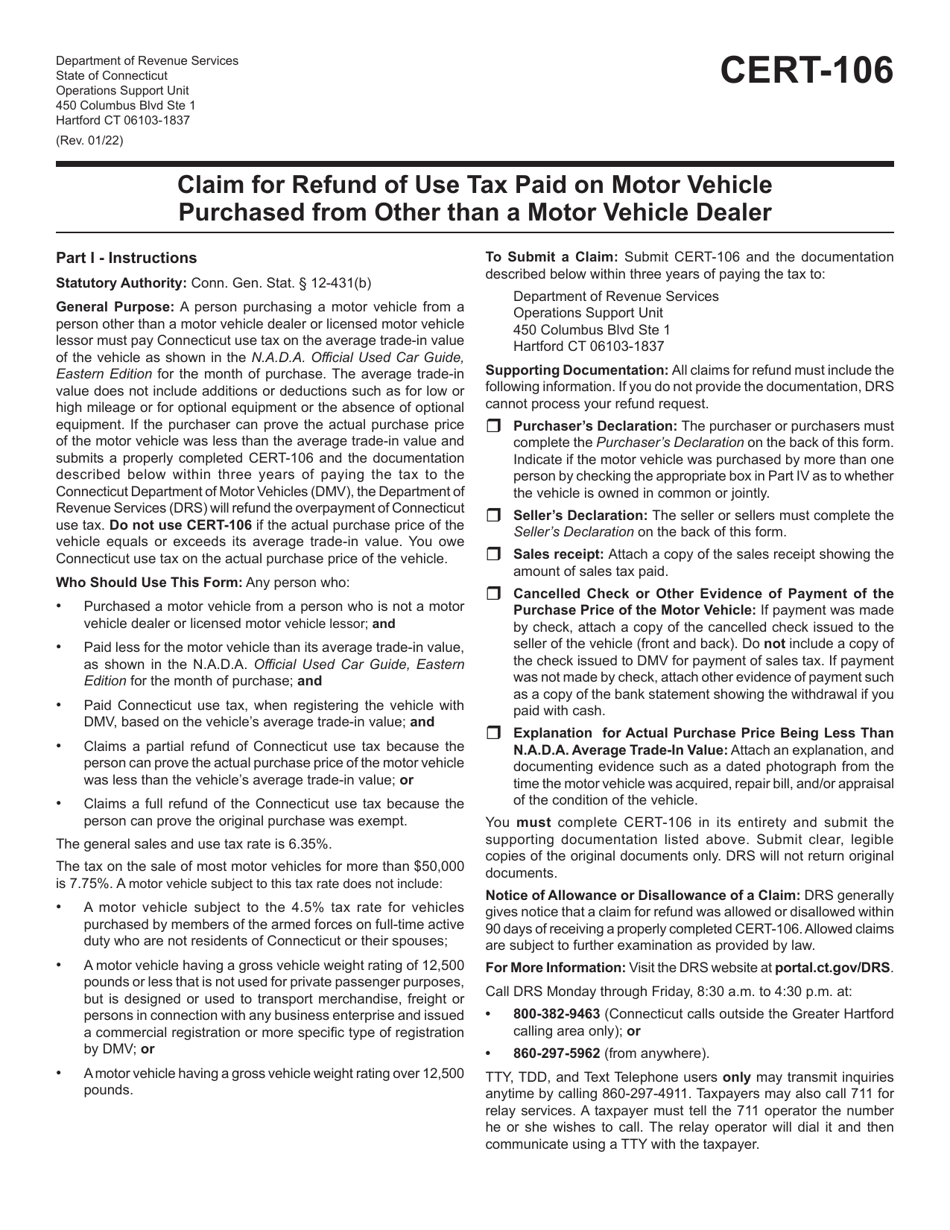

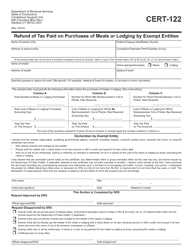

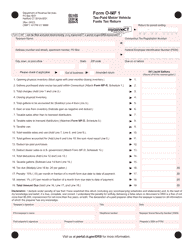

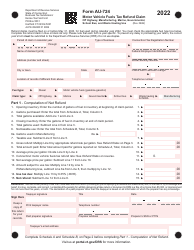

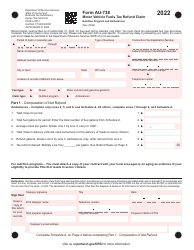

Form CERT-106 Claim for Refund of Use Tax Paid on Motor Vehicle Purchased From Other Than a Motor Vehicle Dealer - Connecticut

What Is Form CERT-106?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the CERT-106 form?

A: The CERT-106 form is a claim for refund of use tax paid on a motor vehicle purchased in Connecticut from someone other than a motor vehicle dealer.

Q: What is use tax?

A: Use tax is a tax on the use, storage, or consumption of tangible personal property in Connecticut when sales tax has not been paid.

Q: Who can use the CERT-106 form?

A: Individuals who purchased a motor vehicle in Connecticut from someone other than a motor vehicle dealer and paid use tax on the purchase can use the CERT-106 form to claim a refund.

