This version of the form is not currently in use and is provided for reference only. Download this version of

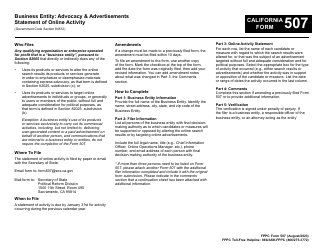

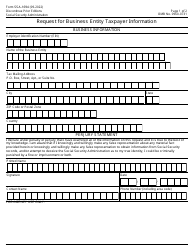

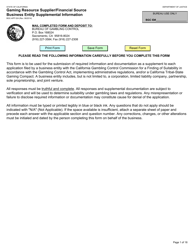

Form FTB3520-BE

for the current year.

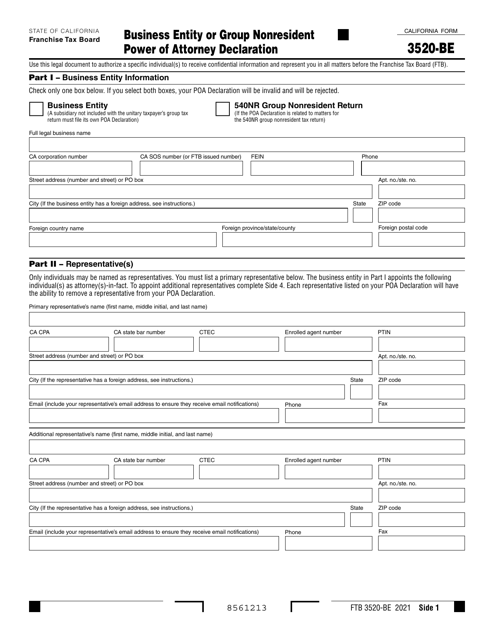

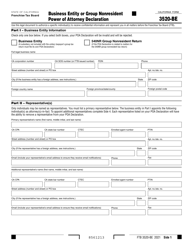

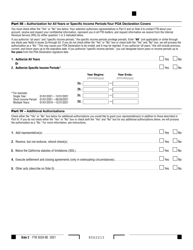

