This version of the form is not currently in use and is provided for reference only. Download this version of

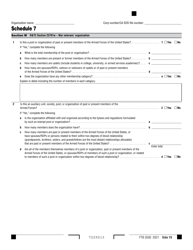

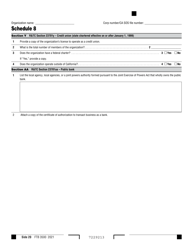

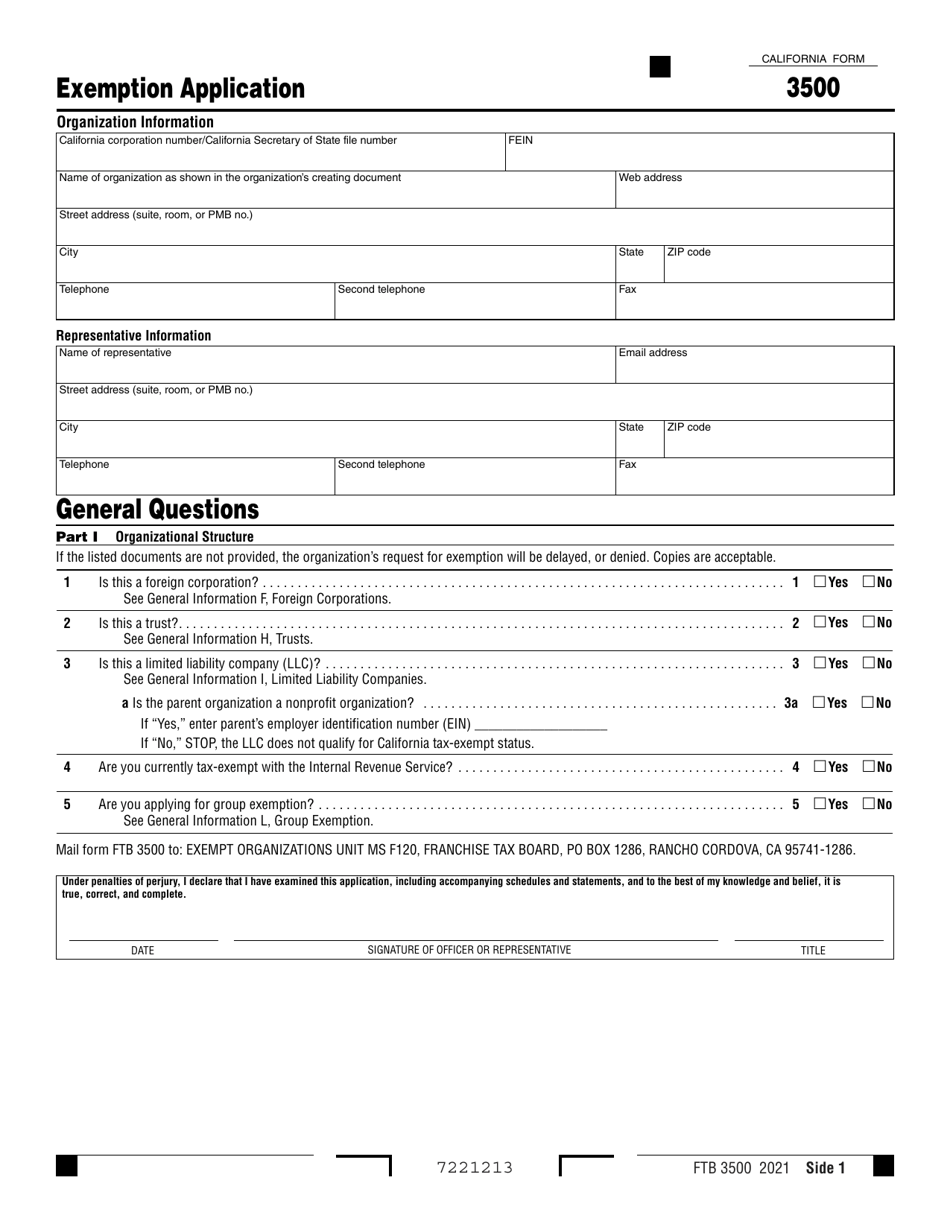