Q: Can I claim a refund if I purchased a motor vehicle from a dealer?

A: No, the CERT-106 form is specifically for motor vehicle purchases from someone other than a motor vehicle dealer. If you purchased from a dealer, you would not use this form.

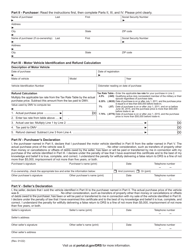

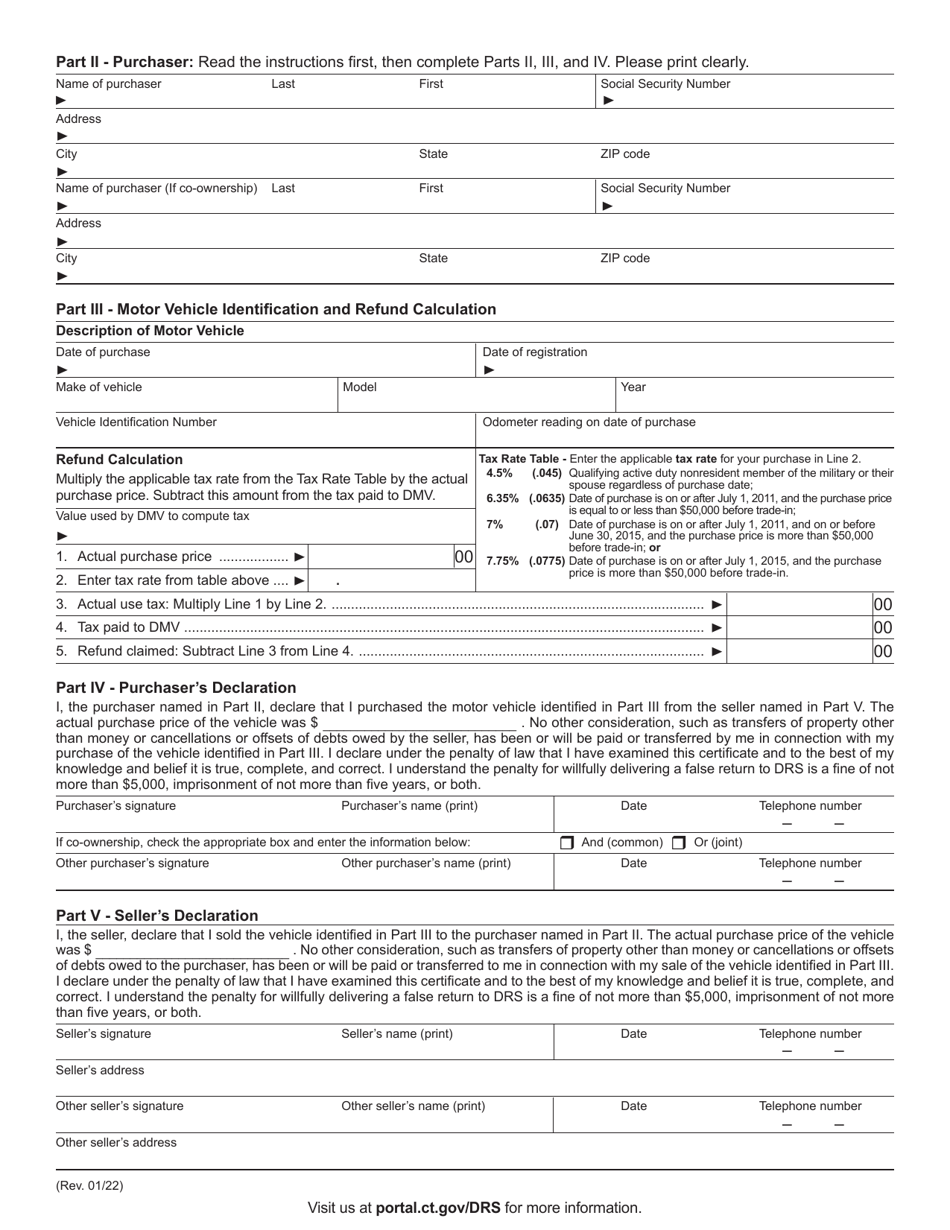

Q: What information is required on the CERT-106 form?

A: The CERT-106 form requires information such as the vehicle details, purchase price, proof of payment, and the reason for claiming a refund.

Q: Is there a deadline to submit the CERT-106 form?

A: Yes, the CERT-106 form must be submitted within three years from the payment of the use tax.

Q: How long does it take to receive a refund?

A: The processing time for a CERT-106 refund can vary. It is recommended to allow several weeks for the Connecticut DRS to review and process your claim.

Q: Can I file a claim for refund of use tax paid on other types of purchases?

A: The CERT-106 form is specifically for motor vehicle purchases. If you have paid use tax on other types of purchases, you may need to use a different form or contact the Connecticut DRS for guidance.

Q: Can I submit the CERT-106 form electronically?

A: Currently, the CERT-106 form cannot be submitted electronically. You will need to mail the completed form and supporting documents to the Connecticut DRS.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CERT-106 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.