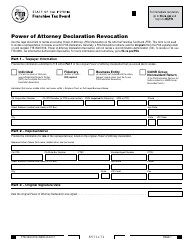

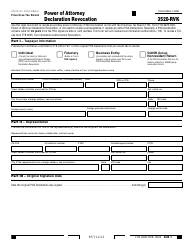

This version of the form is not currently in use and is provided for reference only. Download this version of

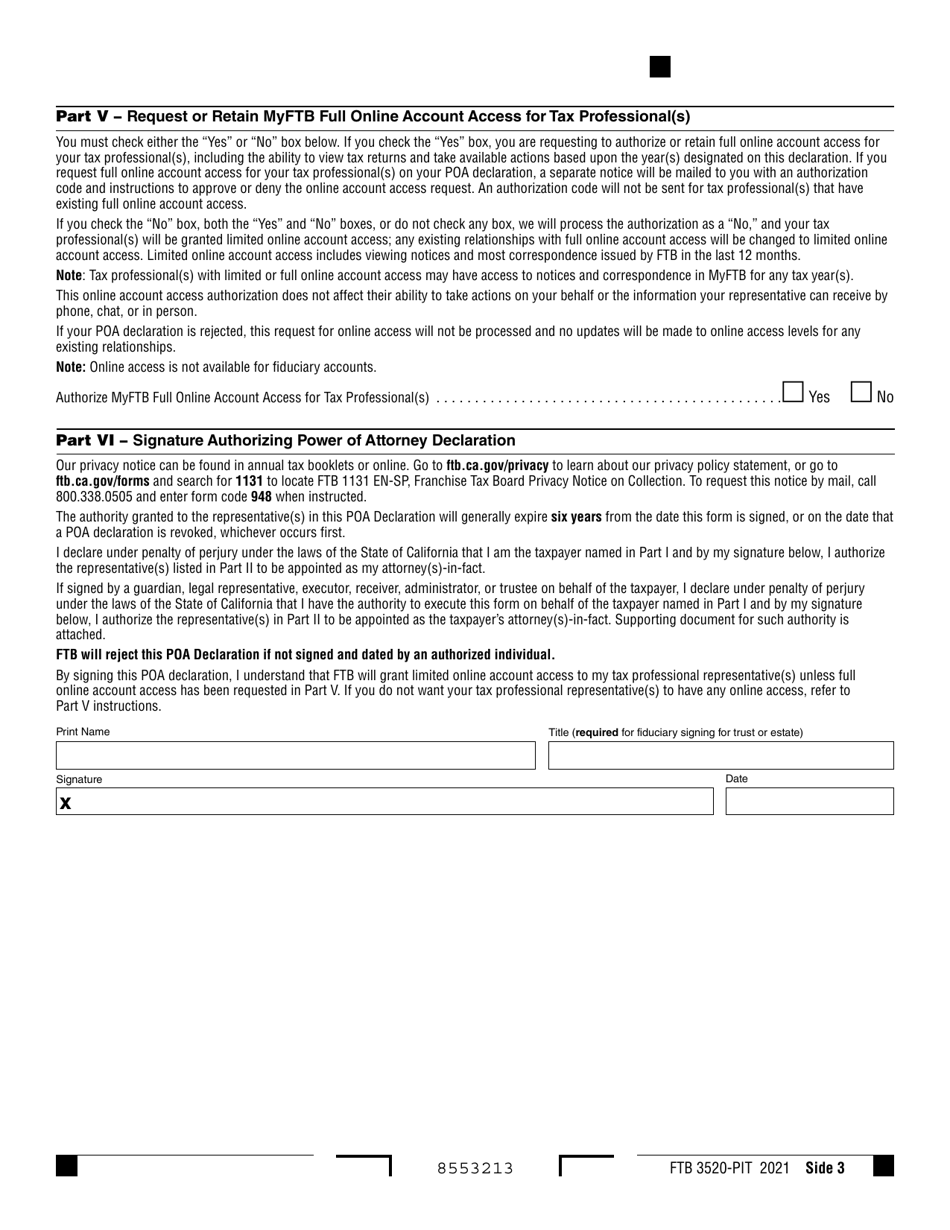

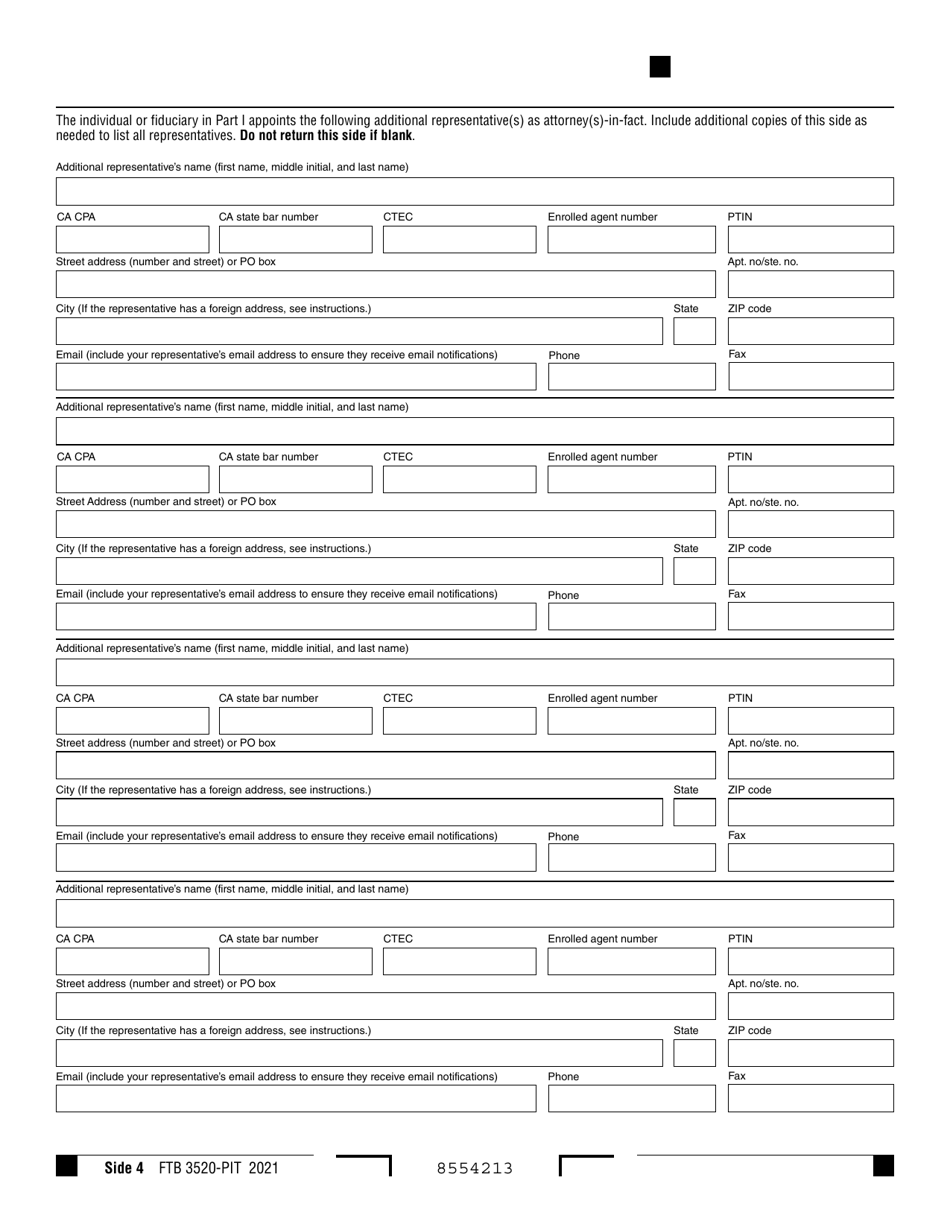