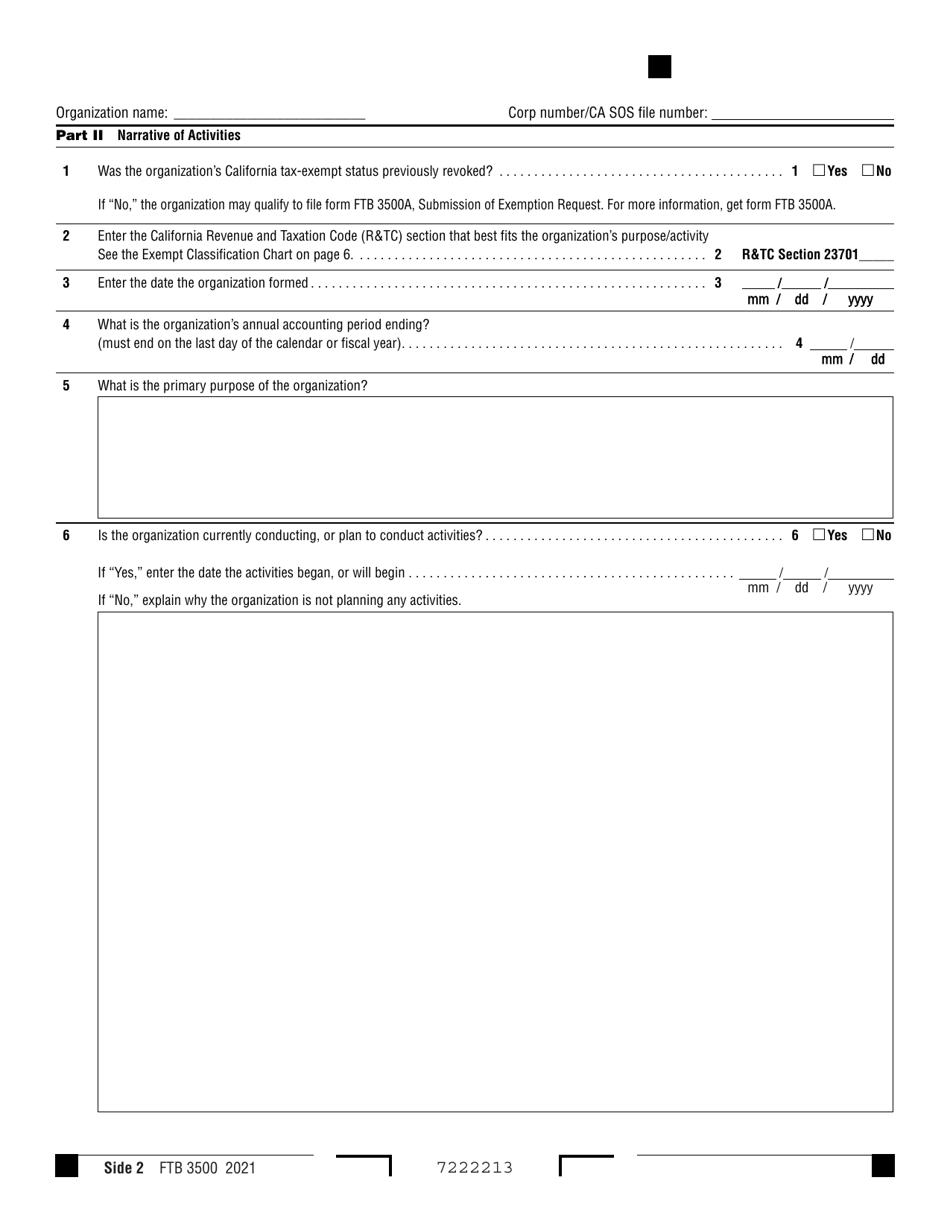

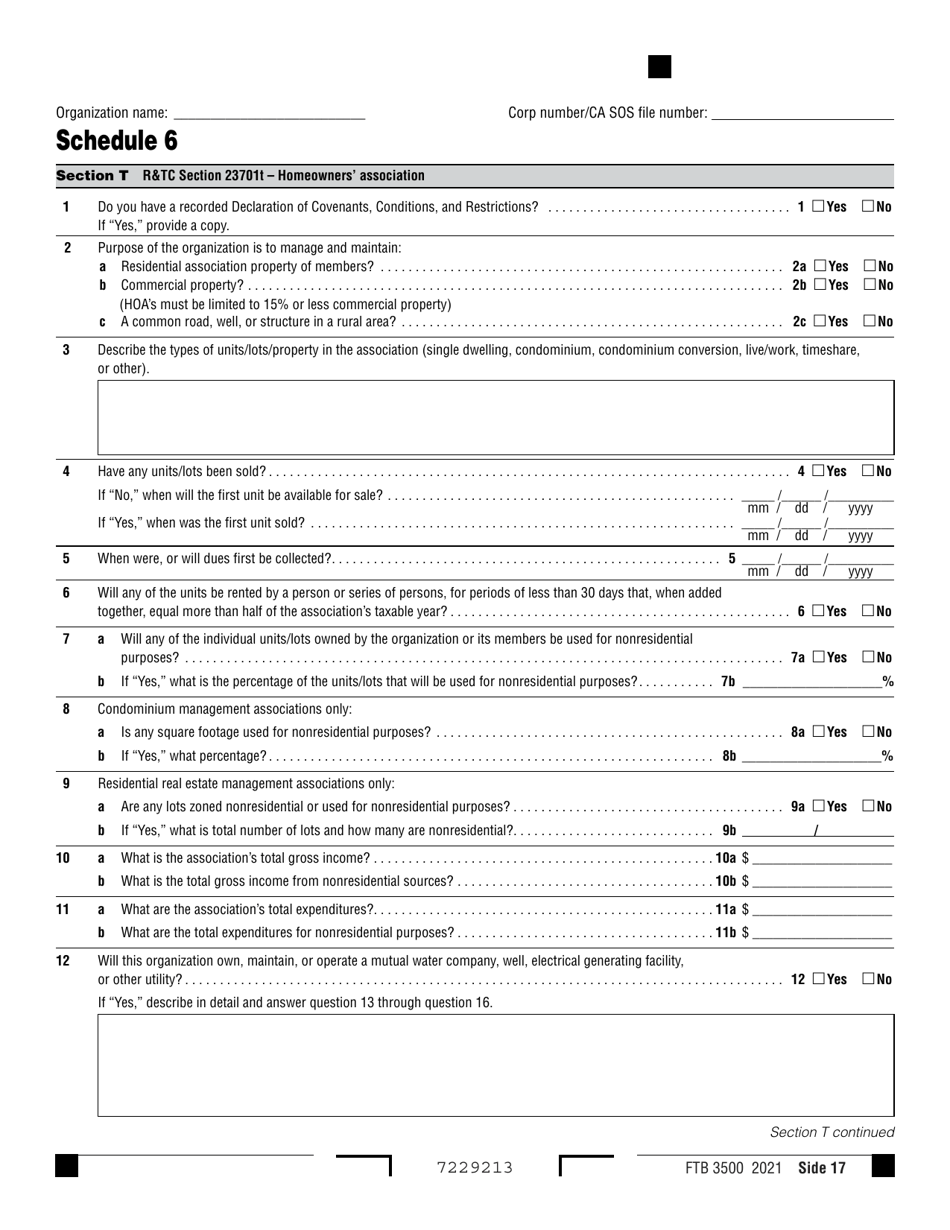

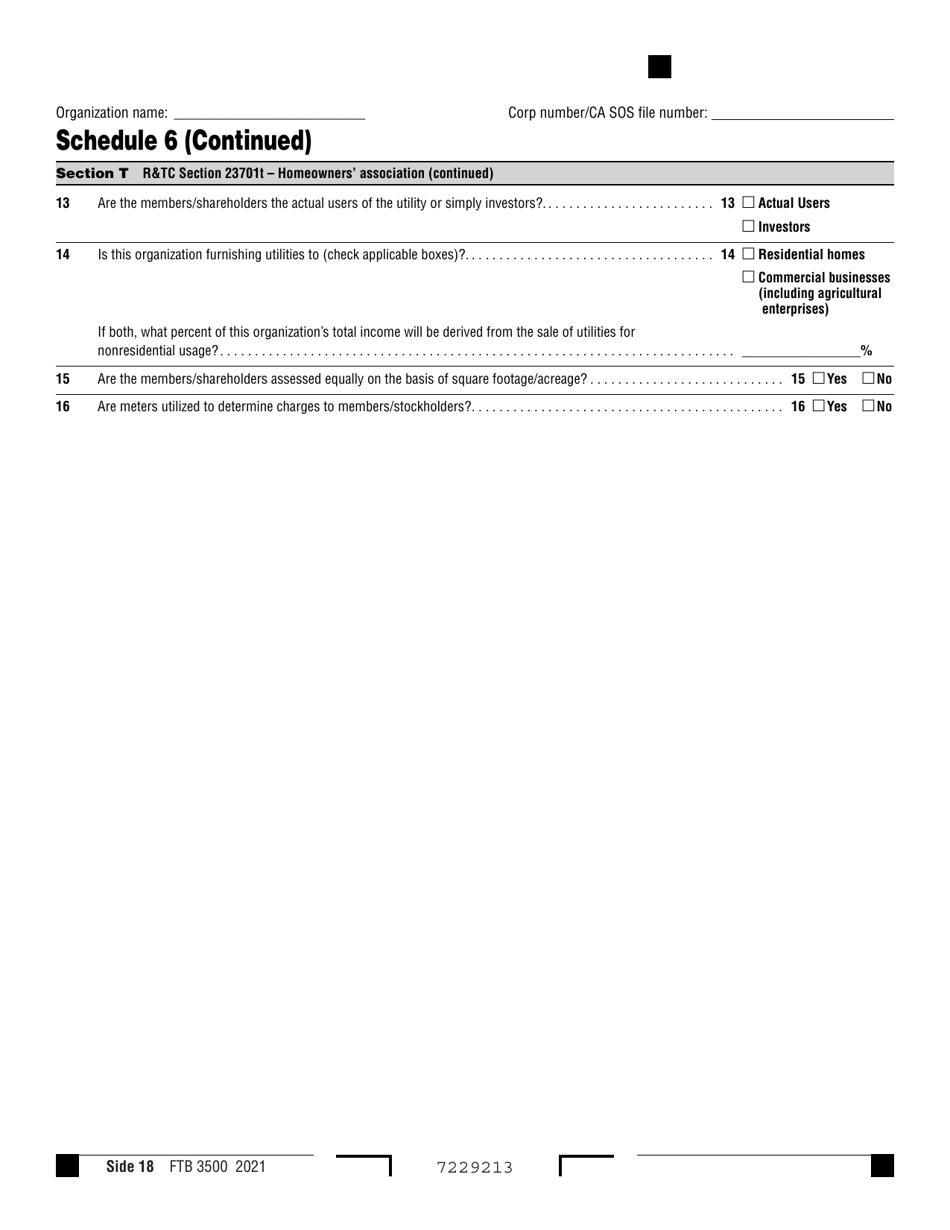

