This version of the form is not currently in use and is provided for reference only. Download this version of

Form 541 Schedule J

for the current year.

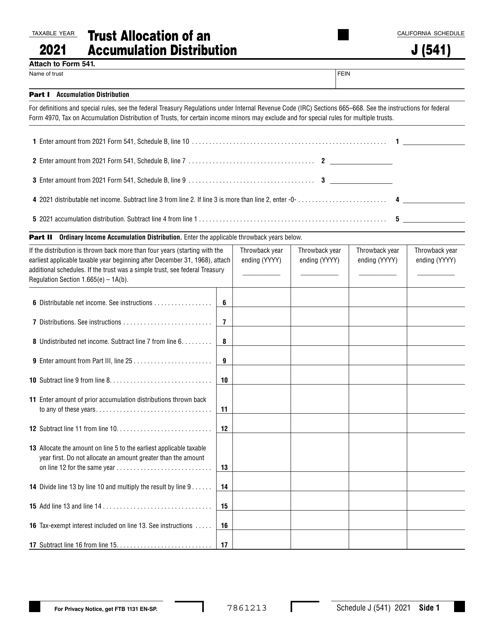

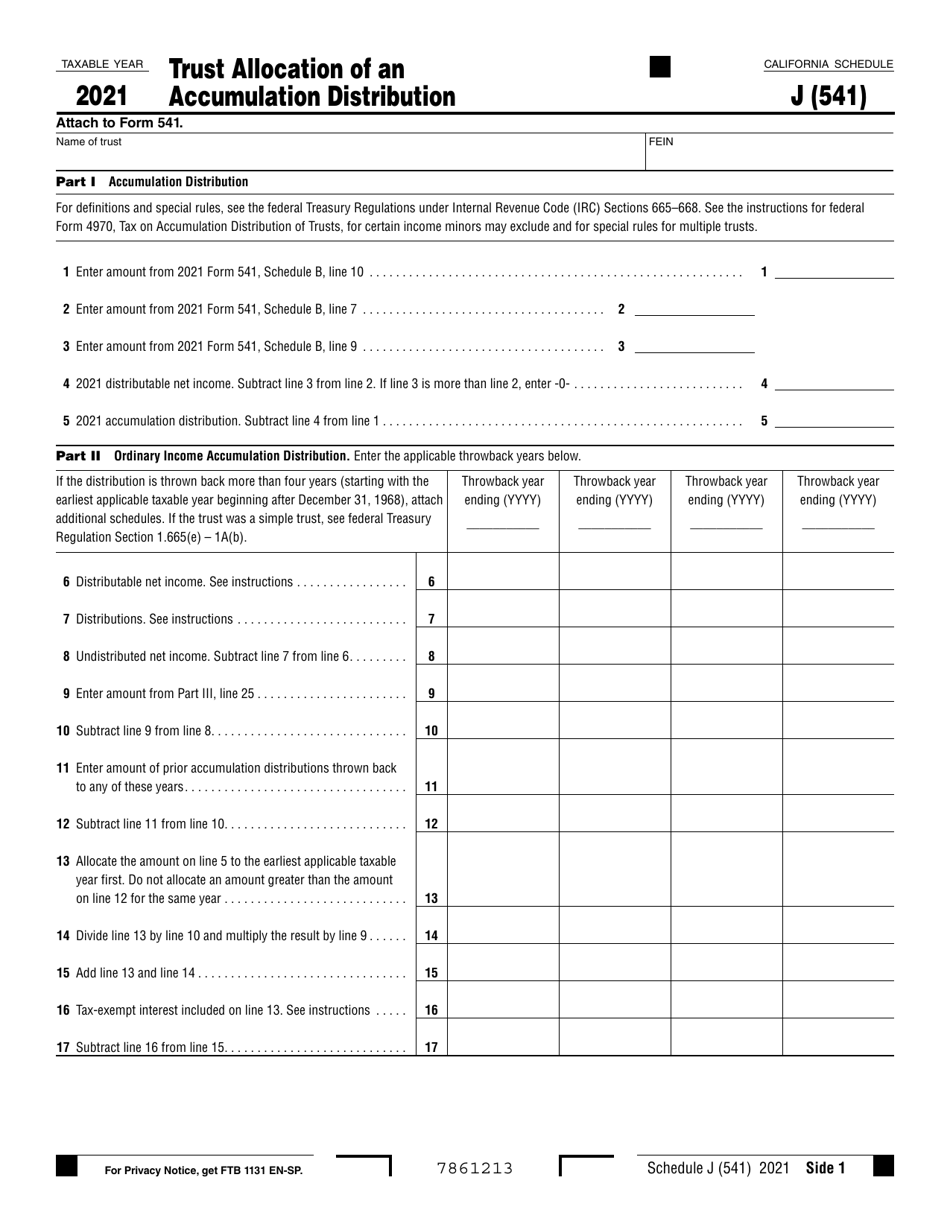

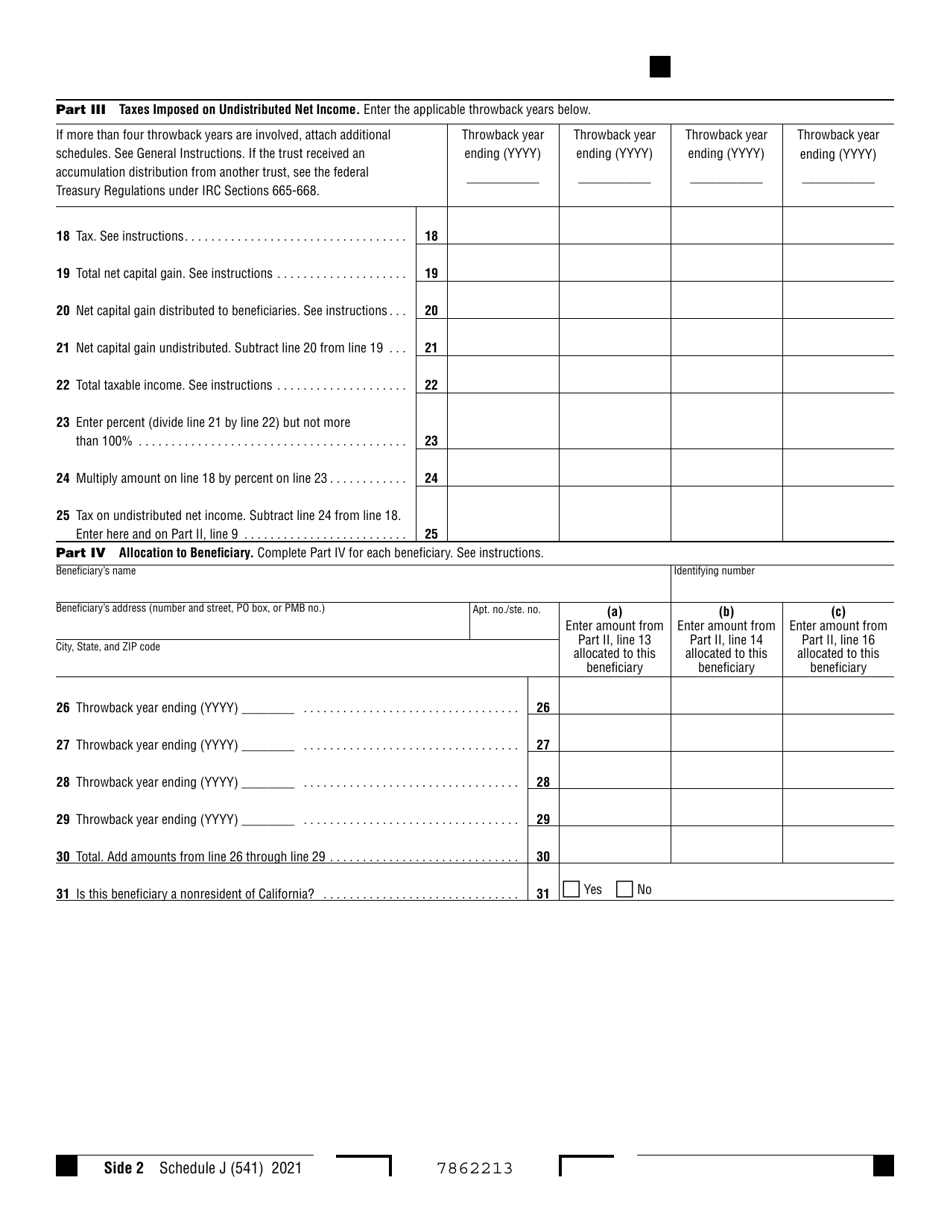

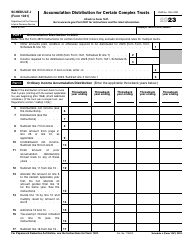

Form 541 Schedule J Trust Allocation of an Accumulation Distribution - California

What Is Form 541 Schedule J?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California.The document is a supplement to Form 541, California Fiduciary Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 541 Schedule J?

A: Form 541 Schedule J is a tax form used in California for the trust allocation of an accumulation distribution.

Q: What is an accumulation distribution?

A: An accumulation distribution is a distribution of income that a trust has accumulated in previous years and is now distributing to beneficiaries.

Q: Who needs to file Form 541 Schedule J?

A: If you are a trustee of a trust in California and you are making an accumulation distribution, you need to file Form 541 Schedule J.

Q: What information is required on Form 541 Schedule J?

A: You will need to provide details about the accumulation distribution, including the amount, the allocation among beneficiaries, and any tax withheld.

Q: When is the deadline to file Form 541 Schedule J?

A: The deadline to file Form 541 Schedule J is the same as the deadline for filing Form 541, which is generally April 15 of the following year.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 541 Schedule J by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.