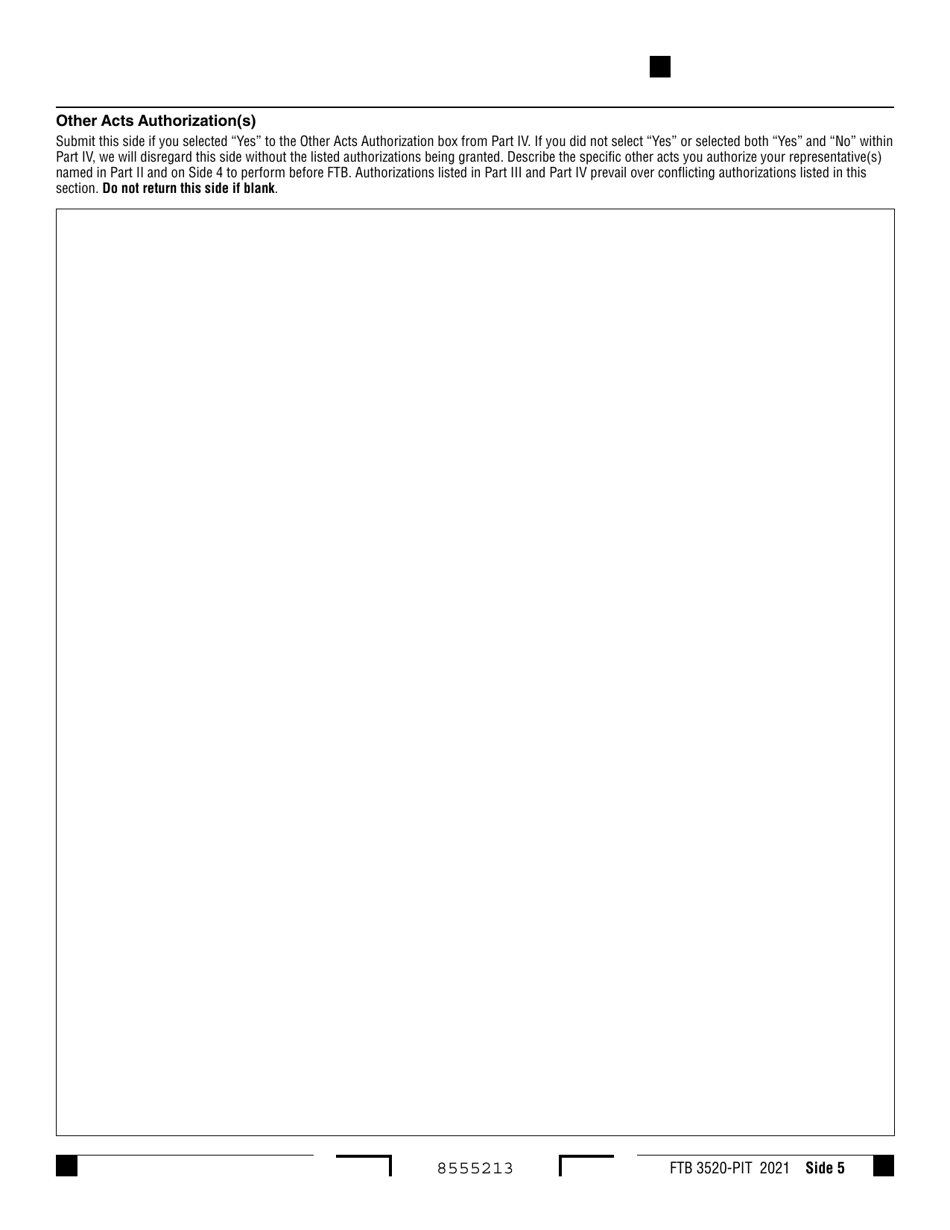

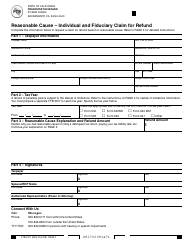

Form FTB3520-PIT

for the current year.