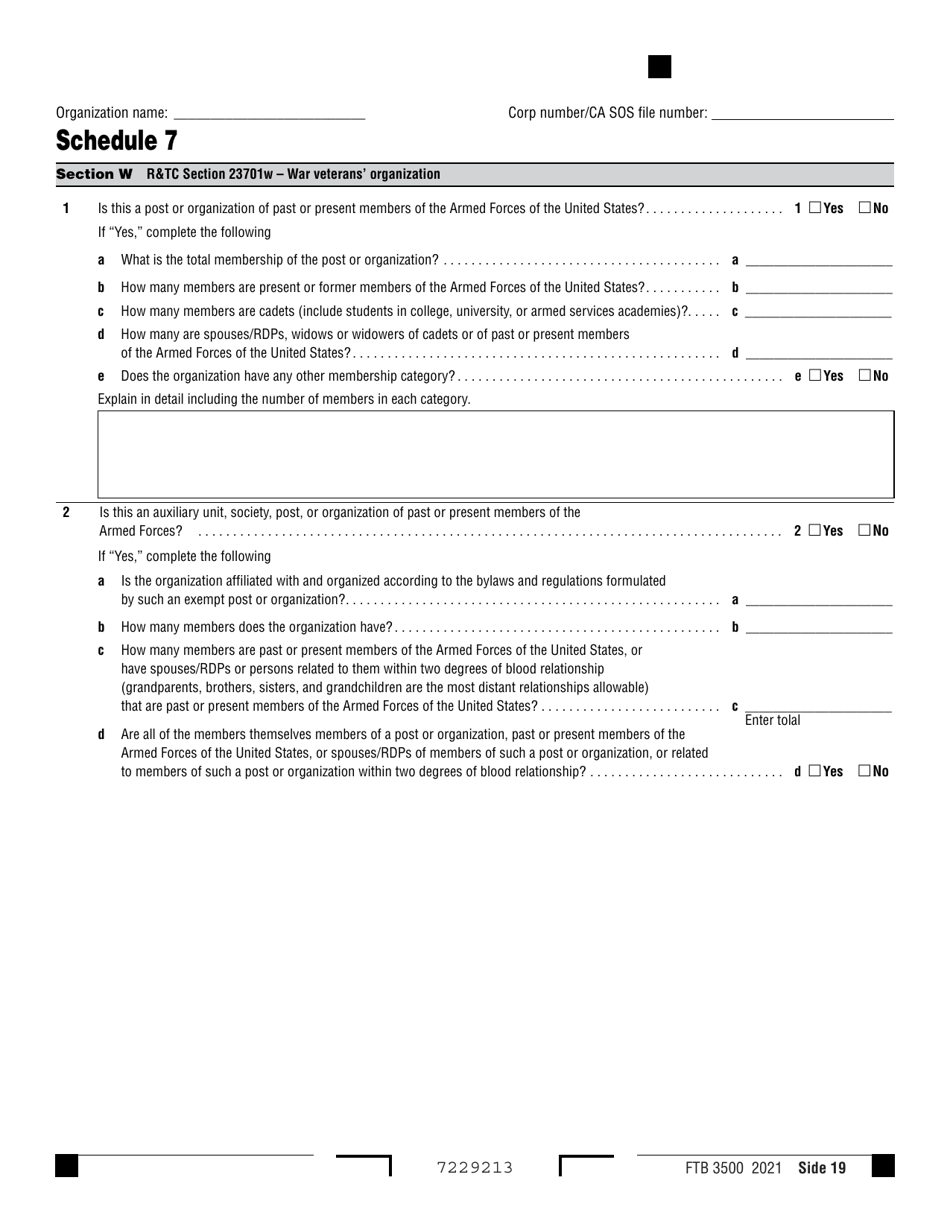

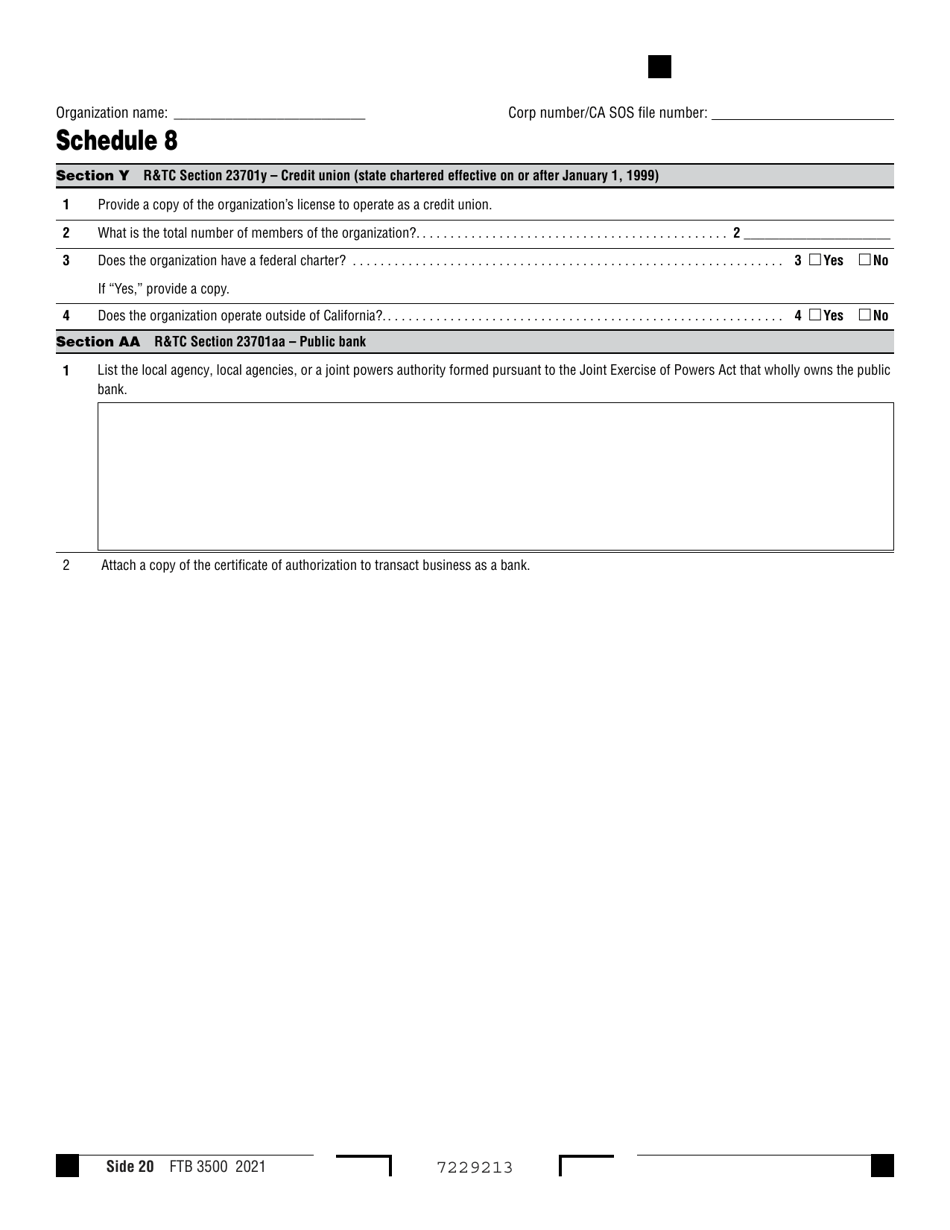

Form FTB3500

for the current year.