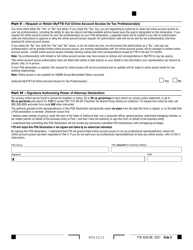

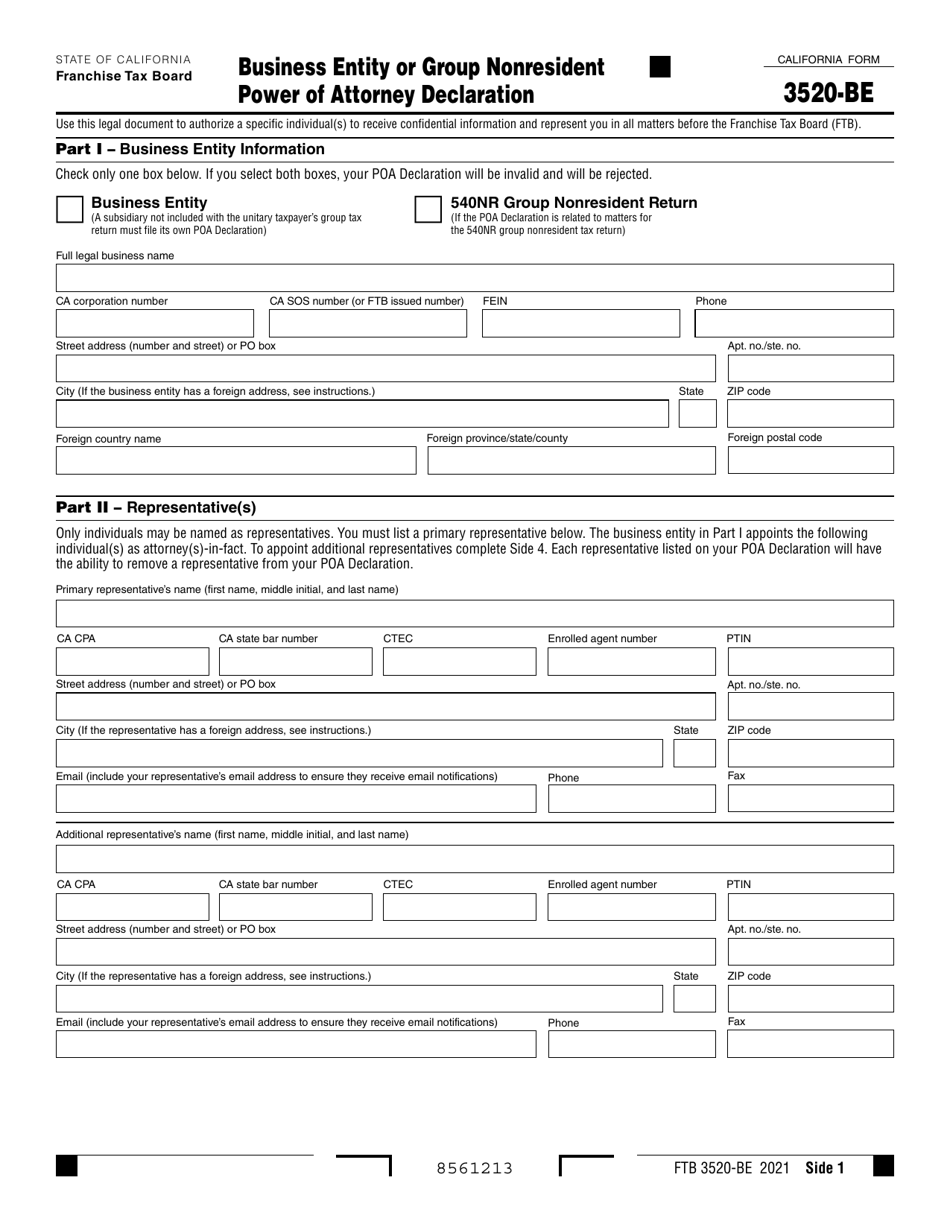

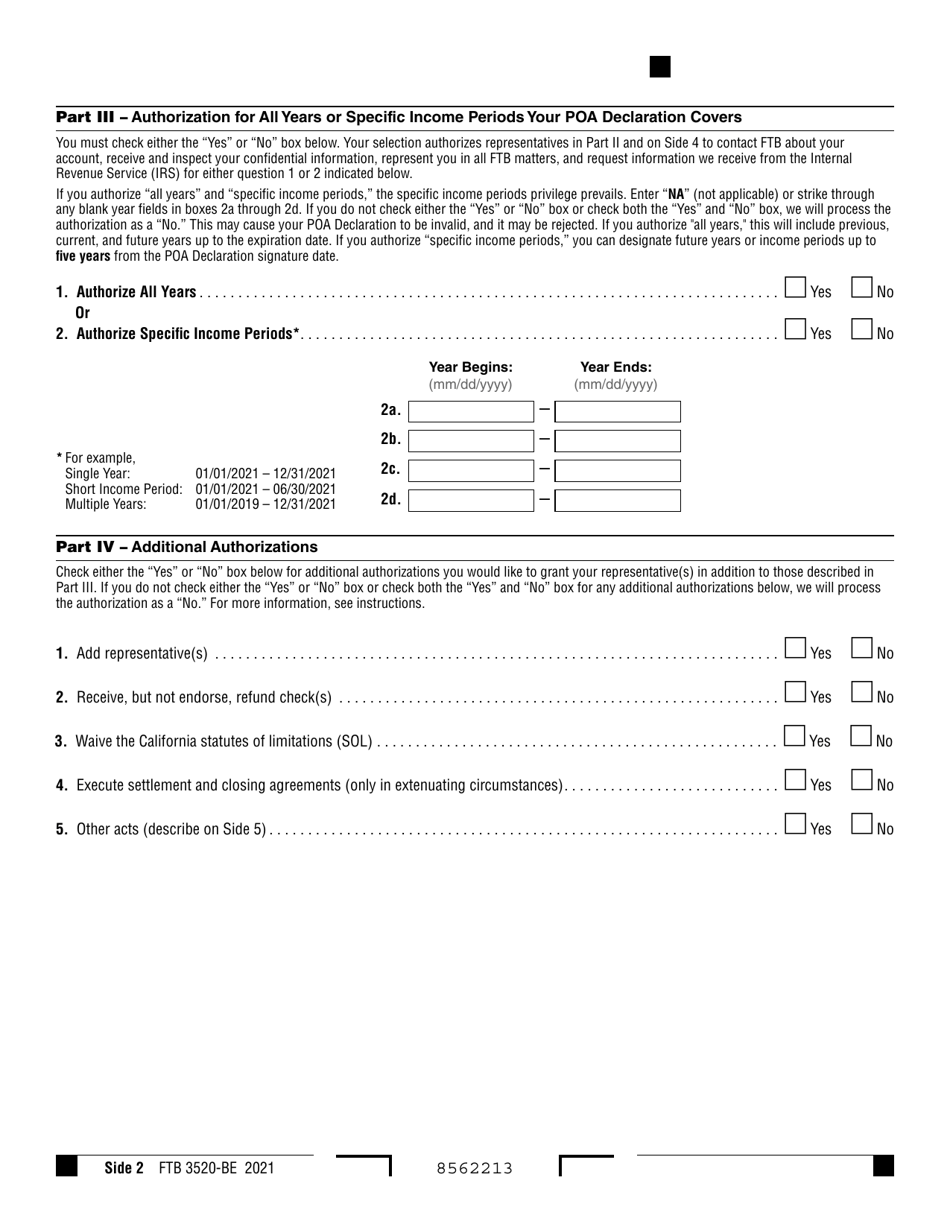

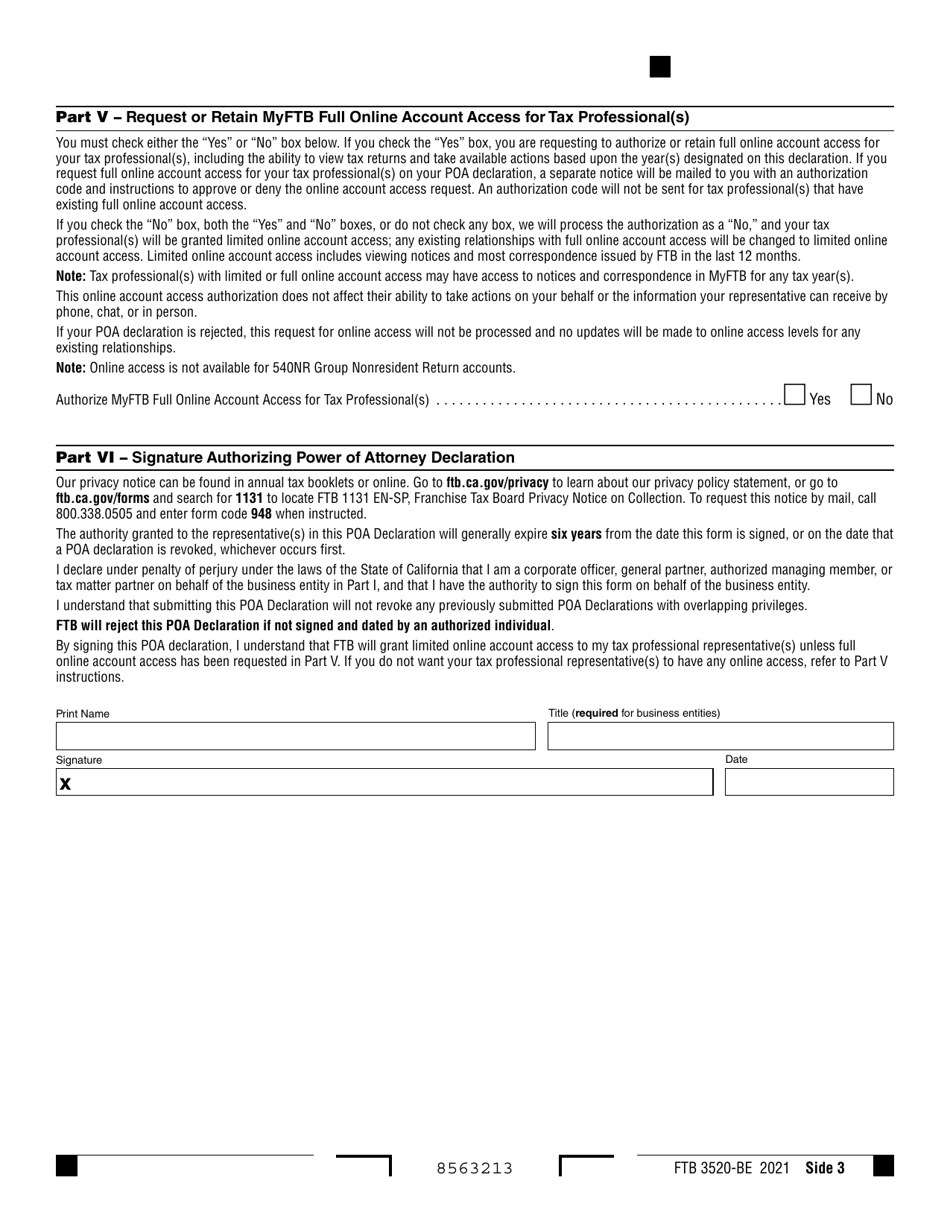

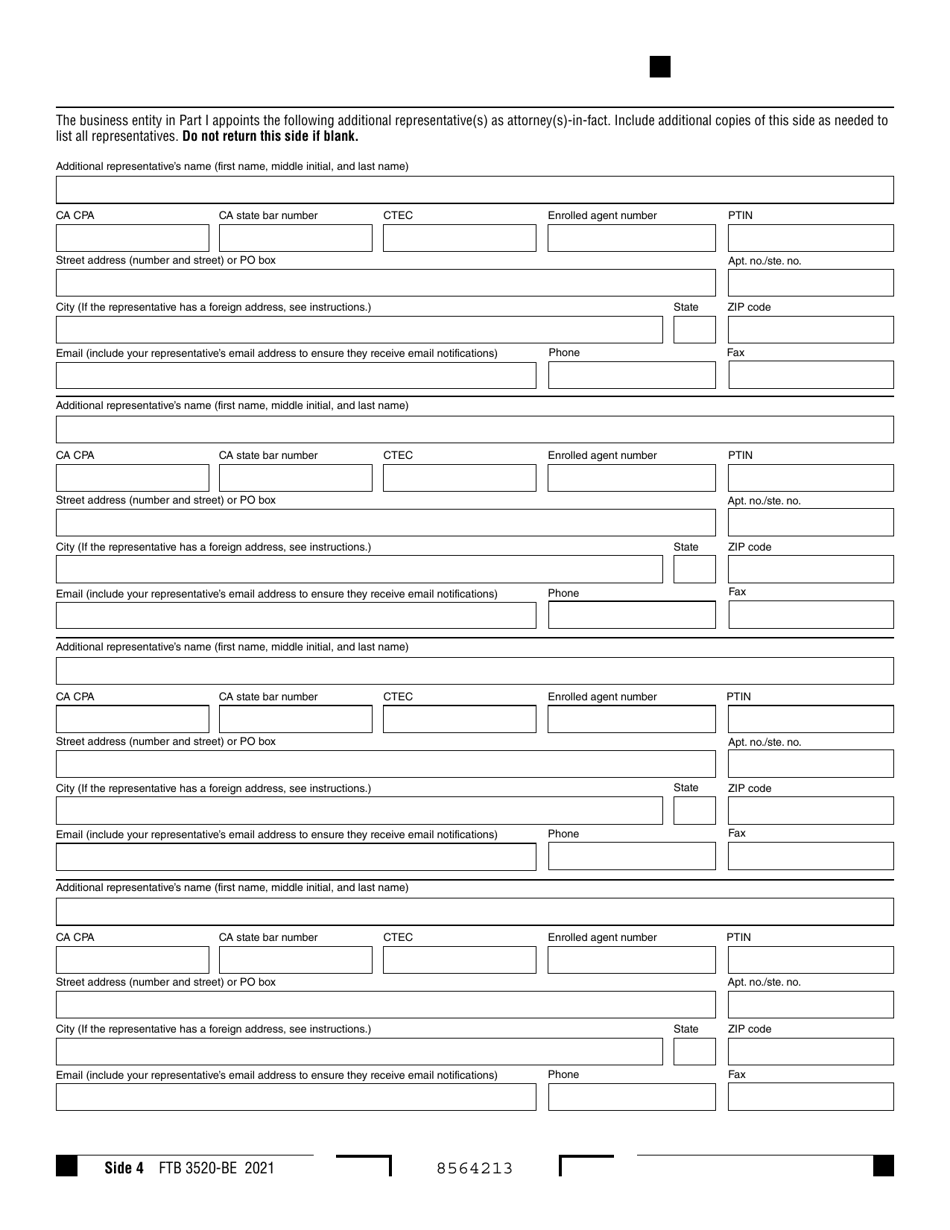

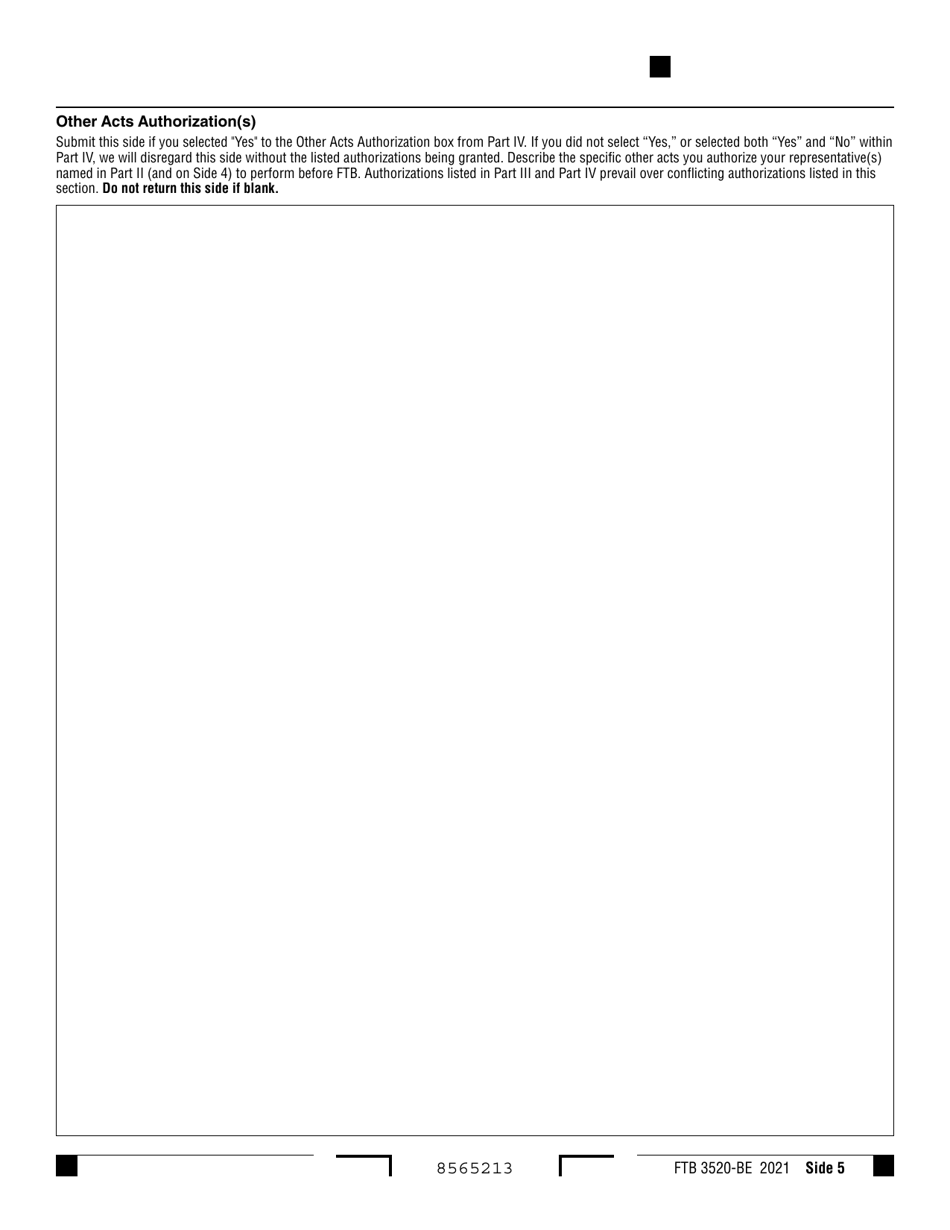

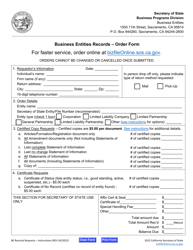

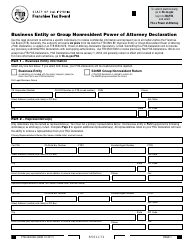

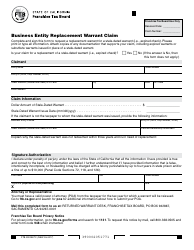