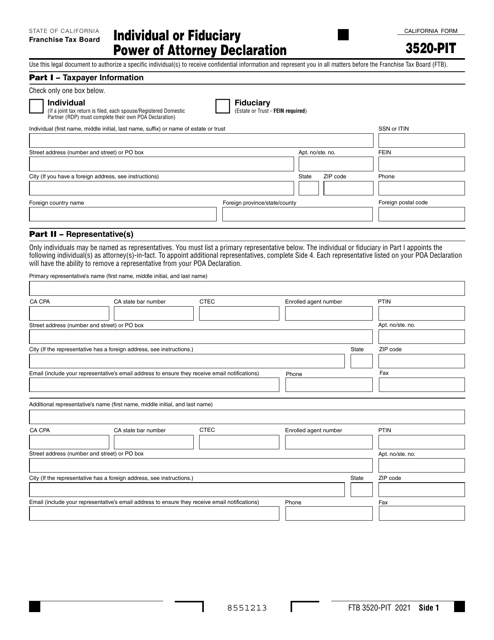

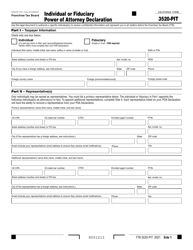

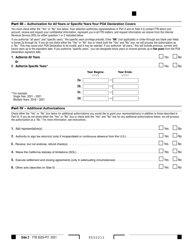

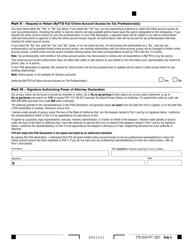

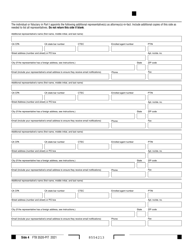

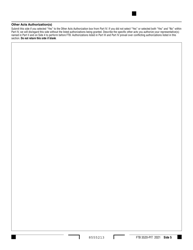

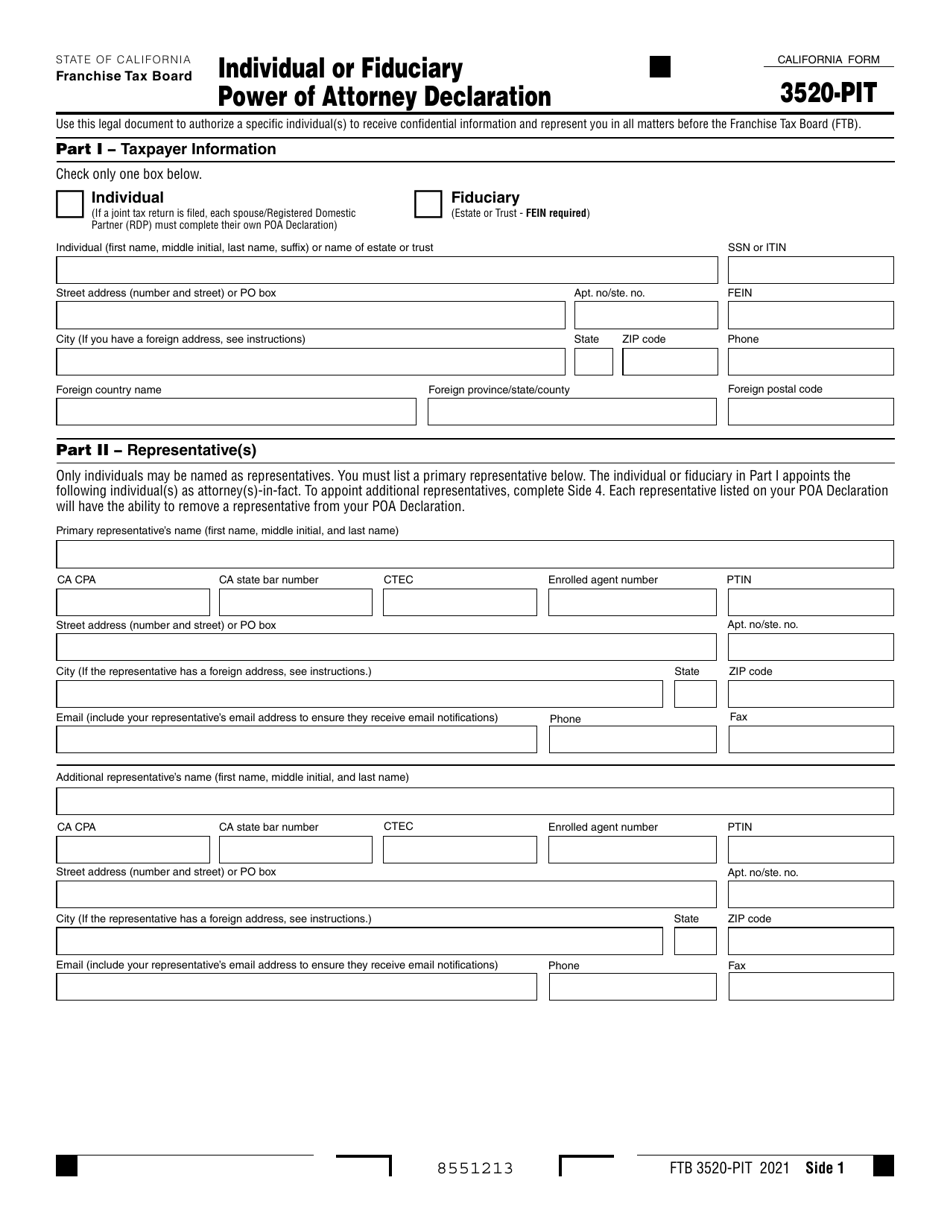

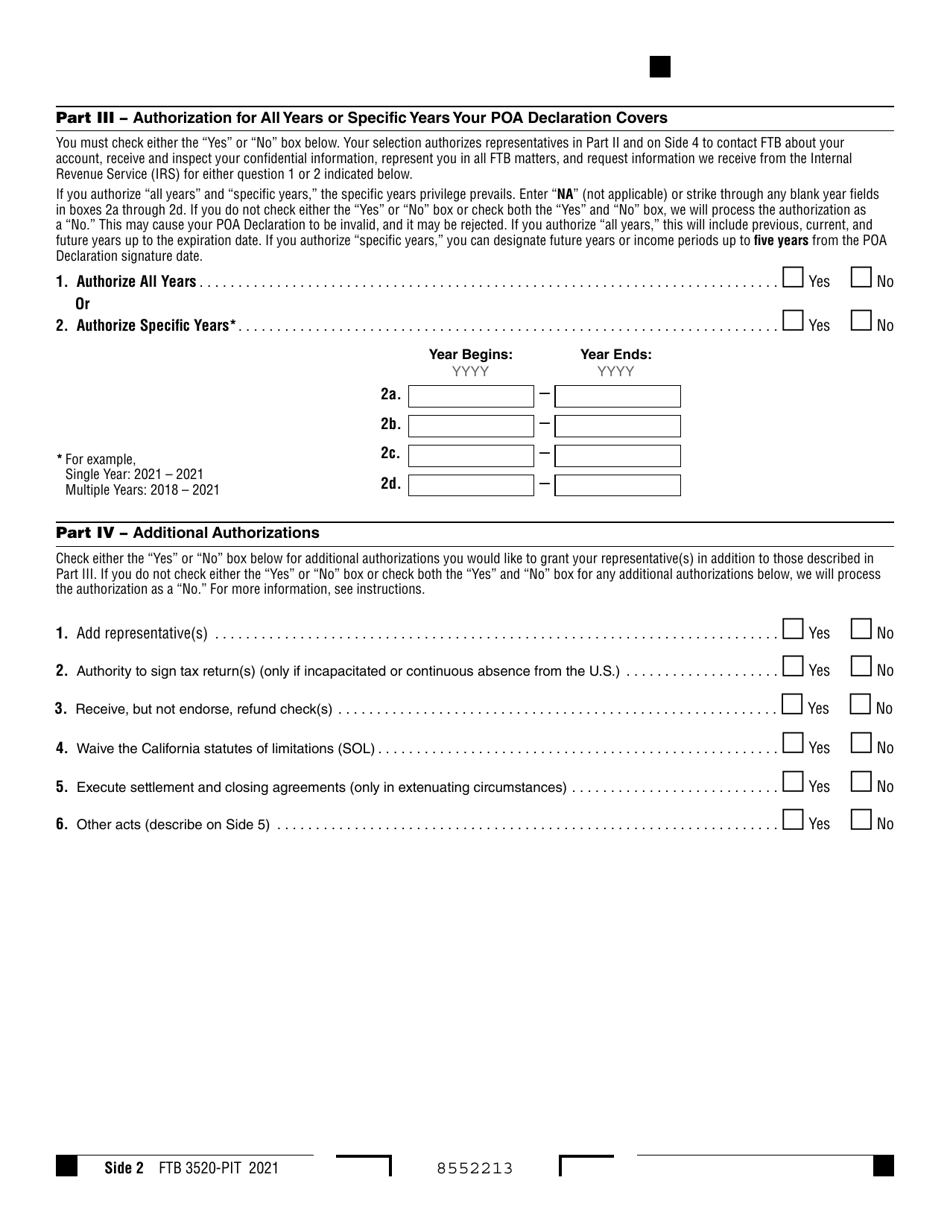

Form FTB3520-PIT Individual or Fiduciary Power of Attorney Declaration - California

What Is Form FTB3520-PIT?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB 3520-PIT?

A: Form FTB 3520-PIT is the Individual or Fiduciary Power of Attorney Declaration form used in California.

Q: Who can use Form FTB 3520-PIT?

A: Both individuals and fiduciaries can use Form FTB 3520-PIT in California.

Q: What is the purpose of Form FTB 3520-PIT?

A: The purpose of Form FTB 3520-PIT is to declare a power of attorney for individual or fiduciary tax matters in California.

Q: Do I need to submit Form FTB 3520-PIT with my tax return?

A: No, Form FTB 3520-PIT should be retained for your records and should not be submitted with your tax return.

Q: Is there a deadline for filing Form FTB 3520-PIT?

A: There is no specific deadline for filing Form FTB 3520-PIT. It should be completed and retained as needed.

Q: Can I use Form FTB 3520-PIT for federal tax matters?

A: No, Form FTB 3520-PIT is specific to California tax matters and cannot be used for federal tax purposes.

Q: Are there any fees associated with filing Form FTB 3520-PIT?

A: No, there are no fees associated with filing Form FTB 3520-PIT.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB3520-PIT by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.