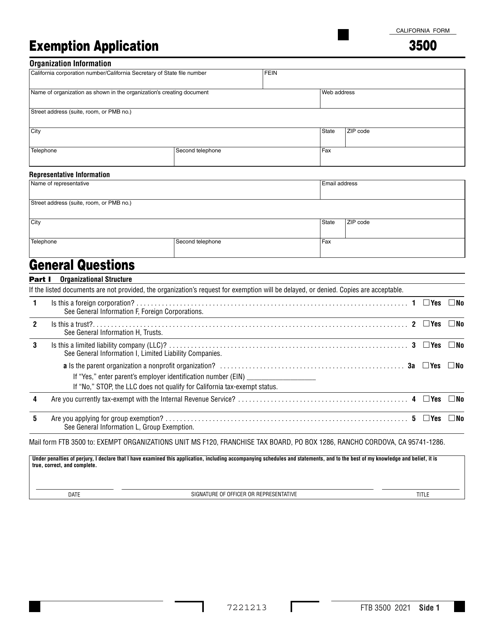

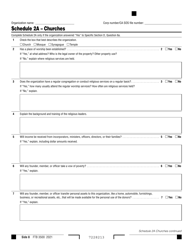

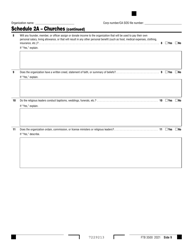

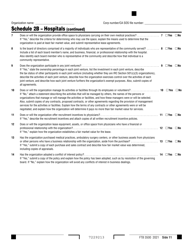

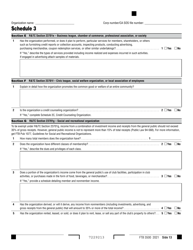

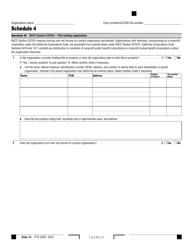

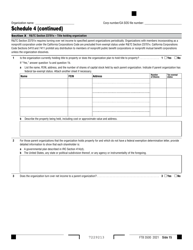

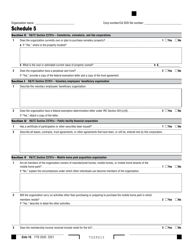

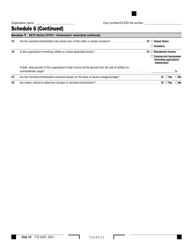

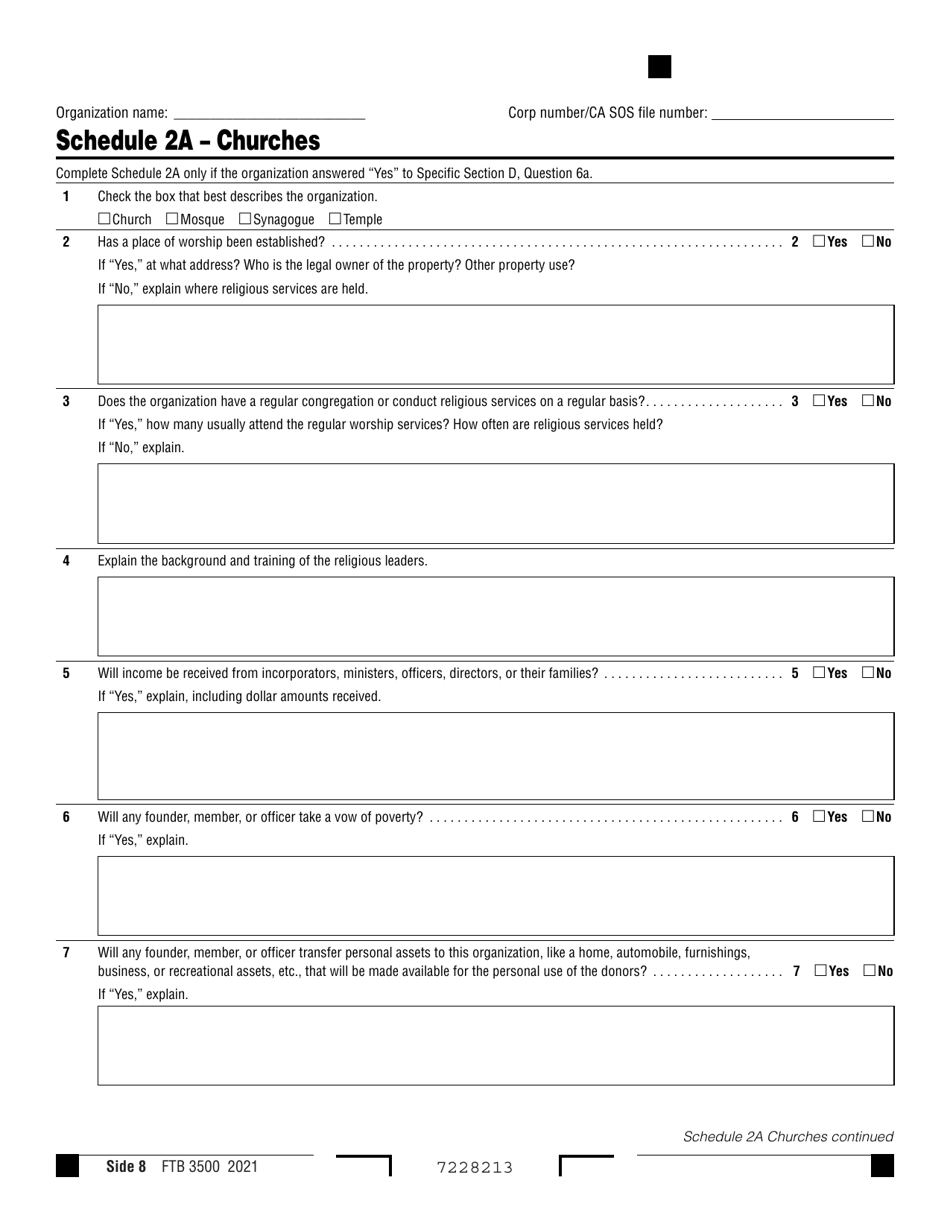

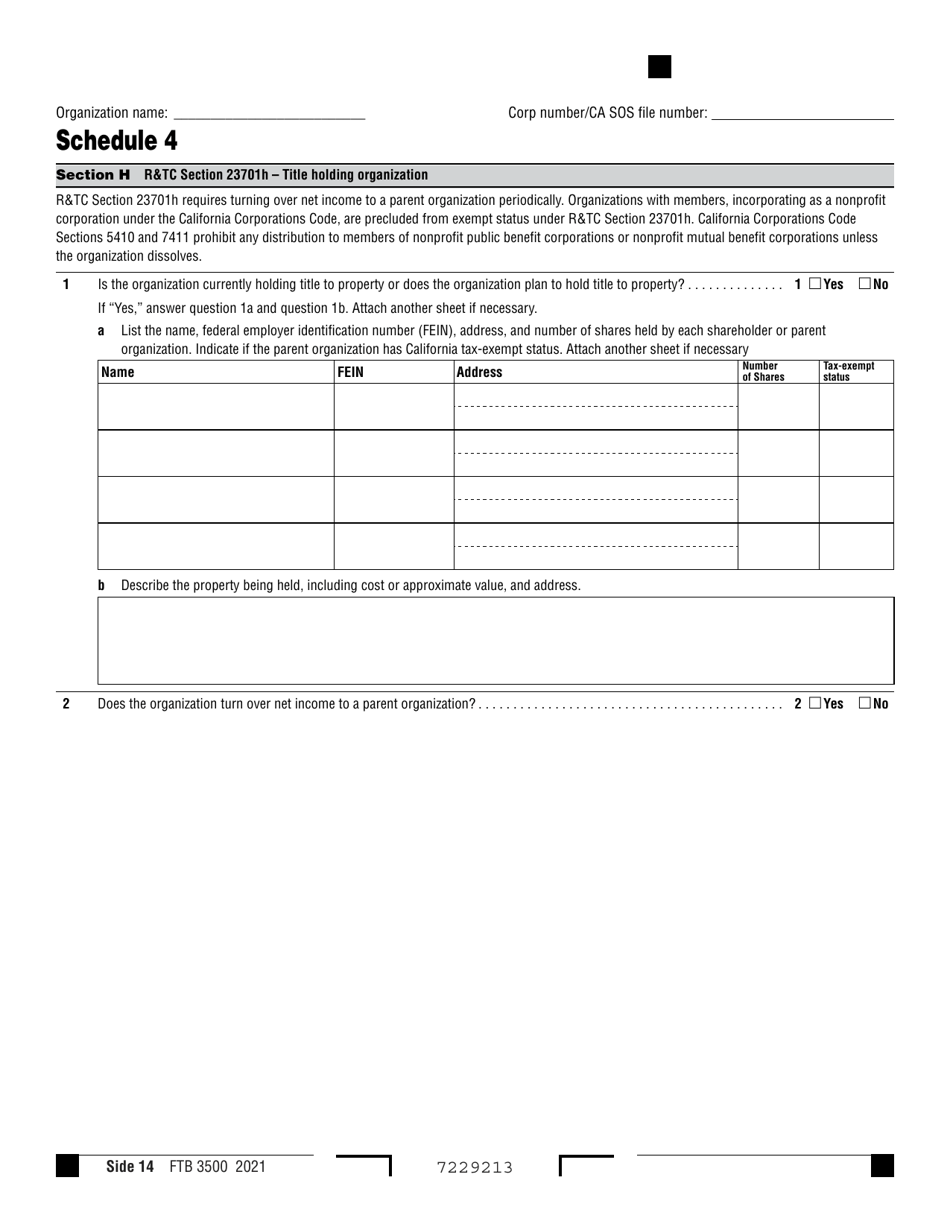