Form FTB3520-BE Business Entity or Group Nonresident Power of Attorney Declaration - California

What Is Form FTB3520-BE?

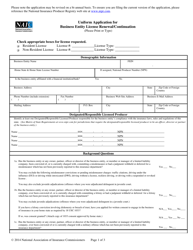

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

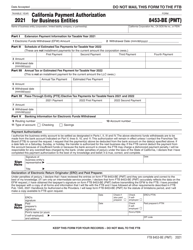

Q: What is Form FTB3520-BE used for?

A: Form FTB3520-BE is used to authorize a nonresident to represent a business entity or group before the California Franchise Tax Board (FTB).

Q: Who needs to file Form FTB3520-BE?

A: Form FTB3520-BE is filed by a business entity or group that wants to authorize a nonresident to act on its behalf for tax-related matters in California.

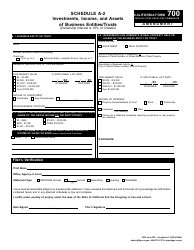

Q: Do I need to file a separate Form FTB3520-BE for each nonresident representative?

A: Yes, a separate Form FTB3520-BE must be filed for each nonresident representative you want to authorize.

Q: What information is required on Form FTB3520-BE?

A: Form FTB3520-BE requires information about the business entity or group, as well as details about the nonresident representative being authorized.

Q: Is there a fee to file Form FTB3520-BE?

A: No, there is no fee to file Form FTB3520-BE.

Q: Can I use Form FTB3520-BE to authorize a resident representative?

A: No, Form FTB3520-BE is specifically for authorizing nonresident representatives.

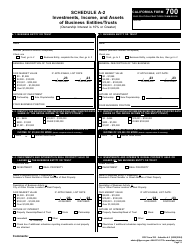

Q: Is Form FTB3520-BE only for businesses based in California?

A: No, Form FTB3520-BE can be used by businesses located outside of California that have tax-related matters in the state.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB3520-BE by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.