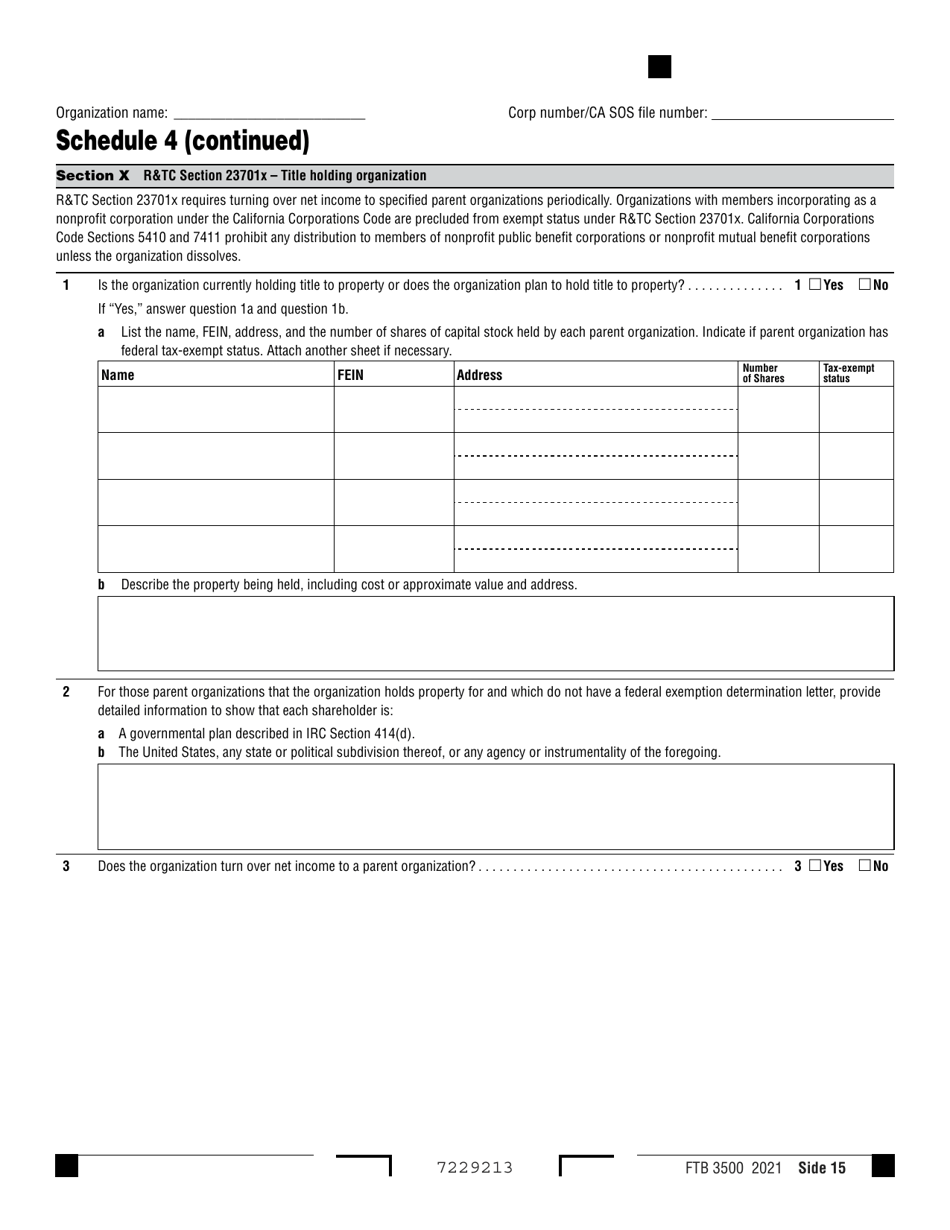

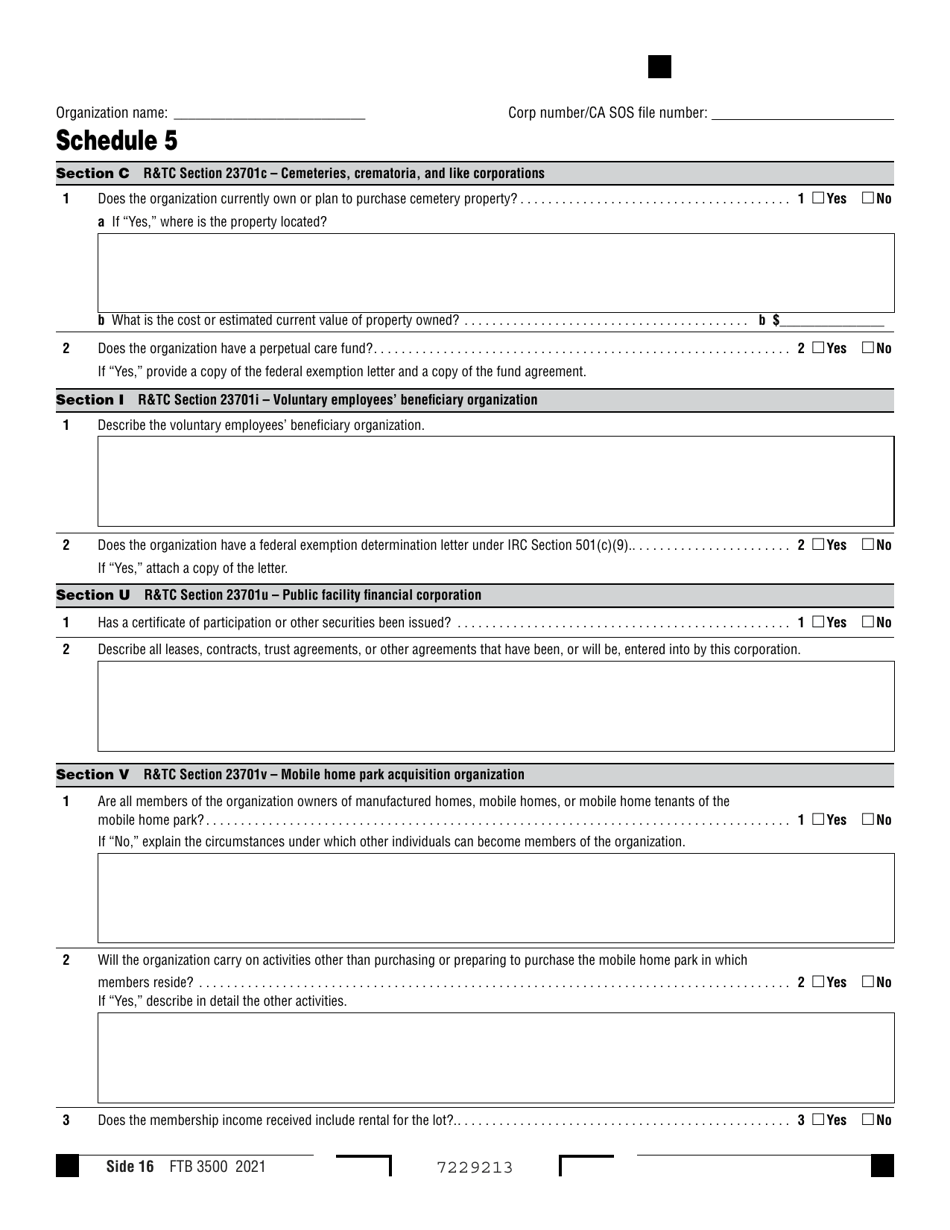

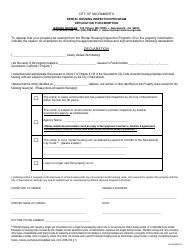

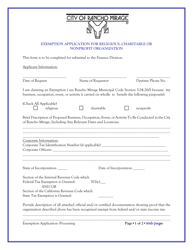

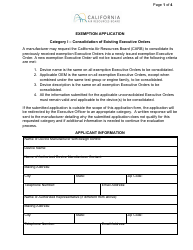

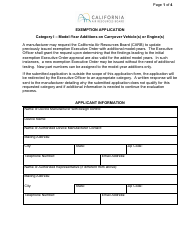

Form FTB3500 Exemption Application - California

What Is Form FTB3500?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB3500?

A: Form FTB3500 is the Exemption Application form for California.

Q: Who needs to fill out Form FTB3500?

A: Nonprofit organizations in California seeking tax-exempt status need to fill out Form FTB3500.

Q: What is the purpose of Form FTB3500?

A: The purpose of Form FTB3500 is to apply for tax-exempt status in California.

Q: What information is required on Form FTB3500?

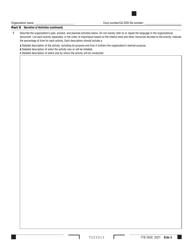

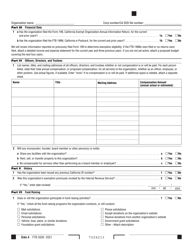

A: Form FTB3500 requires information about the organization's name, purpose, activities, financials, and structure.

Q: Is there a fee to submit Form FTB3500?

A: Yes, there is a fee to submit Form FTB3500. The fee amount depends on the organization's gross receipts.

Q: How long does it take to process Form FTB3500?

A: The processing time for Form FTB3500 varies, but it can take several months to receive a determination letter from the FTB.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB3500 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.